ECG Event Recorder Market Outlook:

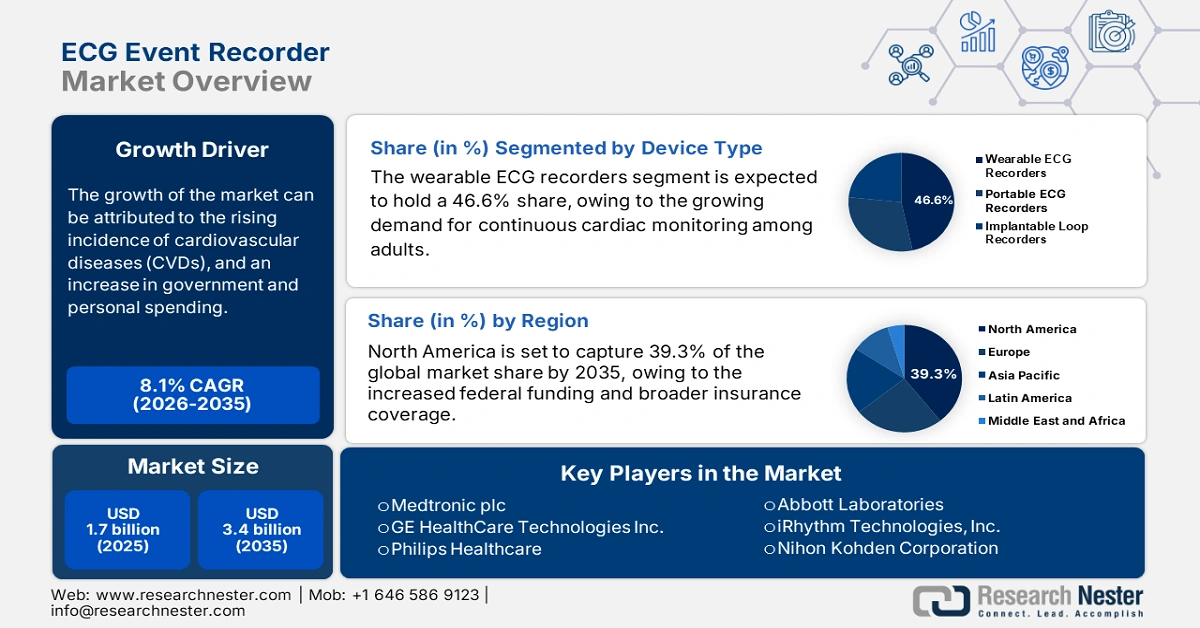

ECG Event Recorder Market size was over USD 1.7 billion in 2025 and is estimated to reach USD 3.4 billion by the end of 2035, expanding at a CAGR of 8.1% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of ECG event recorder is assessed at USD 1.8 billion.

The market is experiencing growth, largely due to the rising incidence of cardiovascular diseases (CVDs) worldwide. In this regard, an NLM study predicted the occurrence, crude incidence, and crude disability-adjusted life-years (DALYs) of CVD to increase by 90.0%, 73.4%, and 54.7% between 2025 and 2050, respectively. It also highlighted that the volume of global cardiovascular deaths is estimated to surpass 35.6 million by the end of the same timeline. Thus, with a proven track record of these tools in greatly enhancing the detection of symptomatic rhythms, the sector fosters a substantial consumer base.

The supply chain of the market includes everything from manufacturing electronic components to assembling devices and distributing them to healthcare facilities. As a result, the payers’ pricing related to this sector varies widely, depending on the model, features, and whether they are single-use or reusable. According to a 2024 NLM study, the price of smartwatches (cleared by the FDA) for monitoring, recording, and analyzing ECG data ranged from USD 199.0 to USD 400.0. On the other hand, the costs related to placement and average monthly monitoring of implantable cardiac devices were USD 6500 and USD 58, respectively. This dataset underscores the urgent need for the development and commercialization of more affordable options to enhance accessibility in this sector.

