Electric Vehicle Battery Recycling Market Outlook:

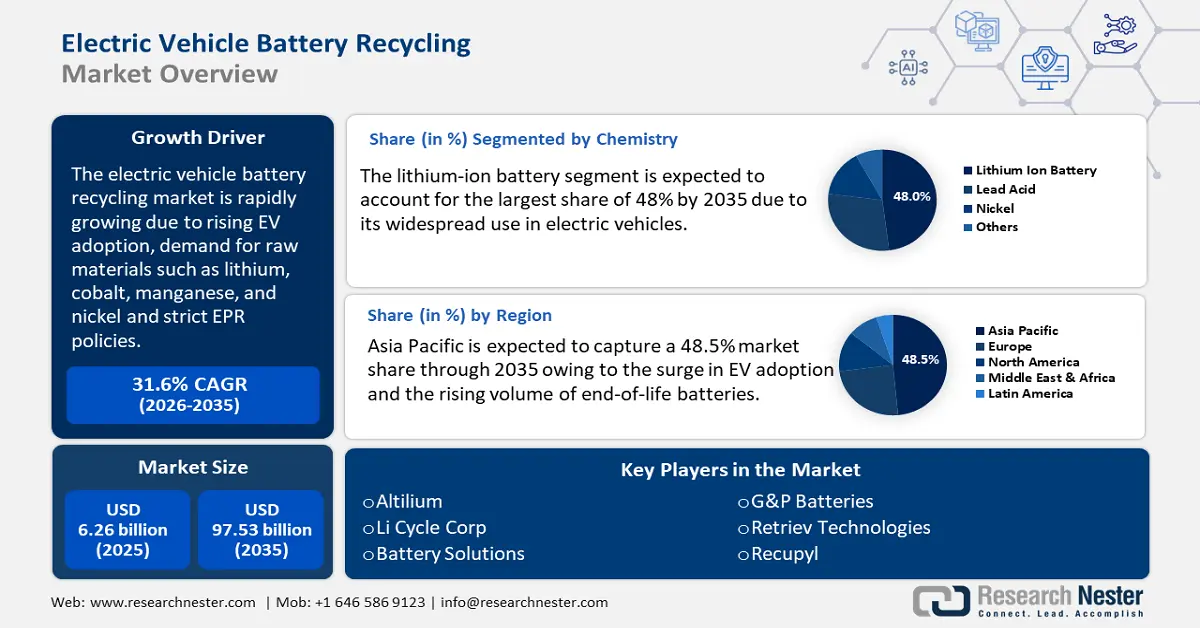

Electric Vehicle Battery Recycling Market size was over USD 6.26 billion in 2025 and is projected to reach USD 97.53 billion by 2035, growing at around 31.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electric vehicle battery recycling is assessed at USD 8.04 billion.

The electric vehicle battery recycling is gaining importance due to the rapid adoption of EVs and the increasing demand for raw materials such as lithium, cobalt, manganese, and nickel. As governments worldwide push for stricter environmental regulations and automakers commit to greener supply chains, recycled lithium-ion batteries have become a necessity. The recycling process not only helps mitigate the environmental impact of battery disposal but also reduces reliance on virgin mining, which is associated with high costs and geopolitical risks. By recovering valuable materials, battery recycling supports a circular economy, ensuring a more sustainable and cost-effective supply of essential components for future EV production.

In addition, as the lifetime of a lithium-ion battery is between 5 and 20 years, it can naturally outgrow the EV it was built for, thus creating the need for repurposing and recycling. In response to these challenges, the United States Department of Energy announced a USD 70.8 million investment in 2024 to optimize the country’s electric vehicle ecosystem. This funding is directed toward developing advanced technologies that can efficiently process the increasing number of EOL batteries, enhance manufacturing capabilities, and support the country’s clean energy goals.

Key Electric Vehicle Battery Recycling Market Insights Summary:

Regional Highlights:

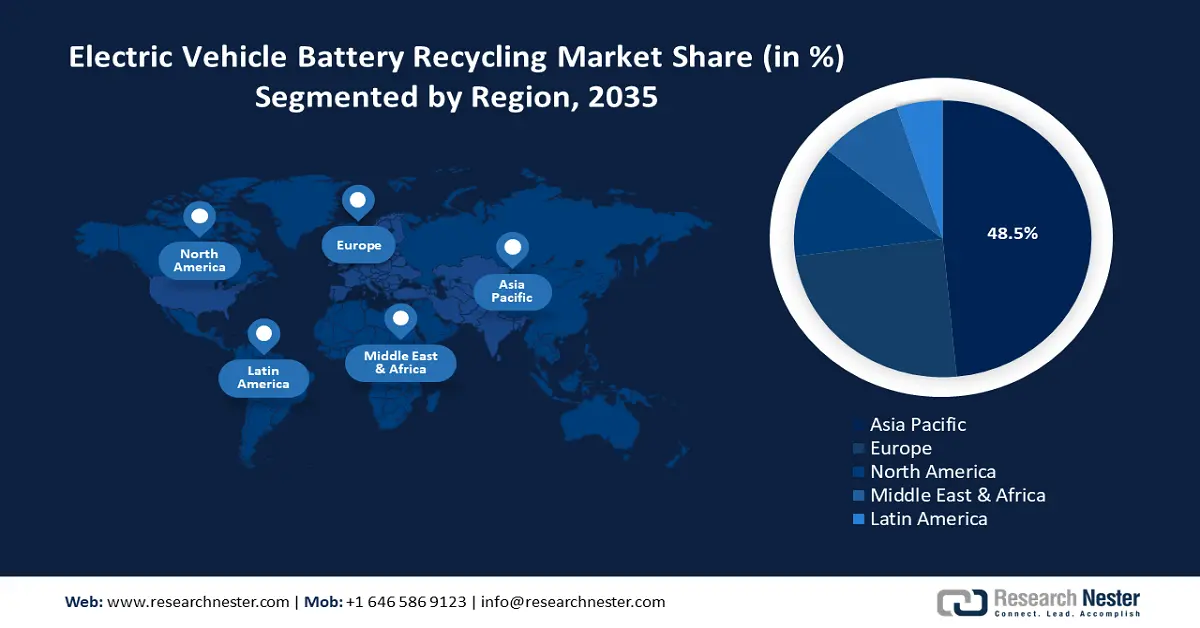

- Asia Pacific electric vehicle battery recycling market will dominate over 48.50% share by 2035, driven by a surge in EV adoption and the rising volume of end-of-life batteries.

- Europe market will achieve a remarkable revenue share by 2035, driven by stringent EU regulations mandating high recycling efficiency.

Segment Insights:

- The lithium-ion battery segment in the electric vehicle battery recycling market is expected to achieve a 48% share by 2035, driven by its widespread use in electric vehicles and valuable material recovery.

- The electric cars segment in the electric vehicle battery recycling market is expected to gain significant share by 2035, driven by rising EV adoption and need for critical material recovery.

Key Growth Trends:

- Strict government regulations and extended producer responsibility (EPR) policies

- Cost reduction benefits for EV and battery manufacturers

Major Challenges:

- Lack of standardization and battery design complexity

- Environmental and safety concerns

Key Players: Altilium, ACCUREC Recycling GmbH, American Manganese Inc., Battery Solutions, Li-Cycle Corp., G & P Batteries, Recupyl, Retriev Technologies, Australian Battery Recycling Initiative, Snam S.p.A, Umicore N.V.

Global Electric Vehicle Battery Recycling Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.26 billion

- 2026 Market Size: USD 8.04 billion

- Projected Market Size: USD 97.53 billion by 2035

- Growth Forecasts: 31.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 8 September, 2025

Electric Vehicle Battery Recycling Market Growth Drivers and Challenges:

Growth Drivers

- Strict government regulations and extended producer responsibility (EPR) policies: The implementation of stringent government regulations and extended producer responsibility (EPR) policies ensures the safe disposal and recycling of lithium-ion batteries used in electric vehicles. Countries such as China, the U.S., and Germany have introduced laws such as the EU’s Battery Regulation and China’s Interim Measures for the Management of Recycling and Utilization of Power Batteries for New Energy Vehicles, mandating the proper collection, disposal, and recycling of EV batteries.

Recently, the European Union released a battery regulation mandate requiring recycled content in EV batteries. Starting in August 2030, EV batteries produced in Europe must include a minimum of 6% recycled lithium and nickel and 16% recycled cobalt. These regulations are compelling automakers and battery manufacturers to establish efficient recycling networks, creating significant investment opportunities in advanced battery recycling technologies. - Cost reduction benefits for EV and battery manufacturers: Recycling spent EV batteries is becoming an economically viable alternative to raw material procurement. With advancements in recycling technologies, the process efficiency is improving, reducing operational expenses for battery manufacturers. Additionally, automakers are increasingly viewing battery recycling as a strategic initiative to offset battery production costs, enhance supply chain resilience, and achieve sustainability goals. For instance, in September 2024, BMW partnered with Redwood Materials to recycle lithium-ion batteries from BMW’s electrified vehicles. Redwood’s advanced recycling process enables the recovery of upto 98% of critical materials such as nickel, cobalt, and copper, which can be reintegrated into the battery supply chain. By sourcing these high-purity materials from recycled batteries, BMW reduces reliance on traditional mining and refining, leading to significant cost savings in battery production.

- Increasing EV sales and battery waste generation: The global EV market is witnessing unprecedented growth driven by technological advancements, government incentives, and rising consumer preference for sustainable transportation. As EV adoption rises, so does the volume of end-of-life lithium-ion batteries, creating an urgent need for recycling infrastructure. For instance, in Australia, research by the University of Technology Sydney projects that by 2030, approximately 30,000 tonnes of used EV batteries are likely to enter the waste stream annually. Further, these numbers are expected to increase to 360,000 tonnes by 2040, and 1.6 million tonnes by 2050. This surge highlights the urgency for robust recycling solutions to manage battery waste effectively.

Challenges

- Lack of standardization and battery design complexity: EV batteries vary widely in chemistry, size, and packaging, making recycling more complex and less efficient. Some batteries use adhesive-based pack designs that are difficult to disassemble, while others contain cathode chemistries such as lithium iron phosphate or nickel manganese cobalt, each requiring distinct recycling methods. The absence of industry-wide design standards prevents recyclers from developing streamlined and automated processes, increasing labor costs, operational costs, and reducing overall recovery efficiency.

- Environmental and safety concerns: Recycling EV batteries poses environmental and safety risks, especially during collection, storage, and processing. Improper handling can lead to fire hazards, toxic chemical leaks, and air pollution from energy-intensive recycling processes. While advanced recycling methods such as hydrometallurgy and direct cathode recycling help reduce emissions, many facilities still rely on pyrometallurgical processes, which generate harmful byproducts.

Electric Vehicle Battery Recycling Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

31.6% |

|

Base Year Market Size (2025) |

USD 6.26 billion |

|

Forecast Year Market Size (2035) |

USD 97.53 billion |

|

Regional Scope |

|

Electric Vehicle Battery Recycling Market Segmentation:

Chemistry Segment Analysis

Lithium-ion battery segment is projected to dominate over 48% EV battery recycling market share by 2035, due to its widespread use in electric vehicles. These batteries contain valuable materials such as lithium, cobalt, and nickel, making recycling economically and environmentally beneficial. With increasing EV adoption and government regulations promoting sustainability, the demand for efficient Li-ion battery recycling is rising. Advancements in recycling technologies are further driving growth by improving material recovery rates and reducing costs.

Application Segment Analysis

The electric cars segment is anticipated to hold a significant electric vehicle battery recycling market share through 2035 as it is the largest contributor to the EV battery recycling market, generating a high volume of end-of-life lithium-ion batteries. With rising EV adoption, the need for efficient recycling solutions to recover critical materials such as lithium, cobalt, and nickel is growing. Automakers and recyclers are investing in advanced processes to create a circular supply chain and reduce environmental impact. Government regulations and sustainability goals are further driving the expansion of battery recycling within the electric cars segment.

Our in-depth analysis of the global EV battery recycling market includes the following segments:

|

Chemistry |

|

|

Application |

|

|

Process |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Vehicle Battery Recycling Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific EV battery recycling market is expected to dominate revenue share of over 48.5% by 2035, owing to the surge in EV adoption and the rising volume of end-of-life batteries. The ruling governments in China, Japan, and South Korea are implementing strict recycling regulations and promoting sustainable battery management. The demand for critical materials such as lithium, cobalt, and nickel is surging investments in advanced recycling technologies. Additionally, the region’s strong EV manufacturing base and focus on resource security are accelerating market expansion.

The EV battery recycling market in China is expanding due to strict government regulations and a rapidly growing EV industry. The government has introduced policies requiring automakers to establish recycling systems and increase the use of recycled materials in new batteries. For instance, in February 2025, CATL signed a strategic MoU with Volkswagen to enhance their partnership in battery research and development. This collaboration focuses on the application of new materials and the development of components, with a particular interest in battery recycling and swapping technologies.

The EV battery recycling market in South Korea is rising due to its strong presence in battery manufacturing and the push for a circular economy. Leading companies such as LG Energy Solution and SK Innovation are investing in advanced recycling technologies to recover lithium and nickel. Government initiatives such as subsidies for recycling infrastructure and stricter disposal regulations are accelerating industry growth. Additionally, South Korea aims to reduce dependence on imported raw materials by strengthening its domestic recycling ecosystem.

Europe Market Insights

Europe is anticipated to garner a remarkable electric vehicle battery recycling market share from 2025 to 2035 due to stringent EU regulations mandating high recycling efficiency and the use of recovered materials in new batteries. The country’s aim for energy independence and reduced reliance on imported critical minerals is driving large-scale investment in recycling infrastructure. Leading automakers and battery firms are forming strategic partnerships to develop closed-loop recycling systems. For instance, in January 2025, BMW Group and Singapore-based SK Tes partnered to form a European battery recycling company to recover cobalt, nickel, and lithium from used batteries. The recovered valuable materials will be used to develop BMW’s next-generation EV vehicle, Neue Klasse. Additionally, the partnership also aims to expand the US-Mexico-Canada by 2026. This highlights the country’s dedication to establishing a circular economy within its automotive sector. The focus on sustainability and carbon neutrality is accelerating the adoption of advanced recycling technologies.

Germany is leading the expansion of the EV battery recycling market due to strong government policies, corporate investments, and a strong automotive sector. Top players in Germany, such as Mercedes Benz and Volkswagen, are investing in advanced recycling facilities to secure critical raw materials domestically. For instance, in October 2024, Mercedes Benz inaugurated its first battery recycling facility in Kuppenheim, Germany, as a step toward sustainable resource management. This plant employs an integrated mechanical hydrometallurgical process to achieve a recovery rate exceeding 96% for lithium, nickel, and cobalt. This facility operates with net carbon neutrality and utilizes 100% green electricity, aligning with the country’s commitment to environmental sustainability. Additionally, government initiatives such as the Battery Pass initiative promote transparency in battery lifecycles and encourage efficient recycling.

The UK EV battery recycling market is growing due to a focus on domestic supply chain resilience and sustainability. The government-backed Faraday Institution is funding research into next-generation recycling technologies such as direct cathode regeneration. Companies such as Altilium are scaling up recycling operations to support UK-based EV production, reducing reliance on raw material imports. As the UK accelerates its EV transition, a circular economy approach is driving new investments in battery recycling.

Electric Vehicle Battery Recycling Market Players:

- Altilium

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ACCUREC Recycling GmbH

- American Manganese Inc.

- Battery Solutions

- Li-Cycle Corp.

- G & P Batteries

- Recupyl

- Retriev Technologies

- Australian Battery Recycling Initiative

- Snam S.p.A

- Umicore N.V.

The EV battery recycling market is highly competitive, with players investing in advanced recycling technologies. Companies are forming strategic partnerships with automakers and battery manufacturers to secure feedstock and scale operations globally. In addition, innovation in hydrometallurgical and direct recycling methods is driving differentiation as firms compete to improve efficiency, recovery rates, and sustainability. Here are some leading players in the EV battery recycling market:

Recent Developments

- In March 2025, Altilium, a UK-based clean technology company successfully produced the first EV battery cells using recycled cathode active materials (CAM) in the UK. This achievement made at the UK Battery Industrialization Centre (UKBIC), is a major step towards creating a circular economy for EV batteries by reusing old materials in new battery production.

- In March 2025, Canadian battery recycling company Li-Cycle announced major partnerships in Germany to power its European battery recycling expansion. These agreements will help expand its battery recycling network and strengthen the electric vehicle (EV) industry. One partnership is with a well-known global EV manufacturer which will supply Li-cycle’s Germany spoke facility with battery materials from an EU-based plant. The second partnership is with a luxury EV brand focused on recycling battery production scrap within Germany. These agreements will strengthen Li-Cycle’s recycling network and ensure a steady supply of materials.

- Report ID: 2012

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Vehicle Battery Recycling Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.