Ethylbenzene Market Outlook:

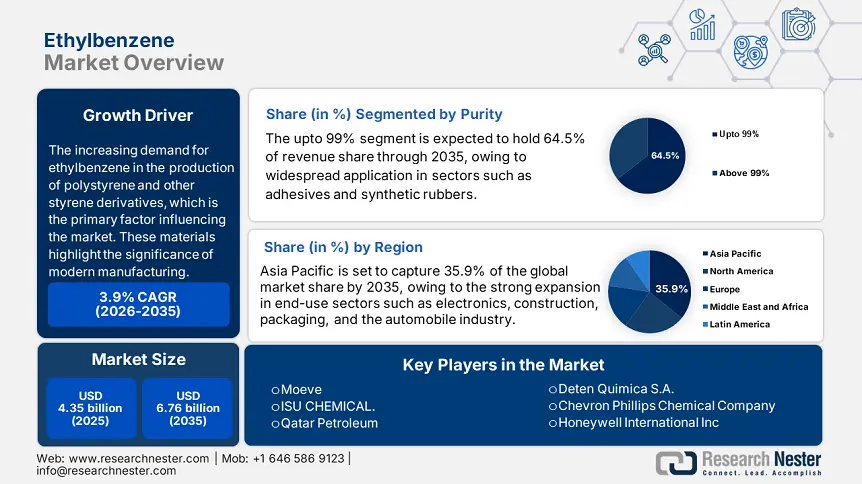

Ethylbenzene Market size was over USD 4.35 billion in 2025 and is poised to exceed USD 6.76 billion by 2035, witnessing over 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ethylbenzene is estimated at USD 4.53 billion.

The ethylbenzene market expansion is driven by the increasing demand for ethylbenzene in the production of polystyrene and other styrene derivatives, which is the primary factor influencing its supply. These materials highlight the compound's significance in modern manufacturing and industry, being essential for various applications such as consumer electronics, automotive components, packaging, and insulation. The demand for ethylbenzene is closely linked to economic conditions due to the links between its end-use products and consumer items, as well as construction projects.

The chemical formula C8H10 designates ethylbenzene as an organic compound. Paints, inks, and varnishes are frequently associated with it. The majority of the ethylbenzene used worldwide is derived from the production of styrene, which largely serves as an intermediary in making polystyrene, a common plastic and rubber. Ethylbenzene is created in the industrial sector by alkylating benzene with ethylene, usually with the aid of a catalyst such as aluminum chloride or zeolite. High-quality polystyrene products must be produced following this process, which yields a high-purity product.

Key Ethylbenzene Market Insights Summary:

Regional Highlights:

- Asia Pacific holds a 35.9% share in the Ethylbenzene Market, fueled by strong growth in electronics, construction, packaging, and automobile sectors, positioning it as a leader through 2035.

Segment Insights:

- The Upto 99% Purity segment is projected to sustain substantial growth through 2026-2035, driven by its widespread use in chemical commodities where ultra-high purity is not required.

Key Growth Trends:

- Rising use in production of styrene

- Increasing adoption in the automobile, agricultural, and construction industries

Major Challenges:

- Chances of health risk

- Rising environmental concern

- Key Players: Honeywell International Inc., Jingtung Petrochemical Corp.,Ltd, Sasol Limited, Huntsman International LLC., Reliance Industries Limited, PT Unggul Indah Cahaya Tbk, S.B.K HOLDING, Indian Oil Corporation Ltd, Desmet Ballestra, and Farabi Petrochemicals Co.

Global Ethylbenzene Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.35 billion

- 2026 Market Size: USD 4.53 billion

- Projected Market Size: USD 6.76 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 12 August, 2025

Ethylbenzene Market Growth Drivers and Challenges:

Growth Drivers

-

Rising use in production of styrene: The demand for ethylbenzene will rise as a result of its extensive use in the production of styrene. Acrylonitrile-butadiene-styrene (ABS), styrene-acrylonitrile (SAN), resins, polystyrene, acrylonitrile butadiene, styrene protective coatings, SBR, and styrene polyester are among the chemicals that styrene is a precursor to and will propel the growth of the ethylbenzene industry over the next decade.

