Embedded AI Market Outlook:

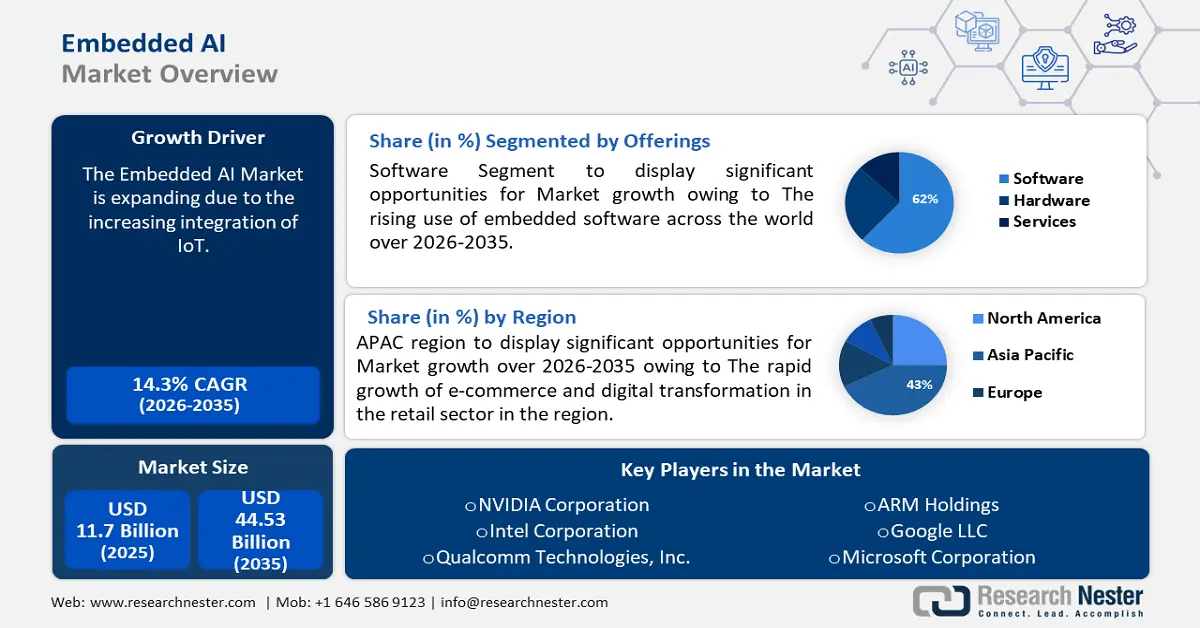

Embedded AI Market size was valued at USD 11.7 billion in 2025 and is expected to reach USD 44.53 billion by 2035, expanding at around 14.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of embedded AI is evaluated at USD 13.21 billion.

The primary reason behind this huge expansion of the embedded AI industry globally is the increasing integration of IoT, as it increases the intelligence and capabilities of IoT devices.

These devices can process and analyze data locally, allowing them to make decisions without relying on centralized cloud servers or a continuous internet connection. In smart homes, for example, IoT devices with AI capabilities, like thermostats, can expertly learn human preferences, optimize energy use, and fine-tune settings for enhanced comfort. A recent estimate based on an analysis of 41 million homes and 1.8 billion connected devices stated that the average American home currently has 21 linked gadgets. The average number of smart devices in a Japanese home is only 10, compared to 17 in Europe.

In addition, the recent concentration on data privacy and security across the world will drive the advancement of embedded AI by the end of the projected timeline. The gathering, utilizing, and disclosing of personal data to outside parties without the knowledge or approval of customers is equally concerning.

Out of 194 countries, 137 had legislation in place to ensure data security and privacy. With 61 and 57% of their countries having implemented such laws, Africa and Asia exhibit varying adoption rates. Just 48% of the share is found in the least developed nations. Embedded AI solves these problems by allowing encryption and on-device data processing.

Key Embedded AI Market Insights Summary:

Regional Highlights:

