Emollients Market Outlook:

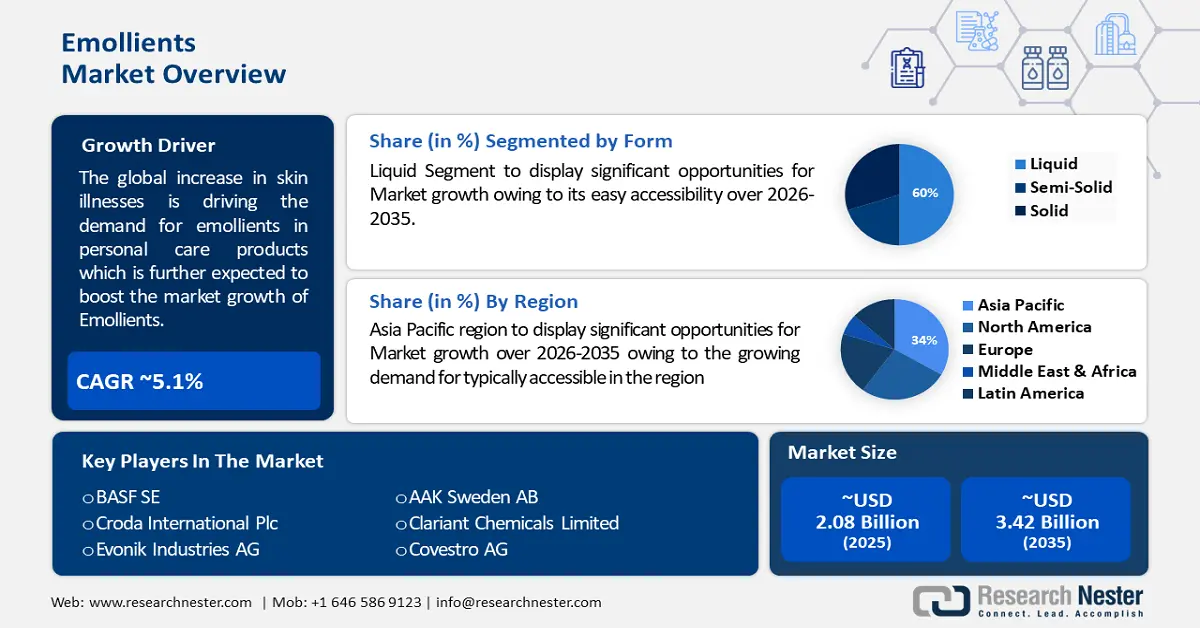

Emollients Market size was valued at USD 2.08 billion in 2025 and is set to exceed USD 3.42 billion by 2035, expanding at over 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of emollients is estimated at USD 2.18 billion.

The global increase in skin illnesses is driving the demand for emollients in personal care products. One in four Americans, or 84.5 million, suffered from a skin condition. The US health care system spent USD 75 billion on medical, preventative, prescription, and over-the-counter medicine costs related to skin condition.

In addition to this, new businesses can place a higher priority on using natural components in their emollient formulations by taking advantage of consumers' growing appreciation for sustainable and natural products. This approach can appeal to eco-conscious customers looking for skincare products with transparent and environmentally responsible sources, since it is in line with the clean beauty movement.

Key Emollients Market Insights Summary:

Regional Highlights:

