Fiber Laser Marking Machine Market Outlook:

Fiber Laser Marking Machine Market size was estimated at USD 2.3 billion in 2025 and is expected to surpass USD 4.6 billion by the end of 2035, rising at a CAGR of 7.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of fiber laser marking machine is estimated at USD 2.4 billion.

The fiber laser marking machines are widely adopted for high-precision manufacturing workflows, especially in electronics, medical devices, and EV battery assembly. The International Energy Agency (IEA) revealed that in 2024, the demand for batteries in the energy sector, including those for electric vehicles (EVs) and energy storage, reached a record 1 terawatt-hour (TWh). Also, a 25% increase in EV battery demand driven by high EV registrations, which hit over 950 gigawatt-hours (GWh) compared to 2023, was reported. The demand for electric truck batteries grew substantially in China, and Europe also saw a 25% rise, making up about 10% of the global total. This indicates that the increasing registrations of electric vehicles are anticipated to propel the demand for fiber laser marking machines in the years ahead.

Supply of raw materials, including specialty optical fiber, diodes, and pump lasers, works from the prior established global silica glass and semiconductor industries. Manufacturing nodes are expanding in the U.S. and globally, with new fiber laser assembly lines in Wuxi, China, and domestic clean room manufacturing facilities. Also, the ongoing R&D commitment in metrology and technology standards for fiber optics is increasing the deployment of enhanced fiber laser instruments.

Key Fiber Laser Marking Machine Market Insights Summary:

Regional Highlights:

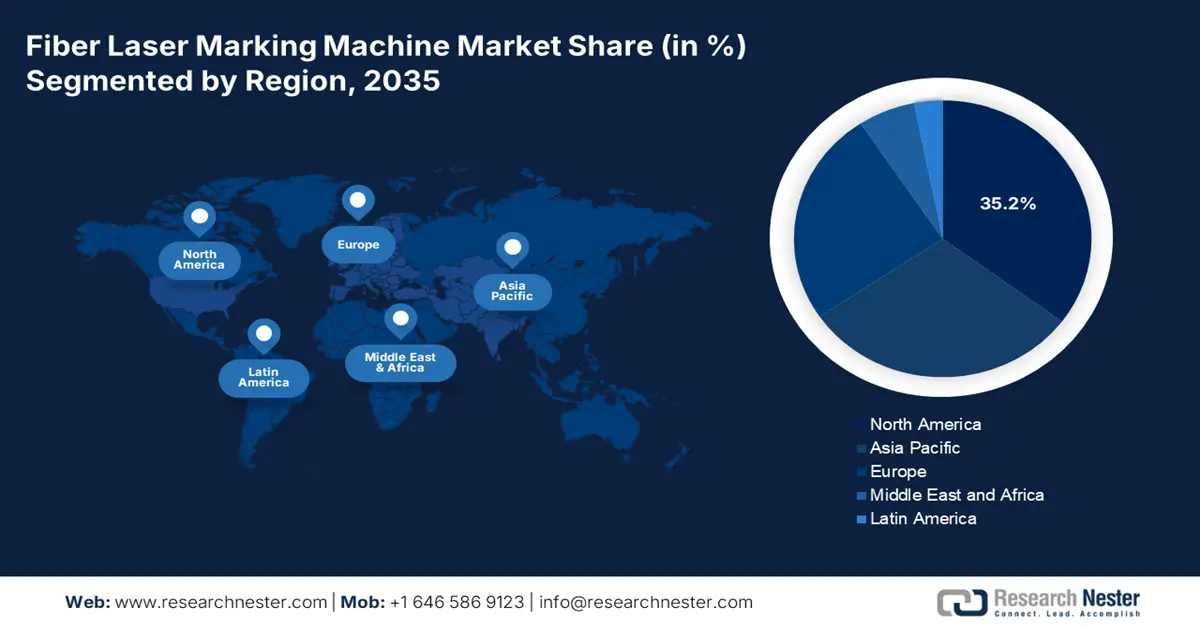

- North America in the fiber laser marking machine market is expected to command a 35.2% share by 2035, attributable to advanced manufacturing processes used in the automotive and electronics industries.

- By 2035, the Asia Pacific region is projected to secure a 30.3% share, stemming from rising electronics, automotive, and packaging demand.

Segment Insights:

- By 2035, the pulsed fiber laser segment in the fiber laser marking machine market is projected to reach a 45.3% share, supported by the rapid adoption of automation in emerging economies.

- The automotive segment is expected to account for a 35.1% share by 2035, reinforced by heightened part identification and compliance requirements.

Key Growth Trends:

- Expansion of electronics and semiconductor manufacturing

- Shift towards automation

Major Challenges:

- High compliance costs due to environmental regulations

- Pricing pressures from global competition

Key Players: IPG Photonics Corporation, Trumpf GmbH + Co. KG, Coherent, Inc. (formerly Rofin-Sinar), Han’s Laser Technology Industry Group, Telesis Technologies, Inc., FOBA (ALLTEC GmbH), Gravotech Marking, Epilog Laser, LaserStar Technologies Corporation, Lumentum Holdings Inc., Daewha Alloytech Co., Ltd., Sahajanand Laser Technology Ltd., Amada Miyachi Co., Ltd., Keyence Corporation, IPG Photonics, DMK Lasers.

Global Fiber Laser Marking Machine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.3 billion

- 2026 Market Size: USD 2.4 billion

- Projected Market Size: USD 4.6 billion by 2035

- Growth Forecasts: 7.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Mexico, Indonesia, Brazil

Last updated on : 9 September, 2025

Fiber Laser Marking Machine Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of electronics and semiconductor manufacturing: Rising demand for consumer electronics and EV components across the globe creates fiber laser marking requirements for microchip labeling, QR coding, and product differentiation. According to the Semiconductor Industry Association (SIA), the global semiconductor chip sales totaled USD 52.0 billion in May 2025, increasing 3.5% month-to-month. In June, the sales grew by 19.6% on a year-to-year basis, and were mainly led by the Asia Pacific and North America markets.

Importers and Exporters of Semiconductor Devices and Similar Devices in 2023

|

Country |

Export Value in USD Million |

Country |

Import Value in USD Million |

|

China |

1500 |

Malaysia |

1910 |

|

Singapore |

1480 |

China |

1520 |

|

Japan |

1040 |

Singapore |

676 |

Source: OEC

- Shift towards automation: The Industry 4.0 and smart manufacturing trends are estimated to fuel the sales of advanced fiber laser marking machines. In the connected production environment, where product identification and traceability are vital, push the use of fiber laser marking machines. The end users with automated production facilities heavily rely on advanced fiber laser marking technologies to boost their operations. In February 2025, Laser Photonics Corporation and its subsidiary, Control Micro Systems, Inc., introduced a new project to improve their Extrusion Line Laser Marking Systems. The goal is to make high-volume manufacturing faster and more precise. This indicates that key players are focusing on this trend and introducing fiber laser marking machines as per the evolving consumer needs.

- Increasing application in the medical sector: The implementation of the Unique Device Identification (UDI) regulation is expected to boost the application of fiber laser marking machines in the medical sector. These machines effectively track medical devices and make recalls easier by offering precise, tamper-proof, and safe markings. The evolving demands in the medical sector are estimated to drive innovations in fiber laser marking machines. Matthews Marking Systems unveiled new additions to its offerings, namely Fiber, Fiber Film, and UV laser systems, in March 2025. The company projects that these solutions are set to be deployed across various industries owing to their fast and accurate marking. Overall, continuous research and development activities are estimated to double the revenues of key players in the years ahead.

Challenges

- High compliance costs due to environmental regulations: Stringent environmental regulations in key markets, such as the U.S. and EU, significantly increase compliance costs. To comply with these restrictions, equipment prices climb drastically for small enterprises. Many SMEs and start-ups don’t stand out in the global landscape owing to budgetary issues, mainly influenced by the competitive environment.

- Pricing pressures from global competition: Laser marking machines have also ultimately become commoditized and have had a severe impact on pricing. Lower cost and government export subsidies enable Chinese manufacturers to reduce the price of laser markers below Western manufacturers. The price model used to entrench competitive positioning proves difficult for U.S. and EU manufacturers to follow. Thus, pricing pressures are estimated to hinder the overall market growth to some extent in the years ahead.

Fiber Laser Marking Machine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2025-2037 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 2.3 billion |

|

Forecast Year Market Size (2035) |

USD 4.6 billion |

|

Regional Scope |

|

Fiber Laser Marking Machine Market Segmentation:

Laser Type Segment Analysis

The pulsed fiber laser segment is predicted to account for the largest market share of 45.3% during the projected period. The demand for high contrast and permanent markings with minimal thermal distortion and necessary to mark sensitive and delicate components that are often heat sensitive. For these applications, a compact device with high peak power and low energy needs becomes necessary to achieve commercial viability in sectors such as electronics, automotive, and medical tools. With each of these sectors emphasizing energy efficiency and laser system durability, the emphasis towards green manufacturing continues to be supported by government-sponsored smart manufacturing programs such as those by the U.S. Department of Energy. Overall, the rapid adoption of automation in emerging economies, driven by mass production, is expected to boost the growth of this segment.

Application Segment Analysis

The automotive segment is anticipated to constitute the most significant growth by 2035, with a 35.1% fiber laser marking machine market share, mainly due to the rising demand for precise part identification requirements, traceability measures, and regulatory compliance. Thus, not only is production of raw materials and electric and connected vehicles increasing, but it is simultaneously creating demand for the identification of electrical parts, metal housings, and safety-critical parts.

The World Economic Forum (WEF) discloses that in 2025, EVs are poised to hold more than 24.5% of global car sales. The transition to lightweight high-strength materials will further contribute to the use of fiber lasers; they can easily adapt to marking different types of metals and composites. In addition, industry-mandated regulations, e.g., NHTSA’s VIN marking regulation and the EU's end-of-life vehicle legislation, are estimated to continue to support this segment.

End user Segment Analysis

The consumer electronics segment is estimated to hold a dominant share of the fiber laser marking machine market by 2035, owing to the increasing demand for extremely precise and high-speed marking solutions. The need for tagging mass-produced components boosts the application of fiber laser marking machines. The expanding sales of smartphones, laptops, wearables, and gaming consoles represent high earning opportunities for key players. The World Economic Forum (WEF) in its April 2023 report disclosed that there are more smartphones than people across the world. Globally, over 8.5 billion mobile subscriptions were in use in 2022. This indicates that expanding mobile adoption is promoting the application of fiber laser marking machines.

Our in-depth analysis of the fiber laser marking machine market includes the following segments:

|

Segments |

Subsegments |

|

Laser Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fiber Laser Marking Machine Market - Regional Analysis

North America Market Insights

By 2035, the North America market is expected to hold 35.2% share of the global market due to advanced manufacturing processes used in the automotive and electronics industries. Key trends in chemical packaging included increased automation, more detailed traceability standards, and the incorporation of sustainable practices into manufacturing processes. Increased investments in robotics, green technology, and domestic supply chains will benefit demand. Also, investment in the extractive industries in automation upgrades is another research area to replace existing marking systems with laser marking systems in the high-precision sectors.

Fiber laser marking machine demand in the U.S. has spurred further with additional federal application under decarbonization grants from President Biden's administration of around ~ USD 6 billion marked for industrial retrofits for 2024, as well as the EPA's 2023 Green Chemistry awards, which allow them to introduce sustainable processes into their plants with the added benefit of eliminating or minimizing hazardous waste. As part of this, the Department of Energy (DOE) FY 2022 also included USD 8 billion for clean-energy innovation. This funding also supports potential upgrades to marking systems.

Canada saw an increase in clean energy industry grants in 2023, supported by the federal clean technology fund of USD 2 billion. The government also aims to use 100% clean power by 2025. The grants help catalyze investment into automated fiber laser marking systems that are highly precise and provide a level of traceability or compliance with the potential for regulations. The clean technology grants were tied to decarbonizing industry and also combined with green chemistry, which motivated demand by enabling a full turnkey package for laser marking in various aspects of chemical packaging, providing accurate and precise marking while helping to reduce regulatory risks.

Asia Pacific Market Insights

The Asia Pacific fiber laser marking machine market is expected to hold 30.3% of the global revenue share through 2035, due to rapid growth, fueled by rising electronics, automotive, and packaging demand. Automation and Industry 4.0 adoption are key drivers of growth, whilst regulatory requirements for traceability flow through downstream supply chains, fostering booming uptake. Along with investment in Electric Vehicle manufacturing and semiconductor fabs, which aid adoption amongst high-precision laser systems, the government's commitment to R&D in growing environmental sustainability via subsidies and strict industrial policies continues to consolidate the region's foothold in high-tech marking applications.

The sales of fiber laser marking machines in China are expected to be driven by its burgeoning EV and semiconductor sectors. Government policy accelerators, including Made in China 2025 and NDRC subsidies for Smart Manufacturing, are fast-tracking the marking process automation. The energy and chemical sectors, with their mandates for traceability and pollution mitigation, have led to fiber lasers moonlighting with millions of domestic companies realizing the 2033 sustainable marking processes.

The India fiber laser marking machine market is expected to register the fastest CAGR from 2026 to 2035, driven by several strong factors, including Make in India, ramping EV output, and automated electronics manufacturing. The India Brand Equity Foundation study reveals that the domestic electronic production has surpassed USD 101 billion in FY23 and is expected to continue growing, owing to the larger consumer base. Also, the government is set to drive the expansion of semiconductors, smartphones, and IT software and hardware components in the next 6 years through around USD 17 million PLI schemes. Domestic companies are scaling capacity to micro-etching and most of the gradient for ASEAN overseas joint promotional export demand dynamics, amongst others. These government-supported policies and industrializing upgrades within the manufacturing sectors will maintain India's peak growth forecast until 2035.

Europe Market Insights

The Europe fiber laser marking machine market is expected to hold 25.2% of the global revenue share due to demand in the automotive, aerospace, electronics, and healthcare sectors. The emphasis on sustainable, ink-free solutions and the momentum of digital traceability are increasing adoption. Industrial automation, regulations in the food and pharma sectors will drive demand. Public support through Horizon Europe and private grants around ecology are expected to accelerate growth even further, over the period 2023-2035.

The market in Germany is expected to register robust growth, supported by its strong automotive, aerospace, and machinery sectors. The emphasis on energy-efficient and low-waste technologies of the fiber laser process aligns with the goals and objectives of the country’s R&D funding. There are also national sustainability regulations and support funding through the Research and Innovation program in the EU and in German grants that are allowing organizations to integrate advanced laser technologies into their green manufacturing processes. EVs are a promising market for fiber laser marking technologies, especially for the precision marking of devices inside vehicles.

The France market for fiber laser marking machines is anticipated to expand at the fastest pace through 2035, owing to the robust investments in the aerospace and medical technologies sectors spearheaded by public agencies and funding from private innovators. The shift towards sustainable manufacturing and the circular economy objectives is surging forward with supportive funding from the EU, which boosts applications for fiber lasers, mostly in EV battery production and precision photonics. According to the International Energy Agency (IEA), Blue Solutions, a semi-solid-state battery producer, plans to invest more than €2 billion in a new factory in the country by 2030. Overall, France is estimated to offer hefty ROI for both domestic and international players in the years ahead.

Key Fiber Laser Marking Machine Market Players:

- IPG Photonics Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Trumpf GmbH + Co. KG

- Coherent, Inc. (formerly Rofin-Sinar)

- Han’s Laser Technology Industry Group

- Telesis Technologies, Inc.

- FOBA (ALLTEC GmbH)

- Gravotech Marking

- Epilog Laser

- LaserStar Technologies Corporation

- Lumentum Holdings Inc.

- Daewha Alloytech Co., Ltd.

- Sahajanand Laser Technology Ltd.

- Amada Miyachi Co., Ltd.

- Keyence Corporation

- IPG Photonics

- DMK Lasers

The global fiber laser marking machine landscape is influenced by the strong presence of industry giants and the increasing emergence of start-ups. The leading companies are focused on R&D activities to introduce next-gen solutions and cater to a wider consumer base. They are also entering into strategic partnerships and collaborations to increase their customer base and product offerings. Furthermore, they are also entering into emerging markets to earn high gains from untapped opportunities.

Some of the key players operating in the market are listed below:

Recent Developments

- In March 2025, Laserax acquired DPSS Lasers Inc., a California-based company that makes powerful ultraviolet lasers. This move makes Laserax a stronger leader in laser technologies worldwide.

- In June 2024, IPG Photonics, which manufactures high-performance fiber laser solutions, announced the expansion of its units in Japan. The company officially inaugurated a new Chubu Technical Center in Anjo City.

- In May 2024, Han's Laser received 2 Ringier Technology Innovation Awards in China. Such achievements are directly uplifting the position of the company in the competitive landscape.

- In April 2024, DMK Lasers announced its participation in the 2024 Japan International Welding Show. The company showcased its various products and gained a larger audience base.

- Report ID: 523

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fiber Laser Marking Machine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.