Express Delivery Market Outlook:

Express Delivery Market size was valued at USD 294.1 billion in 2025 and is projected to reach USD 583.9 billion by the end of 2035, rising at a CAGR of 7.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of express delivery is estimated at USD 314.9 billion.

The public sector data points to sustained structural demand for the express delivery market services and is driven by the e-commerce growth, cross-border trade normalization, and the rising expectations for the time definite logistics in the B2B supply chains. The U.S. Census Bureau report in December 2025 states that the U.S. ecommerce sales reached USD 299.6 billion, which is a rise of 2.2% in Q3 2025, a level that continues to push the manufacturers, distributors, and wholesalers toward a faster fulfillment model to protect the service level agreements and reduce the working capital tied up in inventory. The parallel trends are visible in trade flows. The data from the IATA data in January 2025 indicates that the Asia Pacific has witnessed a 14.5% rise in YoY for air cargo in 2024, underscoring the reliance of pharmaceuticals, electronics, and automotive components on the express networks.

Air Cargo Market (2024)

|

2024 (%year-on-year) |

World Share |

|

Total Market |

100% |

|

Africa |

2.0% |

|

Asia Pacific |

34.2% |

|

Europe |

21.5% |

|

Latin America |

2.9% |

|

Middle East |

13.6% |

|

North America |

25.8% |

Source: IATA January 2025

Government investment in logistics infrastructure and digital trade facilitation is further driving the market expansion. The U.S. Department of Transportation report in December 2023 indicates that the U.S. has allocated over USD 9.4 billion in 2023 via freight and port modernization programs under the Bipartisan Infrastructure Law, targeting faster cargo movement and reduced dwell times, both vital to express delivery performance. The World Bank notes that the countries implementing electronic single window customs systems reduce the average border clearance times, materially improving the economics of express delivery market services for exporters and contract manufacturers. For B2B shippers, these policy-backed improvements translate into more predictable transit times, lower exception-handling costs, and expanded feasibility for just-in-time delivery models across regional and international lanes.

Key Express Delivery Market Insights Summary:

Regional Insights:

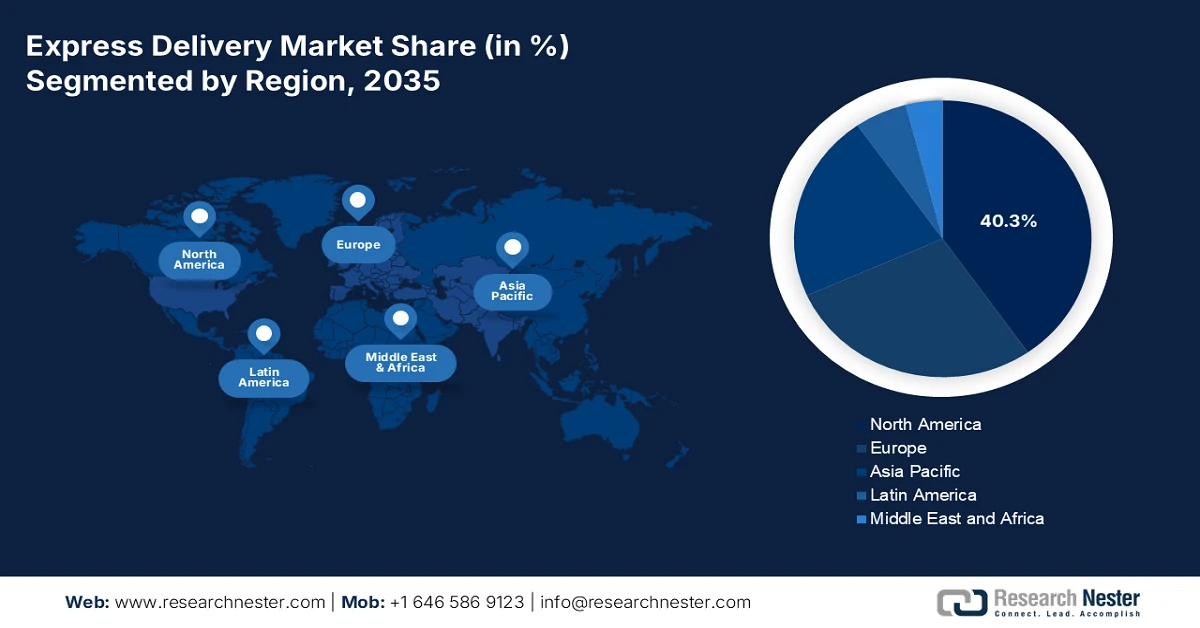

- By 2035, North America is projected to account for a dominant 40.3% revenue share in the express delivery market, underpinned by intense domestic e-commerce demand, extensive cross-border trade, and large-scale infrastructure investment enhancing supply chain efficiency