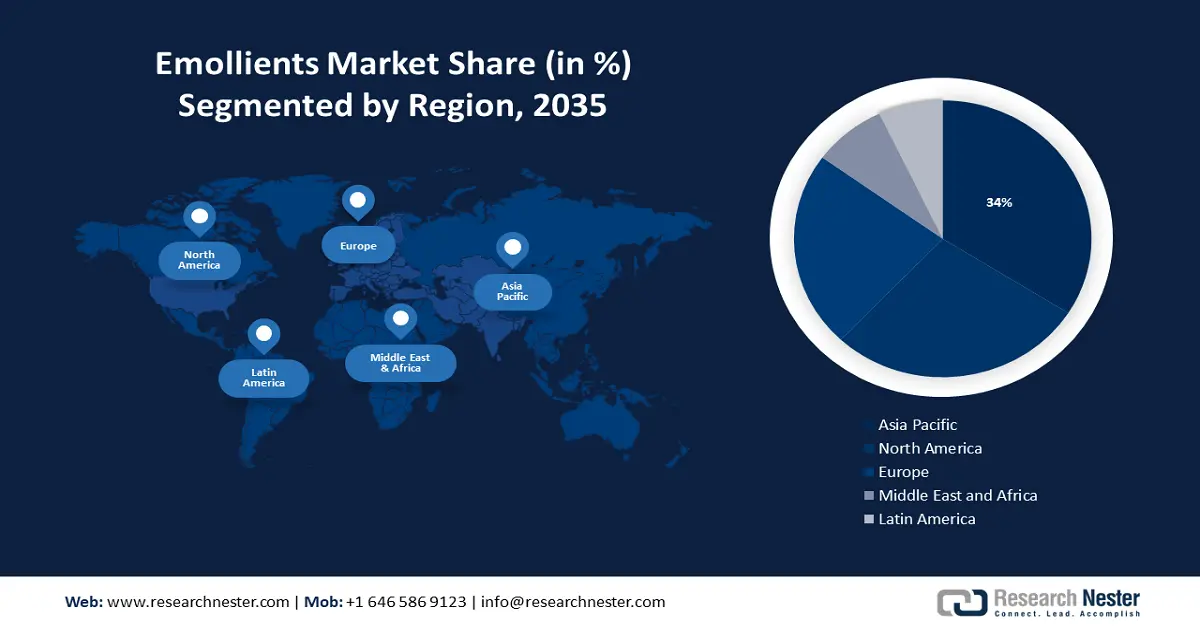

- The Asia Pacific emollients market is expected to capture 34% share by 2035, driven by growing demand for cosmetics, especially among young adults.

- The North America market will achieve a 28% share by 2035, attributed to increasing consumer emphasis on wellness and beauty.

Segment Insights:

- The liquid form segment in the emollients market is anticipated to secure a 50% share by 2035, influenced by widespread use of liquid emollients in personal care formulations such as creams and lotions.

- The botanical source segment in the emollients market is forecasted to see significant expansion by 2035, fueled by growing consumer demand for natural and organic skincare products.

Key Growth Trends:

- Research & Development Activities Producing Improved Emollient Products

- Growing Adoption of Emollients in Skincare Products Due to Customization Trend

Major Challenges:

- Research & Development Activities Producing Improved Emollient Products

- Growing Adoption of Emollients in Skincare Products Due to Customization Trend

Key Players: BASF SE, Croda International Plc, The Lubrizol Corporation, Evonik Industries AG, AAK Sweden AB, Oleon Health and Beauty, Clariant, Chemicals Limited, Eastman Chemical Company, Covestro AG, ABITEC Corporation, Nippon Zetoc Co., Ltd., Aretisme Co., Ltd., Hollywood Co., Ltd., Fukumitsuya Co., Ltd.

Global Emollients Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.08 billion

- 2026 Market Size: USD 2.18 billion

- Projected Market Size: USD 3.42 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 16 September, 2025

Emollients Market Growth Drivers and Challenges:

Growth Drivers

- Research & Development Activities Producing Improved Emollient Products- In the emollients market, ongoing R&D is focused on formulating products with improved qualities, demonstrating a dedication to satisfying changing customer needs and remaining at the forefront of skincare innovation. This research is mostly focused on improving the moisturizing qualities of emollients. Since hydration is essential for preserving the health of the skin, producers work hard to create emollients that provide rich, continuous moisturization. This element responds to the increasing knowledge among consumers of the value of hydrated skin and fits in with the broader movement to support skin that is both healthy and well-hydrated. The integration of anti-aging properties into emollient compositions is another goal of R&D projects. The need for skincare solutions that address age-related issues is rising as the world's population ages. Emollients possessing anti-aging characteristics are engineered to mitigate the visibility of wrinkles, fine lines, and other indications of age, thereby meeting the demands of customers in search of all-encompassing skin care remedies.

- Growing Adoption of Emollients in Skincare Products Due to Customization Trend- Customization in skincare products is becoming a popular trend in the emollients market. Customers are getting a more tailored and efficient skincare experience thanks to emollients that cater to the unique needs of various skin types. This strategy fits in with the industry's larger move to offer customized solutions to satisfy each skincare enthusiast's unique preferences. Researchers and formulators working together also include investigating novel substances and technologies that have the potential to improve emollient performance. This includes using organic and natural ingredients in response to the growing demand from consumers for sustainable and clean beauty products. The creation of emollients with sophisticated delivery methods is made possible by the integration of cutting-edge technology, assuring improved skin absorption and effectiveness.

- Compared to other emollient products, isopropyl myristate is in higher demand- It is an essential cosmetic ingredient that gives the skin a velvety feel, which is why many manufacturers of personal care products want it. One of the main uses is in bath oil compositions. These factors explain why isopropyl myristate is more in demand than other emollients market because of its advantageous qualities, which include low viscosity, active skin absorption, and oxidation inhibition.

Challenges

- Tough Competition from Substitutes and Alternatives- The expansion of the global emollient emollients market is being challenged by competition from alternative skincare ingredients and alternatives, with isopropyl myristate emerging as a prominent challenger. The adoption of emollients may be impacted by this competition as producers and consumers consider a variety of skincare formulation alternatives. Because isopropyl myristate can give the skin a velvety, smooth texture, it can be utilized in place of typical emollients in cosmetic and personal care products. It thus faces competition from traditional emollients in a range of skincare uses.

