Esoteric Testing Market Outlook:

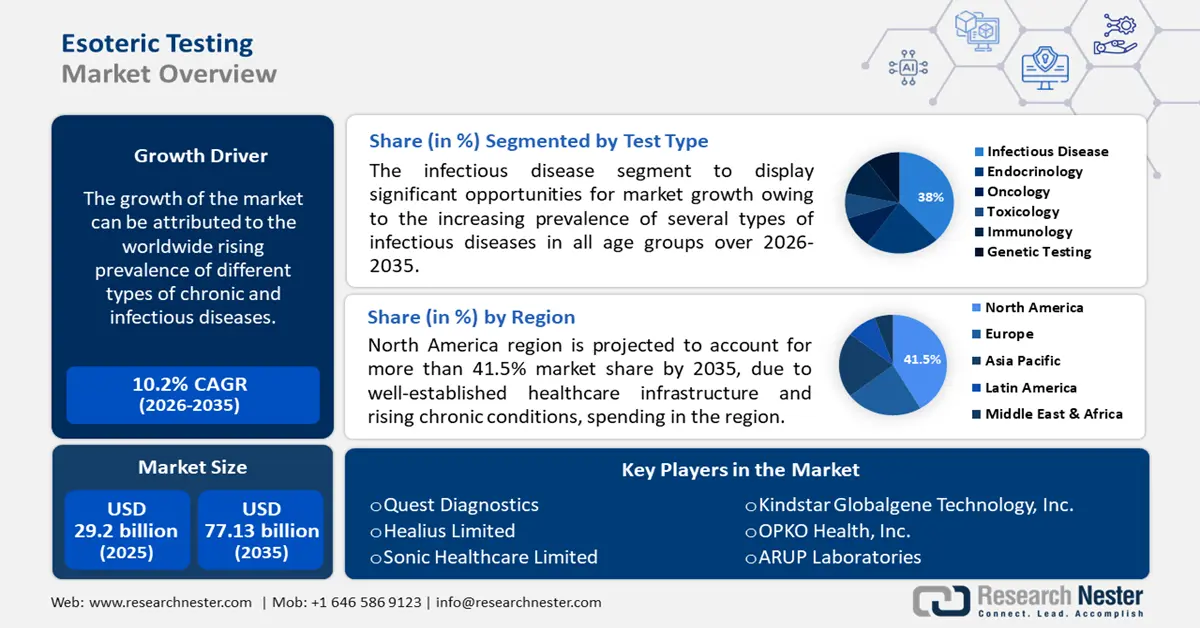

Esoteric Testing Market size was valued at USD 29.2 billion in 2025 and is expected to reach USD 77.13 billion by 2035, registering around 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of esoteric testing is evaluated at USD 31.88 billion.

The growth of the market can be attributed to the worldwide rising prevalence of different types of chronic and infectious diseases. For instance, the prevalence of chronic diseases increased globally by around 57% by the end of 2020. Further, the rapidly growing proportion of the aged population is also expected to add to the market growth. Since aged people are more prone to get infections and falling sick, hence this factor is estimated to dynamically propel the growth of the market in the coming years.

In addition to these, factors that are believed to fuel the market growth of esoteric testing include the soaring effectiveness and demand for enzyme-linked immunosorbent assay (ELISA) as of their high accuracy, coupled with the effectiveness of real-time polymerase chain reaction (RT-PCR) tests across the globe. For instance, based on a clinical study result, the RT-PCR sensitivity in LFIA assays {immunoglobulin G (IgG) and/or immunoglobulin M (IgM)} was nearly 0.67 {96% statistical interval (PrI): 0.63, 0.73}. In the initial week, IgG/M sensitivity was 0.32 (95% PrI:0.23; 0.41) and steadily increased. For the second and third weeks after symptom start, it was 0.75 (95% PrI: 0.67; 0.84) and 0.93 (96% PrI: 0.87; 0.98), respectively. Whereas, ELISA tests are nearly 99% accurate when combined with the confirmatory western blot test. Additionally, an expansion of funding from private and government bodies for diagnostic service centers, and technical breakthroughs in esoteric testing are predicted to present the potential for market expansion over the projected period.

Key Esoteric Testing Market Insights Summary:

Regional Highlights:

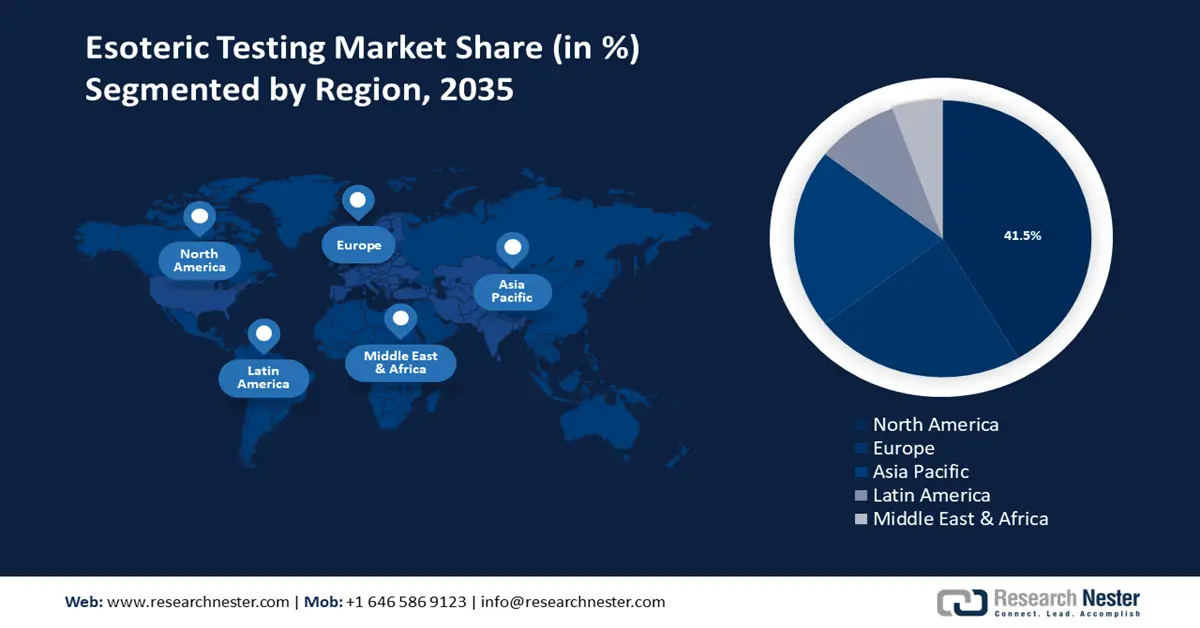

- North America esoteric testing market will dominate over 41.5% share by 2035, driven by well-established healthcare infrastructure and rising chronic conditions.

- Europe market will exhibit notable growth from 2026 to 2035, driven by rapid diagnostics and advancements in precision medicine.

Segment Insights:

- The chemiluminescence immunoassay segment in the esoteric testing market is forecasted to achieve a significant share by 2035, driven by the high precision and early diagnosis capacity of the technology.

- The infectious disease segment in the esoteric testing market will command the largest share, fueled by the rising prevalence of infectious diseases across all age groups, forecast period 2026-2035.

Key Growth Trends:

- Increasing Use of Specialized Rapid Testing Kits

- Rising Investments in Research & Development Activities

Major Challenges:

- Inadequate Reimbursement for Esoteric Tests

- Stringent Regulatory Framework Imposed by the Governments

Key Players: H.U. Group Holdings, Inc., Laboratory Corporation of America Holdings, Quest Diagnostics, Healius Limited, Sonic Healthcare Limited, Thyrocare Technologies Limited, Fulgent Genetics, Inc., Kindstar Globalgene Technology, Inc., OPKO Health, Inc., ARUP Laboratories.

Global Esoteric Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 29.2 billion

- 2026 Market Size: USD 31.88 billion

- Projected Market Size: USD 77.13 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 9 September, 2025

Esoteric Testing Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Occurrence of Rare Disorders - Rare disorders are usually severe, chronic, and life-threatening disorders. A rare disease is defined by the World Health Organization as a disabling lifelong disease or disorder with a prevalence of 1 or fewer per 1000 people. Several countries, however, have their own definitions to meet their specific needs and from the perspective of their population, healthcare system, and resources. Therefore, the surging ratio of several rare disorders is also estimated to boost the growth of the market in the coming years. For instance, in 2019, around 350 million people were expected to be living with a rare disease worldwide.

-

Worldwide Surge in Geriatric Population - The formation of complicated health conditions is also an aspect of old age. Individuals have a greater probability to encounter multiple ailments simultaneously as they aged. Thus, the surge in the geriatric population is another significant factor that is anticipated to spur the growth of the market in the coming years. As per the United Nations statistics, worldwide, 1 in 6 individuals is estimated to be over 65 by 2050, an increase from 1 in 11 in 2019.

-

Dynamic Escalation in Genetic Testing - Genetic testing examines a person's DNA for changes known as mutations or variations. Genetic testing is beneficial in numerous fields of medicine and can modify an individual's medical care. Genetic testing results may be helpful in an array of aspects, including detecting a hereditary condition, initiating therapy, or starting prevention measures. Thus, the expansion in genetic testing is also estimated to drive market growth further over the projected time frame. For instance, approximately 2 million genetic tests were conducted in the United States in 2019.

-

Increasing Use of Specialized Rapid Testing Kits – Specialized testing kits are specially designed for dedicated therapeutics for certain diseases. The recent outbreak of COVID-19 has proved as the biggest boon in the growing demand for specialized rapid testing kits. For instance, globally around USD 28 billion worth of rapid COVID test kits were sold in 2020, while an estimated USD 19 billion worth of PCR COVID testing kits were sold in the same year.

-

Rising Investments in Research & Development Activities – For instance, Pharmaceutical companies invested nearly USD 210 billion worldwide on research & development in 2020.

Challenges

- Inadequate Reimbursement for Esoteric Tests - Medicaid and Medicare coverage for precision medicine is quite limited. The amount of testing has been significantly influenced in recent years by a decrease in the reimbursement of diagnostic tests. Therefore, this factor is anticipated to hinder market growth in the projected time frame.

- Stringent Regulatory Framework Imposed by the Governments

- A Dearth of Required Infrastructural Facilities in Emerging Nations

Esoteric Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 29.2 billion |

|

Forecast Year Market Size (2035) |

USD 77.13 billion |

|

Regional Scope |

|

Esoteric Testing Market Segmentation:

Test Type Segment Analysis

The infectious disease segment is estimated to gain the largest market share over the projected time frame, attributed to the increasing prevalence of several types of infectious diseases in all age groups. For instance, as per a survey, the frequency of visits to medical offices in the United States for infectious and parasitic disorders grew to around 10.5 million in 2019. Infectious disorders are illnesses caused by harmful microbes such as viruses, fungi, or parasites. Infectious diseases are typically transmitted from person to person, by contaminated water or food, or through insect bites. Infectious diseases are relatively frequent all around the world, however, some are more prevalent than others. Inadequate sanitation and poor hygiene contribute to the transmission of infectious diseases. Moreover, the surge in COVID-19 diagnostics has radically increased across the globe which is also projected to spur the growth of the market. Hence, the worldwide surge in the spread of such diseases is estimated to expand the growth of the segment.

Technology Segment Analysis

The global esoteric testing market is also segmented and analyzed for demand and supply by technology into flow cytometry, chemiluminescence immunoassay, mass spectrometry, radio immunoassay, DNA sequencing, real-time polymerase chain reaction, and others. Amongst these segments, the chemiluminescence immunoassay segment is expected to garner a significant share. The growth of the segment can be attributed to the high-performance levels, good precision, and low detection limits of this technology of esoteric testing. Apart from these, the expanding ratio of autoimmune disorders along with the increasing concern regarding the early diagnosis of diseases are also anticipated to boost the segment growth further in the coming years. For instance, more than 10 million people in the United States, or 5% of the population, are affected by all autoimmune disorders. Moreover, rising research and development activities associated with the diagnosis of autoimmune diseases, where chemiluminescence immunoassay is highly used to test the symptoms, are also predicted to boost the market segment growth in the future. On the other hand, the global esoteric testing market is also segmented and analyzed for demand and supply by end-user into independent & reference laboratories, and hospital laboratories. Amongst these two segments, the independent & reference laboratories segment is projected to witness a notable CAGR during the forecast period, owing to the rising count of laboratories throughout the worldwide, coupled with the surge in the frequency of testing, and escalating digitalization of diagnostic laboratories across the globe.

Our in-depth analysis of the global market includes the following segments:

|

By Test Type |

|

|

By Technology |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Esoteric Testing Market Regional Analysis:

North American Market Insights

North America region is projected to account for more than 41.5% market share by 2035, attributed majorly to the well-established medical infrastructure, and high healthcare spending in the region. As per the data provided by the Centers for Medicare and Medicaid Services, healthcare spending in the United States grew 9.7% in 2020, reaching a value of USD 4.1 trillion or USD 12,530 per person. In addition to this, the increasing frequency of chronic disorders, coupled with the growing ratio of diagnostic tests, as well as the vast population base of aged people are also estimated to fuel the regional market growth. Furthermore, the escalating proportion of rare disorders, along with the surging investment in R&D activities for rare diseases is also anticipated to accelerate the growth of the esoteric testing market in the region.

Europe Market Insights

The European esoteric testing market is projected to grow with a notable CAGR during the forecast period, attributed majorly to the rising utilization of rapid diagnosis, followed by the technological advancements to develop enhanced precision medicine in the region.

Esoteric Testing Market Players:

- H.U. Group Holdings, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Laboratory Corporation of America Holdings

- Quest Diagnostics

- Healius Limited

- Sonic Healthcare Limited

- Thyrocare Technologies Limited

- Fulgent Genetics, Inc.

- Kindstar Globalgene Technology, Inc.

- OPKO Health, Inc.

- ARUP Laboratories

Recent Developments

-

Laboratory Corporation of America Holdings has opened a new anatomic pathology and histology (APH) laboratory in Los Angeles. Dedicated to APH laboratory testing solutions, the new lab is a Center of Excellence. Through the expansion of the laboratory, new capabilities are estimated to be added, including digital pathology enhanced by artificial intelligence (AI), multiplex immunohistochemistry (IHC), and other advanced technologies.

-

ARUP Laboratories has begun testing for monkeypox as part of its in-house testing program. Monkeypox virus (including orthopoxvirus) by PCR is a real-time polymerase chain reaction (RT-PCR) test designed to detect the DNA of orthopoxviruses, including monkeypox.

-

Fulgent Genetics, Inc. confirmed that the newly-emerging Omicron variant of the SARS-CoV-2 virus can be successfully detected using the Company's RT-PCR test. Furthermore, Fulgent believes that its Next Generation Sequencing (NGS) tests for COVID-19 can accurately identify the variant.

- Report ID: 3832

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Esoteric Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.