Electric Vehicle Polymers Market Outlook:

Electric Vehicle Polymers Market size was valued at USD 34.18 billion in 2025 and is set to exceed USD 1.49 trillion by 2035, registering over 45.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electric vehicle polymers is estimated at USD 48.3 billion.

The growth of the market can be attributed to the increasing demand for electric vehicles. Further, as customer preference for battery-powered, lightweight cars changes, consumer demand for EVs has increased dramatically over the past several years across the globe are also expected to add to the market growth. Performance polymers are necessary for the overall design and attractiveness of electric automobiles, they are also employed to make them lighter. As of 2026, demand for plug-in EVs for passengers is anticipated to increase by more than 120% to approximately 20 million vehicles globally.

In addition to these, factors that are believed to fuel the market growth of electric vehicle polymers include increasing government regulations. For instance, in recent years, more governments have focused on growing their nations' electric vehicle (EV) sectors. The adoption of electric cars has increased as a result of favorable government rules. To reduce the cost of electric cars, the government provides a variety of financial incentives. Further, to encourage the policy-driven adoption of plug-in electric cars, government incentives for them have been introduced all over the world.

Key Electric Vehicle Polymers Market Insights Summary:

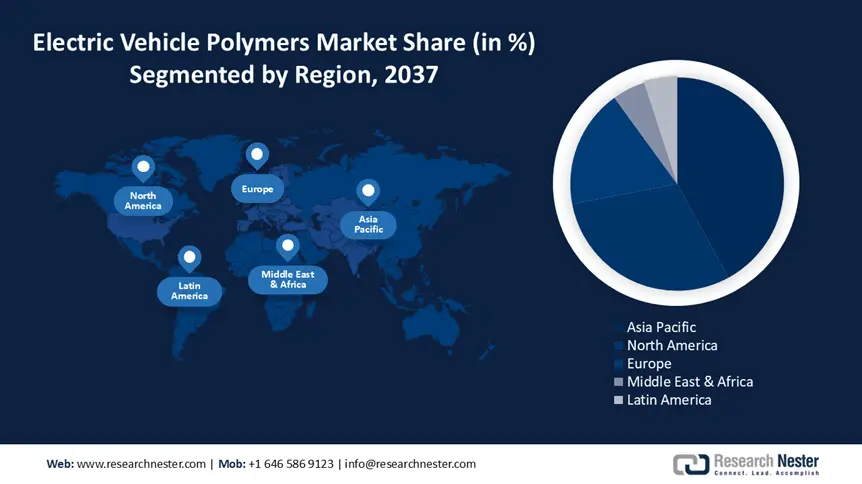

Regional Highlights:

- Asia Pacific electric vehicle polymers market will dominate over 45.5% share by 2035, driven by rising air pollution, government EV adoption policies, and increased hybrid/electric car production in the region.

- North America market will achieve the highest CAGR during 2026-2035, driven by growing electric vehicle adoption, increased polymer use, and enhanced EV charging infrastructure supported by government regulations.

Segment Insights:

- The engineering plastics segment in the electric vehicle polymers market is anticipated to achieve a substantial share by 2035, driven by the replacement of metals to improve fuel economy and reduce weight.

- The engineering plastics segment in the electric vehicle polymers market is projected to capture a substantial share by 2035, driven by the replacement of metals in vehicles to improve fuel economy and reduce weight.

Key Growth Trends:

- Growing Demand for Charging Infrastructure

- Rising Usage of Polymers

Major Challenges:

- Exorbitant Cost of Polymers

- Varying Prices of Raw Materials

Key Players: BASF SE, Evonik Industries AG, Asahi Kasei Corporation, LG Chem Ltd., Lanxess AG, Celanese Corporation, Solvay S.A., Covestro AG, DuPont de Nemours, Inc., Saudi Basic Industries Corporation.

Global Electric Vehicle Polymers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 34.18 billion

- 2026 Market Size: USD 48.3 billion

- Projected Market Size: USD 1.49 trillion by 2035

- Growth Forecasts: 45.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Electric Vehicle Polymers Market Growth Drivers and Challenges:

Growth Drivers

- Growing Demand for Charging Infrastructure – On account of the increasing adoption of electric vehicles, the market is expected to expand more in the upcoming years. According to recent estimates, India would need more than 60,000 electric vehicle charging stations by 2032.

- Rising Usage of Polymers – Owing to their great performance, affordability, and lightweight, polymers are frequently utilized to replace items made of metal and mineral-based materials. Further, to minimize the total weight of electric automobiles, the majority of manufacturers employ polymers in place of metals. India had an average increase in polymer consumption of approximately 190% between 2019 and 2020.

- Surging Environmental Awareness – On account of the increasing air pollution, the market is expected to expand more in the upcoming years. Using fossil fuels for transportation emits carbon dioxide (CO2) into the atmosphere which is bad for both human and environmental health. Further, hybrid and electric vehicle (EV) production leads to less noise pollution, better air quality, and fuel savings. According to the most recent data, the growing environmental concern of the vast majority of people globally has increased by over 70% in 2019.

- Increasing Manufacturing of Electric Cars – It is expected that increasing sales of electric cars are anticipated to drive market growth. It was discovered that 0ver 50% of electric automobiles were sold globally in 2022.

Challenges

- Exorbitant Cost of Polymers - As compared to ordinary thermoplastics, high-performance polymers are frequently more costly, which is one of the major factors predicted to slow down the market growth. For instance, the increasing demand for insulating materials is being made by increased voltages in electric cars. Further, high-performance polymers such as PEEK are being utilized for this purpose more frequently.

- Varying Prices of Raw Materials

- Slow Innovation Rate in EV Manufacturing

Electric Vehicle Polymers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

45.9% |

|

Base Year Market Size (2025) |

USD 34.18 billion |

|

Forecast Year Market Size (2035) |

USD 1.49 trillion |

|

Regional Scope |

|

Electric Vehicle Polymers Market Segmentation:

Type Segment Analysis

The engineering plastics segment in electric vehicle polymers market is poised to account for substantial revenue share by 2035, attributed to the growing automotive and transportation industry across the globe. Owing to their superior mechanical strength, high temperature, and abrasion engineering plastics are quickly replacing metals in the automobile sector. In addition to lowering weight, they improve fuel economy in automobiles. Further, engineering plastics are in greater demand owing to the fact that they are employed in a variety of transportation-related items, including mechanical components, engines, and fuel systems. As of 2021, worldwide motor vehicle manufacturing climbed by over 2%.

Application Segment Analysis

The interior segment is expected to garner a significant share by 2035. Electric vehicles have started a new trend in automotive interiors since they aren't constrained by a heavy internal combustion engine or fuel tank. The creation of a wide array of electric vehicles with cutting-edge features and improvements is also projected to increase demand for polymers. For instance, modern electric car interiors are made of polymers rather than metal, which helps lighten the total weight of these cars. Owing to the polymer's durability, visual appeal, and ability to muffle noise, vibration, and harshness, it has become the ideal material for car interior elements.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Component |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Vehicle Polymers Market Regional Analysis:

APAC Market Insights

Asia Pacific region is expected to account for more than 45.5% market share by 2035, due to increasing air pollution in the region. A growing awareness of the need to reduce carbon footprints has prompted more individuals to shift to electric automobiles. For instance, the Indian government has put in place a number of strategic programs to reduce pollution across the country. India has ambitions to switch entirely to EVs in the next years, taking into account both its huge population and high levels of air pollution. The need for polymers in electric vehicles will rise as a result. Moreover, the growth in the production of hybrid and electric cars is also anticipated to contribute to the market growth. The rising costs of conventional gasoline, are also anticipated to boost the market growth. According to estimates, over 2 million premature deaths occur each year in the Asia Pacific area as a result of air pollution.

North American Market Insights

The North American electric vehicle polymers market is projected to grow with the highest CAGR during the forecast period, attributed majorly to the growing use of electric vehicles. For instance, the boom in the usage of polymers in electric cars in the United States is mostly owing to an increase in the adoption and sales of these vehicles. Further, the stringent government regulations to encourage the usage of electric vehicles and government plans to improve the EV charging infrastructure over the next years is anticipated to boost the market growth.

Europe Market Insights

Europe region is anticipated to register substantial growth through 2035, attributed majorly to the increasing government regulations for the adoption of electric vehicles. For instance, the government of the region is encouraging the owners of diesel vehicles to transition to plug-in electric vehicles, by offering subsidies to them. In addition, some automakers in the area are heavily investing in increasing their facilities for manufacturing, which is also anticipated to boost market growth.

Electric Vehicle Polymers Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik Industries AG

- Asahi Kasei Corporation

- LG Chem Ltd.

- Lanxess AG

- Celanese Corporation

- Solvay S.A.

- Covestro AG

- DuPont de Nemours, Inc.

- Saudi Basic Industries Corporation

Recent Developments

-

BASF SE teamed up with Shanshan to serve the worldwide consumer electronics and energy storage markets. The joint venture is expected to largely concentrate on the fast-expanding electric vehicle (EV) industry.

-

Saudi Basic Industries Corporation introduced thermoplastic solutions for essential EV battery technologies, to aid the sector in enhancing the performance of electric cars (EVs). Further, the company has developed a plastic-intensive EV battery pack concept, to fulfill the crucial industrial demands for flexible design, superior performance, increased safety, and better economics.

- Report ID: 3737

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Vehicle Polymers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.