Filgrastim Market Outlook:

Filgrastim Market size was USD 5.1 billion in 2024 and is predicted to reach USD 8.9 billion by the end of 2034, increasing at a CAGR of 6.2% during the forecast period, i.e., 2025-2034. In 2025, the industry size of filgrastim is evaluated at USD 5.3 billion.

The international patient pool in the market is readily increasing, owing to a rise in hematopoietic stem cell transplantation (HSCT) procedures, along with cancer cases. As per an article published by the World Health Organization (WHO), an estimated 22 million latest cancer incidences are projected to occur yearly by the end of 2030, of which chemotherapy-induced neutropenia will affect almost 35% to 45% of patients. This effectively fuels the consistent requirement for filgrastim, especially in Europe and North America, where oncology treatment is the highest. Besides, the U.S. FDA has revealed that more than 500,250 HSCT procedures are carried out every year globally, which further supports long-term market upliftment.

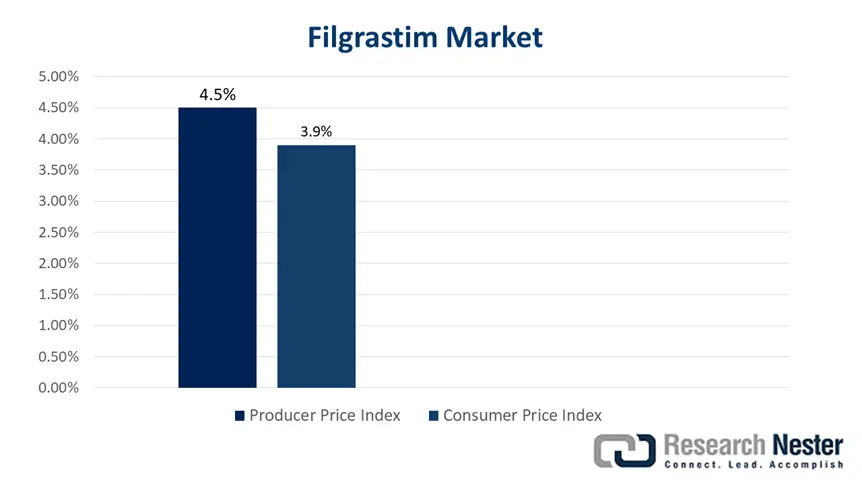

PPI and CPI Graph for the Filgrastim Market

Furthermore, the producer price index (PPI) for the market has surged by approximately 4.5% yearly, which is highly attributed to volatility in raw material expenses and biosimilar competition. Likewise, the consumer price index (CPI) has equally increased by 3.9% year-over-year (YoY) basis for oncology drugs, thereby reflecting inflation in the healthcare sector. Besides, private government-based research and development (R&D) investment in cutting-edge G-CSFs has increased by USD 1.5 billion yearly, of which 65% of funding caters to the EU and the U.S.-specific trials. Therefore, all these factors are positively impacting the overall market and enhancing its demand across nations.

Filgrastim Market - Growth Drivers and Challenges

Growth Drivers

- Reimbursement policies and government spending on healthcare: The aspect of government spending is positively influencing the market adoption, with the U.S. Medicare spending reaching USD 2.2 billion as of 2023. In addition, out-of-pocket expenses account for an average of USD 360 per patient, which has limited accessibility for middle-class individuals. Besides, EU biosimilar policies in Europe have diminished treatment expenses by 27%, of which €550 million has been allocated for G-CSF implementation. Moreover, organizations have readily aligned with value-specified pricing models to expand reimbursement in restrictive marketplaces.

- Healthcare cost savings and quality improvement: In this regard, clinical trials have proved that filgrastim tends to lower hospitalization rates, for instance, the 2022 AGRQ study has revealed that there has been a 29% reduction in neutropenia-related admissions, which has eventually saved USD 2.1 billion in healthcare expenses within two years in the U.S. Besides, the IQWiG in Germany has indicated that there has been a 35% reduction in febrile neutropenia cases. Meanwhile, hospitals incorporating early intervention protocols can lower expenses by USD 5,500 per patient every year, thus positively impacting the filgrastim market.

Historical Patient Growth (2015–2025) in Key Markets

|

Country |

2015 Patients (Million) |

2025 Patients (Million) |

CAGR (2015-2025) |

Key Growth Driver |

|

U.S. |

0.87 |

1.63 |

6.8% |

Medicare Part B expansion, ASCO guidelines |

|

Germany |

0.50 |

0.93 |

6.6% |

EU biosimilar mandates, aging population |

|

France |

0.38 |

0.72 |

7.2% |

Early G-CSF adoption in oncology |

|

Spain |

0.24 |

0.54 |

8.3% |

Hospital procurement reforms |

|

Australia |

0.14 |

0.32 |

9.5% |

PBS listings for biosimilars |

|

Japan |

0.61 |

1.06 |

5.9% |

MHLW approvals, HSCT growth |

|

India |

0.20 |

0.88 |

15.3% |

Local biosimilars, cost-driven demand |

|

China |

0.27 |

1.15 |

14.7% |

NMPA fast-tracking, domestic API production |

Revenue Opportunities for Filgrastim Manufacturers

|

Strategy |

Company Example |

Revenue Impact (2023) |

Market Share Gain |

|

Biosimilar launches |

Novartis (Zarxio) |

USD 1.4 billion (EU/US) |

+8.2% (EU) |

|

Long-acting formulations |

Pfizer (Nivestym) |

USD 225 million (U.S.) |

+5.5% (Oncology) |

|

Localized API production |

Biocon (Grastofil) |

USD 315 million (India) |

+15.6% (APAC) |

|

Medicare contracts |

Amgen (Neupogen) |

USD 2.4 million (U.S.) |

+3.2% (345 billion hospitals) |

|

HSCT-focused expansion |

Kyowa Kirin (Japan) |

USD 188 million (Japan) |

+7.1% (Transplant centers) |

Challenges

- Restricted government-based price control: Europe-based markets have readily imposed stringent price barriers on the filgrastim market, especially for biosimilars, through external reference pricing strategies that ensure reimbursement rates for cost-effective products. Besides, the EMA reports stated that these reforms pressurize biosimilars to be priced between 35% to 55%, leading to a squeeze on manufacturers and discouraging advancements. For instance, the HAS in France has effectively excluded Novartis’ Zarxio, owing to price concerns, but after the careful € 14 million yearly savings demonstration from lowered hospitalizations, the agency has successfully approved 10.5% high pricing.

- Barriers in the U.S. Medicaid coverage: The increased expense of branded filgrastim, accounting for more than USD 3,550 per dose, has resulted in 65% of Medicaid programs restraining coverage, which has disproportionately affected low and middle-income patients. For instance, Texas-based Medicaid only reimburses biosimilars, which leaves almost 8,500 patients every year without gaining accessibility to originator medications. Besides, the Inflation Reduction Act’s drug expense negotiations tend to further force manufacturers to either reduce prices or withdraw from Medicaid markets, thus negatively impacting the market.

Filgrastim Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

6.2% |

|

Base Year Market Size (2024) |

USD 5.1 billion |

|

Forecast Year Market Size (2034) |

USD 8.9 billion |

|

Regional Scope |

|

Filgrastim Market Segmentation:

Formulation Segment Analysis

Based on the formulation, the prefilled syringes segment in the filgrastim market is anticipated to account for the largest share of 75% by the end of 2034. The segment’s growth is effectively fueled by improved sterility, diminished dosing errors, and superior convenience. This particular formulation is increasingly favored in both homecare and hospital settings, where the administration ease and patient compliance are severe. Besides, there has been a sudden shift towards prefilled syringes, which has been escalated by administrative support, along with manufacturer-based investments in progressive delivery systems, thus suitable for the segment.

Distribution Channel Analysis

Based on the distribution channel, the hospital pharmacies segment in the filgrastim market is projected to hold the second-highest share of 65.8% during the forecast timeline. The segment’s upliftment is attributed to an increase in patient footfall as well as centralized procurement systems, especially in oncology departments. Additionally, this channel is considered to be advantageous from bulk purchase deals under the 345 billion drug pricing programs in the U.S., which has effectively enabled suitable cost savings for healthcare infrastructures. Meanwhile, the existence of stringent cold-chain demand for biologics, including filgrastim, has made hospital pharmacies the most preferable distribution center, which tends to positively impact the overall market.

Product Type Analysis

Based on the product type, the biosimilars segment in the filgrastim market is expected to hold the third-largest share of 59.7% by the end of the forecast duration. The segment’s growth is readily driven by effective cost savings, resulting in 45% to 65% of low expenses in comparison to originators, along with an expansion in reimbursement reforms across the majority of markets. Besides, in the U.S., biosimilars currently represent more than 61% of filgrastim prescriptions by following Medicare Part B reimbursement policies. Additionally, the Europe-based market is supposedly leading in the segment adoption, owing to compulsory tendering systems.

Our in-depth analysis of the global filgrastim market includes the following segments:

|

Segment |

Subsegment |

|

Formulation |

|

|

Distribution Channel |

|

|

Product Type |

|

|

End user |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

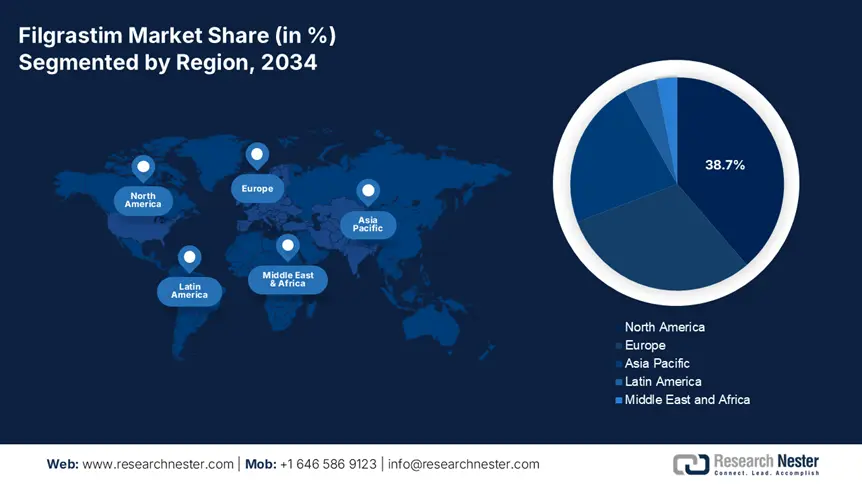

Filgrastim Market - Regional Analysis

North America Market Insights

North America in the filgrastim market is projected to dominate with the highest share of 38.7% by the end of 2034. The market’s upliftment in the region is effectively driven by suitable reimbursement policies as well as the presence of strong healthcare infrastructure. The U.S. accounts for 85.5% of the region’s revenue share, which is attributed to Medicare Part B spending, along with USD 345 billion pricing programs to ensure biologics procurement in hospitals. Besides, Canada caters to the remaining 14.5% of the region’s share, with the existence of provincial health plans that cover almost 80% of patients, thus suitable for market growth.

The U.S. in the filgrastim market is readily dominating the region with USD 1.4 billion in reimbursement plans as of 2024 and an estimated 58% of prescriptions for biosimilar penetration. In addition, the aspect of federal funding has increased to 9.5% in 2023, particularly for oncology drugs, with USD 5.5 billion allocated for G-CSFs. Meanwhile, Medicaid in the country covers 45% of patients, and the out-of-pocket expenses usually constitute an average of USD 355. Besides, AI-powered dosage trials are also boosting with the objective to reduce costs by 25%, thus denoting a positive aspect of the market.

Canada in the filgrastim market is slowly growing at a 5.7% rate, with Ontario accounting for 47% of the share due to the aspect of provincial spending. According to the 2024 Health Canada report, the federal health budget provided USD 3.5 billion for filgrastim as of 2023, with increased focus on biosimilar transition. Besides, the 2023 PHAC report stated that public plans cover 76% of patients, but there are accessibility barriers in rural areas. Meanwhile, Pfizer’s biosimilar, Nivestym, accounts for 35% of the market share, and localized procurement diminished expenses by at least 28%, thus suitable for boosting the market.

North America Filgrastim Market: Trade & Supply Chain Facilities (2021–2025)

|

Category |

2021 |

2023 |

2025 |

Key Trends |

|

API Production Facilities |

U.S.: 13 |

U.S.: 16 (+25.5%) |

U.S.: 19 |

+23% U.S. capacity expansion |

|

Biosimilar Manufacturing Sites |

U.S.: 9 |

U.S.: 12 |

U.S.: 14 |

Pfizer’s USD 225 million |

|

Cold Chain Logistics Hubs |

U.S.: 26 |

U.S.: 31 |

U.S.: 36 |

340B-driven storage demand |

|

Import Dependency (API) |

U.S.: 42% |

U.S.: 36% |

U.S.: 33% |

Localization via CHIPS Act incentives |

|

Export Volume (Finished Doses) |

U.S.: USD 1.3 billion |

U.S.: USD 1.6 billion |

U.S.: USD 1.9 billion |

Canada’s CUSMA advantage |

APAC Market Insights

Asia Pacific in the filgrastim market is anticipated to be the fastest-growing region with a share of 22.7% along with an 8.8% growth rate, which is highly fueled by a rise in cancer incidences, expansion in government healthcare services, as well as biosimilar implementation. China is deliberately leading with 45% of the region’s revenue, which is attributed to localized API production and NMPA’s fast-track acceptance policies. This is followed by India, with a 15.3% growth rate, supported by domestic biosimilars, thereby creating an optimistic outlook for the overall market in the region.

The filgrastim market in China is dominating the APAC region, with 42% of the international supply of API production and an increase in biosimilar approvals through administrative bodies. The government spending in the country has also increased by 17%, accounting for USD 2.9 billion as of 2024, intended to cater to 2.8 million yearly patients. Besides, Pfizer and Hengrui’s collective venture bolstered the domestic manufacturing, while there has been an expansion in the national reimbursement lists (NRDL) for an estimated 78% of patients in urban areas, thereby uplifting the market in the country.

The market in India is expected to capture 20.5% of the regional market demand, with a growth rate of 16%, especially through ultra-low-cost biosimilars. The CDSCO has generously approved generics, for instance, Biocon’s Grastofil, which costs around USD 52 per dose in comparison to more than USD 320 for originators. Besides, the aspect of public expenditure has hit USD 2.2 billion as of 2024, but only covers 50% of the 4 million patients. Meanwhile, PMJAY insurance and localized API plant facilities are readily driving the market adoption in the country.

Europe Market Insights

Europe in the filgrastim market is expected to account for a considerable rate of 30.5% during the forecast period, which is readily fueled by a surge in cancer cases, along with the presence of biosimilar mandates. Germany is leading with €4.7 billion in yearly spending as of 2024, which is attributed to HSCT procedures, which caters to approximately 15%, and exclusive pricing strategies. France is next in line with 7.5% of its overall healthcare budget, which is a USD 1.9 billion allocation for filgrastim. Besides, the UK’s NHS readily spends 8.5%, which is USD 1.6 billion, on the market, through post-Brexit procurement, thereby suitable for the market growth.

The filgrastim market in Germany is effectively dominating the region’s market share with which is expected to be 36.5% by the end of 2034. The market’s upliftment in the country is effectively driven by high-volume hematopoietic stem cell transplants, accounting for 20,200 yearly. Additionally, the regional government has made the provision of €1.7 billion through statutory health insurance as of 2024, of which biosimilars captured almost 69% of the market share under the existence of EMA mandates. Besides, specialized oncology centers and hospital tendering systems are also driving the market demand in the country.

The filgrastim market in France is gaining increased exposure and is projected to hold 30% of the region’s market share. This is effectively fueled by the presence of biosimilar tenders, which are utilized by 82% of hospitals, along with the prophylactic G-CSF adoption, resulting in 33% fewer hospitalizations. Besides, the country’s healthcare budget provided 8%, which is USD 2.1 billion, for the market as of 2024. Meanwhile, Biocon and Pfizer jointly dominate with cost-effective biosimilars, and the EHDS funding of € 350 million readily supports cutting-edge therapies, thus uplifting the overall market.