Key ECG Event Recorder Market Insights Summary:

Regional Insights:

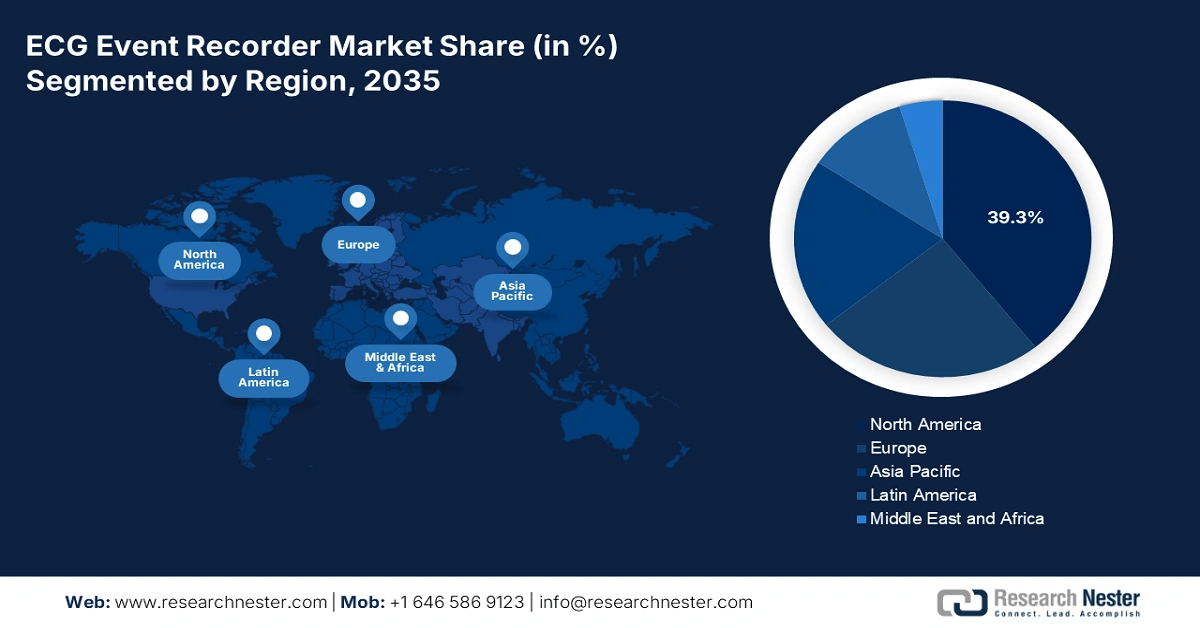

- The North America ECG Event Recorder Market is projected to command a 39.3% share by 2035, attributable to increasing federal funding and broader insurance coverage.

- Asia Pacific is expected to expand at the fastest pace through 2026–2035, supported by rising healthcare awareness and increasing CVD mortality.

Segment Insights:

- Wearable ECG recorders are forecasted to capture a 46.6% share by 2035 in the ECG Event Recorder Market, propelled by the increasing surge in remote and real-time cardiac monitoring.

- Symptom event monitors are anticipated to dominate revenue generation through 2035, bolstered by their ability to facilitate quick and on-site diagnosis of asymptomatic arrhythmias.

Key Growth Trends:

- Shift toward ambulatory and remote monitoring

- Growing awareness and early diagnosis campaigns

Major Challenges:

- Pricing constraints and reimbursement limitations

Key Players: iRhythm Technologies, Inc., GE Healthcare, Abbott Laboratories, Medtronic plc, Boston Scientific Corporation, Hill-Rom Holdings (Baxter), Nihon Kohden Corporation, AliveCor, Inc., Schiller AG, OSI Systems, Inc. (Spacelabs), Fukuda Denshi Co., Ltd., Bittium Biosciences, Getemed AG, BPL Medical Technologies, Compumedics Limited, Bionet Co., Ltd., Mediana Co., Ltd., Borsam Biomedical, Contec Medical Systems.

Global ECG Event Recorder Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.7 billion

- 2026 Market Size: USD 1.8 billion

- Projected Market Size: USD 3.4 billion by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 25 September, 2025

ECG Event Recorder Market - Growth Drivers and Challenges

Growth Drivers

- Shift toward ambulatory and remote monitoring: The transition of the healthcare industry to value-based care is prompting wide adoption of remote patient monitoring (RPM). The products available in the ECG event recorder market, particularly wearable devices, allow patients to collect continuous rhythm data conveniently and affordably without requiring hospital stays, improving patient compliance. Besides, the emergence of telemedicine services, particularly after the pandemic, further accelerates the pace of this shift. Moreover, this movement toward decentralized cardiac care continues to fuel growth in this sector.

- Growing awareness and early diagnosis campaigns: Governments and health organizations across the globe are increasingly participating in public awareness campaigns and cohorts to educate the maximum patient volume about the importance of early detection in managing severe heart conditions. Their efforts to promote regular screening, especially during Heart Month or World Heart Day, further push more people to consider adopting advanced tools from the market. As evidence, in 2024, the U.S. Preventive Services Task Force released new guidelines providing recognition to ECG abnormalities as the primary indicator of CVD events.

- Integration of next-generation data analytics: The market is evolving rapidly through the increasing use of AI for seamless analysis of large rhythm data. As evidence, in May 2024, Philips demonstrated promising results from the retrospective study at the Heart Rhythm Annual Meeting in Boston, solidifying the efficiency of its AI-powered cardiac care pipeline. As per this dataset, the company’s MCOT device lowered hospital readmission rates by 5.2% compared to implantable loop recorders, while reducing the average 18-month cost of stroke events by USD 27,429. These figures yield greater efficiency out of AI-based recorders, making them more valuable to providers.

Demographic Trends in Key Medical Disciplines in the ECG Event Recorder Market

Overview of the Global CVD Durden (2022)

|

CVD Type |

Number of Prevalent Cases |

Number of Death Cases |

Prevalence (per 100,000) |

Deaths (per 100,000) |

DALYs (per 100,000) |

|

Rheumatic heart disease |

46,358,651 |

386,947 |

575.5 |

4.5 |

162.5 |

|

Ischemic heart disease |

315,390,626 |

9,239,181 |

3,610.2 |

108.8 |

2,275.9 |

|

Ischemic stroke |

86,661,746 |

3,542,299 |

994.5 |

42.3 |

819.5 |

|

Intracerebral hemorrhage |

20,509,587 |

3,428,876 |

237.9 |

39.4 |

923.8 |

|

Subarachnoid hemorrhage |

9,281,913 |

344,872 |

107.2 |

4.0 |

120.7 |

|

Hypertensive heart disease |

13,052,641 |

1,353,074 |

150.9 |

16.1 |

292.7 |

|

Non-rheumatic calcific aortic valve disease |

13,551,699 |

146,199 |

156.6 |

1.8 |

26.8 |

|

Non-rheumatic degenerative mitral valve disease |

15,592,046 |

37,843 |

177.9 |

|

11.1 |

|

Other non-rheumatic valve diseases |

12,130 |

2,033 |

0.1 |

<0.1 |

0.6 |

|

Myocarditis |

625,129 |

26,702 |

7.8 |

0.3 |

11.8 |

|

Alcoholic cardiomyopathy |

|

62,661 |

6.3 |

0.7 |

24.6 |

|

Other cardiomyopathy |

4,715,332 |

295,751 |

58.7 |

3.5 |

99.3 |

|

Pulmonary arterial hypertension |

193,710 |

20,561 |

2.3 |

0.2 |

7.4 |

|

Atrial fibrillation and flutter |

55,414,434 |

362,381 |

|

4.5 |

102.9 |

|

Lower extremity peripheral arterial disease |

105,980,247 |

73,928 |

1,213.3 |

0.9 |

19.6 |

|

Endocarditis |

438,374 |

82,402 |

5.4 |

1.0 |

25.8 |

|

Other cardiovascular and circulatory diseases |

86,722,785 |

221,797 |

1,006.1 |

2.6 |

118.8 |

Source: NLM

Challenges

- Pricing constraints and reimbursement limitations: Governments and insurance companies frequently impose price limits and strict reimbursement guidelines. This move favored local manufacturers, giving them a competitive edge over international companies. Dealing with various regulatory environments also becomes time-consuming and expensive due to their differing criteria. Thus, despite being a great favor to local manufacturers, these factors remain a hurdle for global companies seeking globalization.