- Asia Pacific is anticipated to expand at a robust CAGR of 8.7% during 2026–2035, supported by explosive e-commerce growth, rapid digital adoption, and large-scale logistics infrastructure development across manufacturing-intensive economies

Segment Insights:

- By 2035, the ground operational mode segment is expected to capture a commanding 70.4% share in the express delivery market, benefiting from its central role in scalable and cost-efficient last-mile logistics enabled by advanced telematics and route optimization integration

- During the forecast period to 2035, the e-commerce & retail end-user segment is set to retain the highest revenue share, reinforced by omnichannel fulfillment models and rising consumer expectations for fast and reliable delivery services

Key Growth Trends:

- Government investment in freight & logistics infrastructure

- The globalization of manufacturing and supply chains

Major Challenges:

- Massive capital expenditure and scale requirements

- Complex regulatory and security complianc

Key Players: United Parcel Service (U.S.), FedEx (U.S.), DHL Express (Germany), Amazon Logistics (U.S.), United States Postal Service (USPS) (U.S.), SF Express (China), Yamato Transport (Japan), Sagawa Express (Japan), Japan Post (Japan), Royal Mail (UK), La Poste (France), DP World (UAE), DB Schenker (Germany), DSV (Denmark), GeoPost/DPDgroup (France), TNT Express (Netherlands), Australia Post (Australia), CJ Logistics (South Korea), Delhivery (India), Pos Laju (Malaysia).

Global Express Delivery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 294.1 billion

- 2026 Market Size: USD 314.9 billion

- Projected Market Size: USD 583.9 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Singapore, Australia

Last updated on : 20 January, 2026

Express Delivery Market - Growth Drivers and Challenges

Growth Drivers

- Government investment in freight & logistics infrastructure: The public investment in transport and logistics infrastructure is materially strengthening the operating environment for express delivery providers. In the U.S., the report from the U.S Department of Transportation in February 2023 indicates that the Bipartisan Infrastructure Law commits USD 1.2 trillion, with USD 500billion for new investments and programs is directed to port upgrades and freight corridor modernization. These measures are reducing the congestion, shortening the cargo dwell times, and improving the last-mile reliability for time-critical shipments. In Europe, the European Commission continues to finance the TEN-T corridors, stimulating the cross-border road and rail freight integration and improving the transit consistency across the major trade lanes. These programs are lowering the delivery costs and increasing the service predictability for the B2B shippers in sectors such as electronics, industrial components, and pharmaceuticals.

- The globalization of manufacturing and supply chains: The significant dispersion across Asia creates a structural demand for reliable time-sensitive air and ocean freight. The express delivery market carriers provide a critical link for the high-value components and finished goods within these integrated production networks, where delays can halt entire assembly lines. The sustained volume of international trade is the primary indicator of this demand driver. For instance, the report from the UNCTAD in 2023 indicates that the value of the global commercial services trade reached USD 7.9 trillion in 2023, with transport services constituting a major share. This scale of the trade continuously underpins the necessity for the integrated rapid logistics solutions that define the express delivery sector.

- Smart city & urban mobility investments: Municipal and national investments in smart mobility are reshaping the cost structure and service performance of last-mile express delivery. The European Commission via Horizon Europe is funding urban logistics pilots that support traffic flow optimization, share delivery zones, ad data enabled routing in high density cites. In the U.S., the Department of Transportation’s Smart City Challenge is stimulated by the long term investment in intelligent traffic systems and curbside management, improving access for commercial vehicles in congested corridors. Collectively, these initiatives increase the delivery density reduced failed delivery attempts, and enable tighter time windows vital factor for express delivery market services operating in urban markets.

Challenges

- Massive capital expenditure and scale requirements: Establishing a competitive express network requires an immense upfront investment in the aircraft, sorting hubs, a vehicle fleet, and technology. Achieving the density needed for profitability is a huge barrier in the express delivery market. For example, the top players, such as Amazon, invested a significant amount in the logistics infrastructure to build their in-house network, a scale that new entrants cannot match. This capital intensity consolidates power among incumbents such as FedEx and UPS.

- Complex regulatory and security compliance: Operators must navigate a tangle of international trade regulations custom procedures, aviation security, and transportation laws. Non-compliance results in severe delays, fines, or operational shutdowns. For example, DHL excels by employing thousands of customs specialists and advanced digital clearance platforms, a compliance overhead that is a significant hurdle for the new express delivery market players.

Express Delivery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 294.1 billion |

|

Forecast Year Market Size (2035) |

USD 583.9 billion |

|

Regional Scope |

|

Express Delivery Market Segmentation:

Operational Mode Segment Analysis

Under the operational mode segment, the ground is leading the segment in the express delivery market and is poised to hold the share value of 70.4% by 2035. The segment is driven by its indispensable role in the scalable and cost-effective last-mile logistics. This segment’s dominance is underpinned by the vast interconnected road networks that facilitate the final leg of delivery for the surge in e-commerce parcels and local shipments. A key driver is the integration of the advanced telematics and route optimization software to manage density and efficiency. The report from the American Trucking Association data in June 2023 indicates that the For-Hire Truck Tonnage Index has increased by 2.4% in May after decreasing 1.7% in April. This positive fluctuation highlights the underlying resilience and continuous growth in demand for road-based freight, reinforcing its foundational role in the express supply chain.

End user Industry Segment Analysis

The e-commerce & retail sector is the leading end user industry in the express delivery market. The segment is fueled by the permanent shift toward online shopping and consumer expectations for rapid, reliable fulfillment. This segment commands the highest revenue share as retailers and marketplaces rely entirely on the integrated express logistics to offer competitive shipping promises from same-day to next-day delivery. The growth is stimulated by the omnichannel strategies, such as the ship from store and the rise of the direct-to-consumer brands. According to the U.S. Census Bureau's February 2024 report, the U.S. retail e-commerce sales for the Q4 of 2023 reached USD 1,831.4 billion, an increase of 0.4 percent from the Q3 of 2023. This data illustrates the robust and consistent volume growth that directly translates to demand for premium express parcel services.

Destination Segment Analysis

Within the destination segment, the domestic segment is dominating the segment in the express delivery market, as the vast majority of parcel volume originates from and is delivered within national borders. This dominance is driven by the density of intra-country e-commerce, faster transit time expectations, and the economic advantages of streamlined customs-free logistics. The domestic networks benefit from the optimized hub and spoke systems and concentrated last-mile infrastructure. The data from the Postal Regulatory Commission in July 2024 shows that it handled nearly 116.1 billion domestic mail pieces and packages, underscoring the immense scale of internal delivery flows. The segment continues to expand with the regional distribution centers and hyper-local delivery platforms, aiming to reduce middle-mile distances.

Our in-depth analysis of the express delivery market includes the following segments:

|

Segment |

Subsegments |

|

Service Type |

|

|

Business Model |

|

|

Destination |

|

|

End user Industry |

|

|

Operational Mode |

|

|

Weight |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Express Delivery Market - Regional Analysis

North America Market Insights

The North America express delivery market is dominating and is expected to hold the revenue share of 40.3% by 2035. The market is driven by the intense domestic e-commerce demand, extensive cross-border trade, and significant infrastructure investment. The market’s scale is evidenced by the U.S. transportation and warehousing industry value added, which reached USD 1.8 trillion in 2023, as per the BTS December 2024 data, reflecting the immense underlying logistics activity. The key drivers include a massive integrated consumer base driving the parcel volume, and regulatory and public spending focused on supply chain modernization. The NPR in November 2021 reported that the U.S. Bipartisan Infrastructure Law’s USD 110 billion investment in roads, bridges, and freight networks directly enhances operational efficiency, while stringent customs and security frameworks alongside emerging sustainability mandates shape the carrier strategies and technological adoption across both the U.S. and Canada.

The U.S. express delivery market is fundamentally driven by the immense and integrated cross-border supply chains, as quantified by the official trade data. The report from the BTS May 2024 data indicates that the U.S. freight flows with Canada and Mexico totaled USD 1.57 trillion, with USD 996.4 billion moved by truck, demonstrating the vast scale of time-sensitive ground logistics demand. This trade, constituting 30.8% of all the U.S. international trade, consists largely of high-value manufacturing goods such as electronics and automotive parts that require expedited, reliable shipping. The market is operationally defined by the key surface corridors, such as those via Laredo and Detroit, where express carriers must provide seamless customs integration and corridor management. This cross-border industrial activity, combined with the massive domestic e-commerce volume, creates a dual engine demand driver that necessitates dense, reliable networks capable of handling both the B2B and B2C urgency.

Value of Monthly U.S. Freight Flows (USD Millions)

|

Month |

2021 |

2022 |

2023 |

Percent Change 2021-2022 |

Percent Change 2022-2023 |

|

January |

94,284 |

113,707 |

125,783 |

20.6 |

10.6 |

|

February |

95,860 |

112,459 |

119,919 |

17.3 |

6.6 |

|

March |

114,587 |

141,850 |

141,472 |

23.8 |

-0.3 |

|

April |

107,369 |

135,255 |

126,573 |

26.0 |

-6.4 |

|

May |

108,646 |

139,439 |

136,241 |

28.3 |

-2.3 |

|

June |

115,955 |

141,238 |

134,795 |

21.8 |

-4.6 |

|

July |

111,270 |

132,559 |

127,052 |

19.1 |

-4.2 |

|

August |

113,075 |

140,339 |

138,015 |

24.1 |

-1.7 |

|

September |

109,220 |

133,934 |

131,816 |

22.6 |

-1.6 |

|

October |

117,417 |

133,756 |

138,501 |

13.9 |

3.5 |

|

November |

120,094 |

125,826 |

131,020 |

4.8 |

4.1 |

|

December |

117,548 |

121,668 |

121,586 |

3.5 |

-0.1 |

|

Annual |

1,325,325 |

1,574,053 |

1,574,797 |

18.8 |

0.0 |

Source: BTS May 2024

The Canada express delivery market is driven by the vast geography, cross-border trade integration, and federal investment in trade corridors. A dominant trade is the modernization of infrastructure to boost continental supply chains, with the Canadian Government’s National Trade Corridors Fund committing USD 4.6 billion over 11 years for transportation projects, as per the Transports of Canada in November 2023. The e-commerce growth, with the online sales reaching USD 67.3 billion in December, fuels the demand for parcel delivery mainly in major urban centers, based on the Statistics Canada in February 2024. Further, the sustainability and connectivity are further trends as initiatives such as the Green Freight Assessment Program aim to improve energy efficiency. The market is fundamentally shaped by the U.S. trade relationship with expedited customs programs such as CBSA’s eManifest and the Canada-United States-Mexico Agreement (CUSMA) streamlining express cross-border logistics.

Retail Sales, By Province, Territory and Census Metropolitan Area - Seasonally Adjusted

|

Year |

Value (USD million) |

|

December 2022 |

65,432 |

|

November 2023 |

66,683 |

|

December 2023 |

67,301 |

|

November to December 2023 (% Change) |

0.9 |

|

December 2022 to December 2023 (% Change) |

2.9 |

Source: Statistics Canada February 2024

APAC Market Insights

The Asia Pacific express delivery market is the fastest growing and is poised to grow at a CAGR of 8.7% during the forecast period 2026 to 2035. The growth is defined by the vast economic diversity, rapid digital adoption, and deeply integrated manufacturing supply chains. The primary demand is the explosive and sustained growth of e-commerce, mainly in China and Southeast Asia, which generates unprecedented B2C parcel volumes. This is complemented by the region's role as the world’s factory, where the production of electronics, automotive parts, and consumer goods necessitates advanced time-definite B2B logistics for components and finished goods. A dominant trend is the massive investment in logistics infrastructure from automated sortation hubs to airport freight facilities by both governments and private players to handle this scale.

The China express delivery market is shaped by the vast e-commerce ecosystems and globally integrated manufacturing sector. The market is defined by the extreme scale of intense competition among domestic giants such as SF Express and YTO, and leading technological adoption in the automated sorting and AI-driven route optimization. According to the People’s Republic of China data, in January 2024, the express courier firms handled 132.07 billion parcels in 2023, which is a rise of 19.4% compared with the past year. Further, the total revenue generated by the sector reached USD 1,207.4 billion yuan in 2023. These data highlight that the nation is set to position itself as the global volume leader and demonstrate a market operating at an unparalleled scale.

The India express delivery market is growing rapidly and is fueled by the rapid digital adoption, a formalizing economy, and booming e-commerce. The growth is propelled by the increasing internet penetration in the tier 2 and tier 3 cities, supportive government infrastructure projects such as PM GatiShakti, and the rise of quick commerce demanding hyperlocal delivery. The market features a dynamic mix of established postal services, tech-driven startups, and global logistics firms competing on speed and reach. The official government report from the IBEF data in October 2025 shows the transformative impact of this growth, indicating India’s e-commerce market made sales of Rs. 1.19 lakh crore in 2025, reflecting a 12% YoY growth. This figure underscores the immense future demand for reliable cross-border express logistics services from the country.

