Ebola Virus Vaccine Market Outlook:

Ebola Virus Vaccine Market size was valued at USD 249.3 million in 2025 and is projected to reach USD 523.4 million by the end of 2035, rising at a CAGR of 7.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of Ebola virus vaccine is assessed at USD 268.5 million.

The worldwide response to the outbreak of the associated pathogen, particularly in sub-Saharan Africa, is pushing dedicated health authorities to procure offerings from the Ebola virus vaccine market. According to the American Society for Microbiology article in November 2022, for the past 42 years, the virus has taken more than 15,000 people's lives with no changes in the fatality rates. This demonstrates the need for stockpiling effective biologics as per the global preventive and emergency vaccination strategies. Furthermore, growing investments and efforts to establish a strong network of immunization campaigns are helping this sector gain a wider audience and create sustained demand.

The resource supply, biological development, and distribution impose a significant need for capital influx, which often creates economic disparity in the majority of afflicted regions, hindering affordability in the Ebola virus vaccine market. The cost of the Ebola virus vaccine is estimated to be USD 120.7 per vaccine, as stated in the NLM article in October 2023. Various factors, such as an increase in the cost of raw materials and robust GMP compliance, boost payers' pricing in this sector. Hence, continuous government funding and extensive R&D are required to maintain a good business flow and wide adoption.

Key Ebola Virus Vaccine Market Insights Summary:

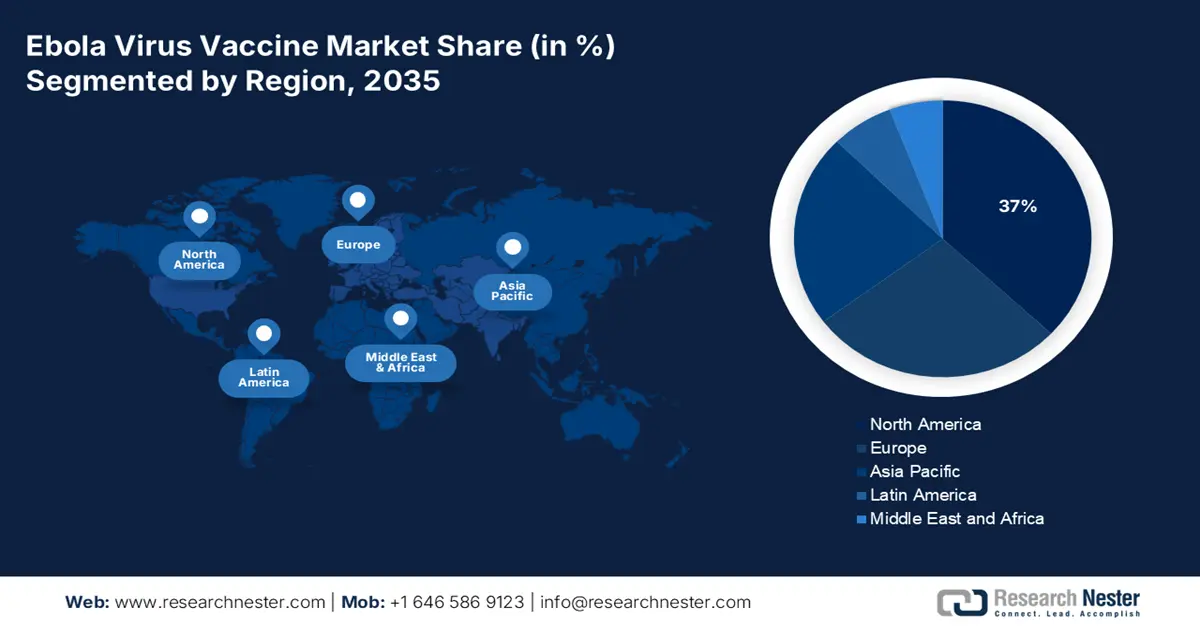

Regional Highlights:

- By 2035, North America is projected to secure a 37% share of the ebola virus vaccine market, supported by robust biopharma capabilities and strong governmental backing owing to exceptional government support.

- Asia-Pacific is set to expand rapidly through 2026-2035, driven by intensifying preparedness strategies and international partnership-led capacity building.

