Enhanced Oil Recovery Market Overview

EOR (Enhanced Oil Recovery) is a phase of oil production process and this technique is to increase the production of crude oil form an oil field. This enhanced oil recovery technique helps to increase the extraction rate of available hydrocarbons.

Market Size and Forecast

The global enhanced oil recovery market is likely to thrive at 23.2% CAGR over the forecast period i.e. 2017-2024. Growing oil & gas industry across the globe is expected to bolster the growth of global enhanced oil recovery market in upcoming years. Further, rising need to maximize production value of oil fields is a major factor which is anticipated to foster the growth of market over the forecast period.

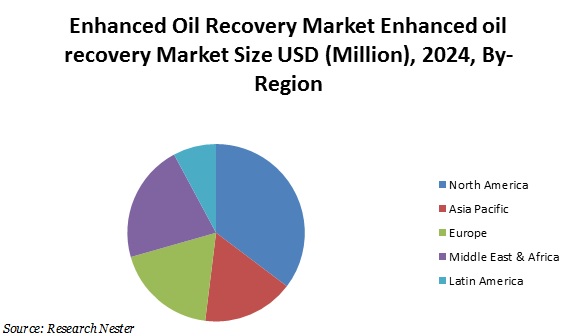

In terms of regional platform, the global enhanced oil recovery market is segmented into North America, Asia Pacific, Europe, Latin America and Middle East & Africa regions. Further, North America accounted for lion market share in 2016. Swelled petroleum and other liquid production in U.S. are expected to drive the growth of enhanced oil recovery market in North America region over the forecast period. For instance, total oil & petroleum production in United States reached 14,855 thousand barrels per day in 2016. Further, this remarkable recovery of US oil production is expected to bolster the growth of enhanced oil recovery market in North America region.

Additionally, Asia Pacific enhanced oil recovery market is expected to grow at maximum pace over the forecast period. High dependency of Asian countries on oil & gas energy and government initiatives to strengthen oil & gas sector are likely to be the major growth drivers of enhanced oil recovery market in Asia Pacific region.

Apart from region, the global enhanced oil recovery market is segmented by technology into chemical injection, thermal injection and chemical injection. Among these segments, thermal injection segment is anticipated to garb lion shares in global market of enhanced oil recovery by the end of 2024. Thermal injection method is used in thinning the oil and to improve its flow characteristics.

Market Segmentation

Our in-depth analysis has segmented global enhanced oil recovery market into the following segments:

By Technology

- Gas Injection

- Thermal Injection

- Cyclic Steam Injection

- Fire Flooding

- Steam Flooding

- Combustion

- Chemical Injection

By Application

- Onshore

- Offshore

By Region

Global enhanced oil recovery market is further classified on the basis of region as follows:

- North America (United States, Canada), Market size, Y-O-Y growth Market size, Y-O-Y growth & Opportunity Analysis, Future forecast & Opportunity Analysis

- Latin America (Brazil, Mexico, Argentina, Rest of LATAM), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Europe (U.K., Germany, France, Italy, Spain, Hungary, BENELUX (Belgium, Netherlands, Luxembourg), NORDIC (Norway, Denmark, Sweden, Finland), Poland, Russia, Rest of Europe), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Asia-Pacific (China, India, Japan, South Korea, Malaysia, Indonesia, Taiwan, Hong Kong, Australia, New Zealand, Rest of Asia-Pacific), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

Growth Drivers & Challenges

With the rising consumption of oil & gas energy, the need to increase the oil & gas production is also increasing across all regions. EOR (Enhanced oil recovery) is anticipated to be one of the most adopted solutions to increase the oil & gas extraction rate.

Enhanced oil recovery solution can be found applicable in most of onshore oil fields. Further, high adoption of enhanced oil recovery solution in onshore fields is a major factor which is likely to drive the growth of Enhanced oil recovery market over the next few years. However, the adoption rate of enhanced oil recovery solution is also increasing at satisfactory rate.

Government initiatives to fuel the expansion of oil & gas sector are also expected to positively impact the growth of global Enhanced oil recovery solution in near future. Further, ongoing exploration of new oil fields is also expected to foster the growth of market over the forecast period.

Increasing crude oil production across the globe and high dependency of world on oil energy is a key factor which is augmenting the growth of enhanced oil recovery market during the forecast period. The increasing global energy demand and rising oil prices are expected to drive the demand for enhanced oil recovery techniques in future years.

However, limited number of offshore oil fields is expected to limit the growth of enhanced oil recovery market in upcoming years.

Top Featured Companies Dominating The Market

- BP PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AUDUBON

- Nalco Company

- Praxair Technology, Inc.

- Royal Dutch Shell

- ExxonMobil Corporation,

- Lukoil Oil Company,

- Schlumberger Limited

- Halliburton

- Baker Hughes Incorporated

- Report ID: 591

- Published Date: Feb 13, 2023

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Enhanced Oil Recovery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert