Fitness Equipment Market Outlook:

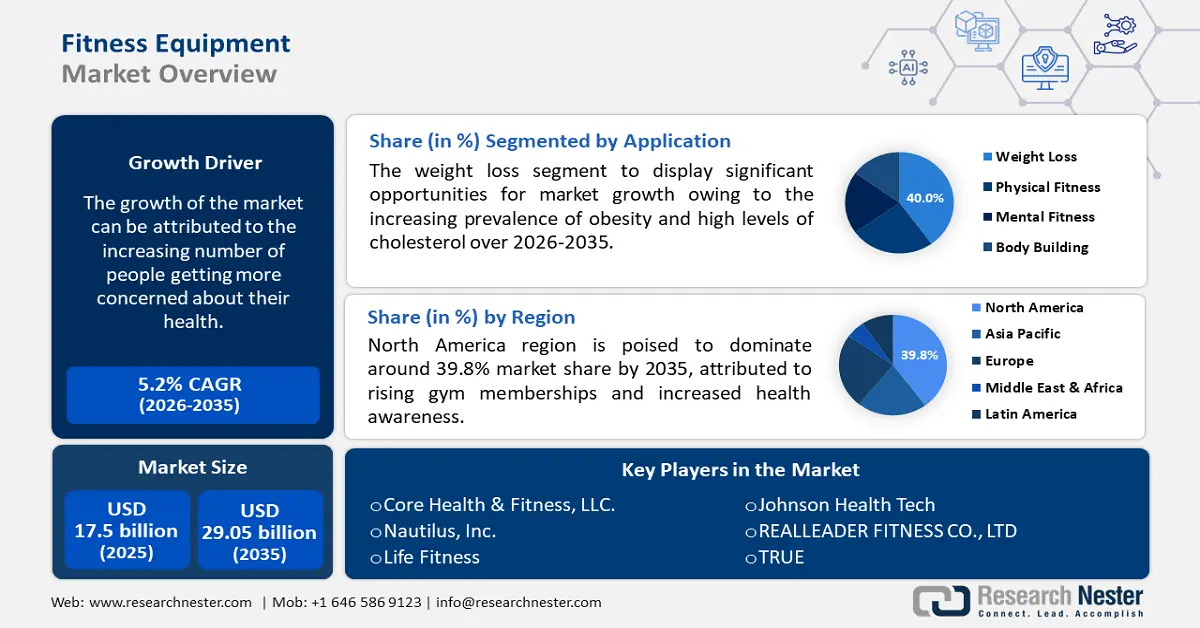

Fitness Equipment Market size was valued at USD 17.5 billion in 2025 and is set to exceed USD 29.05 billion by 2035, expanding at over 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fitness equipment is estimated at USD 18.32 billion.

The growth of the market can be attributed to the rising cases of obesity across the globe. According to the data published by the World Health Organization in March 2024, 1 in 8 people are now living with obesity. People are becoming aware of the benefits of exercising, and it has become a crucial factor for shaping the market dynamics.

Additionally, the fitness market is gaining traction owing to various efforts taken by the government to spread awareness regarding physical activity. The International Society for Physical Activity and Health commemorates World Day for Physical Activity every year on 6th April. The World Health Organization also published data estimating the cost of physical activity to public health care systems between 2020 and 2030 to be USD 300 billion.

Key Fitness Equipment Market Insights Summary:

Regional Highlights:

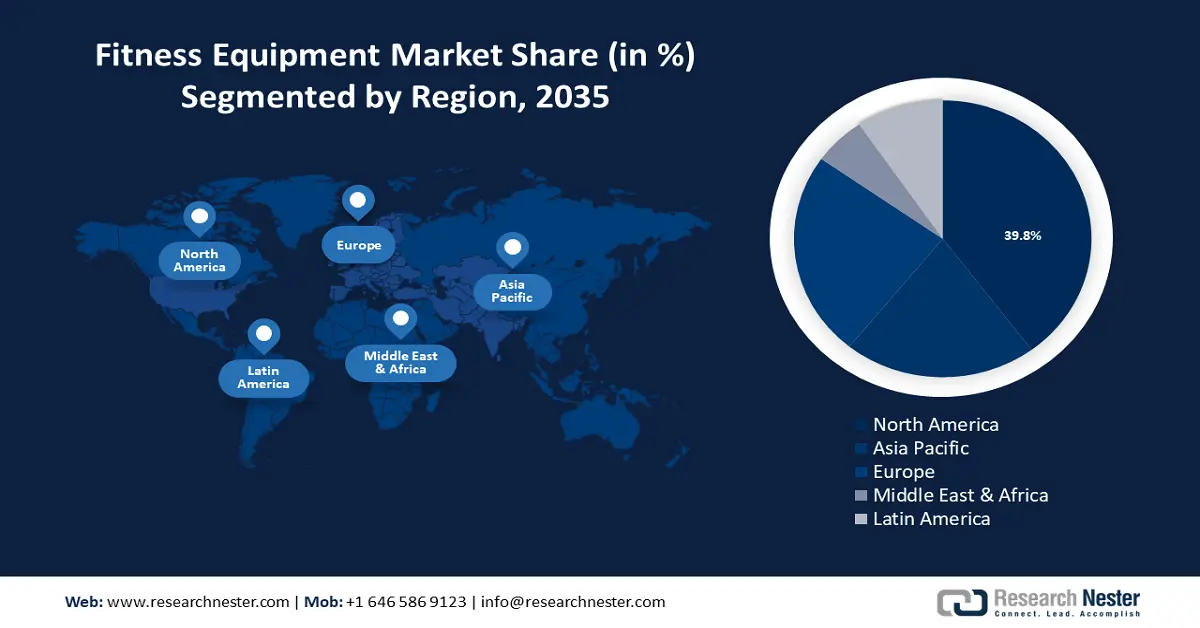

- The North America fitness equipment market is expected to achieve a 39.8% share by 2035, driven by rising gym memberships and increased health awareness.

Segment Insights:

- The weight loss segment in the fitness equipment market is anticipated to hold the largest share by 2035, attributed to the increasing prevalence of obesity and high cholesterol levels.

- The fitness monitoring equipment segment in the fitness equipment market is projected to gain a significant share by 2035, fueled by rising demand for activity monitoring and increased awareness of mental health and sedentary lifestyle risks.

Key Growth Trends:

- Rising prevalence of chronic disease

- Amalgamation of Internet of Things in a gym environment

Major Challenges:

- Concern for data security

- Over-reliance on numbers

Key Players: Core Health & Fitness, LLC., Nautilus, Inc., Life Fitness, Johnson Health Tech, REALLEADER FITNESS CO., LTD, TRUE, Impulse Health Tech CO., LTD, iFIT Inc., Torque Fitness, Body-Solid Inc.

Global Fitness Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.5 billion

- 2026 Market Size: USD 18.32 billion

- Projected Market Size: USD 29.05 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 8 September, 2025

Fitness Equipment Market Growth Drivers and Challenges:

Growth Drivers

- Rising prevalence of chronic disease: People are realizing the importance of physical activity for suppressing the consequences of chronic diseases. Some of the common examples of chronic diseases are heart disease, lung cancer, osteoporosis, etc. According to the British Heart Foundation in 2021, globally, 110 million women and 145 million men had coronary heart disease. Fitness trackers help motivate patients towards living a healthier lifestyle by providing feedback and accountability to maintain a regular workout regimen. Fitness devices also effectively track heart rate and keep informing the user about the heart rate. These factors are fueling the demand for fitness equipment amongst the users, further driving the market growth.

- Amalgamation of Internet of Things in a gym environment: Various gym owners are harnessing the benefits of IoT in gyms. The most common examples of IoT fitness tracking devices are wearables, smart training gear, strength training equipment, etc. According to the Health & Fitness Association in June 2022, U.S. health club membership reached over 66 million Americans. As more people are joining gyms, they are opting for fitness equipment to track burned calories and heart rate.

- Increasing inclination towards walking: Walking helps reduce stress, improve sleep and mood, and lower the risk of other chronic diseases. The Texas Heart Institute recommends aiming for 7,000 to 10,000 total steps per day, a target that is ideal for maintaining cardiovascular fitness. Global organizations are highlighting the importance of breaking the sedentary lifestyle. Also, the American Heart Association celebrates April 6th as World Walking Day. People are adopting fitness trackers to determine how far they have travelled and the kind of activity they are doing.

Challenges

- Concern for data security: Most of the fitness trackers connect with the user’s phone via Bluetooth. This poses potential security loopholes and could allow hackers to access the vital information of the user.

- Over-reliance on numbers: The user generally aims to meet the already set numeric goal, which usually leads to overexertion. Also, in pursuit of reaching the target of calorie or step count, the person can ignore pivotal aspects of fitness.

Fitness Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 17.5 billion |

|

Forecast Year Market Size (2035) |

USD 29.05 billion |

|

Regional Scope |

|

Fitness Equipment Market Segmentation:

Application Segment Analysis

The weight loss segment is estimated to gain the largest fitness equipment market share over the projected time frame. The growth of the segment can be attributed to the increasing prevalence of obesity and high levels of cholesterol. Obesity causes various medical problems such as heart disease, high blood pressure, diabetes, and sleep apnea. For instance, according to the World Health Organization in 2021, the number of adults aged 30-79 years with hypertension reached 1.28 billion. People are using fitness trackers that aim to measure blood pressure and weight loss journey parameters. People who are adopting a weight loss plan consider wearing a fitness tracker to set program reminders and monitor progress.

Product Type Segment Analysis

The fitness monitoring equipment segment is expected to garner a significant fitness equipment market share by 2035, due to the rising demand for monitoring physical activity. There is rising awareness of mental health and breaking a sedentary lifestyle. According to Harvard Medical School in July 2023, 1 out of every 2 people in the world is likely to develop a mental health disorder in their lifetime. Researchers suggest that exercise causes the brain to release “feel-good” chemicals such as serotonin and endorphins that are helpful in improving mood. Fitness trackers are becoming popular to help reduce stress by providing various features, such as breathing exercises. During the breathing exercise, fitness trackers measure the time the user spends in the calm zone.

Our in-depth analysis of the global fitness equipment market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Product Type |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fitness Equipment Market Regional Analysis:

North America Market Insights

North America region is poised to dominate around 39.8% market share by 2035. The growth of the market can be attributed mainly to an increasing number of people indulging in physical activities, followed by a rise in the number of gym memberships. For instance, according to the Health and Fitness Association in June 2022, health club memberships in the U.S. reached 66 million. This is subsequently increasing the demand for commercial fitness trackers as people are willing to change their lifestyles and are exponentially increasing their health awareness. Also, in Canada, every year, the 1st Saturday in June is known as “National Fitness Day”. The government in Canada published data in 2024 that 43.9% of children and 49.2% of adults meet physical activity recommendations in Canada. The government is emphasizing that people of all ages should make physical activity a part of their lives. These factors are propelling the growth of the market in the country in the coming decade.

Asia Pacific Market Insights

The demand for fitness trackers in the Asia Pacific is picking up pace due to the presence of a large consumer base and increasing disposable income of the people. People are adopting modern methods and integrating technology into their daily fitness regime. The fitness tracker market in China is showing remarkable potential due to rising urbanization and government initiatives for promoting the benefits of physical activity. Also, obesity in the country is rising at an alarming rate in the country. As stated by the National Institutes of Health in 2022, the percentage of obese and overweight people in China reached 50.7%. There is an increasing number of obese people opting for corporate wellness facilities and fitness trackers for themselves. Additionally, India is also registering the fastest growth through 2035, on account of rising interest of people in fitness activities. Various companies are coming up with state-of-the-art solutions to help people meet their fitness goals.

Fitness Equipment Market Players:

- Core Health & Fitness, LLC.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nautilus, Inc.

- Life Fitness

- Johnson Health Tech

- REALLEADER FITNESS CO., LTD

- TRUE

- Impulse Health Tech CO., LTD

- iFIT Inc.

- Torque Fitness.

- Body-Solid Inc.

The competitive landscape of the fitness equipment market is rapidly evolving as established key players, healthcare giants, and new entrants are investing in novel technologies. Key players in the market are focused on catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In September 2024, Apple introduced the Series 10 watch with the most advanced display. This Apple Watch is comfortable to wear at night, and users can get data related to heart rate, sleep rate, and wrist temperature while they are sleeping. The watch now offers a feature to help identify signs of sleep apnea.

- In April 2024, Impulse Health Tech Co., LTD. participated in the FIBO Fitness and Bodybuilding Trade Show. The company demonstrated cutting-edge design achievements and meticulous craftsmanship.

- Report ID: 575

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fitness Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.