Segment Insights:

- The zaire ebolavirus segment is anticipated to command 48.6% share by 2035 in the ebola virus vaccine market, underpinned by its high lethality and priority status in global outbreak preparedness.

- Recombinant viral vector vaccines are expected to capture a substantial share by 2035, bolstered by their rapid immunogenicity and scalable platform adaptability.

Key Growth Trends:

- Ongoing R&D investments and innovations

- Rising patient pool

Major Challenges:

- Risk of loss from compliance delays and counterfeits

Key Players: Merck & Co., Janssen Pharmaceuticals, GlaxoSmithKline (GSK), BioNTech, Serum Institute of India (SII), CanSino Biologics, Takeda Pharmaceutical, Moderna, Bharat Biotech, CSL Limited, GreenCross Corp, Bavarian Nordic, Biological E. Limited, Inovio Pharmaceuticals, Medigen Vaccine Biologics, EuBiologics, Biovac, Valneva, Incepta Pharmaceuticals, Pharmaniaga.

Global Ebola Virus Vaccine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 249.3 million

- 2026 Market Size: USD 268.5 million

- Projected Market Size: USD 523.4 million by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Singapore, United Arab Emirates

Last updated on : 22 August, 2025

Ebola Virus Vaccine Market - Growth Drivers and Challenges

Growth Drivers

-

Ongoing R&D investments and innovations: The need for therapeutic efficiency and long-term protection enhancement is amplifying investments and engaging in rigorous research and explorations in the ebola virus vaccine market. This is expanding the product pipeline and scalability in this sector while upgrading the functionality and cost-effectiveness of required biologics. For example, in 2021, the pharmaceutical industry's R&D spending accounted for USD 14.5 billion, representing an increase of 54.59% in the last five years, according to the NLM report of July 2025. Similarly, the Vaccine Network, organized by the UK, prepared an expenditure for testing single-dose candidates to identify substitutes for prime-boost regimens.

-

Rising patient pool: As per the CDC report in May 2024, the number of Ebola cases registered in the West Africa Ebola outbreak recorded more than 28,600 confirmed cases and 11,325 deaths, underscoring the persistent global health threat. On the other hand, North America and Europe have strengthened their preparedness via vaccine stockpiles, advancements in clinical trials, and contingency planning. While airport-based vaccination hubs have been discussed as potential demand drivers, confirmed implementation remains limited to preparedness strategies.

-

Preventive vaccination expansion: The lack of Ebola virus disease outbreaks has transformed the application of vaccines from outbreak response to prevention. As per the CDC report in April 2024, nearly 145,690 doses were shipped from the global stockpile in 2023, among which 95% (139,120) of them were used for preventive vaccination programs, and 5% (6,570) aided in outbreak response. This shift redefines the process in long-term readiness and prioritizes preventive vaccination, aiding governments and other health organizations in preparedness.

Patient Pool of Ebola Virus from 2014 - 2025

|

Year |

Country |

Species |

Number of Cases |

Number of Deaths |

|

2014 |

Democratic Republic of the Congo |

Orthoebolavirus zairense |

69 |

49 |

|

2017 |

Democratic Republic of the Congo |

Orthoebolavirus zairense |

8 |

4 |

|

2018 |

Democratic Republic of the Congo |

Orthoebolavirus zairense |

3,470 |

2,287 |

|

2020 |

Democratic Republic of the Congo |

Orthoebolavirus zairense |

130 |

55 |

|

2021 |

Democratic Republic of the Congo |

Orthoebolavirus zairense |

11 |

9 |

|

2022 |

Uganda |

Orthoebolavirus sudanense |

164 |

55 |

|

2025 |

Uganda |

Orthoebolavirus sudanense |

12 |

4 |

Source: CDC, May 2024

Challenge

- Risk of loss from compliance delays and counterfeits: The Ebola virus vaccine market faces a constraint in regulatory compliance. Long-term approvals of vaccines increase the prices and fail to meet the international standards, often straining producers, mainly in low-income countries. Further, a delay in regional trial approvals can hinder the launch of the product and reduce the potential for revenue. Moreover, the prevalence of counterfeit vaccines in the developing regions undermines consumer confidence and minimizes the adoption showcasing the risk in the overall market growth and long-term trust in the programs related to vaccinations.

