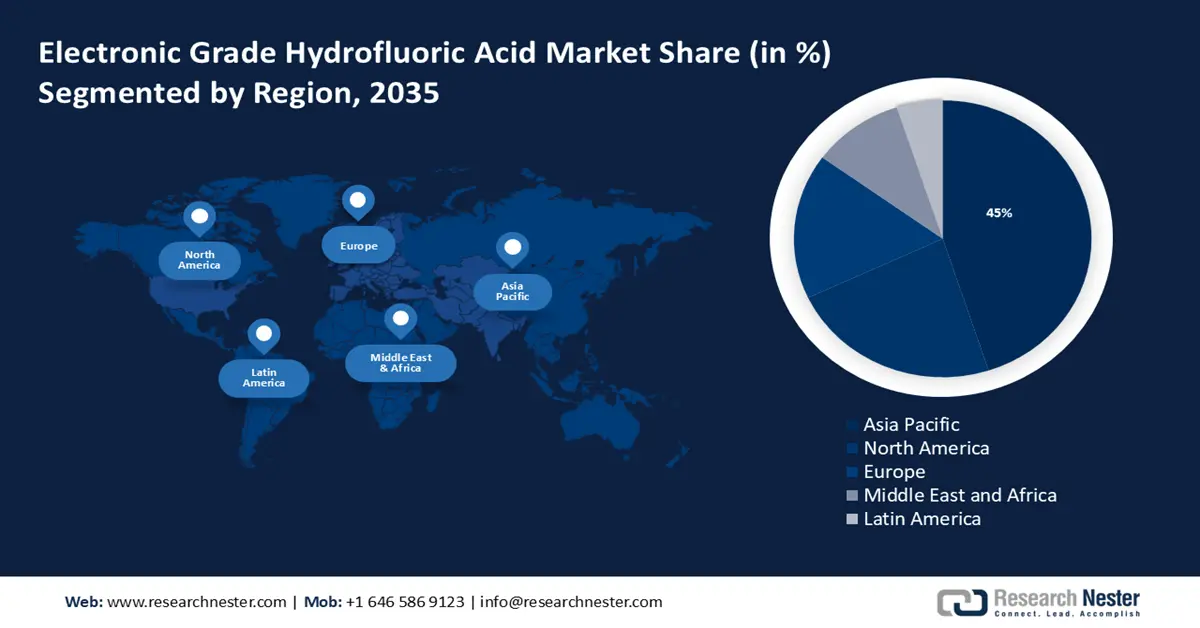

Electronic Grade Hydrofluoric Acid Market Regional Analysis:

APAC Market Insights

Electronic grade hydrofluoric acid market in Asia Pacific industry is expected to dominate majority revenue share of 45% by 2035 impelled by the growing production of fluorspar, and sulfuric acid. With a plethora of Mesozoic igneous rocks and significant reserves of fluorspar, China is by far the world's leading producer of fluorspar from mines. For instance, China continues to be the world's largest producer of fluorspar, producing around 5 million tonnes, or over 55% of the entire volume. Particularly, in 2022, China accounted for a significant global fluorspar mining production, with over 5 million metric tons produced. In addition, China generated more than 90 million metric tons of sulfuric acid in 2022.

Japan is pursuing several cooperative efforts with the U.S. to enhance semiconductor supply chain resilience, including the National Semiconductor Technology Center (NSTC), U.S.-Japan Commercial and Industrial Partnership (JUCIP), Japan’s Leading-Edge Semiconductor Technology Center (LSTC), and the U.S.-Japan University Partnership for Workforce Advancement and Research & Development in Semiconductors (UPWARDS) initiative. Furthermore, Japan has established itself as a major technological and industrial hub in the world map and has emerged as a key contributor of fluorspar to other countries.

North America Market Insights

The North America electronic grade hydrofluoric acid market is estimated to be the second largest regional segment by 2035. In May 2023, the U.S. and Canada established the first North America Semiconductor Conference to strengthen the region’s semiconductor supply chain, comprising workforce and critical minerals. In subsequent dialogues, the governments are committed to collaborating with academic institutions and the private sector to develop policies that will progress regional competitiveness in manufacturing of electronic-grade hydrofluoric acid and semiconductors.

The U.S. electronic grade hydrofluoric acid market is set to experience steep growth owing to supportive government reforms in semiconductor production under the CHIPS and Science Act. These projects include a total investment of USD 350 billion and are anticipated to create 118,000 new employment opportunities, comprising 78,000 construction jobs and 38,000 manufacturing jobs. Furthermore, the Departments of Commerce and Defense is anticipated to receive R&D funding of USD 13 billion as part of the CHIPS Act to boost semiconductor production. U.S. fab capacity is projected to surge by 203% by the end of 2023, thereby tripling U.S. capacity. The U.S. plans to over one-quarter (28%) of the worldwide capex between 2024-2032, an amount estimated at USD 646 billion. In the absence of the CHIPS Act, the U.S. would have captured only 9% of global capex by 2032.