Ear and Nasal Packing Market Outlook:

Ear and Nasal Packing Market size was over USD 315.6 million in 2025 and is anticipated to cross USD 592.42 million by 2035, witnessing more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ear and nasal packing is assessed at USD 334.06 million.

The primary factor for the expansion of the market size during the forecast period is the rising cases of ear and nasal diseases and infections among the global population. Ear and nasal packing are considered vital for the treatment of ear and nasal diseases. Therefore, doctors are using high-quality ear and nasal packing for fast and efficient treatment which in turn is anticipated to bring lucrative growth opportunities for market growth during the forecast period. As per the World Health Organization (WHO), 1 in 4 people in the world is projected to have hearing problems by 2050. Also, as per a report, it is anticipated that nasal infection is estimated to affect around 1 in every 5 people in the United Kingdom in 2035.

Ear and nasal packing are the medical aid solutions that are used post-surgery for controlling bleeding and fast wound healing. This ear and nasal packing are specifically designed for maintaining the patients after nasal surgery such as edema and nose bleed as the polymers have the efficiency of dissolving into the body with a time interval of 2 to 3 weeks. The global ear and nasal packing market are anticipated to increase rapidly grow on the account of rising contagious illnesses among the global population which increases the risk of infection from aerosol and droplet contamination. This is projected to rise the need for ear and nasal packing and expand the market size during the forecast period. Also, the escalation in the awareness level of the advantages of ear and nasal packing along with the technological advancements in the healthcare sector, and the increasing advantages of minimally invasive ENT surgeries are some of the other factors that are projected to create a positive outlook for market growth in the assessment period.

Key Ear and Nasal Packing Market Insights Summary:

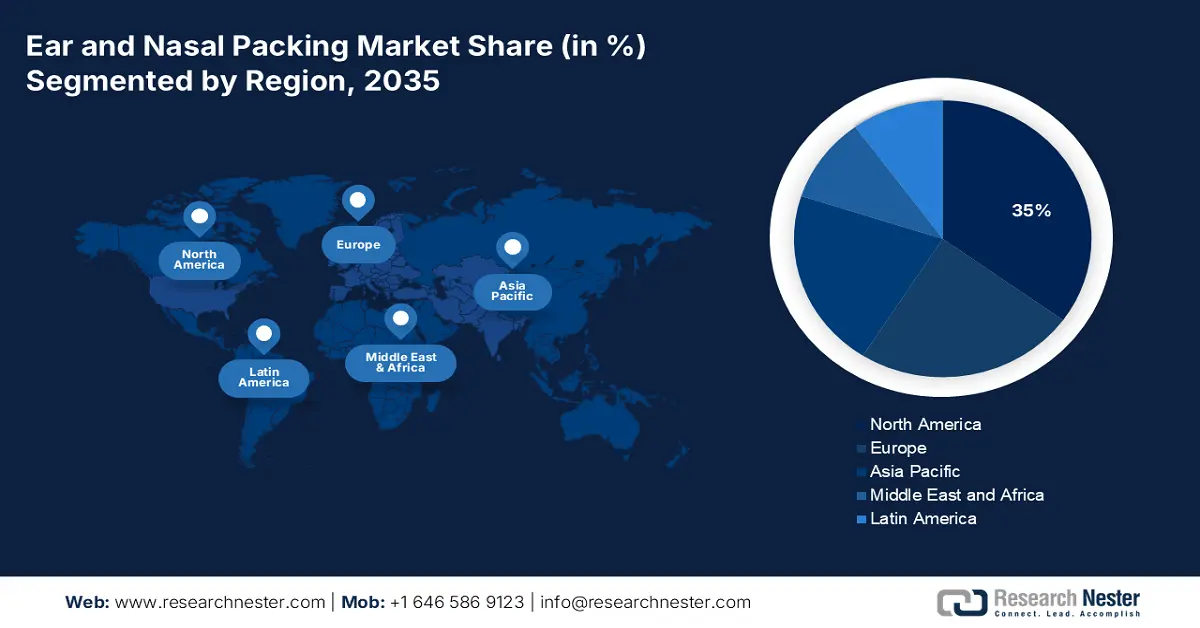

Regional Highlights:

- North America ear and nasal packing market will hold around 35% share by 2035, driven by increasing ear and nose disorder cases and favorable healthcare policies.

- Europe market will capture a 24% share by 2035, attributed to the rising geriatric population and awareness about ear and nasal conditions.

Segment Insights:

- The bio-absorbable segment in the ear and nasal packing market is projected to secure a 59% share by 2035, driven by the advantages of bio-absorbable ear and nasal packing over non-absorbable alternatives.

- The hospital segment in the ear and nasal packing market is anticipated to achieve substantial growth during 2026-2035, attributed to the increasing number of hospitals worldwide and the availability of advanced treatment facilities.

Key Growth Trends:

- Growing Cases of Chronic Sinusitis

- Increase in Level of Air Pollution

Major Challenges:

- Lack of Skilled Professionals

- The High Costs of the Products

Key Players: Stryker Corporation, Cerecor, Inc., Bausch Health Companies Inc., Boehringer Ingelheim International GmbH, AbbVie Inc., Smith & Nephew plc, Amgen Inc., Novartis AG, Bayer AG, Progenity, Inc.

Global Ear and Nasal Packing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 315.6 million

- 2026 Market Size: USD 334.06 million

- Projected Market Size: USD 592.42 million by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 9 September, 2025

Ear and Nasal Packing Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Cases of Chronic Sinusitis – In the recent period, the cases of chronic sinusitis among the global population have risen considerably owing to the rising air pollution and the presence of toxic pollutants in the air. Therefore, the cases of ear and nasal diseases such as chronic sinusitis have increased considerably across the world. As ear and nasal packing are considered to be an effective solution for otolaryngologists and head and neck surgeons for the treatment of sinusitis, the rise in cases of chronic sinusitis is anticipated to increase the demand for ear and nasal packing in the healthcare industry. As per the data shared by the Centers for Disease Control and Prevention (CDC) in 2019, around 11.6% of Americans and 28.9 million adults in the North American region are diagnosed with sinusitis.

-

Increase in Level of Air Pollution – Owing to rapid urbanization and industrialization, the level of air pollution has considerably grown up in the past years. As a result, people are now being diagnosed with various kinds of ear and nasal infections and diseases. Therefore, this factor is estimated to generate a high demand for ear and nasal packing for effective treatment. Hence, the increasing air pollution over the world is anticipated to bring lucrative growth opportunities for market growth during the analysis period. The data published by the World Health Organization (WHO) stated that almost 90% of the global population breathes air that exceeds WHO guideline limits and contains high levels of pollutants. Further, it is estimated that air pollution is responsible for taking up almost 11.65% of deaths around the world.

-

High Focus on Developing the Medical Devices Sector - The data revealed by the India Brand Equity Foundation (IBEF) stated that in FY20, the foreign investments in the Indian medical devices sector increased to USD 301 million from USD 151 million in FY19, which indicates a 98% increment.

-

Rising Focus on Bringing Advancement in the Healthcare Industry - For instance, investment in medical and health research and development (R&D) in the United States (U.S.) increased by 11% to around USD 245 billion in 2020 from previous years.

-

Rapid Growth in the Healthcare Industry – According to the latest statistics, it is being calculated that the revenue generated by the global healthcare segment was USD 60 billion in 2023 which is further anticipated to grow further.

Challenges

-

Lack of Skilled Professionals

-

The High Costs of the Products – Ear and nasal packing requires high-quality ingredients. Owing to this factor, the cost of ear and nasal packing increases. This factor is estimated to lower the adoption rate among the population with low and middle income and subsequently hamper market growth during the forecast period.

