Muscle Stimulator Market Outlook:

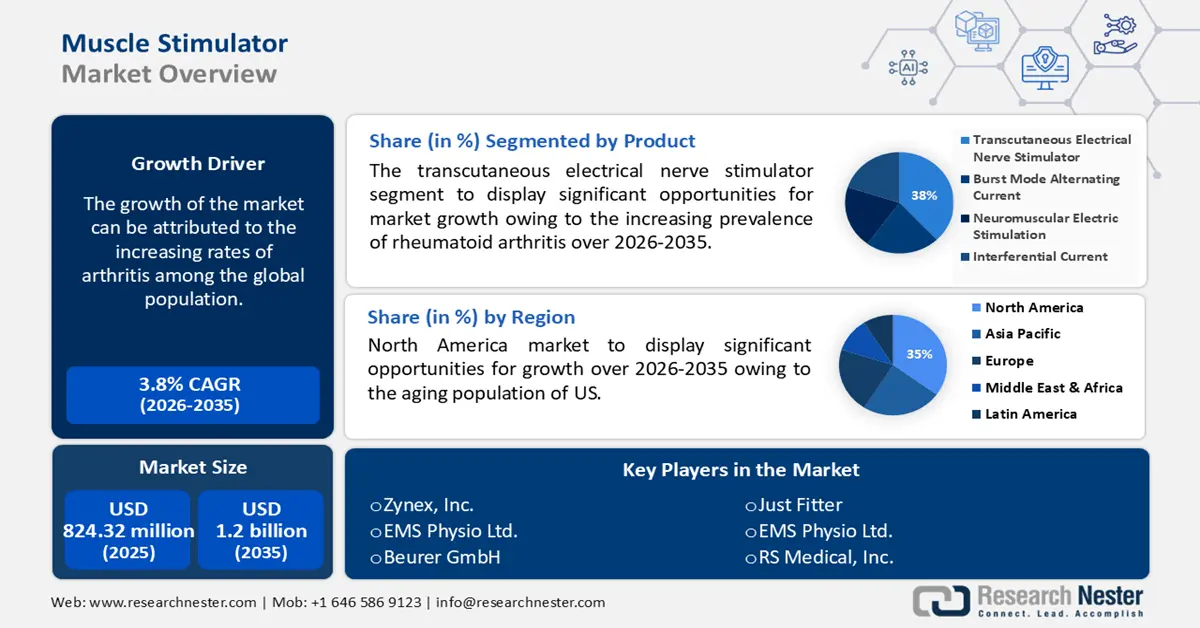

Muscle Stimulator Market size was over USD 824.32 million in 2025 and is anticipated to cross USD 1.2 billion by 2035, witnessing more than 3.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of muscle stimulator is estimated at USD 852.51 million.

The market growth is led by increasing rates of arthritis among the global population. In recent years, individuals have become increasingly sedentary, which increases the chance of developing arthritis. Adult impairment is most commonly caused by arthritis. For instance, arthritis can cause persistent discomfort, making it difficult to carry out everyday tasks. Electric muscle stimulators are employed to treat rheumatoid arthritis's chronic discomfort, retrain muscles, and build up the muscles that support their weaker joints. Hence, with the rising cases of arthritis is expected to increase the utilization rate of muscle stimulator and aid in the expansion of the global market. As per estimates, arthritis affects more than 300 million individuals worldwide.

In addition, the market revenue is propelled by rising adoption of muscle stimulator by physiotherapists. In order to treat pain and muscle spasms, electrical stimulation is utilized by physical therapists. Further, as muscle stimulators are speedier and more effective than manual methods, they are becoming more and more used among physiotherapists as a therapy option for patients in clinical and home care settings. For instance, muscle stimulator enables the physiotherapist to treat and prevent a variety of patient diseases and injuries.

Key Muscle Stimulator Market Insights Summary:

Regional Highlights:

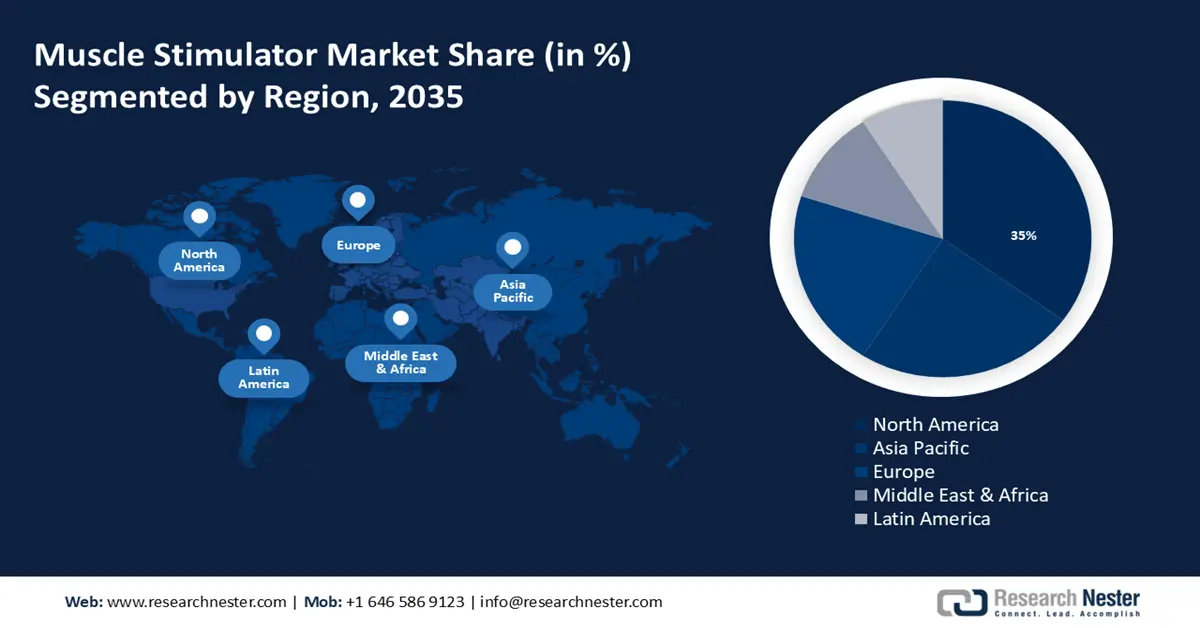

- North America muscle stimulator market is poised to capture 35% share by 2035, driven by the growing aging population and increasing prevalence of musculoskeletal diseases in the US.

- Asia Pacific market will secure 24% share by 2035, driven by the rising awareness and demand for electric muscle stimulators in health and fitness applications.

Segment Insights:

- The pain management segment in the muscle stimulator market is anticipated to capture a 46% share by 2035, attributed to the rising use of muscle stimulators for acute and chronic pain management.

- The transcutaneous electrical nerve stimulator segment in the muscle stimulator market is anticipated to achieve a 38% share by 2035, driven by the increasing prevalence of rheumatoid arthritis.

Key Growth Trends:

- Increasing Cases of Musculoskeletal Conditions

- Growing Rate of Sports Injuries

Major Challenges:

- Exorbitant cost of muscle stimulator devices

- Absence of regulations regarding the use of muscle stimulators

Key Players: Boston Scientific Corporation, NeuroMetrix, Inc., OMRON Corporation, BioMedical Life Systems Inc., Zynex, Inc., EMS Physio Ltd., Beurer GmbH, Just Fitter, EMS Physio Ltd., RS Medical, Inc.

Global Muscle Stimulator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 824.32 million

- 2026 Market Size: USD 852.51 million

- Projected Market Size: USD 1.2 billion by 2035

- Growth Forecasts: 3.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 8 September, 2025

Muscle Stimulator Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Cases of Musculoskeletal Conditions – On account of the increasing population and ageing, the number of persons with musculoskeletal diseases and related functional restrictions is constantly rising. Further, it's possible for older persons to lack the motivation or ability to engage in physical activity appropriately, therefore, the needs of older persons are best served by muscle stimulators. In 2019, there were more than 700 million people worldwide who were 65 or older.

-

Growing Rate of Sports Injuries – Sports-related injuries have become more common over the past several years, mostly as a consequence of increased engagement in athletics. As orthopedic power tools such as electric muscle stimulator disables the pain receptors in the nerves around the injury, which stops the nerves from communicating pain to the brain. Electrical stimulation might thereby lessen the discomfort from the damage. In the US, around 20 million children & teens play sports annually, and there have been more than 3 million reported sports-related injuries.

- Surging Demand for Fitness Products – The demand for sports equipments has risen as a result of an increase in the number of individuals participating in physical activities including biking, running, swimming, and others. Further, electrical stimulation is employed on pain-causing sports-related injuries, which have become more prevalent, as a result of increased participation in fitness-related activities. According to statistics, Australians spend more than USD 8 Billion annually, on exercise services and gear.

- Increasing Popularity of Sports – Owing to rising outdoor sport participation, whole-body electrical stimulation (ES) has gained popularity as a substitute for conventional exercise in order to improve fitness and health in healthy persons. As per estimates, more than 90% of Americans participated in sports and exercise every day in 2019.

Challenges

-

Exorbitant cost of muscle stimulator devices - Customers are being encouraged to choose less expensive alternative therapies such as yoga, acupuncture, and aromatherapy owing to the high expense of muscle stimulators. For instance, acupuncture has been utilized as an alternative type of medicine, mostly for the treatment of pain.