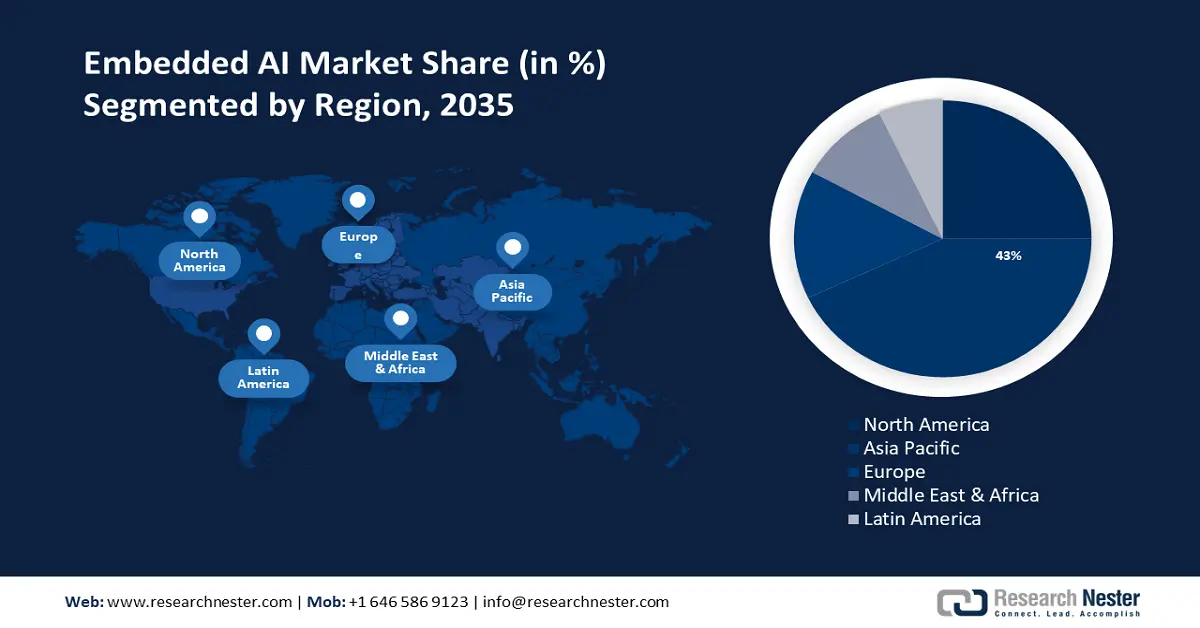

- Asia Pacific embedded ai market will secure over 43% share, driven by rapid e-commerce growth and digital transformation in retail, forecast period 2026–2035.

- North America market will hold the second largest share, fueled by the synergy between research institutions and tech companies, forecast period 2026–2035.

Segment Insights:

- The software segment in the embedded ai market is expected to hold a 62% share by 2035, driven by the widespread use of embedded software across various fields.

- The sensor data segment in the embedded ai market is projected to achieve a 45% share by 2035, attributed to the rising use of sensor data for personalized customer experiences.

Key Growth Trends:

- Rise in demand for energy-effective and powerful processors

- Rising demand for autonomous and smart systems to give customized experiences

Major Challenges:

- Data privacy and security can eat away at the reliability between users and embedded AI solutions.

- Algorithmic efficiency and model size can impede the embedded AI market expansion.

Key Players: NVIDIA Corporation, Intel Corporation, Qualcomm Technologies, Inc., ARM Holdings, Google LLC, Microsoft Corporation, IBM Corporation, MediaTek Inc., Texas Instruments Incorporated, Advanced Micro Devices, Inc.

Global Embedded AI Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.7 billion

- 2026 Market Size: USD 13.21 billion

- Projected Market Size: USD 44.53 billion by 2035

- Growth Forecasts: 14.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 16 September, 2025

Embedded AI Market Growth Drivers and Challenges:

Growth Drivers

- Rise in demand for energy-effective and powerful processors - The growing need for more powerful and energy-efficient processors that can run complex AI algorithms creates increasingly significant economic opportunities. AI algorithms are growing increasingly resource-intensive and complex.

As a result, the need for processors that can efficiently handle these demands is growing. The demand for more powerful processors, such as high-performance CPUs, GPUs, and specialized AI accelerators, presents opportunities for embedded AI solution providers to offer state-of-the-art technology. To capitalize on the growing market requirement and provide high-performance embedded AI solutions that meet customers' evolving expectations, suppliers should focus on developing sophisticated processors, edge computing capabilities, energy-efficient solutions, and partnerships. - Rising demand for autonomous and smart systems to give customized experiences - The increasing need for better technology that can offer customers personalized and flexible experiences will accelerate the embedded AI market uptake of these solutions. Because customized experiences are required, various embedded systems are incorporating AI capabilities.

By using these solutions, gadgets and applications can assess user data, inclinations, and activities to offer tailored advice, ideas, and responses. These solutions eventually improve customer satisfaction and promote market expansion by empowering devices and systems to understand user preferences, adjust to changing conditions, make informed decisions, and offer customized experiences. - Rising demand for high-speed data services in IT & ITES companies globally - For many businesses, big data is essential, and data engineering an architectural approach to information technology ties everything together. This field entails planning, constructing, and managing data warehouses where unprocessed data is converted into easily readable queries for analysts.

The embedded AI helps IT & ITES companies to work smoothly and efficiently with high-speed data services and effective data security processes.

Challenges

- Poor calculating power and model maximization - Embedded AI systems frequently operate on resource-constrained hardware with limited memory, processing power, and energy. Inadequate processing resources may limit the performance of AI systems, leading to longer inference times, lower accuracy, and a less satisfying user experience. When computational limitations make it impossible for AI models to run on embedded devices, adoption of these solutions is hindered since the models might not meet the performance requirements of the intended applications.

As the market continues to grow in these areas, overcoming these challenges will enable the deployment of more powerful and effective AI applications on resource-constrained devices and accelerate the acceptance of embedded AI solutions in several domains. - Data privacy and security can eat away at the reliability between users and embedded AI solutions.

- Algorithmic efficiency and model size can impede the embedded AI market expansion.

Embedded AI Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.3% |

|

Base Year Market Size (2025) |

USD 11.7 billion |

|

Forecast Year Market Size (2035) |

USD 44.53 billion |

|

Regional Scope |

|

Embedded AI Market Segmentation:

Offering Segment Analysis

In embedded AI market, software segment is likely to hold more than 62% share by 2035. The rising use of embedded software across the world will propel the software to grow magnificently during the forecast period. Moreover, worldwide almost 98% of manufactured microprocessors use embedded software.

Embedded systems are employed in many different fields nowadays. Hospital CT and MRI machines, transportation management systems, industrial robots, and interactive kiosks are just a few examples of how embedded systems have transformed automation and human-machine interaction.

Data Type Segment Analysis

In embedded AI market, sensor data segment is predicted to account for around 45% revenue share by 2035. This huge expansion will be the result of the rising use of sensor data in the embedded AI to give personalized experiences to customers. To illustrate, fitness trackers collect data on heart rate, sleep patterns, and activity levels to offer personalized wellness and health recommendations.

The market development in this area is significantly influenced by the numerous benefits that come with integrating sensor data with embedded AI. These benefits range from improved safety and tailored experiences to higher operational efficiency and cost savings.

Recently smart wearable devices consist of sensor data that have been on the rise globally. According to Strategy Analytics, worldwide shipments of smartwatches increased by 47% yearly in the second quarter of 2021, marking the greatest growth rate for the sector since 2018.

Our in-depth analysis of the global embedded AI market includes the following segments:

|

Offering |

|

|

End User |

|

|

Data Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Embedded AI Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to hold largest revenue share of 43% by 2035. The rapid growth of e-commerce and digital transformation in the retail sector is a significant driver for embedded AI in the Asia-Pacific region. Embedded AI technologies contribute to personalized recommendations, supply chain optimization, and fraud detection in e-commerce platforms.

The Asia-Pacific e-commerce sales are assessed to reach USD 3.5 trillion by 2025. The emphasis on smart cities and urban development initiatives is a key growth driver for embedded AI in the Asia-Pacific region. As countries invest in building sustainable and technologically advanced cities, embedded AI technologies contribute to intelligent infrastructure, efficient energy management, and enhanced public services.

North American Market Insights

The embedded AI market in the North America region is foreseen to hold the second-largest share between 2023 and 2035. In North America, a thriving ecosystem of research institutions, universities, and technology companies collaborates to push the boundaries of AI capabilities. The synergy between academic research and private-sector innovation creates an environment conducive to the growth of embedded AI.

This commitment to R&D positions North America as a frontrunner in driving advancements in embedded AI technologies. North America, particularly the United States, has been at the forefront of adopting artificial intelligence across various industries. The high adoption rate signifies the region's willingness to integrate AI technologies into business operations. This widespread acceptance creates a fertile ground for the growth of embedded AI, as organizations seek to leverage the benefits of AI in enhancing efficiency, decision-making, and customer experiences. The pioneering role of North America in AI adoption extends to the development and implementation of embedded AI applications, from intelligent automation in manufacturing to AI-driven analytics in healthcare.

Embedded AI Market Players:

- NVIDIA Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Intel Corporation

- Qualcomm Technologies, Inc.

- ARM Holdings

- Google LLC

- Microsoft Corporation

- IBM Corporation

- MediaTek Inc.

- Texas Instruments Incorporated

- Advanced Micro Devices, Inc.

Recent Developments

- Intel Corporation acquired Tower Semiconductor. This major acquisition, expected to close in 2024, aims to strengthen Intel's foundry business and diversify its manufacturing capabilities.

- Qualcomm Technologies, Inc. recently extended the leading Snapdragon X Series platform portfolio with Snapdragon® X Plus. This space will provide outstanding execution, long battery life, and industry-leading on-device AI capacities.

- Report ID: 5715

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Embedded AI Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.