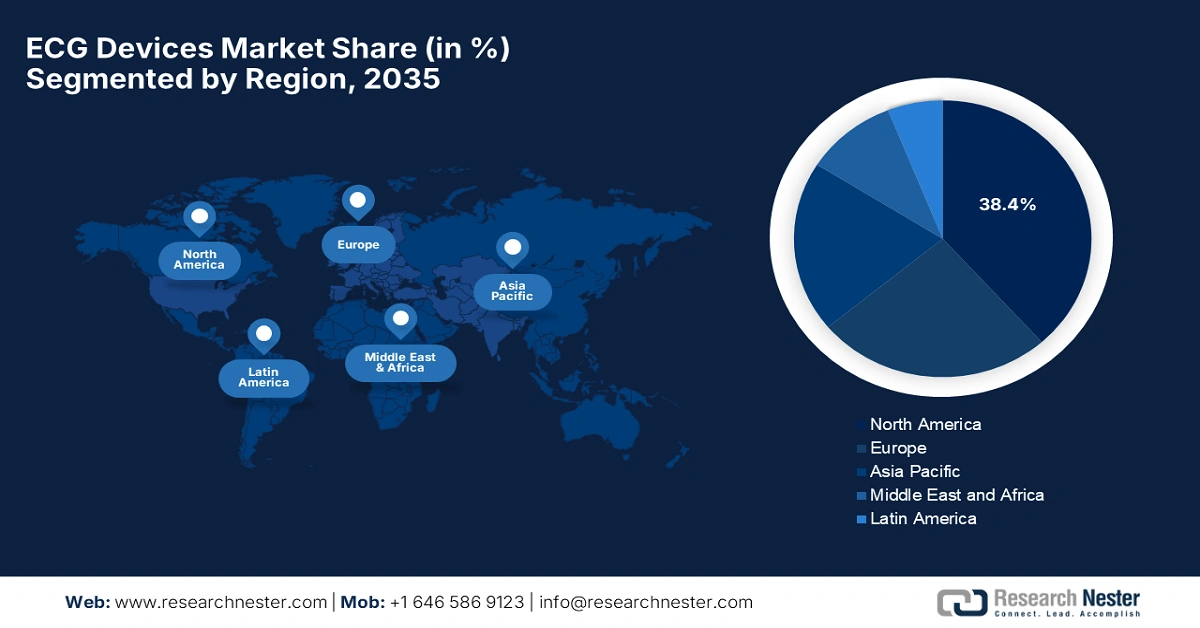

ECG Devices Market - Regional Analysis

North America Market Insights

The North America ECG devices market is poised to capture the largest share of 38.4% throughout the assessed timeline. The region presents a lucrative business environment for both domestic and global leaders in this sector, backed by the heavy capital influx, a favourable reimbursement framework, and an advanced healthcare infrastructure. In this regard, the Colorado General Assembly in 2024 reported a remote monitoring service wherein the Department of Health Care Policy and Financing will reimburse Medicaid members for outpatient telehealth remote monitoring services. It also establishes a grant program offering up to five USD 100,000 grants to rural and provider-shortage area clinics to support telehealth infrastructure.

There is a huge exposure for Canada in the ECG devices industry on account of increasing adoption of digital health technologies, supportive healthcare policies, and investments in telehealth. For instance, in May 2022, the Government of Canada, through the Canadian Institutes of Health Research, launched the Canadian Heart Function Alliance, which is a research network aimed at advancing the prevention, diagnosis, treatment, and care of heart failure, thus benefiting overall market growth.

U.S. Cardiovascular Disease Hospitalization and Cost Statistics (Annual Averages, Most Recent Available Year: 2022)

|

Category |

Condition/Event |

Value |

|

Most Common Hospital Discharge |

Heart Failure |

1,087,000 discharges/year |

|

Cerebrovascular Disease |

800,600 discharges/year |

|

|

Highest Mean Cost per Discharge |

Peripheral Vascular Disease |

USD 33,700 (95% CI: USD 33,300-USD 34,000) |

|

Ventricular Tachycardia/Fibrillation |

USD 32,500 (95% CI: USD 32,100-USD 32,900) |

|

|

Top Contributors to Annual Costs |

Heart Failure |

USD 19,500 million/year |

|

Acute Myocardial Infarction (Heart Attack) |

USD 18,300 million/year |

|

|

Most Frequent Complication |

Acute Kidney Injury |

515,000 cases/year |

|

Highest Cost Complication |

Bradycardia |

USD 17,400 per hospitalization |

Source: AHA

APAC Market Insights

Asia Pacific is expected to exhibit the highest CAGR in the ECG devices market by 2035 due to its leveraging of medical instrument manufacturing capabilities. Besides, the enlarging patient pool, government initiatives, and technological innovations are also accelerating the pace of the region’s propagation in this sector. In May 2025, iRhythm announced the launch of the Zio ECG Monitoring System in Japan, which will offer up to 14 days of uninterrupted ECG monitoring through a compact, AI-powered wearable patch. The system is backed by Japan’s PMDA, and it utilizes advanced AI algorithms to detect 13 arrhythmia types.

Following the current trend of infrastructural development and fast deployment of primary medical assets, India is emerging as a lucrative and reliable consumer base for the market. The country is augmenting its progress majorly with financial and promotional efforts from the governing entities. In September 2023, the country’s government launched a national campaign to raise awareness about heart health and hypertension with strong support from Global Health Advocacy Incubator. Besides, the campaign emphasizes community engagement, outreach, and treatment adherence as key tools in addressing this growing burden.

Europe Market Insights

Europe continues to progress as the second largest contributor to growth in the ECG devices market during the analyzed timeframe. The rising adoption of digital health technologies and remote monitoring solutions is a key factor propelling this growth. In July 2025, Philips reported that it had launched the ECG AI Marketplace, which is a centralized platform that provides cardiac care teams with easy access to various AI-powered diagnostic tools. Anumana’s FDA-cleared ECG-AI LEF algorithm is designed to detect low ejection fraction, which marks the first third-party solution available on the platform.

Switzerland remains the central player for the upliftment of Europe’s market, which is characterized by its focus on cutting-edge medical technology and a strong healthcare research ecosystem. For instance, in August 2025, SCHILLER introduced its CARDIOVIT CS-300, which is a cutting-edge exercise ECG system offering wireless ECG acquisition, customizable analysis, robust connectivity, and enhanced cybersecurity, all designed and manufactured at SCHILLER’s Switzerland headquarters.

Economic Costs of Cardiovascular Diseases in Europe (2021)

|

Cost Category |

Amount (EUR) |

Percentage of Total Cost |

|

Total Annual Cost of CVD |

€282 billion |

100% |

|

Health and Long-term Care |

€155 billion |

55% |

|

Productivity Losses |

€48 billion |

17% |

|

Informal Care Costs |

€79 billion |

28% |

|

Cost per Person |

€630 (range: €381-€903) |

— |

|

Coronary Heart Disease Costs |

€77 billion |

27% of total CVD costs |

Source: NIH