- Shortage of raw materials is anticipated to impede emollients market growth.

- The market for emollients is somewhat restricted by the strict regulations and compliance of many states and countries, since manufacturers and suppliers of chemical components are required to provide accurate data and evidence of their provenance.

Emollients Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 2.08 billion |

|

Forecast Year Market Size (2035) |

USD 3.42 billion |

|

Regional Scope |

|

Emollients Market Segmentation:

Form Segment Analysis

Based on form, liquid segment in the emollients market is anticipated to hold 50% of the revenue share during the forecast period. Liquid emollients are typically accessible. The majority of natural emollients are found in liquid form, including fatty acids, oils, and lipids. Furthermore, because they are used in liquid personal care formulations including creams, lotions, moisturizers, and shampoos, among others, synthetic emollients like butylene glycol and capric/caprylic triglyceride are also available in liquid form. 17.58 million Americans used body moisturizers, creams, or lotions at least 14 times in 2020, according to a survey.

Source Segment Analysis

Based on source, the botanical segment is anticipated to hold 40% share of the global emollients market by 2035. Emollients made from plant-based oils, butter, and botanical extracts are becoming more and more popular as a result of growing customer demand for natural and organic products. Natural emollients are in high demand as a result of consumers' increasing focus on health and wellness and their desire for skincare products with components they believe to be healthier. The value of the global industry for natural cosmetics and personal care would rise, from about USD 35 billion in 2021 to around USD 59 billion in 2031.

Application Segment Analysis

Based on application, skin care segment is anticipated to hold 30% share of the global emollients market by 2035. This is explained by customers using skin care products like lotions, creams, and moisturizers more frequently. Further propelling market expansion is the personal care industry's growing use of plant-based emollients. Many producers of personal care products are creating new items with plant-based oils to give customers efficient personal care options. OrgaGlo made its market debut in India in August 2022 with about eighteen of their newest products, which included plant-based components for skin and hair care.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Source |

|

|

Form |

|

|

Function |

|

|

Application |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Emollients Market Regional Analysis:

APAC Market Insights

Emollients market in Asia Pacific region is projected to hold largest revenue share of about 34% during the projected period. The growing demand for cosmetics is primarily driving the exponential growth of the worldwide emollients market in the Asia Pacific region. Particularly among the young adults and millennials residing in this area, there is a noteworthy surge in the need for personal hygiene goods. As a result, a large number of businesses have started to enter this profitable industry by creating a range of personal care products that are specially designed to meet the needs and preferences of this particular demographic. According to data from the Chinese National Bureau of Statistics, the per capita spending in China on home products rose to USD 3,781.2 in 2021, a small increase of 13.6% from the year before.

North American Market Insights

The emollients market in North America region is attributed to hold the largest revenue share of about 28% during the forecast period. The US's expanding need for cosmetics and personal hygiene goods is the reason for this growth. North America's share of the worldwide emollient market is increasing due to swift changes in consumer lifestyles and an increasing emphasis on wellness and beauty. Furthermore, consumers' changing shopping habits and growing awareness of wellness and beauty are driving the market's rise in North America. Furthermore, one reason contributing to the expansion of the worldwide emollients market is the rising consumer expenditure on skincare and anti-aging cosmeceuticals.

Emollients Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Croda International Plc

- The Lubrizol Corporation

- Evonik Industries AG

- AAK Sweden AB

- Oleon Health and Beauty

- Clariant Chemicals Limited

- Eastman Chemical Company

- Covestro AG

- ABITEC Corporation

- Nippon Zetoc Co., Ltd.

- Aretisme Co., Ltd.

- Hollywood Co., Ltd.

- Fukumitsuya Co., Ltd.

Recent Developments

- A collaboration agreement has been signed by BASF and RiKarbon Inc., a U.S.-based technology start-up, to license and market RiKarbon's unique technology exclusively. By enabling the upcycling of bio-waste into bio-based, biodegradable emollients for the global personal care market, RiKarbon's patented technology supports the industry's push for creative, sustainable solutions.

- Plantasens Pro LM is a revolutionary natural emollient that Clariant introduced in response to customers' growing awareness and interest in skincare products worldwide. This lotion makes the skin feel rich, luxurious, and pampered both during and after use. In addition to providing moisture for skin care, Plantasens Pro LM is made to work well with UV filters and pigments, meeting the growing need for skin that looks healthy. Because of these qualities, it's the best emollient option for providing skin advantages in a variety of sun care, color cosmetic application, and skin care applications. It presents formulators with an opportunity to develop sunscreen and makeup formulas that provide exceptional hydration and moisturizing.

- Report ID: 5946

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Emollients Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.