Europe Market Insights

The Europe express delivery market is a mature and evolving sector defined by the high degree of cross-border integration driven by the EU’s single market. The demand is propelled by several key factors, such as the sustained growth of e-commerce, which requires reliable last-mile delivery, the stringent needs of high-value industries such as pharmaceuticals and electronics for time-critical secure logistics, and increasing regulatory pressure for sustainable transport solutions, pushing investment into electric vehicle fleets and optimized networks. A significant trend is the market’s consolidation around a few major integrated carriers and regional players competing intensely on service quality, digital tracking, and green credentials. The infrastructure is supported by the extensive multimodal transport networks, with road freight dominating intra-European shipments due to its flexibility and dense network coverage.

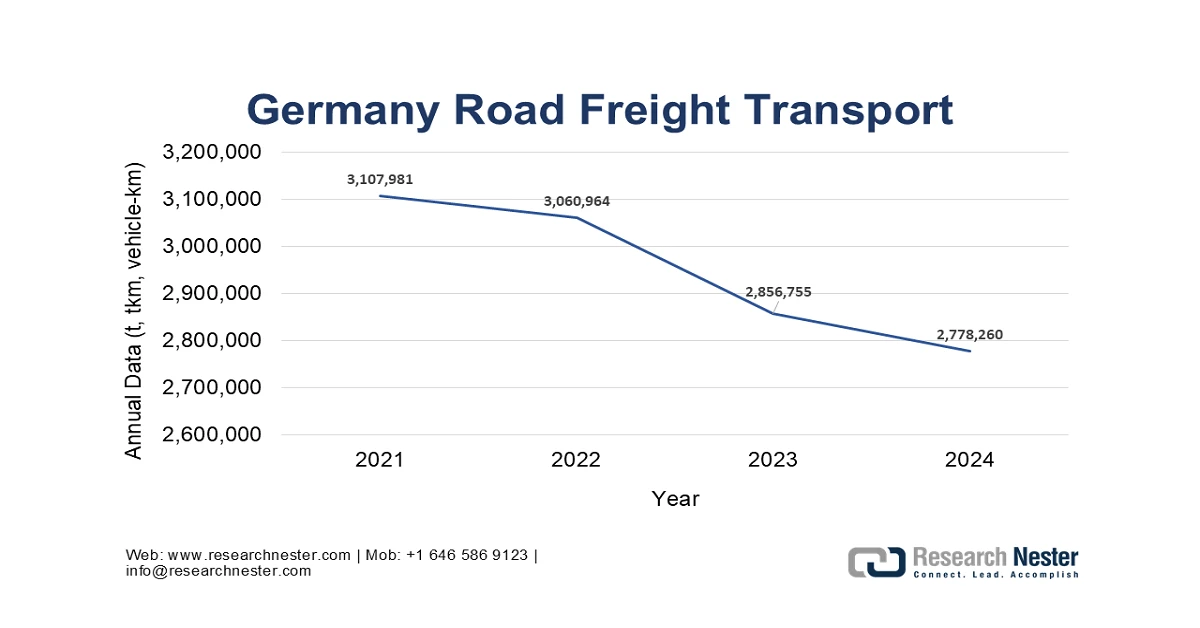

The Germany express delivery market is the largest in Europe, serving as the continent’s central logistics hub due to its strategic location, dense autobahn network, and strong manufacturing export base. The demand is fundamentally driven by the country’s industrial sector, mainly for high-value automotive machinery and chemical products requiring reliable time-critical shipment across the EU. A significant trend is the rapid growth of the B2C e-commerce, placing new pressure on last-mile delivery networks in urban centers and increasing the demand for flexible, sustainable delivery options. Government policy, including the Federal Transport Infrastructure Plan, directly influences the express delivery market by investing in digital and physical logistics corridors. Supporting this, the government official data from Eurostat in November 2025 shows that the total road freight transport in Germany reached 2,778260K tonnes in 2024, illustrating the immense scale of goods movement underpinning the express services.

Source: Eurostat November 2025

The UK express delivery market is defined by a highly developed and competitive e-commerce landscape, which generates immense domestic parcel volume and drives innovation in last-mile delivery, including the lockers same day and out-of-home services. A primary post Brexit trend is the increased complexity and cost of cross-border EU trade, making efficient customs clearance a vital competitive differentiator for carriers. Despite this, the domestic market remains robust, supported by the high consumer demand for fast shipping. A key indicator of the sector’s underlying strength is parcel volume. According to the report from Ofcom's October 2024 data, the measured parcels in the UK increased by 8.3% to 3.9 billion in 2023 to 2024. This figure underscores the market's resilience and ongoing expansion, providing a solid volume base for both incumbent operators and new delivery models.

Key Express Delivery Market Players:

- United Parcel Service (U.S.)

- FedEx (U.S.)

- DHL Express (Germany)

- Amazon Logistics (U.S.)

- United States Postal Service (USPS) (U.S.)

- SF Express (China)

- Yamato Transport (Japan)

- Sagawa Express (Japan)

- Japan Post (Japan)

- Royal Mail (UK)

- La Poste (France)

- DP World (UAE)

- DB Schenker (Germany)

- DSV (Denmark)

- GeoPost/DPDgroup (France)

- TNT Express (Netherlands)

- Australia Post (Australia)

- CJ Logistics (South Korea)

- Delhivery (India)

- Pos Laju (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- United Parcel Service leverages its vast express delivery market network to serve as the vital backbone for time-sensitive healthcare logistics, including the transport of diagnostic kits, lab specimens, and medical devices. Their specialized temperature-controlled supply chain solutions ensure the integrity of sensitive medical shipments from manufacturing to the patient, directly enabling the rapid deployment of remote monitoring technologies. According to the 2024 annual report, USD 6.3 billion was generated in free cash flow.

- FedEx is a pivotal player in the express delivery market for healthcare, offering prioritized shipping for prescription medicines, medical records, and vital healthcare equipment. Their express networks guarantee overnight delivery, which is essential for getting cardiac monitoring devices to patients quickly after diagnosis and for returning collected data modules to clinics for timely analysis, accelerating the diagnostic cycle. The data from the 2025 annual report indicates that the company connects 99% of the world’s commerce and technology.

- DHL Express operates a global express delivery market infrastructure that is fundamental for the international medical technology sector. They facilitate the swift, reliable, and compliant cross-border shipment of advanced cardiac telemetry units, sensors, and components between manufacturing sites, distribution centers, and healthcare providers worldwide, ensuring these life-saving technologies reach markets without delay.

- Amazon Logistics is reshaping the express delivery market for consumer health via its unparalleled last-mile delivery speed and Prime services. This capability is increasingly used for the direct-to-patient shipment of over-the-counter health monitor prescribed medical suppliers and even pharmacy items, setting a new standard for the convenient and rapid home delivery of personal healthcare devices.

- The United States Postal Service, via its Last Mile reach to every U.S. address, is a ubiquitous and cost-effective channel within the express delivery market for healthcare. USPS is essential for the routine and reliable delivery of medication, medical billing, and lighter monitoring equipment, providing a universal service that supports chronic disease management and accessible patient care across all communities.

Here is a list of key players operating in the global express delivery market:

The global express delivery market is defined by intense competition dominated by the integrated logistics giants and agile regional specialists. The key strategic initiatives include a massive investment in automation hub modernization and fleet expansion to handle the e-commerce’s exponential growth. The players are competing in the last mile innovation with drones, electric vehicles, and parcel lockers becoming standard. Sustainability commitments and strategic mergers and acquisitions to enhance regional networks are also pivotal as companies such as UPS and DHL consolidate their global reach while regional leaders such as SF Express and Delhivery deepen domestic dominance. For example, in April 2025, Delhivery announced that it had signed a definitive agreement to acquire a controlling stake in Ecom Express Limited for a cash consideration of Rs. 1,400 Cr from its shareholders.

Corporate Landscape of the Express Delivery Market:

Recent Developments

- In November 2025, Southern Railway has announced the launch of its Intra-Zonal Coast to Coast Parcel Express Train, a dedicated, time-tabled logistics service designed to offer fast, reliable, and cost-effective parcel movement and logistics solutions across Tamil Nadu and Kerala.

- In March 2024, JINGDONG Logistics, the logistics arm of JD.com, announced the expansion of its international express delivery service. This expansion extends the service’s reach from initial hubs in Guangzhou and Shenzhen to nearly every district within China.

- In February 2024, Ecom Express announced the launch of Same Day Delivery (SDD) services across 30 cities in India. This move comes at a time when the company is building its portfolio of D2C brands in online and offline commerce.

- Report ID: 8354

- Published Date: Jan 20, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Express Delivery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.