ECG Devices Market Outlook:

ECG Devices Market size was valued at USD 7.3 billion in 2025 and is projected to reach USD 15.2 billion by the end of 2035, rising at a CAGR of 7.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of ECG devices is estimated at USD 7.8 billion.

The increasing incidences of cardiovascular disease (CVD) across the world are creating a surge in heart monitoring solutions, fueling demand in the market. Testifying to this, the WHO in July 2025 reported that CVDs led to an estimated 19.8 million deaths in 2022, which marks approximately 32% of all worldwide deaths. The report also stated that of these, 85% were due to heart attacks and strokes. Further 75% of CVD-related deaths occur in low- and middle-income countries, highlighting the existence of heightened demand.

This enlarging demography demonstrates the increasing necessity of sustained products from the market. However, the economic burden on patients is rising due to the heightening payers’ pricing, which is mainly caused by supply chain disruptions in raw materials and essential components, such as lithium, rare-earth metals, batteries, and sensors. In February 2024, the AHA reported that in the U.S., cardiovascular-related hospital discharges are led by heart failure, with an annual average of 1,087,000 discharges, followed by cerebrovascular disease at 800,600. Peripheral vascular disease reported the highest mean cost per discharge at USD 33,700, closely followed by ventricular tachycardia/ventricular fibrillation at USD 32,500.

Key ECG Devices Market Insights Summary:

Regional Highlights:

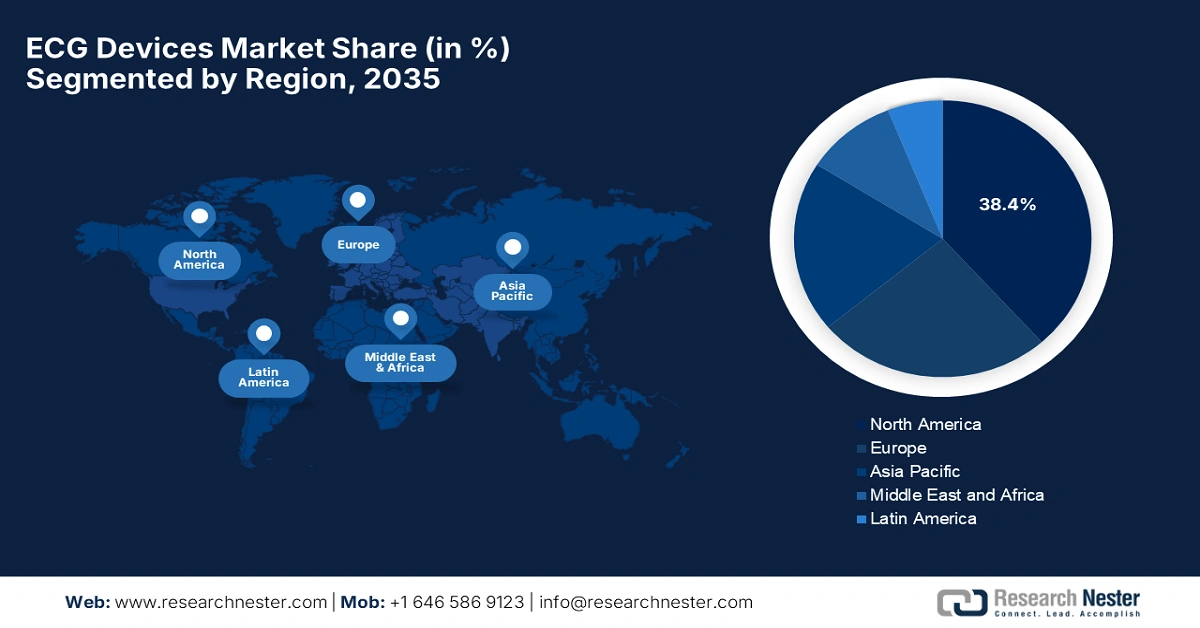

- North America is poised to capture a 38.4% share in the ECG devices market throughout the assessed timeline, driven by advanced healthcare infrastructure, favourable reimbursement frameworks, and heavy capital influx.

