Ethyl Polysilicate Market Outlook:

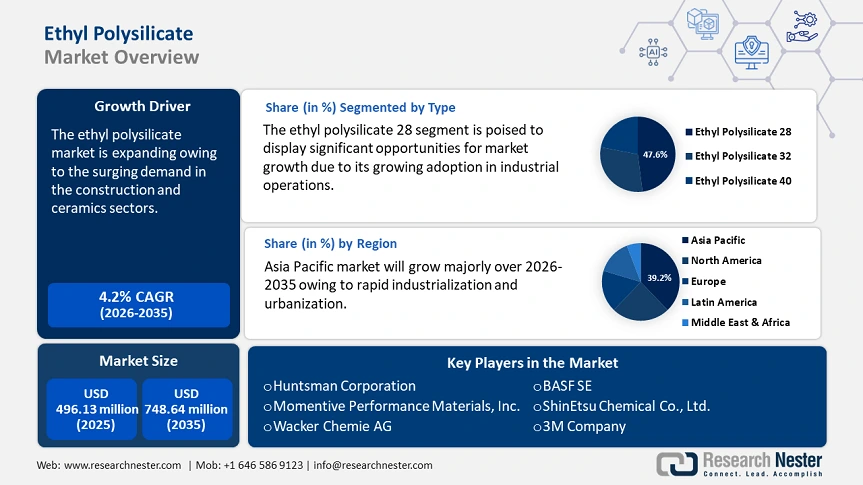

Ethyl Polysilicate Market size was over USD 496.13 million in 2025 and is projected to reach USD 748.64 million by 2035, witnessing around 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ethyl polysilicate is evaluated at USD 514.88 million.

The global ethyl polysilicate market is anticipated to expand due to the surging demand in the construction and ceramics sectors. Ethyl polysilicate's use as a high-performance binder in paints, coatings, and emulsions is becoming more popular in the construction industry owing to its quick curing time, good adherence, and biological and UV damage resilience. Because of these characteristics, it is necessary for infrastructure projects where long-term performance and durability are crucial, such as government buildings, hospitals, airports, and schools. The World Bank Organization revealed that the total amount of private participation in infrastructure (PPI) investment in 2023 was USD 86.0 billion, or 0.2 percent of the GDP of all low- and middle-income nations. The overall commitments in 2023 just slightly surpassed the previous five-year average (2018–2022) of USD 85.5 billion, despite a minor decline from USD 91.3 billion in 2022.

Ethyl polysilicate is also being used more and more in the ceramics industry for ceramic molding operations as a result of its value in binding ceramic particles, removing voids, and improving mechanical stability. This use is especially crucial as the ceramics industry is growing internationally and increasing demand for materials that guarantee the longevity and quality of products.

Key Ethyl Polysilicate Market Insights Summary:

Regional Highlights:

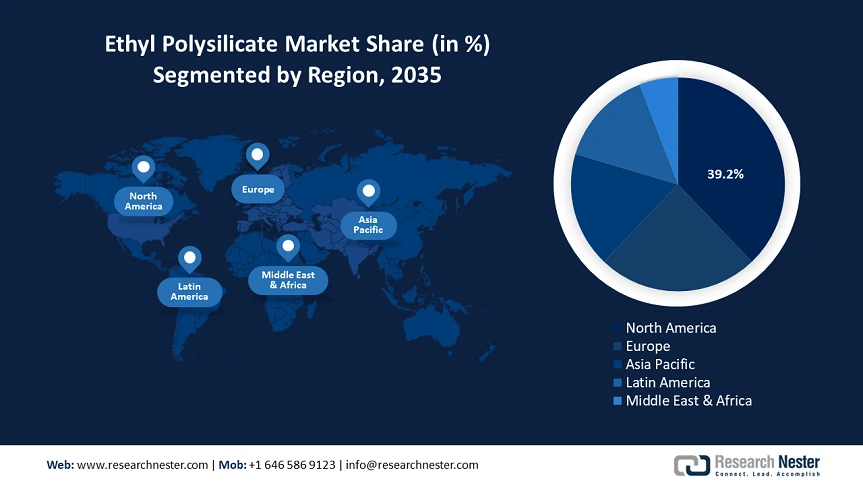

- Asia Pacific leads the Ethyl Polysilicate Market with a 39.2% share, propelled by rapid industrialization and urbanization in nations like China, India, and Japan, ensuring robust growth through 2035.

- North America’s ethyl polysilicate market is expected to achieve significant growth by 2035, driven by technological advancements and a focus on sustainable practices in the construction and automotive sectors.

Segment Insights:

- The Ethyl Polysilicate 28 segment is expected to capture 47.6% market share by 2035, fueled by its extensive application as a cross-linking agent and in silica production.

- The Paints & Coatings segment is expected to gain significant share from 2026-2035, driven by increased catalytic activity and reduced environmental concerns.

Key Growth Trends:

- Growing popularity in industrial applications

- Increasing demand from diverse sectors

Major Challenges:

- Market fragmentation & complex distribution

- Availability of alternatives

- Key Players: Huntsman Corporation, Momentive Performance Materials, Inc., Wacker Chemie AG, BASF SE, ShinEtsu Chemical Co., Ltd., DowDuPont, Inc., Evonik Industries AG, 3M Company, Adeka Corporation, Ineos Oligomers.

Global Ethyl Polysilicate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 496.13 million

- 2026 Market Size: USD 514.88 million

- Projected Market Size: USD 748.64 million by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 12 August, 2025

Ethyl Polysilicate Market Growth Drivers and Challenges:

Growth Drivers

-

Growing popularity in industrial applications: Ethyl polysilicate's variety of applications has significantly increased due to industrial progress toward sophisticated production techniques, creating numerous ethyl polysilicate market opportunities. This compound's special qualities make it highly valued in a wide range of industrial applications, from sophisticated coating systems to specialized chemical processing. Ethyl polysilicate-based solutions have become a popular option in applications where dependability and durability are deemed to be the most important factors, as they improve the material's qualities and are compatible with practically all substrates. This has been driving its need among various industrial sectors in their pursuit of process efficiency and enhanced product quality, while ongoing research and development expand into new areas and improve existing uses.

-

Increasing demand from diverse sectors: The aerospace and automotive industries are using ethyl polysilicate more and more because of its remarkable qualities, which include high-temperature resistance, low thermal conductivity, and superior dielectric strength. Ethyl polysilicate is used in the aerospace sector to create strong, lightweight composite materials for engine nacelles and radomes, among other aircraft parts. It is a useful material for aircraft applications because of its resistance to harsh weather conditions and extremely high temperatures. Ethyl polysilicate is used in the automobile industry to make brake pads, high-performance tires, and other parts that need to be resistant to wear and heat. The demand for ethyl polysilicate in this industry is driven by its use in automotive applications, which enhance vehicle safety and fuel efficiency.

Furthermore, as a result of its high dielectric strength and low leakage current, it is used as a dielectric material in transistors and capacitors. The necessity for sophisticated dielectric materials like ethyl polysilicate is anticipated to fuel the expansion of the ethyl polysilicate market industry as the demand for semiconductors and electronic devices keeps rising.

Challenges

-

Market fragmentation & complex distribution: The ethyl polysilicate market has major obstacles due to market fragmentation and a convoluted distribution network, which impact product accessibility and, consequently, market efficiency. End customers' varied needs and a wide variety of applications have caused market fragmentation, which makes it difficult to maintain supply chains and standardize the quality of the product. This results in fragmentation, which raises operating costs and lengthens lead times for both customers and producers. The industry's potential for expansion is limited by the intricacy of emerging markets' distribution networks, which make it challenging for new competitors to enter or flourish in the market. The operational complexity and cost structure are increased when specific handling and storage requirements are needed across the chain.

-

Availability of alternatives: The ethyl polysilicate market for ethyl polysilicate is severely hampered by the availability of substitute adhesives, sealants, and coatings. Products with comparable or superior performance qualities include silicones, acrylics, and epoxy resins. The demand for ethyl polysilicate may be impacted by their broad availability and affordable prices. Epoxy resins, for instance, are frequently chosen in automotive and construction applications due to their strong adhesive qualities and longevity. The ethyl polysilicate market share and growth of ethyl polysilicate may be hampered by this competition.

Ethyl Polysilicate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 496.13 million |

|

Forecast Year Market Size (2035) |

USD 748.64 million |

|

Regional Scope |

|

Ethyl Polysilicate Market Segmentation:

Type (Ethyl Polysilicate 28, Ethyl Polysilicate 32, Ethyl Polysilicate 40)

Ethyl polysilicate 28 segment is anticipated to dominate over 47.6% ethyl polysilicate market share by 2035. The extensive application of ethylene polysilicate 28 in industrial processes, particularly as a cross-linking agent and in the production of silica, establishes its dominance in the market. This compound is well-suited for a wide range of industrial operations due to its optimal balance of stability and reactivity. Its market share is further augmented by the increasing demand for high-performance materials within the electronics, automotive, and construction sectors. Additionally, Ethylene Polysilicate 28 is favored for its ability to enhance the performance and durability of adhesives and coatings, which are critical components in these industries.

End use (Chemicals, Metals, Paints & Coatings, Textiles, Pharmaceuticals, Optical, Ceramics)

The paints & coatings segment in ethyl polysilicate market is anticipated to garner a significant share during the assessed period. The market is growing as a result of more catalytic activity and fewer environmental concerns. The market demand for industrial-grade precious metal catalysts is directly driven by their application in a variety of industries, such as chemical, automotive, electronics, petroleum, etc., which in turn fuels the industry's expansion. The segment's rapid rise can be attributed to the demand for superior catalysts and more environmentally friendly production processes. Furthermore, the introduction of cutting-edge technology to lower costs has boosted the ethyl polysilicate market for precious metal catalysts.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

End use |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ethyl Polysilicate Market Regional Analysis:

APAC Market Statistics

Asia Pacific in ethyl polysilicate market is expected to dominate around 39.2% revenue share by the end of 2035. The demand for ethyl polysilicate is driven by the rapid industrialization and urbanization of nations like China, India, and Japan. One major contributor is the rapidly expanding building sector, especially in China. The expansion of the electronics and automotive sectors in this area is also quite important, since it raises the demand for high-performance coatings and adhesives.

APAC enjoys the advantages of a big manufacturing base, reduced production costs, and pro-industry government policies. Market expansion is driven by the growing customer base and the strong need for infrastructure development.

North America Market Analysis

North America ethyl polysilicate market is expected to grow at a significant rate during the projected period. The sophisticated construction and automotive sectors are the main drivers of demand in the area. Two important factors driving growth are technological advancements and an emphasis on sustainable practices. Because of well-established industrial bases and consistent demand, the market value in this region is anticipated to increase at a moderate rate.

Key Ethyl Polysilicate Market Players:

- Huntsman Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent developments

- Regional Presence

- SWOT Analysis

- Momentive Performance Materials, Inc.

- Wacker Chemie AG

- BASF SE

- ShinEtsu Chemical Co., Ltd.

- DowDuPont, Inc.

- Evonik Industries AG

- 3M Company

- Adeka Corporation

- Ineos Oligomers

Major companies in ethyl polysilicate Market sector are focusing on growing their global footprint by creating new manufacturing facilities and entering into strategic alliances. To launch cutting-edge goods and technology, major firms are making significant investments in R&D. Leading companies in the ethylene polysilicate market are implementing a number of tactics, including joint ventures, acquisitions, and partnerships, to improve their market positions. As businesses look to diversify their product lines and open up new markets, the ethylene polysilicate market is seeing an increase in mergers and acquisitions. It is anticipated that the market will continue to be highly competitive, with numerous small and medium-sized businesses vying for market share.

Recent Developments

- In April 2024, SCHOTT introduced pilot projects for glass ceramics and specialty glass to promote a circular economy. SCHOTT is working with pilot customers and partners to find solutions to recycle discarded glass-ceramic cooktop panels and pharmaceutical packaging into new products.

- In April 2023, RAK Ceramics opened its second Design Hub in Europe, in the charming village of Gernsheim, Germany. This cutting-edge facility spans two storeys and covers an impressive 650m2, showcasing RAK Ceramics' premium selection of tiles, slabs, and sanitaryware, including the iconic line by renowned fashion designer ELIE SAAB.

- Report ID: 7526

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ethyl Polysilicate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.