- Low Awareness Level about the Advantages

Ear and Nasal Packing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 315.6 million |

|

Forecast Year Market Size (2035) |

USD 592.42 million |

|

Regional Scope |

|

Ear and Nasal Packing Market Segmentation:

Type Segment Analysis

The global ear and nasal packing market is segmented and analyzed for demand and supply by type into bio-absorbable, and non-absorbable. Out of the two types of ear and nasal packing, the bio-absorbable segment is estimated to gain the largest market share of about 59% in the year 2035. The primary growth factor segment growth is the advantages of bio-absorbable ear and nasal packing over the non-absorbable ear and nasal packing which includes the integration of organic components, natural ingredients, and non-toxic constituents. Moreover, a rising preference for organic products for medical procedures to reduce the risks of on-site infections and other side effects of chemical-based products. All these factors couple up to fuel segment growth during the assessment period.

End-user Segment Analysis

The global ear and nasal packing market is also segmented and analyzed for demand and supply by end-user into hospitals, specialty clinics, ambulatory centers, and others. Amongst these segments, the hospital segment is expected to garner a significant share of around 42% in the year 2035. The major factors attributed to the growing segment size are the rising number of hospitals across the globe and the availability of features and facilities for the proper conduction of treatment with ear and nasal packing. For instance, there were over 8,000 hospitals in Japan as of 2020. Korea, by contrast, had about 4,000 hospitals. In addition, there were more than 6000 hospitals in the United States. Also, the preference of hospitals for treatment as the result of trained medical staff and professionals for proper use of ear and nasal packing during surgeries is estimated to expand the segment size in the upcoming years.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Material |

|

|

By Product |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ear and Nasal Packing Market Regional Analysis:

North American Market Insights

North America industry is estimated to dominate majority revenue share of 35% by 2035. The major factor for market growth in the region is the increasing incidences of ear and nose disorders, such as sinus in the region. According to the data from the Centers for Disease Control and Prevention, in the United States, 11.6% of adults were diagnosed with sinusitis in 2020. Moreover, people have easier access to better healthcare facilities, backed by favorable medical reimbursement policies by the government and regulatory bodies which is also estimated to create favorable opportunities for market growth during the assessment period. Further, the presence of a strong healthcare network in the region, with the availability of supportive policies along with the region's expanding healthcare industry and the increasing adoption of healthcare quality management are also anticipated to boost market growth during the forecast period.

Europe Market Insights

The European ear and nasal packing market are estimated to be the second largest, registering a share of about 24% by the end of 2035. The burgeoning geriatric population who are more prone to ear and nasal diseases in the body and the presence of a large pool of patients in the region are majorly contributing positively to market growth. In addition to other factors, the expansion of ASEAN and Japan digital advertising in pharma and medical equipment is also estimated to increase the awareness level of ear and nasal illnesses and ear and nasal packing among the population and aid the expansion of the market in the region.

Europe region is projected to observe substantial growth through 2035. The factors that are expected to contribute positively to market expansion in the region are rising research and development activities along with the proven success in the development of ear and nasal packing as an efficient treatment method. In addition, the rising prevalence of various types of chronic ear, nose, and throat diseases and disorders among the European people is also estimated to create a favorable outlook for market growth during the forecast period.

Ear and Nasal Packing Market Players:

- Stryker Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cerecor, Inc.

- Bausch Health Companies Inc.

- Boehringer Ingelheim International GmbH

- AbbVie Inc.

- Smith & Nephew plc

- Amgen Inc.

- Novartis AG

- Bayer AG

- Progenity, Inc.

Recent Developments

-

Stryker Corporation - Vocera, a part of Stryker Corporation, launched a new wearable, voice-driven device that enables health workers to communicate completely hands-free.

-

Smith & Nephew plc announced the launch of PICO 7 and PICO 14 negative pressure wound therapy systems, for superficial and deep surgical incisions. The U.S. Food and Drug Administration (FDA) has approved the systems for use on closed surgical incisions.

- Report ID: 4035

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ear and Nasal Packing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.