-

Absence of regulations regarding the use of muscle stimulators

- Acceptance of alternative therapies by patients

Muscle Stimulator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.8% |

|

Base Year Market Size (2025) |

USD 824.32 million |

|

Forecast Year Market Size (2035) |

USD 1.2 billion |

|

Regional Scope |

|

Muscle Stimulator Market Segmentation:

Product Segment Analysis

The transcutaneous electrical nerve stimulator segment is predicted to dominate about 38% market share by 2035. The segment growth can be attributed to increasing prevalence of rheumatoid arthritis. A chronic, systemic, inflammatory condition known as rheumatoid arthritis (RA) primarily affects the synovial membranes of many bodily joints, most likely caused by a mix of genetic predisposition, numerous environmental circumstances, and a person's lifestyle. Inflammatory arthritis, such as rheumatoid arthritis, may also be treated using transcutaneous electrical nerve stimulator (TENS). As part of an arthritis self-management plan, it is affordable, safe, and simple to use. Further, the discomfort associated with rheumatoid arthritis is frequently managed by transcutaneous electrical nerve stimulation. According to estimates, rheumatoid arthritis affects approximately 1% of people globally.

Application Segment Analysis

The pain management segment is expected to garner around 46% market share by 2035. Aches in the muscles are a common occurrence in all ages and occupations, which can result from a known injury, illness, or a medical procedure. Additionally, acute pain may result from injuries such as cuts, burns, muscle strains, and others, whereas chronic pain can be caused by disease such as arthritis or cancer. Further, muscle stimulators are being used more often to treat both acute and long-term pain. For instance, transcutaneous electrical nerve stimulation (TENS) is a low-cost nonpharmacological therapy for acute and chronic pain disorders. TENS units send electrical impulses that block pain by resembling the nervous system's pain signals.

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By Product |

|

|

By End User |

|

|

By Modality |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Muscle Stimulator Market Regional Analysis:

North American Market Insights

North America industry share is poised to cross 35% by 2035, owing to growing aging population of US, musculoskeletal diseases are becoming a greater burden every year. Elderly people are more prone to musculoskeletal diseases and injuries. The most common musculoskeletal problems prevalent in the area are osteoporosis, which increases the risk of fractures, back and neck discomfort, injuries from sports, arthritis and other activities. The quality of life, activity level, and productivity can all be negatively impacted by musculoskeletal disorders that affect the bones, joints, and muscles.

Further, many excruciating musculoskeletal illnesses are treated by electrical muscle stimulation. For instance, individuals with musculoskeletal disorders may benefit from using percutaneous electrical nerve stimulation (PENS) as a rehabilitation strategy to reduce mixed chronic pain in patients with musculoskeletal disorders. According to data, musculoskeletal ailment affects more than 120 million Americans.

APAC Market Insights

The Asia Pacific Muscle Stimulator Market is estimated to account for 24% share by the end of 2035. The market growth is propelled by growing understanding of electric muscle stimulator in the region. For instance, rising concern for health and fitness in the area has surged the demand for electric muscle stimulator. EMS training uses a spectrum of electric currents to trigger muscular contractions.

Moreover, active exercise can be substituted by electrical muscle stimulation (EMS), which doesn't require patient involvement. By raising the demand for oxygen, electrical stimulation of unloaded muscles induces cardiovascular activity. Further, electrical stimulation training has been found to increase muscular strength and endurance. For instance, Ab stimulators, which is a kind of muscle stimulator uses electricity to provide the appearance of tighter, more toned abdominal muscles. Recently, in India, several gyms are using EMS equipment, as it is practical, safe, and non-intrusive.

Europe Market Insights

The orthopedic prosthetic devices market in the European region is predicted to register moderate growth till 2035. The increasing number of the population suffering from lifestyle disorders coupled with the presence of the highly developed machines and devices will fuel the market growth. The rising industrial development in the region leads to the development of the enhanced healthcare infrastructure coupled with stringent government policies regarding the healthcare is anticipated to drive the market size in the region.

Muscle Stimulator Market Players:

- Boston Scientific Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NeuroMetrix, Inc.

- OMRON Corporation

- BioMedical Life Systems Inc.

- Zynex, Inc.

- EMS Physio Ltd.

- Beurer GmbH

- Just Fitter

- EMS Physio Ltd.

- RS Medical, Inc.

Recent Developments

- Omron Healthcare, Inc. introduced the release of an nerve stimulator (model HV-F013), to provide drug-free pain relief. Further, owing to its suitability for treating nearly all types of pain, including nerve, muscle, and joint pain, patients will feel better and need opioids less frequently.

- Boston Scientific Corporation introduced the Wave Writer Alpha spinal cord stimulator systems, which are backed by Cognita Solutions, to address common pain management issues like raising awareness of drug-free pain management options, and helping patients locate nearby doctors.

- Report ID: 3225

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Muscle Stimulator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.