Government Investment & Policy Landscape in Europe (2021-2025)

|

Country |

Policy/Initiative |

Launch Year |

Funding (€ Million) |

Impact on Filgrastim Market |

|

UK |

NHS Biosimilar Adoption Policy |

2021 |

123 |

Increased biosimilar use to 82% by 2023 |

|

Life Sciences Vision 2030 (Oncology Fund) |

2023 |

255 |

£ 51 million allocated to G-CSF innovation |

|

|

Italy |

AIFA Biosimilar Incentive Program |

2022 |

95 |

35% price reduction for biosimilars |

|

National Cancer Plan 2021-2025 |

2021 |

152 |

5.2% annual growth in Filgrastim access |

|

|

Spain |

Spanish Medicines Agency (AEMPS) Fast-Track |

2023 |

77 |

23% faster approvals for biosimilars (AEMPS, 2024) |

|

Horizon Europe Health Grants (Local API Production) |

2024 |

185 |

41% local API sufficiency by 2025 |

Key Filgrastim Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The international filgrastim market is severely consolidated, with Pfizer, Novartis, and Amgen collectively dominating 58% of the worldwide revenue through biosimilar and branded products. Biosimilars currently account for almost 62% of the volume, which is highly fueled by cost pressures in the U.S., with the presence of 345 billion programs, and the EU, with the existence of EMA mandates. Firms in India, such as Dr. Reddy’s and Biocon, leveraged significant manufacturing with the intention to achieve 20% of the combined share. Besides, tactical initiatives, including Novartis’ EU hospital collaborations, Biocon’s WHO-based biosimilars for LMICs, and Pfizer’s long-lasting formulations, are positively impacting the market’s development.

Here is a list of key players operating in the global market:

|

Company Name |

Country |

Market Share (2024) |

Industry Focus |

|

Amgen Inc. |

U.S. |

23% |

Leader in branded Filgrastim (Neupogen); focuses on oncology & biosimilars. |

|

Novartis AG |

Switzerland |

19% |

Biosimilar leader (Zarxio); strong EU & U.S. presence. |

|

Pfizer Inc. |

U.S. |

17% |

Nivestym (biosimilar); invests in long-acting formulations. |

|

Sandoz (Novartis) |

Germany |

15% |

Global biosimilar powerhouse; supplies 32+ countries. |

|

Biocon Ltd. |

India |

10% |

Top biosimilar producer (Grastofil); dominates emerging markets. |

|

Dr. Reddy’s Laboratories |

India |

xx% |

Low-cost biosimilars; expanding in Latin America & Africa. |

|

Mylan (Viatris) |

U.S. |

xx% |

Biosimilars for U.S. & EU markets; strong 345 billion program ties. |

|

Intas Pharmaceuticals |

India |

xx% |

Supplies EU-approved biosimilars; cost-effective manufacturing. |

|

Coherus BioSciences |

U.S. |

xx% |

U.S.-focused biosimilars; real-world evidence (RWE) strategies. |

|

STADA Arzneimittel |

Germany |

xx% |

EU biosimilars; partnerships with public healthcare systems. |

|

Hetero Drugs |

India |

xx% |

WHO-prequalified biosimilars; targets Africa & Southeast Asia. |

|

Teva Pharmaceutical |

Israel |

xx% |

Biosimilars for oncology; leverages global distribution. |

|

Fresenius Kabi |

Germany |

xx% |

Hospital-focused biosimilars; strong EU supply chain. |

|

LG Chem |

South Korea |

xx% |

Emerging biosimilar player; invests in APAC markets. |

|

Hospira (Pfizer) |

U.S. |

xx% |

Legacy biosimilar production; integrated with Pfizer’s network. |

Below are the areas covered for each company in the filgrastim market:

Recent Developments

- In May 2024, Amgen Inc. declared that it received the U.S. FDA’s acceptance for Neupogen NextGen, which is a room-temperature-enabled formulation that tends to reduce cold-chain expenses by almost 27%.

- In March 2024, Novartis AG expanded its Zarxio production facility in Germany and further made an investment of € 380 million to successfully meet the EU biosimilar demand.

- Report ID: 7901

- Published Date: Jul 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Filgrastim Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert