Ferulic Acid Market Outlook:

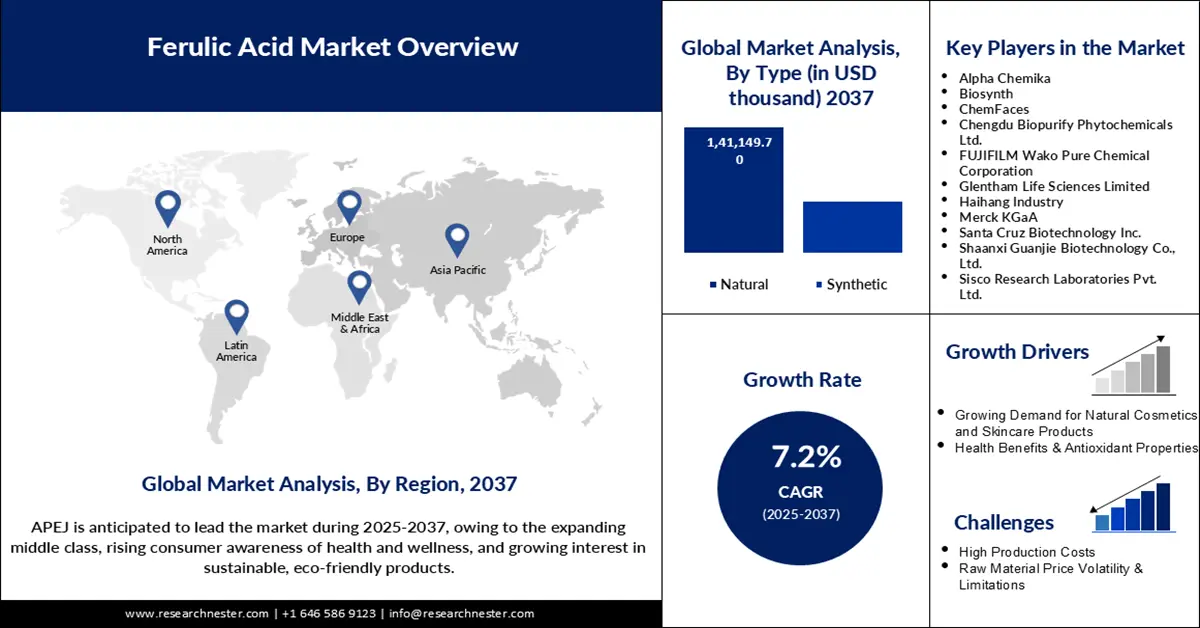

Ferulic Acid Market size was valued at USD 76,513.6 thousand in 2024 and is projected to reach a valuation of USD 199,662.4 thousand by the end of 2037, rising at a CAGR of 7.2% during the forecast period, i.e., 2025-2037. In 2025, the industry size of ferulic acid is assessed at USD 86,088.6 thousand.

The ferulic acid market is witnessing a rise in innovation due to the rising use of natural antioxidants in the skin care, pharmaceutical, and food industries. In January 2024, Tsuno Co., Ltd. obtained a patent for a high dosage ferulic acid formulation obtained from rice bran that has strong ultraviolet light absorption capability. This development improves the stability of the product in sunscreen applications and provides an opportunity to use plant-based filters instead of synthetic ones. The market is also addressing demographic shifts, with the WHO expecting the global population of people aged 60+ to double by 2050, driving the consumption of anti-aging ingredients. These trends make ferulic acid a valuable ingredient for the new generation of wellness and skincare products.

Digital commerce and international distribution are further enhancing market access. According to a survey, 63% of global consumers are now concerned with clean labeling, particularly with regard to sustainability and origin. Governments are also investing in the R&D of plant-based alternatives in line with net-zero and circular economy initiatives. Due to the corporate drive for rebranding and a push in the public sector, the ferulic acid market is set to become more saturated and innovative in its applications. Moreover, the increasing demand for clean-label cosmetics is continuing to transform the formulations of beauty products around the world.

Ferulic Acid Market - Growth Drivers and Challenges

Growth Drivers

- Increased consumer interest in natural and clean-label products: The increasing trend toward clean-label products is driving the growth of ferulic acid in the cosmetics and nutraceutical industries. Studies show that 78% of consumers are willing to spend more money on a product that is labeled ‘natural. This shift is currently affecting the beauty industry as synthetic-free, transparent compositions are now the norm. In December 2023, Biosynth purchased VIO Chemicals to expand the firm’s capabilities in scalable chemical production, including bio-derived ferulic acid. Brands are turning to nature identical as sustainability and regulatory compliance are the new trend and standard in the clean beauty market.

- Anti-aging and UV-protection functional benefits: As per Research Nester, 56% of Gen Z consumers (female) and 57% of millennials express concern over early aging, the need for anti-aging skincare products is increasing. Ferulic acid, which is widely known for its antioxidant and UV-protective properties, is now gaining popularity as an ingredient in sunscreens and anti-aging products. Furthermore, in January 2024, Tsuno Co., Ltd. and Matsumoto Trading launched a ferulic acid-based sunscreen to illustrate the commercial synergy of dermal care with youth. With the increasing trend of using early intervention in skincare, ferulic acid is set to become a key ingredient in multifunctional products for both prevention and cure.

- Expansion in functional food and health products: The World Health Organization has projected that the proportion of people aged 60 years and above will increase to one-sixth of the global population by 2030. This demographic shift is increasing the demand for nutraceuticals that contain ferulic acid to address issues related to oxidative stress and chronic diseases. In March 2023, Sabinsa’s Hassan facility was inaugurated with the ability to manufacture various active ingredients, such as ferulic acid, to cater to the global health and wellness market. With an aging population, preventive supplementation and dietary applications will open up fresh opportunities for the compound in functional foods and nutraceutical formulations.

Challenges

- Raw material variability and agricultural dependency: The availability of ferulic acid is highly dependent on agricultural raw materials such as rice bran and corn. According to the USDA, America’s corn yield was 377.6 thousand metric tons in 2024. However, ferulic content differs from one crop to another or even from one region to another. Such fluctuations make it difficult to sustain a steady and reliable yield extraction rate. With increasing consumer and industrial usage, producers need to explore other raw materials or secure supplies through synthesis or enzymes. Maintaining scale while ensuring that the ingredients are consistent is one of the challenges that global manufacturers face.

- Complex extraction and formulation barriers: The purification of ferulic acid is also a challenging task because it is necessary to go through several steps of extraction and may need to undergo chromatography and biotransformation. Even though enzymatic hydrolysis is more efficient in terms of product purity, it is relatively expensive. To target the broad market and particularly for cost-sensitive applications, there are issues of production constraints and purification that need to be overcome by firms. Thus, without further technological standardization, access and affordability may remain limited in emerging markets.

Ferulic Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Period |

2025-2037 |

|

CAGR |

7.2% |

|

Base Year Market Size (2024) |

USD 76,513.6 thousand |

|

Forecast Year Market Size (2037) |

USD 199,662.4 thousand |

|

Regional Scope |

|

Ferulic Acid Market Segmentation:

Type Segment Analysis

Natural ferulic acid is expected to be the largest segment, with a market share of 72.2% during the forecast period, attributed to increased demand for natural ingredients. The American Chemical Society noted that 40% of beauty consumers are now willing to pay for natural ingredients instead of synthetic ones. In January 2024, Tsuno Group successfully patented a high-dosage natural ferulic acid from a rice bran formulation. This is in line with clean beauty claims, making it more suitable to expand its application in anti-aging and sun protection products. Natural variants also conform to eco-label standards, providing both a regulatory and a marketing edge. As a result, the demand for natural ferulic acid is expected to continue to grow in the coming years.

Source of Materials Segment Analysis

The non-fossil-based segment is anticipated to expand at a CAGR of 7.5% between 2025 and 2037, surpassing synthetic solutions. Fermentation and biomass-derived ferulic acid have been mainly promoted due to the increased focus on low-carbon manufacturing across the globe. In March 2023, Biokemik established fermentation-based technologies employing microorganisms from the Spanish CECT library. This innovation offers the ability to produce at scale while needing minimal space, which is important to brands concerned with transparency and carbon emissions. This segment is likely to see more investment and commercialization, with regulatory authorities pushing for bio-based sourcing.

Our in-depth analysis of the ferulic acid market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Source of Materials |

|

|

Non-Fossil Sources & Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ferulic Acid Market - Regional Analysis

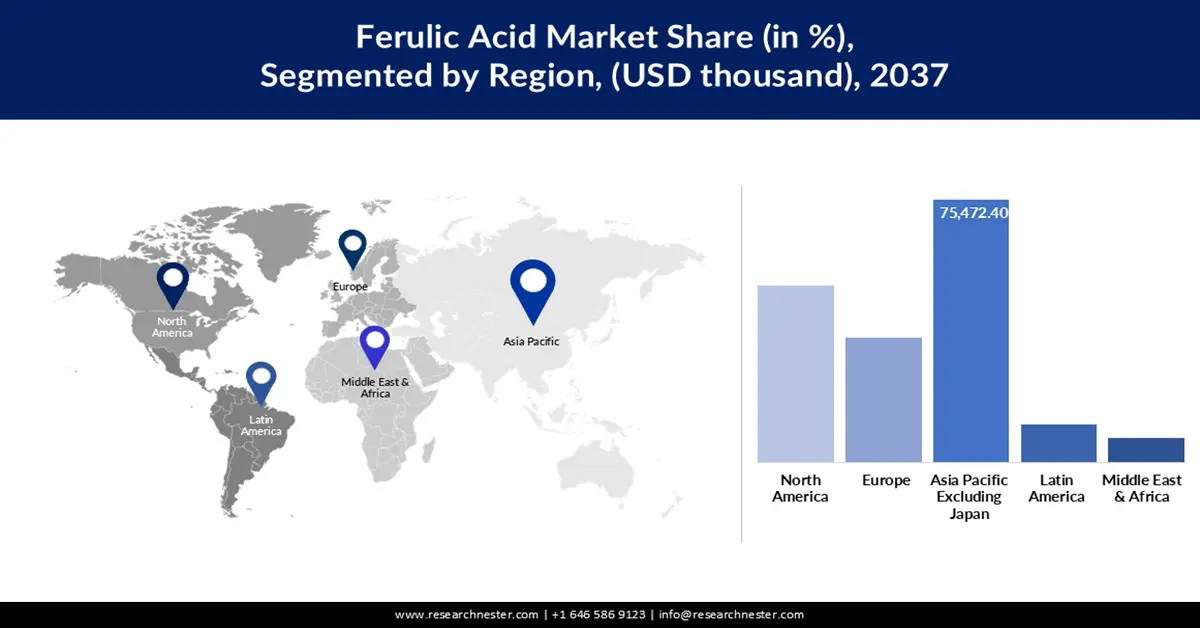

Asia Pacific Excluding Japan Market Insights

Asia Pacific excluding Japan is expected to dominate the market, holding around 37.7% share by 2037, mainly driven by industries such as food and beverages, cosmetics, and pharmaceuticals. As per the ITC report in 2024, China is the leading exporter of ferulic acid, with 39% global export market share and 291 export shipments. Governments in the regions are focusing on clean-label and bio-derived ingredients due to the decrease in manufacturing costs. This is due to initiatives such as India’s ‘Make in India’ and China’s shift from manufacturing-centric industrial policy to research and development.

China is the largest producer and consumer of genetically modified products due to its large pharmaceutical and food industries. China continues to lead the markets for fermentation through well-developed fermentation facilities and the extensive use of cosmetics. Furthermore, the country’s exports are indicative of this scale, making it the largest exporter of the product in the world. Domestic demand is further bolstered by a switch to healthier formulations, particularly in anti-aging and sun protection. China is committed to the industrial development of biochemical innovation to maintain its position in the ferulic acid value chain.

India is turning out to be a lucrative market for clean-label ferulic acid products. In 2023, India accounted for 5,000 plus clean label products, which were 13% of total global new product launches. This translates to a shift in demand across health, food, and beauty products. Moreover, in May 2024, Haihang Industry changed its name to GetChem and established an office in Shanghai to enhance its operations in India and transportation. Local nutraceutical brands on the ONDC platform and the expansion of tier 2 and tier 3 cities are driving the availability of ferulic acid. With this level of support from the regulatory authorities and digital advancement, India is poised for speedy adoption.

North America Market Insights

North America is projected to rise at a CAGR of 7.5% through 2037, owing to large personal care, pharmaceuticals, and wellness markets. A report from the U.S. Centers for Medicare & Medicaid Services revealed that total healthcare spending stood at USD 4.5 trillion in 2022, with a strong emphasis on preventive health. Furthermore, in December 2023, Biosynth strengthened its portfolio by acquiring VIO Chemicals and increasing ferulic acid production for pharmaceutical and skincare customers. Due to the emphasis on clean-label and dermatologically proven ingredients, North America presents a favorable market for plant-based antioxidants.

The U.S. is one of the largest markets for pharmaceuticals and cosmetics, owing to the development of the respective industries. As stated by the European Federation of Pharmaceutical Industries and Associations (EFPIA), the U.S. captured 67.1% of new pharma sales between 2018 and 2023. This makes the country a key consumer of ferulic acid in the dermaceutical and nutraceutical industries. Brands are leveraging anti-aging attributes among young consumers, and federal policies are encouraging bio-based product development. Owing to their robust R&D capabilities and green chemistry initiatives, the U.S. players are serving as pioneers in the ferulic acid market.

Canada ferulic acid market is expanding due to clean beauty trends as well as the regulation of health products. The country facilitates natural ingredient imports with appropriate labeling and product claims management. Bioscience and direct consumer marketing strategies are some of the approaches used by companies in Canada to inform consumers about antioxidant formulations. This demand is especially observed among urban people, especially those in their postmenopausal period, who are in search of natural remedies from plants.

Key Ferulic Acid Market Players:

- Alpha Chemika

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Biosynth

- ChemFaces

- Chengdu Biopurify Phytochemicals Ltd.

- FUJIFILM Wako Pure Chemical Corporation

- Glentham Life Sciences Limited

- Haihang Industry

- Merck KGaA

- Santa Cruz Biotechnology Inc.

- Shaanxi Guanjie Biotechnology Co., Ltd.

- Sisco Research Laboratories Pvt. Ltd.

- Spectrum Chemical

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Tsuno Co., Ltd

- Xi'an Healthful Biotechnology Co.,Ltd

The competitive outlook of ferulic acid market involves both major chemical manufacturers and specialty botanical ingredient producers. Some of the key players in this market are Biosynth, ChemFaces, Chengdu Biopurify Phytochemicals Ltd., FUJIFILM Wako Pure Chemical Corporation, Glentham Life Sciences Limited, Haihang Industry, Merck KGaA, and Tsuno Co., Ltd. These companies are not only broadening production fields but also application areas, particularly in anti-aging cosmetics and functional well-being. The competition is rising in bioprocess innovation, sustainable sourcing of raw material, and strategic regional partnerships to gain market dominance.

Glentham Life Sciences strategically expanded into the EU market in April 2024. This expansion included the establishment of a new office and facility in Planegg, Germany, and the initiation of direct product deliveries to EU customers, significantly enhancing its capacity to provide agile, scalable solutions across the nutraceutical and pharmaceutical sectors. With industry participants ramping up their focus on biogenic sourcing and strengthening their regional positions, competitive differentiation will increasingly revolve around the compatibility of formulations, product purity, and regulatory compliance.

Here are some leading companies in the ferulic acid market:

Recent Developments

- In November 2024, SmartSKN launched the Muilli AI Dermascope, a groundbreaking portable skin analyzer powered by advanced AI. Designed for clinical-grade diagnostics, it enables personalized skincare formulation by precisely evaluating individual skin conditions. The innovation is expected to boost demand for high-efficacy actives like ferulic acid. This signals the growing intersection of AI and functional ingredients in beauty tech.

- In May 2024, VIO Biosynth rebranded to Biosynth, aligning under the unified Biosynth Group brand. The rebranding strengthens the company’s position as a trusted supplier of specialty chemicals, including intermediates and excipients such as ferulic acid. Biosynth’s integrated operations now ensure broader scalability and improved global delivery. Customers benefit from consistent, flexible manufacturing across all production stages.

- In May 2024, Haihang Industry transitioned to GetChem Co., Ltd., establishing a new headquarters in Shanghai to strengthen its market presence and service efficiency. The rebranding supports a more agile supply chain and personalized engagement with clients. With a focus on specialty chemicals, including ferulic acid, the move enhances global distribution capabilities. The update reflects Haihang's continued focus on customer-centric chemical trade.

- Report ID: 7353

- Published Date: Aug 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ferulic Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert