Ethanolamine Market Outlook:

Ethanolamine Market size was valued at USD 3.58 billion in 2025 and is likely to cross USD 5.61 billion by 2035, registering more than 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ethanolamine is assessed at USD 3.73 billion.

The soaps and detergents industry drives the ethanolamine market by generating strong demand for its role in surfactants, emulsifiers, pH adjusters, and formulation stabilizers. The market for ethanolamine keeps growing as global demand for personal and household cleaning products and hygiene awareness rise. Ethanolamines are commonly used to produce surfactants, which are the core cleaning agents in soaps and detergents. They help reduce surface tension, allowing water to mix with oils and dirt for easier removal.

Triethanolamine (TEA) is often used to stabilize the pH of cleaning products. Maintaining the right pH improves the effectiveness of the detergent and ensures product stability over time. In liquid soaps and shampoos, ethanolamines act as foam boosters and stabilizers, enhancing the user experience and product performance. They also assist in emulsifying oily residues and solubilizing ingredients that do not naturally mix well, which is important in complex cleaning formulations.

As consumer demand shifts toward liquid detergents and personal care products like hand washes and shampoos, the use of ethanolamines grows, since they are more commonly used in liquid formulations than in solid soaps. Beyond household use, ethanolamines are widely used in industrial and institutional cleaners, where stronger and more complex chemical formulations are needed, which is another key growth driver for the market.

Key Ethanolamine Market Insights Summary:

Regional Highlights:

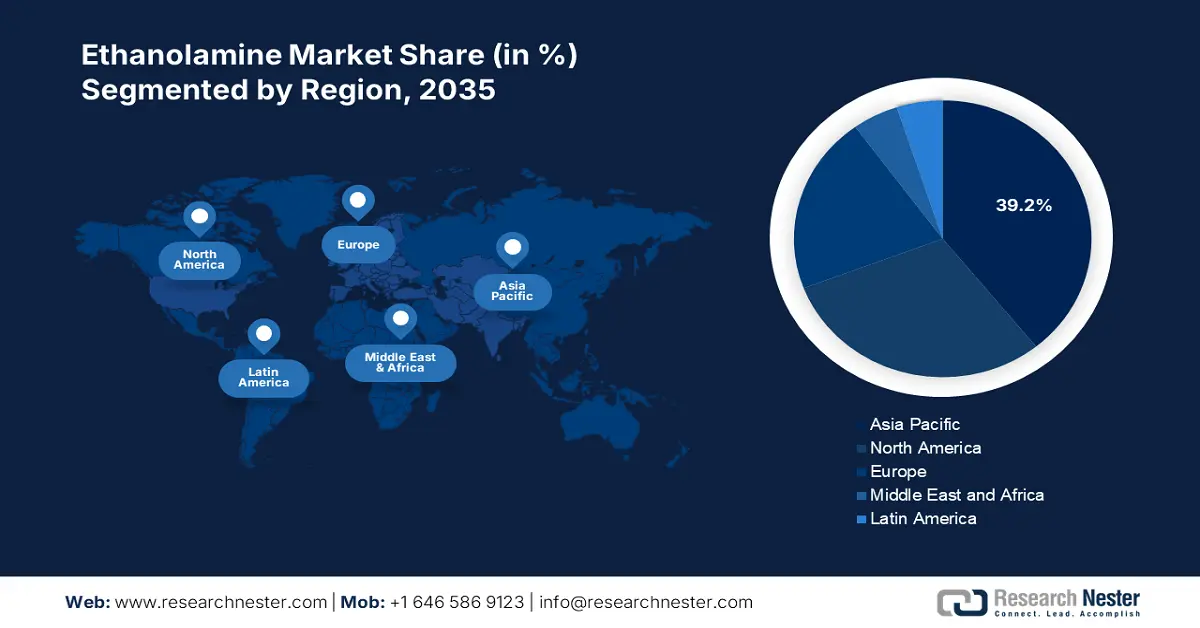

- Asia Pacific's 39.2% share in the Ethanolamine Market is driven by rapid industrialization, urbanization, and increasing demand in end-use industries, positioning it for robust growth through 2035.

- North America's ethanolamine market is experiencing significant growth by 2035, driven by rising demand in gas treatment and industrial cleaning applications.

Segment Insights:

- The Triethanolamine (TEA) segment is anticipated to hold 36.6% market share by 2035, propelled by its diverse applications in personal care and industrial processes.

- The Pharmaceutical segment is expected to secure a significant share by 2035, driven by its critical applications in drug synthesis and rising demand for high-purity intermediates.

Key Growth Trends:

- Booming agrochemicals industry

- Expanding construction and cement industry

Major Challenges:

- Health and environmental concerns and regulatory restrictions

- Supply chain disruptions and competition from substitutes

- Key Players: Huntsman Corporation, China Petroleum & Chemical Corporation, Thai Ethanolamines Co., Ltd, Sinopec Shanghai GaoQiao Petrochemical Corporation, Akzo Nobel, Shijiazhuang Haisen Chemical Co., Ltd, Alkyl Amines Chemicals Ltd., Air Products and Chemicals Inc., Celanese Corporation.

Global Ethanolamine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.58 billion

- 2026 Market Size: USD 3.73 billion

- Projected Market Size: USD 5.61 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 12 August, 2025

Ethanolamine Market Growth Drivers and Challenges:

Growth Drivers

-

Booming agrochemicals industry: Ethanolamines, especially monoethanolamine (MEA) and diethanolamine (DEA), are used to form ethanolamine salts of glyphosate, one of the most widely used non-selective herbicides globally. As demand for glyphosate-based herbicides increases due to expanding agricultural activities, so does the need for ethanolamines. With global population growth, there’s increasing pressure on farmers to boost crop yields. This leads to higher consumption of fertilizers, herbicides, fungicides, and pesticides, many of which use ethanolamines as solubilizing agents, pH stabilizers, and emulsifiers.

Modern agriculture increasingly uses customized agrochemical formulations to minimize waste and environmental impact. Ethanolamines help optimize these formulations, ensuring effectiveness while meeting eco-friendly standards. Moreover, countries like India, China, and Brazil are rapidly expanding agrochemical production capacities. Ethanolamine demand rises in parallel, both as a reactant in synthesis and as a formulation aid. - Expanding construction and cement industry: TEA and DEA are widely used as grinding aids in cement manufacturing. These compounds help prevent agglomeration of cement particles, improving grinding efficiency and reducing energy consumption in cement mills. As global cement production rises, especially in infrastructure-heavy regions, ethanolamine demand increases.

Ethanolamines enhance cement quality by improving its fineness, setting time, and strength. TEA also acts as a setting time regulator, making it ideal for diverse climatic and construction conditions. Additionally, urbanization, smart cities, housing, and transportation projects in emerging economies fuel cement demand. As construction scales up, the use of cement additives like ethanolamines becomes more critical to meet performance and efficiency goals.

Challenges

-

Health and environmental concerns and regulatory restrictions: Ethanolamines, especially DEA and TEA, are under scrutiny due to potential health risks. Some studies link prolonged exposure to skin irritation, respiratory issues, and even carcinogenicity. Regulatory bodies like the EPA, REACH, and ECHA impose strict usage guidelines, limiting their application in cosmetics and cleaning products.

Increasingly stringent regulations on chemical formulations, especially in Europe and North America, may restrict ethanolamine usage or require reformulations. Moreover, the cost of compliance with safety, labelling, and environmental norms can reduce profit margins and delay product launches. - Supply chain disruptions and competition from substitutes: Geopolitical issues, trade restrictions, or disruptions in chemical manufacturing hubs like China and the U.S. can impact global ethanolamine supply. In industrial applications, ethanolamines compete with other amines, glycols, and newer chemical blends that offer better performance or safety profiles.

Ethanolamine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 3.58 billion |

|

Forecast Year Market Size (2035) |

USD 5.61 billion |

|

Regional Scope |

|

Ethanolamine Market Segmentation:

Product Type (Monoethanolamine (MEA), Diethanolamine (DEA), and Triethanolamine (TEA))

The triethanolamine (TEA) segment is projected to gain a 36.6% market share by 2036, driven by its diverse applications across multiple industries. TEA serves as a surfactant, emulsifier, and pH adjuster in various personal care products, including shampoos, conditioners, lotions, and creams. The increasing global demand for skincare and cosmetic products, fueled by heightened awareness of personal hygiene and grooming, propels the growth of TEA in this sector.

Additionally, TEA finds applications in metalworking fluids and as a corrosion inhibitor in various industrial processes. Its role in enhancing the efficiency and longevity of machinery contributes to its steady demand in the industrial sector.

Grade (Pharmaceutical, Food, and Industrial or Technical)

The pharmaceutical segment is anticipated to garner a significant share during the assessed period. Pharmaceutical grade ethanolamine plays a pivotal role in driving the growth of the market, owing to its critical applications in drug synthesis, formulation, and delivery systems. The expanding global pharmaceutical industry, driven by increasing healthcare needs and aging populations, has led to a heightened demand for high-purity chemical intermediates like pharmaceutical-grade ethanolamine. This demand is further amplified by the rise in chronic diseases requiring complex medication regimens.

Our in-depth analysis of the global ethanolamine market includes the following segments:

|

Product Type |

|

|

Grade |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ethanolamine Market Regional Analysis:

APAC Market Statistics

Asia Pacific ethanolamine market is predicted to garner a share of 39.2% by 2036, driven by rapid industrialization, urbanization, and increasing demand across various end use industries. The region’s robust manufacturing sector, particularly in chemicals and pharmaceuticals, is a significant contributor to ethanolamine demand. Rapid industrialization in countries such as China and India has led to increased utilization of ethanolamines in various applications, including gas treatment and metal cleaning.

China’s extensive urbanization, with a projected urbanization rate of 70% by 2030, has led to a surge in residential and commercial construction. Ethanolamines are used in cement grinding aids and concrete admixtures, supporting this sector’s growth. Further, ethanolamines serve as intermediates in herbicide formulations, aligning with China’s focus on enhancing agricultural productivity. India’s ethanolamine market is poised for steady growth, driven by diverse industrial applications and increasing demand in sectors like agrochemicals, textiles, and personal care. The market’s expansion is further supported by domestic production capabilities and a focus on supply chain reliability.

North America Market Analysis

The North America ethanolamine market is expected to grow at a significant rate during the projected period. The market growth is characterized by rising demand in gas treatment and industrial cleaning applications. Rising energy demand, shale gas production, and stricter emission regulations in the U.S. and Canada. Ethanolamines are used in metal cleaners, cutting fluids, and corrosion inhibitors. A resurgence in North American manufacturing and emphasis on equipment maintenance and protection.

In the U.S., key companies such as Dow Inc., Huntsman Corporation, and Eastman Chemical Company are investing in research and development to innovate and expand their product portfolios, aiming to meet the evolving demands of end use industries. In Canada, MEA acts as an intermediate chemical in manufacturing timber preservatives, which are widely used in the country to preserve wood and other timber products.

Key Ethanolamine Market Players:

- INEOS Oxide Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent developments

- Regional Presence

- SWOT Analysis

- Huntsman Corporation

- China Petroleum & Chemical Corporation

- Thai Ethanolamines Co., Ltd

- Sinopec Shanghai GaoQiao Petrochemical Corporation

- Akzo Nobel

- Shijiazhuang Haisen Chemical Co., Ltd

- Alkyl Amines Chemicals Ltd.

- Air Products and Chemicals Inc.

- Celanese Corporation

Key players are not just expanding production, they are shaping the future of the ethanolamine market through innovation, sustainability, and strategic market positioning. This proactive approach enables them to meet rising demand while differentiating themselves from competitors. Companies are also developing high-purity ethanolamines for sensitive applications such as pharmaceuticals, electronics, and personal care.

Here are some of the key players:

Recent Developments

- In September 2024, BASF opened a new, large-scale alkyl ethanolamine production facility at its Verbund facility in Antwerp, Belgium. With this additional investment, the company's capacity to produce alkyl ethanolamines, such as methyl diethanolamine (MDEOA) and dimethyl ethanolamine (DMEOA), globally will rise by about 30% to more than 140,000 tons annually.

- In February 2022, PetroChina Jilin Petrochemical Company started its initiative to upgrade and reform. Participants in the launch ceremony were CNPC Chairman Dai Houliang and CPC Jilin Provincial Committee Secretary Jing Junhai. CNPC's efforts to meet the 3060 targets and further the superior growth of its petrochemical and refining operations include the Jilin project. It is CNPC's first chemical project that is entirely powered by green electricity and uses cutting-edge energy-saving and environmental protection technologies for environmentally friendly production.

- Report ID: 7634

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ethanolamine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.