Electronic Security Market Outlook:

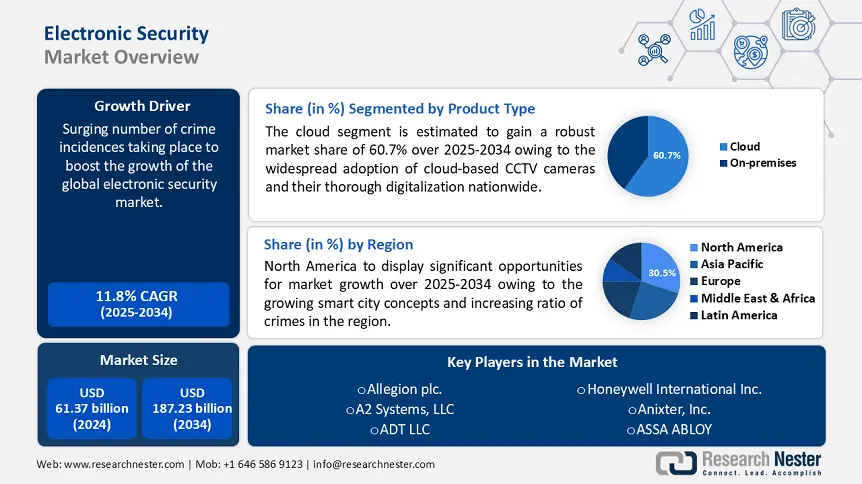

Electronic Security Market size was over USD 61.37 billion in 2024 and is anticipated to cross USD 187.23 billion by 2034, growing at more than 11.8% CAGR during the forecast period i.e., between 2025-2034. In the year 2025, the industry size of electronic security is assessed at USD 67.53 billion.

The market growth is attributed to massively increasing ratio of crime incidences such as robbery, and theft across the globe. For instance, until mid of 2022, the ratio of violent crime in United States has boosted to approximately 48.50 per 100,000 inhabitants.

Electronic security encompasses all systems that use electronic devices and integrated technology to boost safety and protect human life and physical assets. It consists surveillance, access control, intrusion detection, alarm and other security channels. Such systems comprise of alarms, access controls and CCTVs (closed circuit televisions), which are prominently and broadly utilized. The electronic security provides users with invaluable video surveillance benefits. Video surveillance helps to oversee entry points in the home or business.

The mounting adoption of electronic security systems by government agencies, and manufacturing industries is the significant factor to boost the electronic security market revenue. For instance, by 2022, around 44% of police agencies are anticipated to use digital tools to improve public security and an alternate solution framework, such as live video streaming and shared workflows.

Key Electronic Security Market Insights Summary:

The North American market is projected to hold the largest share of the electronic security market by 2034.

The video surveillance systems segment is anticipated to lead the electronic security market share throughout the forecast period.

Key Growth Trends:

- Increasing Awareness for Safety and Security

- Upsurge in Larceny Theft Incidences

Key Players:

- ASSA ABLOY, Honeywell International Inc., A2 Systems, LLC., Axis Communications AB, ADT LLC,ALL-TAG Corporation, Anixter, Inc., Hangzhou Hikvision Digital Technology Co., Ltd., Hanwha TechwinCo., Ltd., Allegion plc.

Global Electronic Security Market Forecast and Regional Outlook:

- 2024 Market Size: USD 61.37 billion

- 2025 Market Size: USD 67.53 billion

- Projected Market Size: USD 187.23 billion by 2034

- Growth Forecasts: 11.8% CAGR (2025-2034)

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

Last updated on : 13 June, 2025

Electronic Security Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Awareness for Safety and Security – Since the crime and theft cases are increasing day by day, thus installing security systems gives enterprises and residential inhabitants a feeling of safety and security. As a result, there has been a significant increase in the adoption of such electronic security components which is driven by the growing awareness for safety and security among the people. For instance, around 773 million security cameras were installed globally by the end of 2019.

- Upsurge in Larceny Theft Incidences – According to the Federal Bureau of Investigation, an estimated 5,086,096 larcenies - thefts were reported in the United States in 2019.

- Emerging Terrorist Attacks – For instance, with a startling 50% of all terrorism-related deaths worldwide, Sub-Saharan Africa has been emerging as the world's center stage of terrorism.

- Escalating Urbanization - As per the World Economic Forum, 80% of the world's population, up from the present 55%, is estimated to inhabit in urban areas by 2050.

- Growing Wi-Fi Penetration - Presently, around 5.35 billion people worldwide have internet connectivity.

Challenges

- High Cost Associated with the Electronic Security Systems

- Lack of Awareness Among Consumers Regarding the Security Products

- Deficit of Technical Knowledge to Use Electronic Security Systems

Electronic Security Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

11.8% |

|

Base Year Market Size (2024) |

USD 61.37 billion |

|

Forecast Year Market Size (2034) |

USD 187.23 billion |

|

Regional Scope |

|

Electronic Security Market Segmentation:

Product Type Segment Analysis

The video surveillance systems segment is expected to dominate majority of electronic security market share during the forecast period, owing to growing count of crime cases around the world, and growing adoption of surveillance systems. For instance, until 2019, there were an estimated 780 million surveillance cameras installed around the world, with China accounting for 56% of those cameras.

Our in-depth analysis of the global electronic security market includes the following segments:

|

By Product Type |

|

|

By Deployment Mode |

|

|

By Connectivity |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electronic Security Market Regional Insights:

The market in North America is anticipated to account for majority electronic security market share by the end of 2034, propelled by increasing crime ratio, surge in smart city concept, and constantly rising number of retail stores and facilities in the region. For instance, in 2020, there were nearly 1.10 million retail outlets in the United States.

Key Electronic Security Market Players:

- ASSA ABLOY

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.

- A2 Systems, LLC.

- Axis Communications AB

- ADT LLC

- ALL-TAG Corporation

- Anixter, Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Hanwha TechwinCo., Ltd.

- Allegion plc.

Recent Developments

- ASSA ABLOY acquired Bird Home Automation GmbH ("DoorBird"), a German manufacturer of indoor station and smartphone-controlled IP door intercoms for single and multi-family buildings.

- Axis Communications AB announced the AXIS A12 Network Door Controller Series, which offers several product versions to meet various requirements. The AXIS A12 door controller offers fast and easy wall installation with a keyhole mounting plate and DIN rail mount support.

- Report ID: 344

- Published Date: Jun 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electronic Security Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.