Electric Motorcycles & Scooters Market Outlook:

Electric Motorcycles & Scooters Market size was valued at USD 27.24 billion in 2025 and is set to exceed USD 78.75 billion by 2035, registering over 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electric motorcycles & scooters is estimated at USD 29.99 billion.

The growth of the market can be attributed primarily to the increase in demand for electronic vehicles as a result of the stringent regulations on carbon emissions in places such as the Asia Pacific and Europe. It has been observed that the count of electric vehicles on the roads in Australia doubled at the beginning of 2023 to exceed 82999, growing from 43999 vehicles in the same period last year.

The global electric motorcycles & scooters market size is also projected to expand as a result of the progress in urbanization. The steady growth in urban population over the last few decades all over the world increases the need for convenient options in transportation. According to the World Bank, the number of people residing in urban areas worldwide in 2021 constituted 56% of the total world population, compared to 52% in 2011. The other factors contributing to the market growth include government initiatives to promote e-mobility, the escalating prices of petroleum-based fuels, and the low operational and maintenance expenditures on EVs. Further, the use of solar power to charge the batteries used in EVs should also lead to market growth.

Key Electric Motorcycles & Scooters Market Insights Summary:

Regional Highlights:

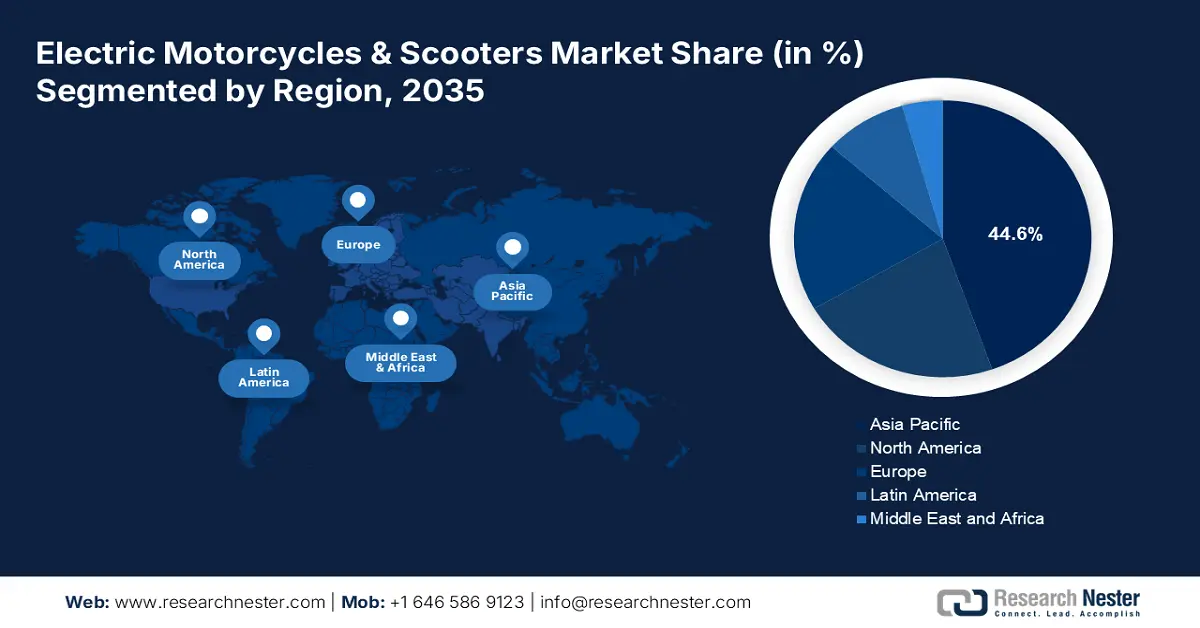

- Asia Pacific electric motorcycles & scooters market achieves a 44.6% share by 2035, driven by rising awareness of limiting carbon emissions and government subsidies.

Segment Insights:

- The 48v voltage segment in the electric motorcycles & scooters market is expected to capture a 41% share by 2035, influenced by high power output and long charging cycles enhancing performance.

- The motorcycles segment in the electric motorcycles & scooters market is expected to capture a significant share by 2035, fueled by better speed and range compared to electric scooters.

Key Growth Trends:

- Stringent Regulations to Keep Carbon Emissions Under Check

- Supportive initiatives by Governments to Promote EVs

Major Challenges:

- Problems related to the overheating of batteries and their ignition in EVs

- Uncertainties about the range of transportation for EVs among the consumers

Key Players: Lightning Motorcycles, Niu International Co. Ltd., Terra Motors India Pvt. Ltd., Vmoto Limited ABN, Z Electric Vehicle, Zero Motorcycles, Inc., BMW AG, Harley-Davidson, Inc., Hero MotoCorp Ltd., KTM Sportmotorcycle GmbH.

Global Electric Motorcycles & Scooters Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27.24 billion

- 2026 Market Size: USD 29.99 billion

- Projected Market Size: USD 78.75 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Electric Motorcycles & Scooters Market Growth Drivers and Challenges:

Growth Drivers

-

Stringent Regulations to Keep Carbon Emissions Under Check – It is estimated that the annual carbon dioxide emissions by a typical passenger vehicle should amount to 5 metric tons. However, this figure varies as per different kinds of fuel, the fuel economy, and the distance traveled by the vehicle per year. Several regulatory measures have been adopted by governments and other organizations to curb these emissions within a set time frame. For instance, as per the European Green Deal that was unveiled by the European Commission in 2020, the European Union (EU) should attain climate neutrality by 2050. To achieve this goal, the EU has planned to reduce more than 89% of transportation-induced greenhouse gas emissions before 2050.

-

Supportive initiatives by Governments to Promote EVs – Several governments worldwide are adopting initiatives aimed at increasing the consumption of EVs. Tax reductions on EVs, a special electric mobility zone, and battery-swapping policies by the Government of India are instances of such initiatives. Further, in 2019, the Ministry of Heavy Industries under the Indian Government approved the second phase of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme. As per FAME II, about 86% of a budgetary outlay equivalent to ~USD 1 billion would be used to increase demand for EVs in the country.

-

Grave Concern Regarding Air Pollution in Different Parts of the World – It is estimated that annually ~7 million people succumb to health complications after being exposed to poor air quality.

-

Steady Drop in the Price of Batteries Used in EVs – Lithium-ion batteries play a major role in the success of EVs in providing sustainable and environmentally friendly transportation. The global pricing of lithium-ion battery packs, which stood at ~ USD 181 per kilowatt hour in 2018, fell to ~ USD 138 per kilowatt hour in 2020. This pricing has been projected to drop further to reach ~ USD 59 per kilowatt hour in 2030.

Challenges

-

Problems related to the overheating of batteries and their ignition in EVs - It has been observed that yearly more than 2,820 electric cars catch fire worldwide. Though EVs catching fire is rarer when compared to gas-powered vehicles going through the same, it still poses a threat to the passengers in the EV. Hence, this threat is expected to hinder market growth significantly.

- Uncertainties about the range of transportation for EVs among the consumers

- Inadequate infrastructure, including a limited number of charging stations for EVs exists in some parts of the world

Electric Motorcycles & Scooters Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 27.24 billion |

|

Forecast Year Market Size (2035) |

USD 78.75 billion |

|

Regional Scope |

|

Electric Motorcycles & Scooters Market Segmentation:

Product Segment Analysis

The motorcycles segment is estimated to gain a significant market share over the projected time frame. Such a remarkable growth of the segment could be attributed mainly to the limitations of the electric scooters concerning their range and performance. It has been observed that many electric motorcycles would outperform average lightweight electric scooters when it comes to speed and range. For instance, when an average e-scooter and average e-bike without pedaling are compared after a single recharge and in the absence of extra batteries, the average range of the e-scooter reaches 33 km against that of the e-bike which falls anywhere between 31 and 57 km as per the battery size. This increased range makes e-motorcycles/e-bikes more favorable for long-distance commutes and different activities such as off-roading and racing.

Voltage Type Segment Analysis

The segment for 48V is expected to garner 41% electric motorcycles & scooters market share by 2035. High power output to enable good performance is the major factor driving the demand for this voltage category in the market. A 48V battery for e-scooters or motorcycles has been observed to allow a current supply between 9 and 41 amperes. Such a current supply is considered ample for minimizing the power lag, which should otherwise occur with a battery of lower voltage. The 48V battery should provide good acceleration for the e-motorcycles and e-scooters and also stands out for its long charging cycles that avoid the need for frequent charging. Further, manufacturers are integrating regenerative braking and other advanced technologies into the 48V batteries. Such modifications would make 48V battery packs preferable for e-scooters and motorbikes and would lead to the segment's growth in the market.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Battery Type |

|

|

By Voltage Type |

|

|

By Distance Covered |

|

|

By Technology Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Motorcycles & Scooters Market Regional Analysis:

APAC Market Insights

Asia Pacific region is poised to dominate around 44.6% market share by 2035, driven by rising awareness of limiting carbon emissions and government subsidies. It has been observed that Asia Pacific contributed to over 51% of the total carbon dioxide emissions in the world in 2020. The region has some of the largest emitters of carbon, such as China and India. In 2020, about 60% of the region's carbon emissions came from China alone, while India contributed 14% of the regional emissions. Hence, several governments in the region are taking measures to promote e-mobility to curb the damage to air quality. The subsidies offered to the producers by the government and the very low tax rates for e-vehicles are instances of such measures. Therefore, all these factors are predicted to surge the growth of the market in the region.

Europe Market Insights

Europe is another region that is projected to hold a significant share of the global market for electric motorcycles & scooters. Europe's market share can be attributed primarily to the high demand for electric two-wheelers in the region for various reasons. A boom has been observed in the sales of electric bikes in different parts of Europe during recent years. For instance, Italy, the sales of electric bikes grew up to 45% during the one year from 2019 and 2020. Moreover, this growth in sales continued through 2021. In addition, the Netherlands is another place in Europe that is showing remarkable growth in the demand for e-bikes. The sales for these bikes in the Netherlands have been projected to be twice that of the present by 2027. The demand for electric scooters and motorcycles in the region got a boost following the pandemic, as people started turning to cycle as a means of outdoor exercise while adhering to the needs of social distancing. Additionally, the consciousness of the people in the region about pollution and sustainability plays a big role in the regional market growth for electric two-wheelers.

Electric Motorcycles & Scooters Market Players:

- Lightning Motorcycles

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Niu International Co. Ltd.

- Terra Motors India Pvt. Ltd.

- Vmoto Limited ABN

- Z Electric Vehicle

- Zero Motorcycles, Inc.

- BMW AG

- Harley-Davidson, Inc.

- Hero MotoCorp Ltd.

- KTM Sportmotorcycle GmbH

Recent Developments

-

BMW AG announced its BMW Motorrad Austria having collaborated with Vagabund Moto GmbH to create the multifunctional e-scooter, BMW CE 04. The e-scooter for urban use comes with an attractive color scheme, including black, white, beige, and dark green. The scooter's various functional elements mainly target the youth.

-

Hero MotoCorp Ltd announced selling 4, 50,154 units of motorcycles and scooters in March 2022. This sales volume reflected a sequential growth over that of the month of February. In February 2022, the company successfully sold 358,254 units of scooters and motorcycles while recovering after the pandemic-induced decline.

- Report ID: 4722

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.