Rising styrene demand from a variety of end-user sectors and growing ethylbenzene use in natural gas recovery are the primary drivers driving the ethylbenzene market's expansion. Furthermore, the extensive use of styrene-based polymers, elastomers, and resins in a range of end-user industries, such as electronics, packaging, agriculture, petrochemicals, and construction, is anticipated to increase the demand for ethylbenzene throughout the forecast period. -

Increasing adoption in the automobile, agricultural, and construction industries: In the application sector, the global ethylbenzene market is anticipated to offer profitable opportunities. Significant adjustments to ethylbenzene usage regulations are being made in several developing countries, which present appealing opportunities for market players. The increasing use of ethylbenzene in end-use industries such as polymer, construction, automotive, and agriculture is expected to support market growth over the forecast period. In the paint and coating industries, ethylbenzene is also frequently used to create lacquers, paints, and varnishes. Insecticides for the agricultural industry are also made with ethylbenzene.

Challenges

-

Chances of health risk: Since ethylbenzene is easily transferred from soil and water and is commonly found in soil and air in concentrations, continuous and excess exposure to it can be harmful to human health. Growing concerns about the risks of ethylbenzene, including irritation of the throat and eyes, light-headedness, and other neurological consequences, may cause some restraint in the market in the years to come. Furthermore, the existence of stringent laws and regulations governing the usage of ethylbenzene by different governments is expected to be one of the main factors preventing market expansion during the projected period.

-

Rising environmental concern: Significant obstacles are presented by regulatory demands and environmental concerns about the emissions and pollutants linked to the manufacture of ethylbenzene. Hazardous chemicals are used in industrial processes, and improper management of these substances can have negative effects on the environment. Manufacturers are being forced to invest in cleaner technology and innovate in response to stricter restrictions aimed at lowering industrial emissions, which may result in higher operating expenses.

Ethylbenzene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 4.35 billion |

|

Forecast Year Market Size (2035) |

USD 6.76 billion |

|

Regional Scope |

|

Ethylbenzene Market Segmentation:

Purity (Upto 99% and Above 99%)

The upto 99% segment is projected to gain a 64.5% share through 2035. This segment's significance is due to the widespread use of up to 99% purity in the creation of various chemical commodities when extraordinarily high purity is not required. Up to 99% pure ethylbenzene finds widespread application in sectors such as adhesives and synthetic rubbers, where it functions as a crucial solvent and intermediate chemical. Manufacturers seeking to strike a balance between quality and manufacturing costs favour it because it is more affordable than higher purity grades.

Ethylbenzene with a purity of more than 99%, on the other hand, is used in highly specialised applications that require higher quality and performance. When producing polystyrene and other high-performance plastics, where even small contaminants can have a big impact on the finished product's qualities, this section is essential. Despite having a smaller market share, this higher purity category is crucial for applications that demand strict adherence to environmental, safety, and health laws and fetches a premium price.

Form (Liquid and Solid)

Based on the form, the liquid segment is likely to hold a noteworthy share by the end of 2035. This form is used because of its versatility and ease of use in industrial settings, such as styrene production, where it is a crucial solvent. The liquid form is crucial in industries like the production of synthetic rubber and plastics since it is easy to handle and incorporate into a variety of chemical processes.

Even though it is less prevalent, solid ethylbenzene has a purpose in places where liquid versions could be dangerous or difficult to store. It is utilized in specific, specialized applications where accurate dosage is necessary and where powder form can provide benefits in terms of stability and dispersion. Despite having a lower market share than its liquid cousin, solid ethylbenzene is essential for specific applications that capitalize on its distinctive qualities.

Our in-depth analysis of the global ethylbenzene market includes the following segments:

|

Purity |

|

|

Form |

|

|

Application |

|

|

End use |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ethylbenzene Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific is expected to lead the ethylbenzene market with a share of 35.9% during the forecast period. The market growth in the region is propelled by strong expansion in end-use sectors such as electronics, construction, packaging, and the automobile industry. The existence of significant manufacturing centers in China, Japan, South Korea, and India defines the market in the area. These nations have seen large investments in downstream industries, especially in the electronics and packaging sectors, as well as styrene production plants. The market for ethylbenzene-based products is still being driven by the region's rapid industrialization, rising disposable income, and growing urbanization.