Ebola Virus Vaccine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

249.3 million |

|

Forecast Year Market Size (2035) |

523.4 million |

|

Regional Scope |

|

Ebola Virus Vaccine Market Segmentation:

Target Strain Segment Analysis

In the target strain segment, Zaire ebolavirus dominates the segment and is expected to hold the Ebola virus vaccine market share value of 48.6% by 2035. This dominance is due to the most lethal and historically the cause of the majority of Ebola outbreaks, including the pandemic in West Africa. The rVSV-ZEBOV (Ervebo) was developed specially to target the strain and has received prequalification from WHO. The NLM study published in December 2024 depicts that the effectiveness of the rVSV-ZEBOV vaccine is projected to be 84% against Ebola virus disease, highlighting the widespread use of vaccines during the outbreak of Ebola virus disease. Further, U.S. FDA and CDC emphasize Zaire as the highest-priority strain for research, stockpiling, and outbreak preparedness.

Vaccine Type Segment Analysis

Recombinant viral vector vaccines leads the vaccine type segment and are expected to hold a considerable Ebola virus vaccine market share value by 2035. The segment is driven by its efficiency and rapid immune response against Ebola outbreaks. WHO and CEPI mention that vector-based platforms rVSV-ZEBOV (Ervebo) were used effectively in DRC and Guinea outbreaks, significantly curbing the rate of transmission. Prioritized in WHO's Prequalification and Emergency Use guidelines, these vaccines get regulatory backup and global procurement. Scalable production and being capable of adapting to future mutations also increase market demand, making them the dominant vaccine type by 2035.

Distribution Channel Segment Analysis

Stockpile & emergency reserves lead the segment with Government & NGO supply programs and are expected to hold the largest share of revenue in 2035. Ebola virus vaccine market dominance owes its drive from large-scale purchasing and deployment by institutions like the WHO, Gavi, and UNICEF, handling the Ebola vaccine stockpile to facilitate swift availability in outbreak areas. UNICEF has agreed to keep 500,000 rVSV-ZEBOV Ebola vaccine doses in stock in 2023 to make sure supplies are available and allow for bulk purchasing, distribution, and cold-chain facilities, mainly in the West and Central African regions with high risk.

Our in-depth analysis of the global Ebola virus vaccine market includes the following segments:

| Segment | Subsegment |

|

Vaccine Type |

|

|

Dosage Regimen |

|

|

End user |

|

|

Distribution Channel |

|

|

Target Strain |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ebola Virus Vaccine Market - Regional Analysis

North America Market Insights

North America is anticipated to garner the highest revenue share of 37% in the ebola virus vaccine market throughout the discussed period. The presence of established biopharma pioneers and exceptional government support is fostering the region's leadership over the upcoming years. As per the government of Canada report released in January 2025, the Ebola virus treated in the U.S. received early supportive care and among 27 cases 82% people are diagnosed and survived. On the other hand, Besides, a strong control of the overseas supply, the region also consists of a notable domestic consumer base, fueled by frequent military operations.

The U.S. Ebola virus vaccine market is specialized and preparedness-driven, not mass-market. As reported by the CDC in January 2025, the FDA approved ERVEBO to prevent Ebola disease in individuals aged 12 months of age upwards, which was produced by Merck. Federal funding goes from NIH/NIAID for vaccine research and development and filovirus science, and HHS/BARDA for advanced development and strategic procurement. CDC budgets highlight global health security, surveillance, and readiness rather than domestic mass immunization. Additionally, R&D funding from the NIH to speed up the development of thermostable Ebola vaccines is introducing innovation into this merchandise as well as encouraging more firms to join this cohort.

Trade Data Vaccines for Human Medicine in 2022

|

Country |

Trade Flow |

Product Description |

Trade Value 1000USD |

|

U.S. |

Export |

Vaccines for human medicine |

7,923,202.83 |

|

Canada |

Export |

Vaccines for human medicine |

389,073.27 |

|

U.S. |

Import |

Vaccines for human medicine |

8,938,945.51 |

|

Canada |

Import |

Vaccines for human medicine |

2,285,058.41 |

Source: WITS, 2022

APAC Market Insights

Asia-Pacific is the fastest-growing region in the Ebola virus vaccine market. The market is driven by the demand for Ebola vaccines is primarily driven by preparedness strategies rather than widespread incidence. Public health agencies aim on occupational protection for frontline workers, enhancing cross-border surge capacity, and strengthening cold-chain infrastructure. Governments are aligning policies with international guidelines while benefiting from global partnerships such as WHO, UNICEF, Gavi, and CEPI, which provide funding and technical support. Growth in this region is steady, anchored in readiness and contribution to international outbreak responses.

The Ebola vaccine market in China is led by the regulatory oversight and robust government-led preparedness measures. The National Medical Products Administration has highlighted the surge of approval frameworks for vaccines to overcome the high consequence pathogens. On the other hand, national health authorities integrate Ebola preparedness into broader infectious disease control plans. As per the BMJ report published in July 2023, nearly 700 million vaccines have been produced in China over the past five years. Further, the investment is focused on strengthening the domestic vaccine R&D, expanding biomanufacturing capacity, and ensuring cold-chain readiness.

Europe Market Insights

The Ebola virus vaccine market in Europe is shaped by strong policy support, preparedness strategies, and rising emphasis on public health security. The market is driven due to the demand in the reinforcement by EU-led initiatives on infectious disease response and vaccine innovation, mainly under the European Health Emergency Preparedness and Response Authority. Europe is the global leader in vaccine research, development, and manufacturing, and has held 22% of the global vaccine clinical trials over the past two decades. Further, the European Commission report in June 2022 depicted that in 2021 European Investment Bank has signed a €30 million global vaccine distribution with the biotechnology company for massive production.

Germany plays a vital role in Ebola vaccine preparedness and is driven by the federal investments in global health security and partnering with Gavi and WHO. EIB in January 2025 has funded €9.6 billion to Germany to enhance the competitiveness in pharmaceutical sector. The country’s advanced biotech and CMO ecosystem facilitates fill-finish, scale-up and export-oriented supply chains that meet EMA and WHO prequalification standards, attracting long-term supply contracts. Further, Germany supports vaccine stockpiling, international deployments, and R&D funding through initiatives like CEPI, positioning the country as a leading EU hub for outbreak response and vaccine resilience.

Key Ebola Virus Vaccine Market Players:

- Merck & Co.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Janssen Pharmaceuticals

- GlaxoSmithKline (GSK)

- BioNTech

- Serum Institute of India (SII)

- CanSino Biologics

- Takeda Pharmaceutical

- Moderna

- Bharat Biotech

- CSL Limited

- GreenCross Corp

- Bavarian Nordic

- Biological E. Limited

- Inovio Pharmaceuticals

- Medigen Vaccine Biologics

- EuBiologics

- Biovac

- Valneva

- Incepta Pharmaceuticals

- Pharmaniaga

Currently, the focus of key players in the Ebola virus vaccine market is concentrated on expanding global reach and product pipeline. They are engaging their R&D and financial resources to accomplish these goals. Key strategies to maintain their competency include localized production, mRNA innovation, and large-scale government contracts, which are propelling growth in this sector. Furthermore, the alliance formation between biopharma and biotech leaders is also gaining traction due to the growing trend of fostering comprehensive and competent pricing models across Africa and Asia.

Below is the list of some prominent players operating in the global Ebola virus vaccine market:

Recent Developments

- In September 2024, ReiThera and the Sabin Vaccine Institute collaborated and initiated Phase 2 clinical trial in Uganda for the development of a vaccine against Sudan ebolavirus. Sabin, ReiThera manufactured, released, and shipped the vaccine to Uganda.

- In July 2024, SK bioscience has acquired IDT Biologika, which is the top vaccine manufacturing contractor. SK bioscience acquires 60% of IDT Biologika’s shares from the Klocke Group accounting KRW 339 billion.

- Report ID: 2348

- Published Date: Aug 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ebola Virus Vaccine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.