External Pacemaker Market Outlook:

External Pacemaker Market size was valued at USD 1.76 billion in 2025 and is likely to cross USD 2.63 billion by 2035, expanding at more than 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of external pacemaker is estimated at USD 1.82 billion.

The global pacemaker market is witnessing growth, primarily fueled by increasing instances of cardiovascular diseases, technological developments, and the heightened demand for temporary pacemakers in critical care units. According to a WHO report published in 2023, cardiovascular diseases are causing 18.2 million deaths per year, with arrhythmia reporting of 33.7 million across all nations. Besides, NIH in 2023 reported that the demand for post-surgical and emergency care will expand at the highest rate among the geriatric population, as one out of 6 people will be aged above 60 by 2030. Hence, these factors will appreciably contribute to market development.

Furthermore, global trade activities also remarkably offer their support for driving business in the sector. The U.S. and EU are the crucial importers of external pacemakers similarly, China and Mexico are leading with major export values. In this regard, in 2023, it is reported that the U.S. imported USD 2.4 billion worth of cardiac rhythm management devices. Besides, NIH in 2023 declared that investments for research and development reached USD 1.6 billion, with 65.2% assigned for wireless pacing and AI-based monitoring. Furthermore, government-backed programs, such as the NIH’s Artificial Heart Program, are accelerating innovation, particularly in temporary pacing for emergency medicine.

Key External Pacemaker Market Insights Summary:

Regional Highlights:

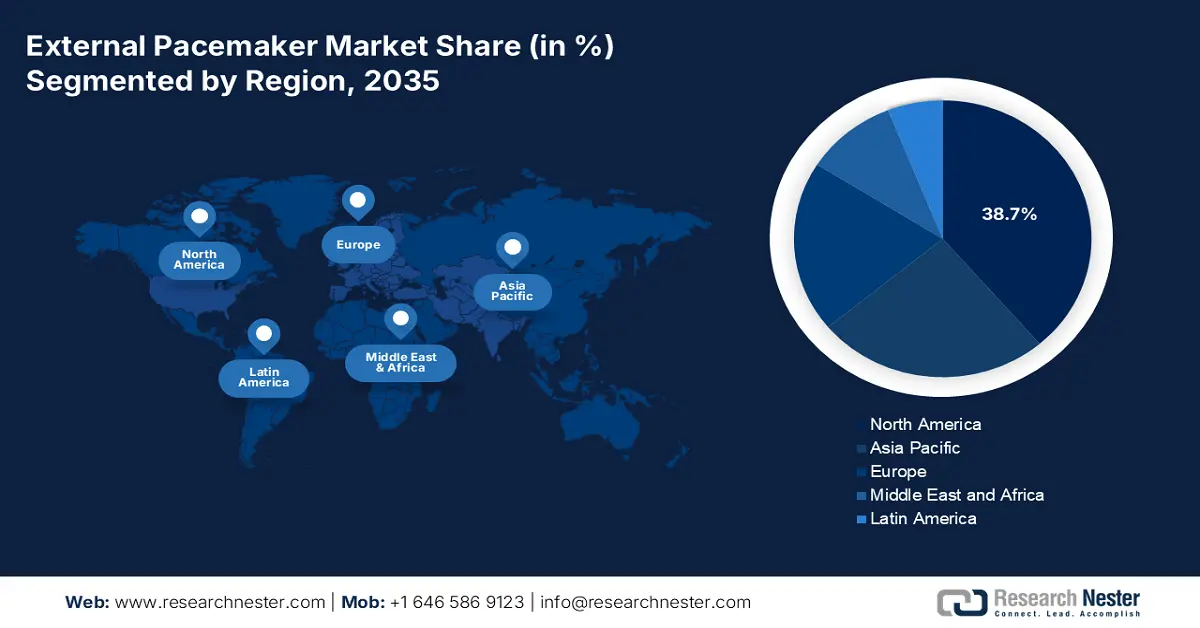

- North America external pacemaker market is poised to capture 38.70% share by 2035, driven by Medicaid reimbursement increases and AI-based monitoring adoption.

- Asia Pacific market will exhibit the fastest growth during the forecast timeline, driven by medical tech innovation and aging population demand for pacemakers.

Segment Insights:

- The hospitals & cardiac centers segment in the external pacemaker market is expected to capture a 62.50% share by 2035, driven by the availability of specialized cardiac units and emergency services.

- The temporary external pacemakers segment in the external pacemaker market is forecasted to secure a 48.60% share by 2035, attributed to extensive use in cardiac recovery settings post-surgery.

Key Growth Trends:

- Rising government expenditure

- Technological advancements

Major Challenges:

- Rising government expenditure

- Technological advancements

Key Players: Biotronik SE & Co KG, Medtronic plc, Osypka Medical GmbH, Braile Biomedica, Boston Scientific Corporation, Oscor Inc., Galix Biomedical Instrumentation Inc. and Shree Pacetronix Ltd.

Global External Pacemaker Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.76 billion

- 2026 Market Size: USD 1.82 billion

- Projected Market Size: USD 2.63 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

External Pacemaker Market Growth Drivers and Challenges:

Growth Drivers

-

Rising government expenditure: One of the key drivers in the market is the increasing government expenditure, which is fueling the demand for advanced healthcare devices. For instance, in 2023, CMS reported that U.S. Medicare expenditure on cardiac equipment reached a substantial amount of USD 4.2 billion, with external pacemakers particularly accounting for USD 620.3 million. Besides, in 2024, Germany's public healthcare systems assigned €1.4 billion for arrhythmia treatments. Hence, such spending is readily blistering the market expansion internationally.

- Technological advancements: Ongoing innovations in the external pacemaker market significantly support market expansion across all nations. The patient population worldwide is encouraging for the development of advanced pacemakers. In 2023, the U.S. FDA highlighted that leadless pacemaker grew by 24%, and the adoption of remote monitoring conserved nearly 900,000 readmissions in 2024. Hence, this is the evidence for a wider scope, allowing the adoption of affordable technological innovations.

Historical Patient Growth and Its Impact on Market Expansion

The global market is primarily shaped by its large patient pool, which is rising prevalence of cardiovascular diseases among the aging population across all nations. This higher instance led to a rapid adoption of these innovative external pacemakers in the global markets of the U.S., Germany, and Japan. Besides, the developing countries such as China and India witnessed growth due to improved access to cardiovascular care. Germany and France reported annual growth of 4.9% and 5.3% due to state-funded cardiac initiatives. To capture the revenue potential, manufacturers must leverage affordable and innovative pacemaker solutions, thereby uplifting market development.

Below is the historical patient growth from 2010 to 2020, that is, external pacemaker users in millions:

|

Country |

2010 Patients |

2020 Patients |

CAGR (%) |

|

USA |

0.84 |

1.53 |

6.3 |

|

Germany |

0.35 |

0.55 |

4.9 |

|

France |

0.30 |

0.49 |

5.3 |

|

Spain |

0.21 |

0.35 |

5.5 |

|

Australia |

0.15 |

0.24 |

5.9 |

|

Japan |

0.48 |

0.95 |

7.5 |

|

India |

0.12 |

0.21 |

9.3 |

|

China |

0.21 |

0.49 |

8.6 |

Feasible Expansion Models Shaping the Market

The external pacemaker market is gaining traction with the consequential expansion models opted by the key players involved. One of the crucial trends preferred is the region-specific strategies, such as cost optimization, collaborations, and regulatory shifts. For instance, in 2024 WHO declared that suppliers of external pacemakers witnessed a 14% increase in their revenue from 2022 to 2024 by collaborating with domestic hospitals and a 32% cost reduction. Besides, in 2023, CMS reported an 8.3% revenue increment with outpatient coverage. Hence, these expansion models are anticipated to augment the market growth by 2035.

Below are feasibility models for market expansion (2023-2025):

|

Region |

Strategy |

Revenue Impact |

Key Driver |

|

India |

Local manufacturing |

+14% revenue (2022-2024) |

Cost reduction (32%) |

|

USA |

Medicare outpatient coverage |

+8.3% revenue (2023) |

Expanded reimbursement |

|

Germany |

Public-private partnerships |

+15.4% adoption (2024) |

State-funded programs |

|

China |

Tier-2 city penetration |

+9.5% sales (2023-2025) |

Healthcare infrastructure upgrades |

|

Japan |

Premium wireless devices |

+11.6% ASP growth (2024) |

An aging population demands |

Challenge

-

Increasing cost of advanced pacemakers: One of the primary challenges posed by the market is the high cost of the pacemakers. In this regard, AHRQ in 2024 reported that it costs around USD 1200 for temporary pacing in the U.S. Besides, in India, private healthcare facilities charge 3 times more than public healthcare systems, as reported by WHO in 2023. Furthermore, in 2024, the National Institute of Health stated that only 40.2% of patients in China can afford external pacemakers. These expenses restrict the widespread adoption of pacemaker equipment, limiting the industry's expansion.

External Pacemaker Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 1.76 billion |

|

Forecast Year Market Size (2035) |

USD 2.63 billion |

|

Regional Scope |

|

External Pacemaker Market Segmentation:

Product Type Segment Analysis

The temporary external pacemakers segment is expected to garner the highest share of 48.6% in the external pacemaker market by the end of 2035. The dominance of the segment is attributed to its extensive usage in post-surgery recovery in cardiac care units, ICUs, and emergency cardiac units. Besides, in 2023 CDC reported that nearly 806,000 heart surgeries were performed in the U.S. in a year and used temporary pacing during recovery. Furthermore, the American Heart Association states that dual-chamber pacemakers improve hemodynamic efficiency by synchronizing atrial and ventricular contractions, reducing complications such as pacemaker syndrome. Thus, denoting a positive market outlook.

End User Segment Analysis

The hospitals and cardiac centers segment is projected to grow at a lucrative share of 62.5% in the external pacemaker market during the forecast period. The growth in the segment is subject to remarkable cardiac care in terms of specialized cardiac units, electrophysiology labs, and 24/7 emergency services. Besides the rising mortality rates, which is WHO 2023 report estimated at 18.2 million annual deaths due to CVDs, also concerns healthcare facilities to incorporate innovative pacemakers. Furthermore, hospitals are the go-to solution, offering all cardiac measures, thereby driving business in the pacemaker sector.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

External Pacemaker Market Regional Analysis:

North America Market Insights

The North America external pacemaker market is projected to register the highest share of 38.7% during the forecast period. The region benefits from the developmental tendency of countries such as the U.S. and Canada, which hold global market players. The U.S. dominates North America’s market with a lucrative share, owing to the expanded Medicaid reimbursements that increased by 12.6% in 2024, benefiting more than 500,000 patients. Besides, in 2024 FDA reported that AI-based monitoring adoption grew by 25.4%, highlighting the reduced hospital readmissions. Hence, these factors widen the use of pacemakers, allowing a positive market development.

Canada external pacemaker market is witnessing significant growth opportunities driven by both public and private healthcare reforms. In this regard, Health Canada in 2024 declared Ontario invested a substantial value of USD 320.4 million in cardiovascular care, reflecting heightened government support. Moreover, according to CIHI, there is a 15.3% increase in implant growth from 2020. The market in the country is further propelled by an 18.5% expanded access in rural areas for cardiac health. This is the evidence for a wider scope, thereby creating a prolific opportunity for domestic players in Canada.

Asia Pacific Market Insights

The Asia Pacific external pacemaker market is projected to witness the fastest growth with a considerable share of 22.5% during the forecast period. The expanding aging population and the innovations in medical technologies are readily responsible for market upliftment in the region. Besides, countries such as Japan and South Korea are at the forefront, necessitating the demand for external pacemakers. Furthermore, the enhanced device efficacy and patient comfort are fostering a favorable business environment in this sector. Upgraded medical facilities and access to advanced treatments further contribute to market growth in the Asia Pacific.

The market in India is gaining immense traction owing to factors such as exacerbated government expenditure and a huge patient population. As reported, the government spending on cardiovascular diseases increased by 18.4% over the last decade, that is USD 1.9 billion per year, reflecting the government’s support to improve cardiac care in the country. Besides, in India, the patient population who received cardiovascular diseases reached 2.5 million, highlighting the growing demand for pacemaker devices. Hence, this patient-centric approach in the country is allowing noteworthy investments in India.

External Pacemaker Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boston Scientific Corporation

- Abbott Laboratories

- BIOTRONIK SE & Co. KG

- OSYPKA MEDICAL

- OSCOR Inc.

- Fluke Biomedical

- Avery Biomedical Devices, Inc.

- Pacetronix Ltd.

- Lepu Medical Technology (Beijing) Co., Ltd.

- MicroPort Scientific Corporation

- Zoll Medical Corporation

- Asahi Kasei Medical Co., Ltd.

- Shree Pacetronix Ltd.

- Medico S.R.L.

- Netech Corporation

- FIAB SpA

- ATACOR MEDICAL, INC.

- Cor-Medical

- Vitatron

The market is supremely competitive owing to the presence of companies that are putting extensive efforts to strengthen their presence in the global market. Emerging manufacturers, in collaboration with regional players, are emphasizing exclusive product launches, regulatory approvals, and collaborations. In this regard, Medtronic Plc launched Micra AV2 and Micra VR2 leadless pacemakers that have enhanced miniaturization and minimally invasive procedures. Besides, Pacetronix Ltd. and Shree Pacetronix Ltd. are focusing on affordability and accessibility to meet the growing demand in developing nations.

Prominent players in the market are listed below:

Recent Developments

- In March 2024, Medtronic Plc launched the NuvoVentrix Leadless Temporary Pacemaker, which is the first FDA-approved leadless temporary pacemaker, designed for post-cardiac surgery patients.

- In June 2024, Abbott Laboratories launched TempuraSync Dual-Chamber External Pacemaker, which is a wirelessly programmable temporary pacemaker for emergency and ICU use, approved in Europe and India.

- Report ID: 2576

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

External Pacemaker Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.