China's growth trajectory is fueled by rising investments in downstream sectors, especially in packaging and electronics manufacturing. The government's emphasis on technical innovation and sustainable development has encouraged investments in state-of-the-art production facilities. Growing consumer demand for packaged goods and electronics, along with the development of urban infrastructure, is opening up new market expansion prospects. Ethylbenzene market expansion is also anticipated to be further aided by the nation's strategic objectives to increase domestic manufacturing capabilities and lessen reliance on imports. In March 2021, an award for Lummus Technology's ethylbenzene technology was announced by a Jiangsu Province, China, customer. The unit will use EBOne technology to generate 508 KTA of ethylbenzene once it is finished. The EBOne technology has established itself as one of the most cutting-edge, dependable, and effective methods for producing intermediate ethylbenzene. Furthermore, Lummus has consistently increased its vast base of experience with this technology through innovation since its win.

In India, the demand for items made of styrene is still being driven by the thriving building industry and the expanding automobile sector. With the help of government programs encouraging industrial growth and technical advancement, the nation has seen large investments in new production facilities and capacity expansions. The nation's excellent supply chain infrastructure and the presence of significant domestic and foreign industries enhance its standing in the regional market.

North America Market Forecast

North America ethylbenzene market is expected to experience a stable CAGR during the forecast period. This expansion is fueled by growing demand from sectors that use ethylbenzene to make styrene, a crucial ingredient in the creation of plastics and automobiles. Ethylbenzene solutions are widely used in the area due in large part to the strong industrial base and developments in chemical processing technology.

In the U.S., the growing demand from important end-use sectors and growing investments in sustainable production methods are the main drivers of the expansion. The nation's emphasis on process efficiency enhancements and technical innovation keeps drawing investments for capacity increases. Growth in the market is further supported by the robust recovery in building activity and the rising demand for packaging solutions. Furthermore, new prospects for market expansion are being generated by the growing use of styrene-based products in a variety of applications.

In Canada, the increased demand from the building industry, a growing automobile sector, and increased industrialization all have an impact on the market development of the region. Market dynamics are still shaped by the existence of significant petrochemical facilities and continuous investments in capacity expansions. The market for ethylbenzene-based products is still being driven by the existence of significant automakers and a thriving construction industry. Market development is further influenced by the nation's concentration on circular economy ideas and sustainable production methods.

Key Ethylbenzene Market Players:

- Moeve

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ISU CHEMICAL.

- Qatar Petroleum

- Deten Quimica S.A.

- Chevron Phillips Chemical Company

- Honeywell International Inc

- Jingtung Petrochemical Corp.,Ltd

- Sasol Limited

- Huntsman International LLC.

- Reliance Industries Limited

- PT Unggul Indah Cahaya Tbk

- S.B.K HOLDING

- Indian Oil Corporation Ltd

- Desmet Ballestra

- Farabi Petrochemicals Co

Major firms are spending money on R&D to create ethylbenzene that is flexible, long-lasting, and of high quality in order to satisfy the changing demands of sectors like the automotive and construction industries. Prominent companies are increasing their market share through partnerships and acquisitions. Additionally, firms are concentrating on sustainable production practices and circular economy concepts as part of a growing emphasis on environmental responsibility. This strategy satisfies legal requirements and appeals to customers who care about the environment.

Here are some leading players in the ethylbenzene market:

Recent Developments

- In December 2021, LyondellBasell, a plastics, chemical, and refining corporation, and China Petroleum & Chemical Corporation (Sinopec) announced the signing of a joint venture agreement to create a 50:50 reciprocal joint venture to construct a PO/SM plant in China. The name of the joint venture will be LyondellBasell New Materials Co., Ningbo Zhenhai Refining & Chemical. The demand for ethylbenzene will rise sharply as a result.

- In April 2021, Lummus Technology said that PJSC Nizhnekamskneftekhim has given it a master licensor contract for its innovations related to olefin conversion, ethylene dimerization, styrene monomer, and ethylbenzene. The extension of an olefins production facility in Nizhnekamsk, Russia, will include these four plants. The olefins conversion and dimerization units will be the first in Russia.

- Report ID: 7645

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ethylbenzene Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.