ECG Event Recorder Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 1.7 billion |

|

Forecast Year Market Size (2035) |

USD 3.4 billion |

|

Regional Scope |

|

ECG Event Recorder Market Segmentation:

Device Type Segment Analysis

Wearable ECG recorders are poised to lead the sector with a share of 46.6% by the end of 2035. The leadership in this sector is largely fueled by the increasing surge in remote and real-time cardiac monitoring, particularly among older adults. These devices provide convenience while spotting heart issues at an early stage, fostering a greater acceptance than other solutions available in the market. Besides, wearables have been clinically proven to be a cost-effective solution for patients seeking affordable options. The substantial demand base in this segment can be further testified by the NLM findings, stating that a total of 280 million units of smartwatches and fitness trackers were shipped worldwide in 2024, showcasing an 11% rise from 2021.

Monitor Type Segment Analysis

Symptom event monitors are expected to garner a majority of the net revenue generation in the ECG event recorder market over the analyzed period. Due to having the ability to identify episodes of symptoms even through subtle recordings, this subtype is highly desired across various medical settings. This type of devices enable crucial insights for diagnosing asymptomatic cardiac arrhythmias, making them one of the most used tools in outpatient environments that require cost-effective and user-friendly solutions. Moreover, prioritization of quick and on-site diagnosis in preventing serious complications solidifies the segment’s forefront position in this sector.

Application Segment Analysis

Cardiac arrhythmia monitoring is predicted to remain the dominant application segment in the ECG event recorder market throughout the discussed timeline. Amplifying patient volume of this medical condition is the primary growth factor in this category. As evidence, the Global Burden of Disease (GBD) data underscored that the number of new cases, DALYs, and deaths of AFib around the world accounted for 4.4 million, 8.3 million, and 340,000, respectively, in 2021. In the same year, another NLM study estimated the absolute volume of this condition globally to rise by more than 60% in 2050. These figures, coupled with the rapidly aging populations, indicate continuous expansion of this segment in the future.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegment |

|

Device Type |

|

|

Monitor Type |

|

|

Lead Type |

|

|

Technology |

|

|

Application |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

ECG Event Recorder Market - Regional Analysis

North America Market Insights

The North America ECG event recorder market is anticipated to account for the largest share of 39.3% by the end of 2035. The region’s leadership in this sector is attributed to the increased federal funding and broader insurance coverage, where a notable proportion of the national healthcare budget was earmarked for cardiac monitoring technologies. These allocations are a direct response to the rising demand for non-invasive and remote diagnostic options. Besides, the growing patient population across the region also contributes to the continuous expansion of this sector.

The U.S. market follows a positive pace of growth on account of its substantial consumer base, which is fueled by the rising incidence of CVD-related deaths and risk factors. In this regard, a 2024 NLM report unveiled that AFib alone causes 599,790 emergency department visits, 453,060 hospitalizations, and 21,712 deaths nationwide every year. It also mentioned that the annual cost of hospital admissions totaled USD 4 billion in the U.S., underscoring the urgent need for heart monitoring technologies deployment. For the same utility, more than 21% of adults living across the country wear a smartwatch or wearable fitness tracker.

APAC Market Insights

Asia Pacific is poised to exhibit the fastest pace of growth in the global ECG event recorder market during the analyzed timeframe. The rising healthcare awareness, increasing CVD mortality, and expanding access to advanced medical technologies are collectively fostering a lucrative business environment for both domestic and foreign pioneers in this field. On the other hand, robust urbanization, aging, and government initiatives are accelerating the region’s progress in this sector by creating a surge in portable and remote cardiac monitoring solutions.

China holds a leading position in the Asia Pacific market, backed by its large patient population and strong emphasis on medical device manufacturing. Testifying to the demography, a 2022 NLM study revealed that 2 out of every 5 deaths in the country were caused by CVD. In addition, the mortality rate of CVDs accounts for 46.7%-44.2% of all deaths in rural and urban areas, as per the 2024 clinical findings. Thus, the country is pushing the pace and scale of healthcare digitization under its ambitious goals of Healthy China 2030, which are boosting demand for advanced diagnostic technologies, including ECG monitoring devices.

Public Provinces to Support Adoption

|

Country |

Program/Initiative |

Key Notes |

Timeline |

|

India |

National Health Mission (NHM) |

USD 4.4 billion allocation nationwide NCD screening (including CVD prevention/intervention) |

2025-2026 |

|

China |

National Health Commission |

Raised its per capita government subsidies for basic public health services to USD 12.4 |

2023 |

|

Australia |

Cardiovascular Health Mission |

Invested USD 220 million to transform heart and vascular health and stroke |

2022-2025 |

Source: PRS, NMPA, and Government of Australia

Europe Market Insights

Europe is estimated to hold a prominent position in the global ECG event recorder market over the timeline between 2026 and 2035. The region’s consistent propagation in this sector is largely propelled by the rise in geriatric populations, the increased rates of CVD incidence and mortality, and the rapid deployment of digital health infrastructure. According to the NLM, CVDs made up over 36% of all fatalities in Europe till 2023, while impacting the health and quality of life severely for more than 60 million people. Such alarming figures are strengthening the region-wide efforts on deploying early detection tools, such as ECG event recorders.

High utilization rates in outpatient monitoring programs are the major growth factors for the UK ECG event recorder market. Reimbursement reforms by the National Health Service (NHS) are also playing a crucial role in boosting adoption in this category. Moreover, the rise of public-private partnerships (PPPs) is improving access to innovative wearable ECG devices, cultivating an attractive landscape of revenue generation for innovators. This can be evidenced by funding from the Association of Medical Research Charities (AMRC) till 2022, which contributed to the spin-out of over 61 new companies and the production of more than 550 medical products, including medical devices and diagnostic tools.

Country-wise Potential Consumer Bases

|

Country |

Key Notes |

Timelines |

|

UK |

Age-standardized CVD incidence was as high as 527 per 100,000 population |

2021 |

|

Germany |

56.6% and 60.5% of men and women were living with raised cholesterol |

2022 |

|

Italy |

65.3% and 51.5% of male and female populations were overweight |

2022 |

|

France |

Crude CVD mortality accounted for 230 per 100,000 population |

2021 |

|

Ireland |

Age-standardized CVD incidence stood at 511 per 100,000 population |

2021 |

Source: World Heart Observatory

Key ECG Event Recorder Market Players:

- Philips Healthcare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- iRhythm Technologies, Inc.

- GE Healthcare

- Abbott Laboratories

- Medtronic plc

- Boston Scientific Corporation

- Hill-Rom Holdings (Baxter)

- Nihon Kohden Corporation

- AliveCor, Inc.

- Schiller AG

- OSI Systems, Inc. (Spacelabs)

- Fukuda Denshi Co., Ltd.

- Bittium Biosciences

- Getemed AG

- BPL Medical Technologies

- Compumedics Limited

- Bionet Co., Ltd.

- Mediana Co., Ltd.

- Borsam Biomedical

- Contec Medical Systems

The ECG event recorder market is set to be led by MedTech pioneers from North America and Europe, such as Medtronic, GE Healthcare, and Philips, holding more than a third of the global revenue share. On the other hand, medical device innovators, such as iRhythm, AliveCor, and Movesense, are setting new avenues with their wearable and AI-driven solutions. Exemplifying the same, in February 2025, Movesense introduced a revolutionary wireless ECG monitor, CardioRTHM, that helps capture hard-to-find arrhythmias by recording and storing high-quality ECG and heart rate data. Furthermore, leaders in APAC, such as Nihon Kohden and BPL Medical, are making strides by providing value-driven solutions.

Such key players are:

Recent Developments

- In May 2025, AliveCor launched its most advanced personal ECG system, the groundbreaking AI-powered KardiaMobile 6L Max, featuring KardiaAlert, for a wider range of arrhythmia detection. The first-of-its-kind tool can identify potential changes over time, even subtle ones, that are not visible in a single recording.

- In May 2025, iRhythm announced the commercial launch of its Zio long-term continuous ECG monitoring (LTCM) system in Japan after gaining approval from the Pharmaceuticals and Medical Devices Agency (PMDA). This AI-powered recording and analysis device revolutionized the ambulatory cardiac monitoring segment.

- Report ID: 3801

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

ECG Event Recorder Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.