E-Visa Market Outlook:

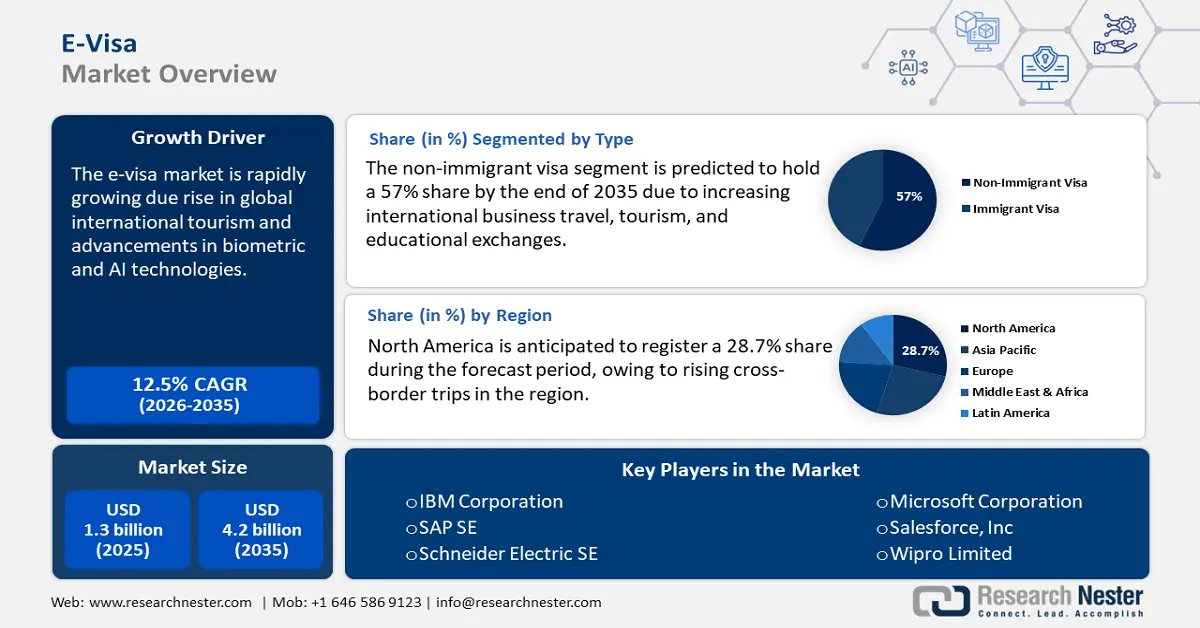

E-Visa Market size was valued at USD 1.3 billion in 2025 and is projected to reach USD 4.2 billion by the end of 2035, rising at a CAGR of 12.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of e-visa is assessed at USD 1.4 billion.

The rapid rise in global international tourism is a major driver for the growth of the e-visa market. As global mobility rises, travelers demand quicker, convenient, and hassle-free visa application processes. Traditional visa procedures, often defined by long queues, extensive paperwork, and delays, no longer align with the expectations of modern, digitally savvy travelers. Governments around the globe are responding to this shift by adopting e-visa systems, which allow travelers to apply for visas online without visiting embassies or consulates. This not only improves consumer experience but also optimizes internal processing and resource allocation for immigration authorities.

India serves as an important example of how e-visa systems can fuel tourism growth. The government of India has expanded its e-visa program to citizens of over 172 countries, making it one of the most accessible visa regimes globally. This surge is directly linked to improvements in the digital visa experience, which includes simplified online forms, faster processing times, and multilingual support. As a result, tourism revenue has seen a substantial boost, supporting local economies and reinforcing the value of e-visa programs. Moreover, the outbreak of the COVID-19 pandemic has increased the demand for contactless and virtual services, encouraging the adoption of e-visas as a safer alternative to in-person processing. The intersection of rising global tourism and growing demand for easy digital services is pushing nations to modernize border entry systems, making e-visas a key tool in supporting economic growth through travel and tourism.

According to the UN Tourism’s latest World Tourism Barometer, around 1.4 billion people traveled internationally in 2024, nearly reaching 99% the levels before the pandemic. This indicates an 11% increase from 2023, with 140 million more tourists. The prime factor driving this growth after the pandemic is good performance from major travel markets and the continued recovery of destinations in Asia Pacific. Increasing investments in technology, such as USCIS’s inflation-adjusted premium processing fees, necessitate the demand for digital upgradation. On a global scale, the e-visa supply chain relies on trade in tech goods and services with international collaboration and regulatory guidelines as key to smooth operations.

|

The Middle East, Europe, and Africa see the strongest results in 2024 relative to 2019 |

|||

|

Region |

2024 Arrivals (Million) |

Change vs. 2019 |

Change vs. 2023 |

|

Middle East |

95 |

+32% |

+1% |

|

Africa |

74 |

+7% |

+12% |

|

Europe |

747 |

+1% |

+5% |

Source: UN Tourism

Key E-Visa Market Insights Summary:

Regional Highlights:

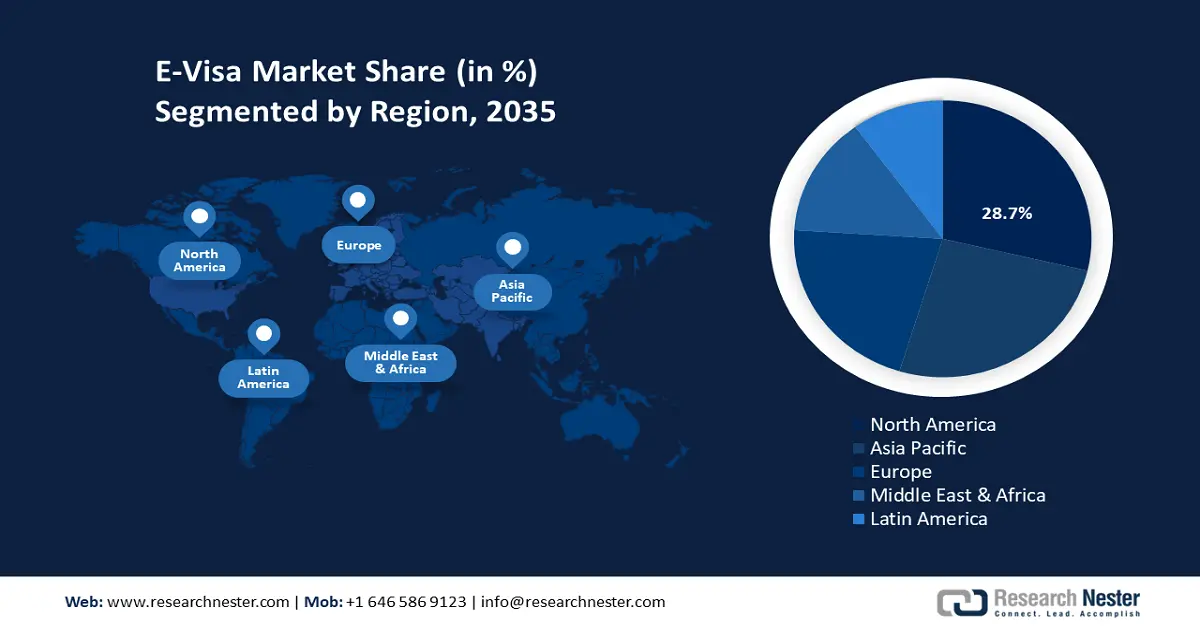

- By 2035, North America is anticipated to command a 28.7% share of the E-Visa Market, supported by escalating cross-border travel and expanding electronic travel authorization systems owing to rising digital immigration initiatives.

- The APAC region is projected to grow at a 14.8% CAGR from 2026–2035, underpinned by rapid digital infrastructure development and surging tourist mobility across key economies impelled by accelerated government digitalization programs.

Segment Insights:

- The non-immigrant visa segment is projected to secure a 57% share by 2035 in the E-Visa Market, reinforced by the rising need for short-term travel and streamlined digital visa processing stimulated by government efforts to simplify applications.

- The leisure travel segment is anticipated to hold a 47% share during 2026–2035, supported by increasing tourism spending and a global post-pandemic travel resurgence encouraged by the convenience and speed of e-visa issuance.

Key Growth Trends:

- Advancements in biometric and AI technologies

- Government initiatives and digital transformation

Major Challenges:

- Cybersecurity Challenges

- Digital infrastructure gaps

Key Players: IBM Corporation, SAP SE, Schneider Electric SE, ENGIE SA, Microsoft Corporation, Salesforce, Inc., Enablon (Wolters Kluwer), Sphera Solutions, Inc., Intelex Technologies, Envirosuite Limited, Infosys Limited, Wipro Limited, DHI Group, Hitachi Ltd., Mitsubishi Electric Corporation.

Global E-Visa Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.3 billion

- 2026 Market Size: USD 1.4 billion

- Projected Market Size: USD 4.2 billion by 2035

- Growth Forecasts: 12.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (28.7% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, India, United Kingdom, Germany

- Emerging Countries: Indonesia, Vietnam, Philippines, Mexico, United Arab Emirates

Last updated on : 30 September, 2025

E-Visa Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in biometric and AI technologies: The incorporation of biometric authentication methods such as facial recognition, iris scanning, and fingerprint identification has significantly increased the security and accuracy of e-visa systems. The use of AI in automating the decision-making process flags fraudulent applications and accelerates the visa approval process. These technologies help governments reduce human error, enhance national safety, and offer faster service to travelers. For instance, in February 2025, VFS Global introduced a generative AI-powered chatbot to help UK visa applicants in over 141 countries. The chatbot handles customer inquiries, guides users through application procedures, and offers 24/7 multilingual support, significantly enhancing user experience and reducing manual workload. AI tools like this are also being used for real-time risk assessment and fraud detection, showcasing how intelligent automation is reshaping e-Visa services.

- Government initiatives and digital transformation: Governments across the globe are emphasizing digital transformation as part of a broader policy strategy aimed at improving governance and public service delivery. In the immigration sector, this has resulted in the digitization of visa systems, allowing seamless data handling, faster processing, and transparency. Many countries are collaborating with private tech firms to build flexible, secure digital platforms for e-Visas. In August 2025, the Ministry of Home Affairs revealed that India had expanded its e-visa facility to include 172 countries, making it one of the most accessible digital visa systems globally. This move has significantly boosted tourism, made business travel and bureaucratic procedures convenient. This move is a reflection of India’s wider digital governance efforts, such as the Digital India initiative.

- Cost efficiency and administrative streamlining: One of the key advantages of e-visa systems is the decrease in operational and administrative expenditures. Digital visa platforms remove the need for physical paperwork, postal deliveries, and in-person visits, leading to significant savings in time and resources for visa applicants and the government. These savings can be redirected into improving infrastructure or scaling up digital services. Multiple reports, including those from Global Growth Insights and Market Research, highlight how e-Visas cut down on the cost of printing, distributing physical documents, and employing large processing teams. Governments have reported increased efficiency in visa issuance, with turnaround times shrinking from weeks to just a few days, thanks to centralized digital processing systems.

Challenges

- Cybersecurity Challenges: One main challenge of the e-visa market is the rising cybersecurity concerns. As e-Visa systems manage sensitive personal and biometric data, they are the main targets for cyberattacks and data breaches. Thus, ensuring robust security measures across all components, such as data storage, identity verification, and application processing, is critical. However, maintaining high security while scaling systems globally and integrating third-party technologies remains complex and expensive. A slight exposure to risks can compromise user trust and disturb international travel and immigration processes.

- Digital infrastructure gaps: The digital infrastructure gaps are significant barriers to the adoption of e-visa platforms. Most countries in the developing regions have low infrastructure development budgets, which directly impacts the trade of ICT solutions, including e-visa solutions. The limited broadband coverage and access to mobile internet further deter the expansion of the e-visa solution trade.

E-Visa Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.5% |

|

Base Year Market Size (2025) |

USD 1.3 billion |

|

Forecast Year Market Size (2035) |

USD 4.2 billion |

|

Regional Scope |

|

E-Visa Market Segmentation:

Type Segment Analysis

The non-immigrant visa segment is predicted to hold a 57% e-visa market share by the end of 2035 due to increasing international business travel, tourism, and educational exchanges. This visa type is tailored to short-term stays, making it highly demanded by professionals, students, and tourists. The growth is fueled by the government's push to simplify visa application procedures to bring in foreign visitors and boost economic activity. In 2023, DHS granted an estimated 132 million nonimmigrant admissions to the U.S., according to the Department of Homeland Security report. This showcases higher demand for short-term travel. Further, advancements in digital technology have made non-immigrant visas easier and quicker to apply for online. This enhances user convenience, improves turnaround times, and reduces paperwork. As worldwide mobility solutions recover after the pandemic, the non-immigrant e-visa segment is expected to expand significantly.

Application Segment Analysis

The leisure travel segment is estimated to register a 47% share during the stipulated time frame. The dominance is attributed to the rising disposable incomes in multiple economies, along with an expanding tourism footfall globally, compounded by the post-pandemic tourism boom. E-Visas tend to offer convenience along with faster processing time for travelers in comparison to traditional visa methods, making the former a lucrative option. The greater preference for e-visas has prompted numerous governments to promote e-visa schemes in a bid to attract tourists and bolster the local economy.

The rise of low-cost airlines has also been a significant catalyst for the segment's profitability. For instance, these airlines have expanded the accessibility of international leisure travel and have ensured that the leisure tourism footfall will substantially increase by the end of 2035. The convergence of the trends is set to ensure that the segment remains dominant throughout the forecast period.

Component Segment Analysis

The software segment is projected to account for the largest e-visa market share throughout the study period. The governments and immigration authorities are prime end users of e-visa software solutions. The flexibility, scalability, and automation capabilities are mainly boosting the sales of advanced e-visa software technologies. The rise of cloud-based platforms is further expected to strengthen the dominance of software systems. Continuous technological advancements are set to enhance the capabilities and revenues of key producers.

Our in-depth analysis of the e-visa market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

Services Type |

|

|

Component |

|

|

Platform |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

E-Visa Market - Regional Analysis

North America Market Insights

The North America e-visa market is poised to register a leading revenue share of 28.7% during the forecast period. A major factor in the market's expansion is the rising cross-border trips in the region. The governments in the U.S., Canada, and Mexico are all investing in electronic travel authorization (ETA) and digital visa platforms, which reflects the region’s shift toward paperless immigration processing. The robust technological advancements and strong presence of tech-savvy consumers are set to promote the trade of e-visa platforms in the years ahead.

The U.S. e-visa market is poised to maintain its leading share in North America. A key driver of the market is the high international traffic volume in the U.S. With the robust digital ecosystem ensuring faster processing times, the opportunities are slated to be rife in the U.S. market throughout the forecast timeline. The U.S. Travel Association reveals that in March 2025, international visits to the country decreased by around 14% compared to the same period last year. The changing government policies are responsible for low tourist visits, leading to less adoption of e-visa applications.

The Canada e-visa market is projected to be driven by its Electronic Travel Authorization (eTA) system. The eTA mandatory for visa-exempt foreign nationals traveling by air is set to fuel the use of e-visa platforms. The number of personal vehicles visiting the U.S. from Canada was around 13,345,500 in 2024, according to the analysis by the U.S. Department of Transportation. Thus, both air and road transport activities are amplifying the demand for advanced e-visa solutions.

Asia Pacific Market Insights

The APAC e-visa market is estimated to exhibit the largest expansion, rising at a CAGR of 14.8% between 2026 and 2035. The APAC market is reinforced by the rapid expansion in digital infrastructure and heightened cross-border travel across the region. Economies such as India, Japan, and China in APAC have reported large-scale tourist footfalls after the pandemic. The proliferation of digital infrastructure has ensured faster processing time for E-Visas, making them a preferred means of travel. Additional countries such as Australia, Indonesia, Taiwan, Thailand, Singapore, Philippines, Vietnam, and New Zealand are accelerating e-visa technology adoption through government digitalization programs supported by agencies like DTA Australia and DICT Philippines.

China is projected to hold the highest revenue share in the APAC e-visa market during the forecast period. A key factor of growth in the China market is the rapid digital transformation bolstered by proactive government initiatives. The government spending on e-visa and other related ICT technologies is also gaining momentum. Opportunities are expected to be rife in providing cloud-based visa processing platforms. With China encouraging greater tourist footfalls in the country, the market is expected to reach maturity by the end of 2035.

The India e-visa market is set to expand at a high pace throughout the study period, owing to supportive government policies and initiatives. The government’s e-Visa facility, which covers categories such as tourism, business, medical, and conference visas, creates a lucrative environment for key players. The Embassy of India in Kuwait announced that starting July 13, 2025, Kuwaiti citizens are able to use the e-Visa service to travel to India. This makes the process easier and more convenient. Also, the increasing tourism activities have increased the use of e-visa solutions.

Europe Market Insights

The Europe e-visa market is set to increase at the fastest pace from 2026 to 2035, owing to its rapidly modernizing border management regulations. The rising tourism, student mobility, and labor migration are also contributing to the increasing demand for e-visa platforms. The growing inbound tourism, particularly from Asia Pacific and North America, is pushing demand for more transparent digital processing such as e-visa platforms.

The Germany e-visa market is foreseen to be driven by its major business hub and a top tourist destination. The digital shift and increasing integration of biometric screening have fueled the adoption of e-visa platforms. The strong attraction of students for education has also increased the demand for advanced e-visa software solutions.

The U.K. e-visa market is projected to increase at a robust pace throughout the forecast period, owing to its strong e-visa policy. The government’s fully digital visa and immigration system is positioning the e-visa as a central tool for managing international mobility. The UK’s Electronic Travel Authorization (ETA), launched in phases from 2024, is also contributing to the overall market growth. The robust digitalization and rise in public-private strategies are likely to accelerate the production and commercialization of e-visa platforms.

Key E-Visa Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SAP SE

- Schneider Electric SE

- ENGIE SA

- Microsoft Corporation

- Salesforce, Inc.

- Enablon (Wolters Kluwer)

- Sphera Solutions, Inc.

- Intelex Technologies

- Envirosuite Limited

- Infosys Limited

- Wipro Limited

- DHI Group

- Hitachi Ltd.

- Mitsubishi Electric Corporation

The global e-visa market is expected to remain highly competitive throughout the study period due to the strong presence of mature companies. Leading companies are investing heavily in research and development activities to introduce next-gen solutions. They are also entering into strategic collaborations and partnerships to increase their revenue shares and reach. Further, some of the key players are expanding their operations in the developing regions to earn lucrative gains from untapped opportunities. Given below is a table of the top players in the market with their respective shares.

Recent Developments

- In July 2025, the European Union announced ETIAS, a new travel permit for people who don’t need a visa to visit 30 European countries. ETIAS is set to begin working in the last three months of 2026.

- In May 2024, the Embassy of Iraq in Washington launched an e-visa service to make applying for a visa easier. This initiative has enabled people to apply for a visa online without visiting the embassy.

- Report ID: 3227

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

E-Visa Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.