Enterprise Payments Platform Market Outlook:

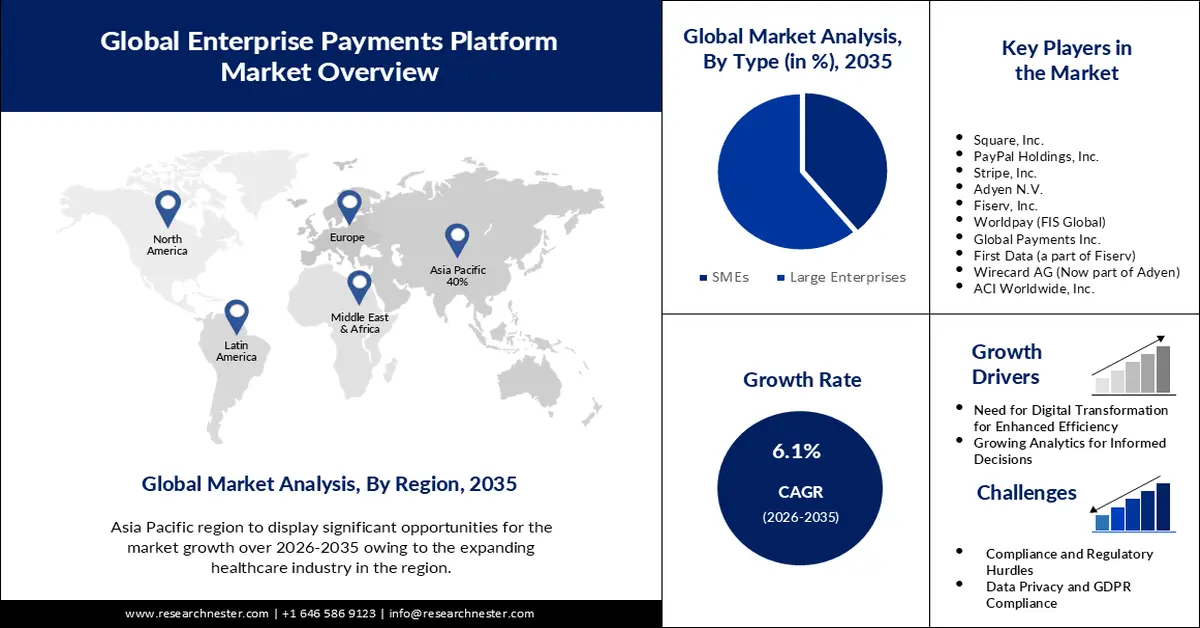

Enterprise Payments Platform Market size was valued at USD 8.93 billion in 2025 and is likely to cross USD 16.14 billion by 2035, expanding at more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of enterprise payments platform is assessed at USD 9.42 billion.

Many businesses were increasingly adopting digital payment solutions to replace traditional, paper-based payment methods. This trend was driven by the need for efficiency, security, and cost-effectiveness. Enterprise Payments Platforms are often integrated with other financial and business systems, such as accounting software, enterprise resource planning (ERP) systems, and customer relationship management (CRM) tools. This integration allowed for seamless data flow and financial management. Given the sensitivity of financial transactions, security and compliance with regulations like PCI DSS and GDPR were paramount in the market. Vendors focused on providing robust security features.

Enterprise Payments Platform market is a rapidly evolving sector within the broader financial technology (FinTech) industry. Enterprise Payments Platforms are software solutions designed to facilitate and streamline payments for businesses, helping them manage financial transactions, payment processing, and related activities more efficiently. These platforms play a crucial role in enabling businesses to send and receive payments, manage cash flow, and reconcile transactions. Some platforms aimed to build ecosystems by partnering with other fintech providers, creating a one-stop-shop for various financial services beyond just payments.