Extended Reality Market Outlook:

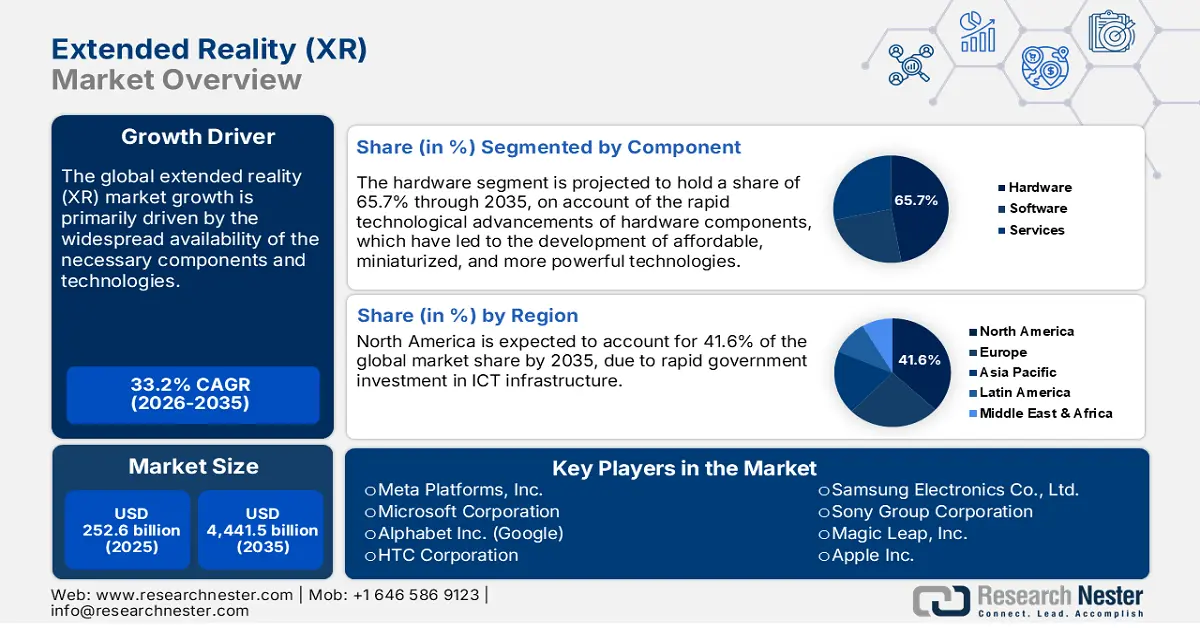

Extended Reality (XR) Market size was USD 252.6 billion in 2025 and is estimated to reach USD 4,441.5 billion by the end of 2035, expanding at a CAGR of 33.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of extended reality is evaluated at USD 336.5 billion.

The global trade of extended reality is heavily reliant on the supply chain of optical components, sensors, semiconductors, and display technologies, all of which are primarily sourced from East and Southeast Asia. The widespread availability of the necessary components and technologies contributes to increasing the convenience of developing and producing extended reality (XR)-based products and services. As revealed by SPIE in July 2022, the core optics and photonics industry globally accounted for a revenue of over USD 300 billion in 2023. Similarly, sales in the global semiconductor industry totaled USD 526.8 billion in the same year, as per the Semiconductor Industry Association (SIA) report. Despite the dominance of the Asia Pacific, in 2023, the U.S. maintained a consistent surplus of semiconductor trade and exported the technology to a value of USD 52.7 billion. In addition, tariffs for semiconductors are low in a wide range of countries globally. Accessibility of raw materials creates a profitable environment for companies involved in the development and production of XR-based products and services.

The functionality and growth of the XR-based products are expected to surge with the expansion of electronics production encompassing the manufacturing of XR devices, such as smart glasses, interaction controllers, headsets, haptic devices, holographic displays, and others. For example, in February 2024, the leading consumer electronics manufacturer, Apple, announced the market availability of Apple Vision Pro, which is a mixed reality headset. The development of this type of advanced XR-based product indicates significant investor interest in the market, expected to continue to fuel production.

Key Extended Reality Market Insights Summary:

Regional Insights:

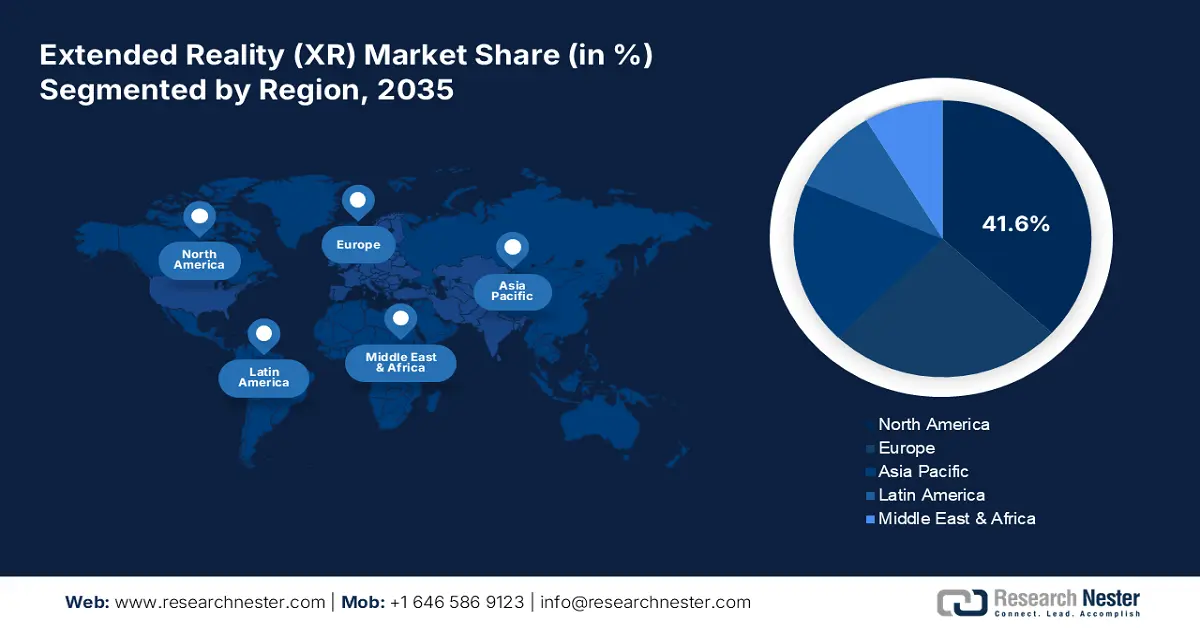

- The North America Extended Reality (XR) Market is expected to command a 41.6% revenue share through 2035, attributed to rapid government investment in ICT infrastructure and the increasing availability of semiconductors supporting XR-based product development.

- Europe is anticipated to hold a significant revenue share by 2035, supported by robust government funding, rising digital infrastructure initiatives, and strong participation of SMEs in XR innovation.

Segment Insights:

- The hardware segment in the Extended Reality (XR) Market is projected to capture a 65.7% revenue share by 2035, propelled by rapid technological advancements leading to affordable, miniaturized, and more powerful hardware components.

- The virtual reality (VR) segment is estimated to account for a 56.1% market share by 2035, fueled by rising demand across sectors such as healthcare, education, gaming, and automotive, supported by the growing availability of advanced VR headsets.

Key Growth Trends:

- Surge in industrial training and simulation applications

- Increasing use of XR in healthcare diagnostics and therapy

Major Challenges:

- High cost of XR hardware and pricing pressure

- Data protection regulations and compliance complexity

Key Players: Meta Platforms, Inc., Microsoft Corporation, Alphabet Inc. (Google), HTC Corporation, Samsung Electronics Co., Ltd., Sony Group Corporation, Magic Leap, Inc., Apple Inc., Varjo Technologies Oy, Lynx (SystemActive), Tata Elxsi Ltd., Vection Technologies Ltd., Globetronics Technology Berhad, Canon Inc., Panasonic Holdings Corporation, Meta Platforms, Inc., Microsoft Corporation, Alphabet Inc. (Google), HTC Corporation, Samsung Electronics Co., Ltd.

Global Extended Reality Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 252.6 billion

- 2026 Market Size: USD 336.5 billion

- Projected Market Size: USD 4,441.5 billion by 2035

- Growth Forecasts: 33.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Singapore, Brazil, United Arab Emirates, Australia

Last updated on : 6 October, 2025

Extended Reality Market - Growth Drivers and Challenges

Growth Drivers

- Surge in industrial training and simulation applications: The manufacturing, airline, defense, and education sectors are set to drive the sales of extended reality technologies in the coming years. The extended reality solutions are gaining traction owing to the immersive simulation training that reduces operational risk and cost. In October 2024, a leading airline company, Emirates, extended its immersive virtual training platform MIRA to enable more than 23,000 cabin crews to pursue safety & emergency training. Similarly, as disclosed by the U.S. Library of Congress in June 2025, the use of XR-based products and services, including XR training environments, has become common in the national defense sector encompassing the Army, Air Force, and DOD. The use of XR training environments in integrating with live army, flight, and medical training is consistent nowadays.

- Increasing use of XR in healthcare diagnostics and therapy: The healthcare sector is estimated to propel the trade of extended reality in the coming years, as these technologies are widely used in physical therapy, pain management, and surgical training. Continuous innovations are accelerating the application of both augmented and virtual reality solutions in healthcare settings. The U.S. Department of Veterans Affairs in September 2023 reported that its initiative (VA Immersive) to expand the implementation of BraveMind, a virtual reality (VR) exposure therapy system, led to the deployment of 1450 Virtual reality Headsets across over 165 medical centers. Overall, medical settings are poised to double the revenues of key players during the forecast period.

- Rapid adoption of extended reality in retail and market: Retail businesses globally are increasingly adopting XR for marketing and advertising with the motive of driving customer experiences. XR-based products and solutions help to blend digital and physical experiences across different organizational products and services. For example, in December 2021, Nykaa adopted ModiFace, an advanced, AI-powered virtual try-on technology launched by L’Oréal. The technology consists of AI-enabled shade calibration and Augmented Reality (AR) simulation, allowing users to enable virtual try-on of beauty products on the website and mobile application of Nykaa.

Challenges

- High cost of XR hardware and pricing pressure: The production of extended reality solutions is a capital-intensive process due to the involvement of specialized components such as OLED microdisplays, spatial tracking sensors, and custom silicon chips. These raw materials add up to the final product costs, limiting their adoption in budget-constrained sectors and businesses. Tariffs on the import of electronics in different countries can lead to an increase in selling prices of XR-based products and services, which is expected to make the technology unaffordable for people with low-income status.

- Data protection regulations and compliance complexity: Stringent regulations related to data protection in different countries impose strict user consent and data residency rules. The data privacy regulations further create compliance requirements for extended reality platforms that handle sensitive biometric and spatial data. This limits the transfer of personal information across jurisdictions, hindering the adoption of extended reality solutions. Thus, strict data regulations are likely to hamper product innovation and time-to-market.

Extended Reality Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

33.2% |

|

Base Year Market Size (2025) |

USD 252.6 billion |

|

Forecast Year Market Size (2035) |

USD 4,441.5 billion |

|

Regional Scope |

|

Extended Reality Market Segmentation:

Component Segment Analysis

The hardware segment is projected to acquire a revenue share of 65.7% by the end of 2035, on account of the rapid technological advancements of hardware components, which have led to the development of affordable, miniaturized, and more powerful technologies. For example, in September 2024, Meta introduced Orion, an advanced pair of AR glasses. The lightweight glasses are best suited for use in both indoor and outdoor environments and are equipped with holographic displays and AI. Miniaturization of hardware components automatically leads to a decline in finished XR-based products and services, contributing to increasing market affordability.

Application Segment Analysis

By the end of 2035, the virtual reality (VR) segment is expected to account for extended reality (XR) market share of 56.1%, owing to rising demand across a wide range of industries, including healthcare, education & training, gaming, retail, automotive, and interior design, and healthcare. For example, in December 2022, Honda revealed its involvement in leveraging VR technology in the development of the full-electric 2024 Honda Prologue. The company boosted collaboration with different engineering and design groups with the use of VR environments. The growing availability of relevant hardware technologies, including VR headsets, is also expected to bolster the dominance of the segment.

Industry Vertical Segment Analysis

The gaming segment is anticipated to hold a 30.5% share of the extended reality (XR) market by the end of 2035. The gaming craze among youngsters and adults is creating a profitable environment for extended reality technology manufacturers. Companies are increasingly investing in research and development related to the integration of XR technology in gaming. As reported by NPR in April 2022, popular gaming company Epic Games received an investment of USD 2 billion from Kirkbi and Sony Group Corp for the acceleration of progress in building the metaverse and creating spaces for gamers, where they can have fun with friends through immersive experiences.

Our in-depth analysis of the extended reality market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Application |

|

|

Industry Vertical |

|

|

Enterprise Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Extended Reality Market - Regional Analysis

North America Market Insights

North America extended reality market is expected to account for 41.6% of the global revenue share through 2035. The rapid government investment in ICT infrastructure is estimated to bolster the adoption of XR-based products and services. The easy availability of wireless connectivity networks and early adopters is also estimated to fuel the sales of extended reality technologies. For example, under the CHIPS Act, enacted in August 2022, the U.S. government announced the International Technology Security and Innovation (ITSI) fund of USD 500 million for the promotion of secure telecommunication networks and to ensure security and diversification of semiconductor manufacturing. With the rising availability of semiconductors, the production of XR-based products and services is expected to become increasingly convenient.

The large-scale defense contracts and immersive content creation activities are likely to amplify the sales of extended reality solutions in the U.S. The rise in edge computing infrastructure is also contributing to the increasing demand for extended reality solutions. Strategic government-private partnerships are also taking place to obtain the advantage of VR, accelerating the use of XR-based products and services. As reported by the National Training and Simulation Association in December 2022, HTX Labs took the responsibility of modernizing the critical training facility at Sheppard Air Force Base with the use of VR in November of the same fiscal year.

Canada extended reality (XR) market is projected to witness a robust CAGR throughout the forecast timeline, due to government support, making the adoption of the technology convenient. Start-up innovation is another factor expected to fuel market growth. As disclosed by the Centre for International Governance Innovation in March 2024, around 253 VR start-ups were in Canada as of June 2023. A wide range of technology companies based in Canada are redefining the convergence of XR breakthroughs. The adoption of XR-based products and services is at its peak in the healthcare and education sectors across Canada.

Europe Market Insights

Europe extended reality market is estimated to account for a remarkable revenue share during the stipulated timeframe, attributed to the robust government support and growing digital infrastructure investments. For instance, in March 2025, the European Commission announced a financial grant of USD 1.5 billion for the deployment of the critical technologies that are essential for the future of the region strategically. Access to such funding is expected to make the adoption of XR-based products and services easier for organizations. Rapid advancements of XR solutions by SMEs are expected to boost the market growth in the years ahead. The European Commission also reported in July 2025 that the proportion of SMEs working on XR is 90% in Europe. With the development of technologies such as AI, 5G or 6G, edge computing, and cloud computing, XR-based products and services are expected to be more powerful over time.

Germany holds a dominant Europe extended reality (XR) market share owing to a robust industrial base and consistent public-sector investments. The digital transformation agents operating in Germany are accelerating the production and advancement of extended reality technologies. One such example is Theorem Solution’s update of TheoremXR. The update is allowing users to leverage the power of mixed and virtual reality for conducting appropriate time and motion studies. The automotive, manufacturing, and healthcare sectors are expected to continue to emerge as the prime end users of extended reality solutions in Germany.

The extended reality (XR) market in the UK is anticipated to undergo robust growth from 2026 to 2035, on account of the public-private collaboration partnership in the adoption of advanced extended reality solutions. For example, in March 2025, Varjo revealed that it received approval from the UK Ministry of Defense and NATO accreditation for XR-4 series headsets, developed by UK-based company Inzpire. The XR solutions were integrated into a Joint Terminal Attack Controller (JTAC) training solution. The rapid expansion of the 5G infrastructure across the country is also expected to improve the user experience of XR solutions.

APAC Market Insights

Asia Pacific extended reality (XR) market is foreseen to acquire a remarkable revenue share during the forecast timeline, due to large-scale government investments, swift digitalization, and widespread enterprise adoption. Substantial ICT allocations toward XR hardware, a rise in digital learning, and automation trends are propelling the sales of extended reality solutions during the forecast period. The favorable government policies and investments are further expected to accelerate the manufacturing and commercialization of extended reality solutions. In March 2025, the International Federation of Robotics reported that the National Development and Reform Commission of China announced an investment of USD 138 billion for the advancement of AI, robotics, and cutting-edge innovation. Similarly, South Korea introduced a Digital New Deal worth USD 44.6 billion to leverage new technologies that include XR solutions.

The government-led industrial automation, smart city programs, and educational digitization moves are expected to boost the sales of extended reality technologies in China. In July 2025, the Cheung Kong Graduate School of Business (CKGSB) revealed that augmented reality is playing a crucial role in smart city management and public services across China. The healthcare sector is also driving the adoption of XR solutions. As reported in April 2023, China has plenty of use cases of XR solutions and remote medical devices, surrounding trials and deployments, including autonomous medical delivery and remote medical consultation. The strong presence of high-tech end users is poised to double the revenues of key players in the years ahead.

India is set to emerge as an expanding extended reality (XR) market at a high CAGR between 2026 and 2035, backed by the regulatory push for digitalization. This is likely to accelerate the adoption of the XR solutions across the country. In June 2025, the Press Information Bureau revealed that the contribution from the digital economy of the country is expected to surge to 13.42% by the end of 2025 from 11.7% in 2022-2023, positioning India third in the global digitalization index. Rapid 5G rollout in India is also anticipated to increase the market attractiveness of XR solutions. The affordability of the relevant hardware can fuel the production of the XR-based products in India.

Key Extended Reality Market Players:

- Meta Platforms, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation

- Alphabet Inc. (Google)

- HTC Corporation

- Samsung Electronics Co., Ltd.

- Sony Group Corporation

- Magic Leap, Inc.

- Apple Inc.

- Varjo Technologies Oy

- Lynx (SystemActive)

- Tata Elxsi Ltd.

- Vection Technologies Ltd.

- Globetronics Technology Berhad

- Canon Inc.

- Panasonic Holdings Corporation

- Meta Platforms, Inc.

- Microsoft Corporation

- Alphabet Inc. (Google)

- HTC Corporation

- Samsung Electronics Co., Ltd.

The extended reality (XR) market is characterized by the presence of gigantic companies and the increasing emergence of start-ups. Leading companies are holding domain share through immersive ecosystem development and software platform integration. They are continuously investing in advanced technologies to boost the efficiency of their products and reach a wider consumer base. Some industry giants are entering into strategic partnerships with other players to boost their profits. Collaborations with raw material suppliers are also expected to offer smooth production cycles to key players. Furthermore, the organic marketing strategies are likely to double the revenues of leading companies in the coming years.

Here is a list of key players operating in the extended reality (XR) market:

Recent Developments

- In September 2025, Meta unveiled its plan to make its large language model (LLM) available across Europe and Asia, as well as NATO and EU institutions. The technology is capable enough to process video, text, audio, and images, ideal for the creation of effective XR environments.

- In February 2025, Meta launched Aria Gen 2 glasses, a next-generation hardware. It is expected to significantly help in finding the way AR and VR can be integrated into smart vehicles.

- In December 2024, Google initiated the introduction of Android XR, bringing a new era of operating systems. In collaboration with Qualcomm and Samsung, the technology giant developed the OS with the motive of providing immersive experiences to headsets and glasses.

- Report ID: 4863

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Extended Reality Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.