- Asia Pacific is expected to exhibit the highest CAGR in the ECG devices market by 2035, owing to medical instrument manufacturing capabilities, government initiatives, and technological innovations.

Segment Insights:

- The hospitals & clinics segment is expected to garner the largest revenue share of 52.6% in the ECG devices market during the discussed timeframe, propelled by high-volume demand for advanced ECG devices and the need for early cardiovascular diagnosis.

- The 12-lead ECG devices segment is projected to attain a share of 45.3% during the analyzed timeframe, driven by superior diagnostic information offered through multiple-angle heart electrical activity monitoring.

Key Growth Trends:

- Growing focus on preventive healthcare

- Technological progress

Major Challenges:

- Volatility in availability and worldwide adoption

Key Players: Philips Healthcare, Abbott Laboratories, Medtronic plc, Siemens Healthineers, Nihon Kohden, Hill-Rom Holdings (Baxter), OSI Systems (Spacelabs), Schiller AG, Boston Scientific, Koninklijke Philips N.V., AliveCor, Inc., BPL Medical Technologies, Biotronik, Fukuda Denshi, Mindray Medical, ACS Diagnostics, BSE Medical (Bionet), Cardiac Science, Comen (Navitor).

Global ECG Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.5 billion

- 2026 Market Size: USD 17.8 billion

- Projected Market Size: USD 61.8 billion by 2035

- Growth Forecasts: 14.8% CAGR (2026-2035)

Key Regional Dynamics:

Largest Region: North America (38.4% share by 2035)

Fastest Growing Region: Asia Pacific

Dominating Countries: United States, Japan, Germany, Australia, South Korea

Emerging Countries: India, China, Brazil, Mexico, Indonesia

Last updated on : 26 September, 2025

ECG Devices Market - Growth Drivers and Challenges

Growth Drivers

- Growing focus on preventive healthcare: Due to the escalation in mortality rates associated with CVDs, both governments are increasingly focusing on early detection of chronic conditions, which is the major driving factor for the market. As of the August 2025 NHM report, the National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke aims to reduce the burden of major CVDs through prevention, early detection, and timely management. District NCD Clinics and cardiac care units have been established for screening and treatment across all 13 districts.

- Technological progress: The market has extensively benefited from innovations such as AI-powered ECG interpretation, wearable ECG monitors, wireless connectivity, and mobile-integrated ECG apps, which are revolutionizing the detection procedures. For instance, in March 2025, Peerbridge Health announced the launch of Cor MDx, which is a Next-Gen IoT ECG wearable that features real-time multi-lead ECG streaming, BLE, and LTE connectivity via AT&T, and AI-driven diagnostics.

- Growing adoption of remote patient monitoring: The emergence of telehealth and remote monitoring is reshaping the foundation of the market. In this regard, TeleMedCare in July 2025 has partnered with a major U.S. health insurance provider to launch a Remote Patient Monitoring program targeting chronic conditions such as chronic heart disease, COPD, diabetes, and hypertension. Besides, the Florida-based pilot highlights TeleMedCare's adaptable technology as part of the insurer’s USD 2 billion global health strategy for pandemic and long-term care.

Historic Cardiovascular Disease Statistics and Economic Impact

|

Statistic |

Value/Detail |

|

Deaths due to CVD in the US (2015) |

633,842 |

|

Proportion of deaths caused by CVD in the US |

1 in every 4 deaths |

|

Deaths due to cancer in the US (2015) |

595,930 |

|

Global deaths due to CVD (2015, WHO data) |

17.7 million |

|

Indirect annual costs of CVD in the US |

USD 237 billion |

|

Projected indirect costs of CVD by 2035 |

USD 368 billion |

|

Risk of heart disease by age 45 in the general population |

50% |

Source: NIH

Monthly and Year-to-Date Export Data for Medical Equipment U.S. (2025 vs. 2024)

|

Metric |

Medical equipment |

|

July 2025 |

4,054 |

|

June 2025 |

3,994 |

|

Monthly Change |

61 |

|

Year-to-Date 2025 |

26,754 |

|

Year-to-Date 2024 |

27,058 |

|

Year-to-Date Change |

-304 |

Source: Census.gov

Challenges

-

Volatility in availability and worldwide adoption: The factors such as geopolitical clashes, regulatory delays, and budgetary pressures pose a major hurdle for the expansion of the market. In addition to this, regulatory durations across different nations are ultimately slowing down the device entry to the market, adding more costs for the processes, and restricting the widespread adoption. Furthermore, this financial constraint is especially witnessed in developing nations, wherein the healthcare budgets are limited, thereby causing a hindrance to the market progression.

ECG Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.6% |

|

Base Year Market Size (2025) |

USD 7.3 billion |

|

Forecast Year Market Size (2035) |

USD 15.2 billion |

|

Regional Scope |

|

ECG Devices Market Segmentation:

End user Segment Analysis

Based on end user hospitals & clinics segment is expected to garner the largest revenue share of 52.6% in the ECG devices market during the discussed timeframe. The subtype remains as the primary center of care for cardiac diagnosis, surgery, and emergency care, which requires high-volume advanced ECG devices. The increasing global occurrence of cardiovascular deaths is necessitating early diagnosis; hence, this growing demand is driving significant investments in this field to improve patient outcomes.

Lead Type Segment Analysis

In terms of lead type, the 12-lead ECG devices segment is projected to attain a lucrative share of 45.3% in the ECG devices market during the analyzed timeframe. The view of the heart’s electrical activity from 12 different angles, offering superior diagnostic information, is the key factor behind the leadership. Clario in June 2024 reported that its SpiroSphere platform, integrated with the wireless COR‑12 ECG device, has received FDA 510(k) clearance, which streamlines workflows and improves the experience for both patients and trial sites.

Product Segment Analysis

Based on product, resting ECG systems are predicted to gain a share of 38.6% in the ECG devices market during the analyzed timeframe. The growth in the segment originates from its role as a first-line diagnostic tool for assessing heart rhythm and detecting abnormalities such as arrhythmias, ischemia, and past myocardial infarction. In June 2024, Fukuda Denshi announced the launch of its FX-9800 resting ECG and EFS-1000 data management system, which possesses 18-lead synthesis for enhanced detection of Acute Coronary Syndrome and is especially designed for ERs and ICUs.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Lead Type |

|

|

Product |

|

|

Technology |

|

|

Age Group |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

ECG Devices Market - Regional Analysis

North America Market Insights

The North America ECG devices market is poised to capture the largest share of 38.4% throughout the assessed timeline. The region presents a lucrative business environment for both domestic and global leaders in this sector, backed by the heavy capital influx, a favourable reimbursement framework, and an advanced healthcare infrastructure. In this regard, the Colorado General Assembly in 2024 reported a remote monitoring service wherein the Department of Health Care Policy and Financing will reimburse Medicaid members for outpatient telehealth remote monitoring services. It also establishes a grant program offering up to five USD 100,000 grants to rural and provider-shortage area clinics to support telehealth infrastructure.

There is a huge exposure for Canada in the ECG devices industry on account of increasing adoption of digital health technologies, supportive healthcare policies, and investments in telehealth. For instance, in May 2022, the Government of Canada, through the Canadian Institutes of Health Research, launched the Canadian Heart Function Alliance, which is a research network aimed at advancing the prevention, diagnosis, treatment, and care of heart failure, thus benefiting overall market growth.

U.S. Cardiovascular Disease Hospitalization and Cost Statistics (Annual Averages, Most Recent Available Year: 2022)

|

Category |

Condition/Event |

Value |

|

Most Common Hospital Discharge |

Heart Failure |

1,087,000 discharges/year |

|

Cerebrovascular Disease |

800,600 discharges/year |

|

|

Highest Mean Cost per Discharge |

Peripheral Vascular Disease |

USD 33,700 (95% CI: USD 33,300-USD 34,000) |

|

Ventricular Tachycardia/Fibrillation |

USD 32,500 (95% CI: USD 32,100-USD 32,900) |

|

|

Top Contributors to Annual Costs |

Heart Failure |

USD 19,500 million/year |

|

Acute Myocardial Infarction (Heart Attack) |

USD 18,300 million/year |

|

|

Most Frequent Complication |

Acute Kidney Injury |

515,000 cases/year |

|

Highest Cost Complication |

Bradycardia |

USD 17,400 per hospitalization |

Source: AHA

APAC Market Insights

Asia Pacific is expected to exhibit the highest CAGR in the ECG devices market by 2035 due to its leveraging of medical instrument manufacturing capabilities. Besides, the enlarging patient pool, government initiatives, and technological innovations are also accelerating the pace of the region’s propagation in this sector. In May 2025, iRhythm announced the launch of the Zio ECG Monitoring System in Japan, which will offer up to 14 days of uninterrupted ECG monitoring through a compact, AI-powered wearable patch. The system is backed by Japan’s PMDA, and it utilizes advanced AI algorithms to detect 13 arrhythmia types.

Following the current trend of infrastructural development and fast deployment of primary medical assets, India is emerging as a lucrative and reliable consumer base for the market. The country is augmenting its progress majorly with financial and promotional efforts from the governing entities. In September 2023, the country’s government launched a national campaign to raise awareness about heart health and hypertension with strong support from Global Health Advocacy Incubator. Besides, the campaign emphasizes community engagement, outreach, and treatment adherence as key tools in addressing this growing burden.

Europe Market Insights

Europe continues to progress as the second largest contributor to growth in the ECG devices market during the analyzed timeframe. The rising adoption of digital health technologies and remote monitoring solutions is a key factor propelling this growth. In July 2025, Philips reported that it had launched the ECG AI Marketplace, which is a centralized platform that provides cardiac care teams with easy access to various AI-powered diagnostic tools. Anumana’s FDA-cleared ECG-AI LEF algorithm is designed to detect low ejection fraction, which marks the first third-party solution available on the platform.

Switzerland remains the central player for the upliftment of Europe’s market, which is characterized by its focus on cutting-edge medical technology and a strong healthcare research ecosystem. For instance, in August 2025, SCHILLER introduced its CARDIOVIT CS-300, which is a cutting-edge exercise ECG system offering wireless ECG acquisition, customizable analysis, robust connectivity, and enhanced cybersecurity, all designed and manufactured at SCHILLER’s Switzerland headquarters.

Economic Costs of Cardiovascular Diseases in Europe (2021)

|

Cost Category |

Amount (EUR) |

Percentage of Total Cost |

|

Total Annual Cost of CVD |

€282 billion |

100% |

|

Health and Long-term Care |

€155 billion |

55% |

|

Productivity Losses |

€48 billion |

17% |

|

Informal Care Costs |

€79 billion |

28% |

|

Cost per Person |

€630 (range: €381-€903) |

— |

|

Coronary Heart Disease Costs |

€77 billion |

27% of total CVD costs |

Source: NIH

Key ECG Devices Market Players:

- GE Healthcare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Philips Healthcare

- Abbott Laboratories

- Medtronic plc

- Siemens Healthineers

- Nihon Kohden

- Hill-Rom Holdings (Baxter)

- OSI Systems (Spacelabs)

- Schiller AG

- Boston Scientific

- Koninklijke Philips N.V.

- AliveCor, Inc.

- BPL Medical Technologies

- Biotronik

- Fukuda Denshi

- Mindray Medical

- ACS Diagnostics

- BSE Medical (Bionet)

- Cardiac Science

- Comen (Navitor)

The market is highly dominated by global MedTech pioneers, including GE Healthcare, Philips Healthcare, and Abbott Laboratories, which have captured the maximum revenue share. The incorporation and utilization of AI analytics in new instruments have become the key contributor to their market expansion strategy. In addition, they are adopting several advanced components to reduce the cost of final products, widening the range of options for every individual and hence increasing adoption in this field.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In March 2025, Powerful Medical reported that its PMcardio STEMI AI ECG model has received Breakthrough Device Designation from the U.S. FDA due to its ability to detect both STEMI and STEMI-equivalent heart attacks with greater accuracy.

- In December 2024, HeartBeam notified that it has secured FDA 510(k) clearance for its first-of-its-kind, credit card-sized, cable-free ECG device that captures high-fidelity heart signals from three directions for remote arrhythmia assessment.

- Report ID: 4241

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

ECG Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.