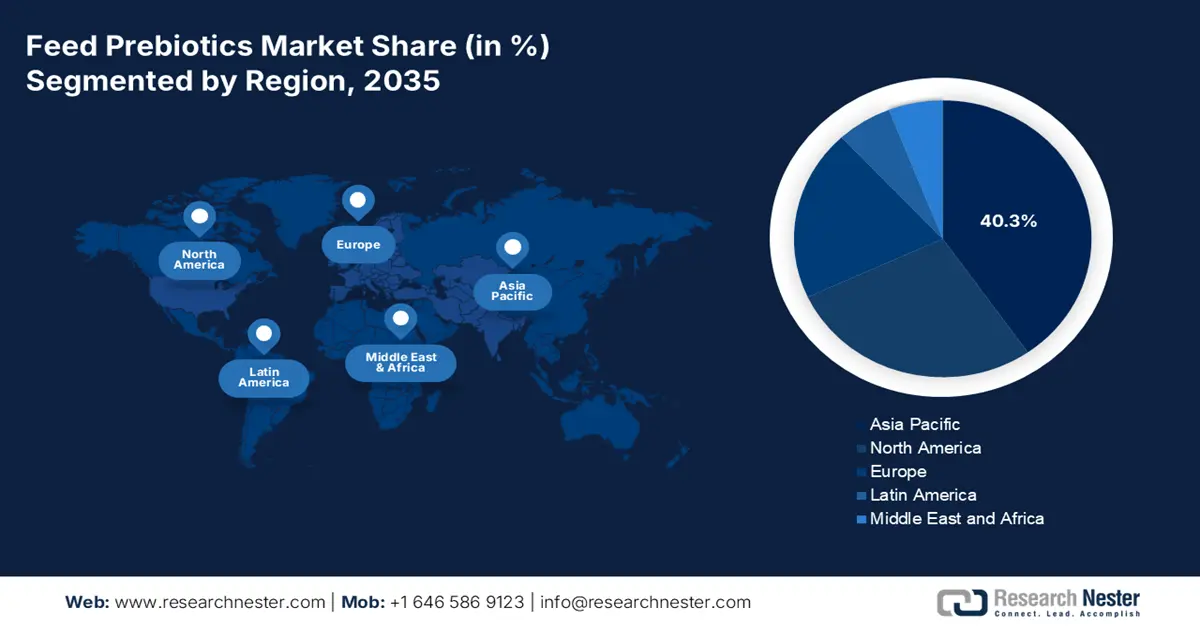

Feed Prebiotics Market - Regional Analysis

APAC Market Insights

The Asia Pacific is the dominant player in the market and is poised to hold the market share of 40.3% by 2035. The market is driven by the massive scale and rapid intensification of its livestock and aquaculture sectors. The primary demand driver is the need to enhance animal productivity and health to meet the soaring regional protein consumption, all while managing the industry’s strategic shift away from the antibiotic growth promoters that countries, including China, have heavily regulated. The key trends include the integration of the prebiotics into cost-effective formulations for the large-scale commercial farms, rising investment by the regional feed mill giants, and growing application in the aquaculture, the world’s fastest growing food production sector. Government initiatives, such as India's National Livestock Mission, further propel market growth by modernizing animal husbandry. The market is characterized by a strong presence of global players alongside competitive local manufacturers focusing on staple ingredients like MOS and FOS.

China’s feed prebiotics market is driven by the sheer scale of the world’s largest livestock and feed production sectors, operating under the government's strict 2020 ban on the growth-promoting antibiotics. The dominant trend is the use of prebiotics in the high-volume cost optimized formulations for the massive industrial pork and poultry operations, focusing on enhancing the feed efficiency and disease resilience. Further, China’s Ministry of Agriculture and Rural Affairs continues to prioritize feed efficiency, disease prevention, and biosafety in large-scale livestock systems as part of the national food security objectives, reinforcing the demand for non-antibiotic feed ingredients. The report from the OEC 2023 has depicted that China has exported USD 1.48 billion of animal feed preparations, incentivizing the integration of the prebiotics to meet the importing countries’ residue safety and antimicrobial stewardship requirements while maintaining cost control in high-volume operations.

By 2035, India is set to be fueled by a huge livestock population, government-led modernization initiatives, and the world’s largest dairy herd transitioning towards more intensive management. A key trend is the application of prebiotics to improve the milk yield and fat content in dairy cattle, as well as to support the burgeoning and highly cost-sensitive commercial poultry sector. The USDA September 2025 report notes that India’s skimmed milk production in 2025 was 770,000 MT, indirectly boosting prebiotic-fortified feeds for livestock nutrition. Further, the demand stems from the commercial feed mills incorporating the prebiotics like mannans and fructans to enhance digestion, immunity, and feed efficiency. Government investments in livestock productivity further solidify this demand.

North America Market Insights

North America is the fastest growing market and is expected to grow at a CAGR of 6.1% during the forecast period 2026 to 2035. The market is driven by the robust regulatory enforcement of antibiotic reduction, advanced livestock productivity demands, and integrated supply chains. The U.S. Veterinary Feed Directive and Canada’s Categorization of Antimicrobial Drugs create a non-negotiable demand for the alternatives. The trends include precision nutrition, where prebiotics are integrated into customized feeds for the specific life stages, and significant investment in R&D for the next generation symbiotic combinations. Sustainability metrics, such as reducing the environmental impact via improved feed efficiency, are becoming key purchasing criteria. The market consolidation among the large feed and animal health companies shapes the competitive landscape, focusing on value-based solutions over cost.

The U.S. feed prebiotics market is shaped by the large-scale integrated livestock operations and robust enforcement of the FDA’s Veterinary Feed Directive. The primary demand driver is the need to maintain animal health and productivity metrics while adhering to antibiotic reduction mandates. This has stimulated the adoption of prebiotics as a core component of the precision nutrition strategies often formulated in synergistic blends. The OEC 2023 report states that the U.S. is the second leading exporter of animal feed preparations, accounting for USD 2.09 billion. This report highlights the vast scale of the sector in which additive innovation must compete and integrate to capture and ensure regulatory compliance. This export-oriented production further intensifies the need for proven, science-backed additives that meet stringent international residue standards.

In Canada, the feed prebiotics market is driven by its robust regulatory framework for antimicrobial stewardship, led by Health Canada’s categorization of veterinary drugs and a strong export-oriented livestock sector. A key trend is the alignment of prebiotic use with national sustainability and climate goals, mainly in the ruminant sector, to support the methane reduction strategies. The Animal Nutrition Association of Canada report in 2025 depicts that the total feed consumption is estimated to be 28.9 million tons in 2024, with 19.3 million tons supplied by commercial feed mills, which defines the addressable volume base where the feed prebiotics are most commonly incorporated. Prebiotics are added at the commercial milling and premix level, not at the forage level, and this makes the commercially milled share especially relevant.

Total Feed Consumption by Species (2024)

|

Species |

Total Feed Tons |

|

Swine |

9,536,997 |

|

Beef Cattle |

7,795,382 |

|

Dairy Cattle |

5,346,616 |

|

Poultry |

5,399,435 |

|

Others |

856,152 |

Source: ANACAN 2025

Europe Market Insights

The feed prebiotics market in Europe is defined by the world’s robust regulatory framework and is driving the demand via a full ban on the use of antibiotic growth promoters. The primary driver is compliance with the EU Regulations that mandate rigorous scientific evaluation for all the feed additive authorizations. This creates a high barrier value-driven market where the prebiotics are essential for maintaining the animal health, welfare, and productivity. Major trends include the integration of the prebiotics into the precision farming and circular economy models, utilizing by-products from the food industry. The growth is concentrated in Western Europe, with the ruminant and swine sectors being the key demand centers. The EU Horizon Europe program allocated significant budget to the sustainable food system research, including projects on animal nutrition and gut health.

The UK market is shaped by its independent post Brexit regulatory regime that maintains a high standards while seeking to foster domestic agri tech innovation. The key driver is the reduction of antimicrobial use across its intensive livestock sectors, supported by the UK Government’s five-year National Action Plan on antimicrobial resistance. A primary trend is the integration of the prebiotics into premium welfare focused production systems to secure export market access and meet the retailer driven assurance schemes. The report from the Government of UK in July 2025 indicates that the animal feed contributed £4,604 million to intermediate consumption in England in 2024 confirms that feed is the largest cost input within the livestock production system. Feed prebiotics are incorporated within this cost base mainly via compound feeds that are explicitly identified as the dominant feed category.

UK Animal Feed Production and Consumption (2024)

|

Metric |

Value |

Change from 2023 |

|

TIFF Intermediate Consumption (England) |

£4,604 million |

- |

|

Total UK Compound Feed Production |

+567 kilotonnes |

+4.4% |

|

Cattle & Calf Feed |

- |

-11.3% |

|

Pig Feed |

- |

-12.2% |

|

Sheep Feed |

- |

-11.2% |

|

Poultry Feed |

- |

-11.2% |

|

Animal Feed Straights Prices |

- |

Decrease |

Source: Government of UK July 2025

Germany market is the largest in Europe and is the most technologically advanced, driven by the robust national implementation of the EU regulations, highly productive livestock sector, and a strong consumer demand for the antibiotic free meat. The primary trend is the adoption of precision feeding strategies where the prebiotics are precisely formulated into the rations to optimize gut health and nutrient efficiency, mainly in the country’s substantial pig and dairy industries. The report from the OEC in 2023 notes that the country has exported animal feed preparations worth USD 1.98 billion, highlighting the immense volume and industrial advancement that defines the demand for the feed additives. This export strength positions German feed manufacturers as key innovators in developing specialized additive blends for the global market.