Dystonia Drugs Market Outlook:

Dystonia Drugs Market size was valued at USD 0.94 billion in 2025 and is projected to reach USD 1.53 billion by the end of 2035, rising at a CAGR of approximately 5% during the forecast period (2026–2035). In 2026, the industry size of dystonia drugs is evaluated at USD 0.99 billion.

In 2023, the National Institutes of Health published a report stating that dystonia is 3rd most prevalent movement disorder, affecting 500,000 children and adults in North America. This surge in patient volume has resulted in a consistent increase in the active pharmaceutical ingredient supply and finished drug production. The botulinum toxin API, manufactured in various countries such as Germany, the U.S., and Ireland, is strictly regulated due to its biological origin and is categorized as a Schedule A substance under the FDA and EMA.

The trade dynamics of the drug are significantly shaped by the worldwide movement of high-value biologics, mainly botulinum toxin products. The product mainly originates from Germany, the UK, and Ireland, and requires strict cold chain logistics. Additionally, the largest import market is the U.S., becoming hugely exposed to altering policies such as tariffs on imports. On the other hand, oral medicines rely heavily on raw materials from China and India. This means that any issues or policy changes in these countries result in a lack of supply everywhere. To eradicate the chances of any disruptions, market players are giving attention to adequate storage facilities and backup suppliers.

Key Dystonia Drugs Market Insights Summary:

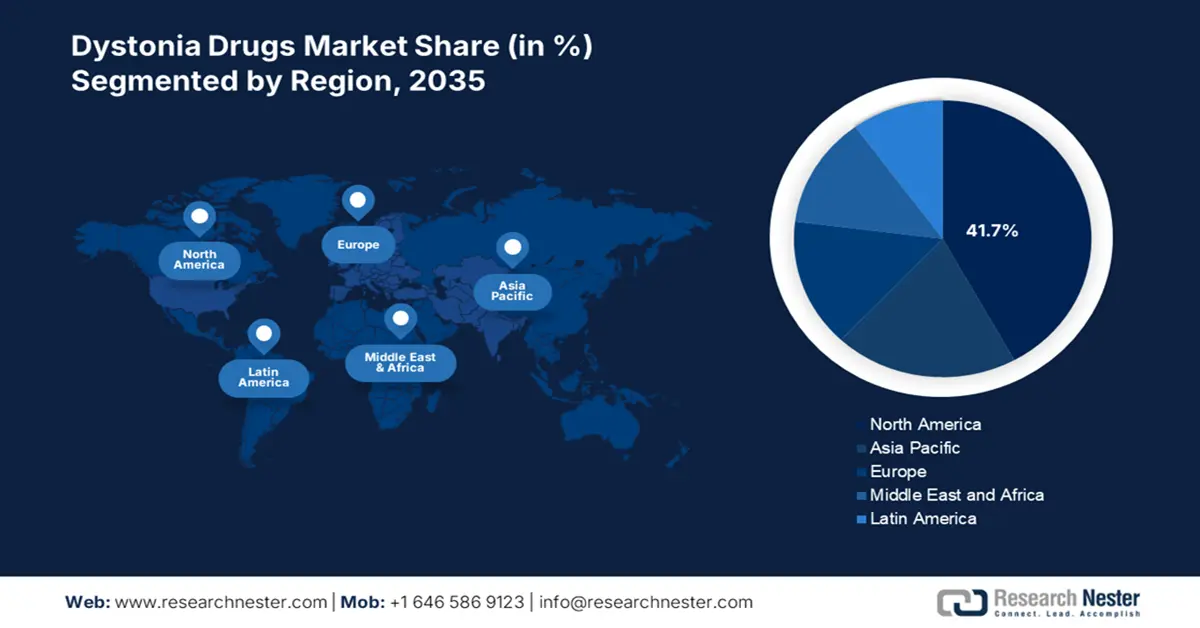

Regional Highlights:

- North America is anticipated to capture 41.7% share by 2035, fueled by high prevalence rates, robust reimbursement frameworks, and substantial healthcare expenditure.

- APAC is expected to hold 20.8% share by 2035, impelled by enhancements in public health infrastructure and government-backed funding for neurological disorders.

Segment Insights:

- Injectable segment is projected to account for 41.8% share by 2035, propelled by clinical preference for administering botulinum toxin.

- Botulinum toxin segment is expected to hold 39.9% share by 2035, owing to its targeted and localized muscle relaxation effect.

Key Growth Trends:

- Aging population and associated risk factor

- Advancements in drug development and delivery

Major Challenges:

- Government-imposed price caps

Key Players: AbbVie Inc., Ipsen Pharma, Merz Pharmaceuticals GmbH, Revance Therapeutics, Inc., Daewoong Pharmaceutical, Evolus, Inc., Hugel, Inc., MediTox Inc., Kyowa Kirin Co., Ltd., Sun Pharma, Teijin Pharma Ltd., Cipla Ltd., Zydus Lifesciences Ltd., Oba Pharmaceuticals, Glenmark Pharmaceuticals, Sanofi, Viatris Inc. (formerly Mylan), BioCSL (Seqirus), Hovid Berhad, Allergan Aesthetics (AbbVie)

Global Dystonia Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 0.94 billion

- 2026 Market Size: USD 0.99 billion

- Projected Market Size: USD 1.53 billion by 2035

- Growth Forecasts: 5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, France, Canada

- Emerging Countries: India, China, Japan, South Korea, Brazil

Last updated on : 27 August, 2025

Dystonia Drugs Market - Growth Drivers and Challenges

Growth Drivers

- Aging population and associated risk factors: According to the World Health Organization, by 2050, the global population of people aging more than 60 years and older will reach 2.1 billion. Aging is one of the prominent factors for causing dystonia, mainly the segmental form. The geriatric population is more susceptible to dystonia and usually needs treatment to maintain an adequate quality of life and eliminate the chances of secondary complications such as musculoskeletal issues. The rising geriatric population demographic trend is leading to increased demand for long-term drug therapy and recurring administration of botulinum toxin.

- Advancements in drug development and delivery: The significant progress in conducting pharmaceutical research is due to the adoption of next-generation treatment with enhanced efficacy. According to the European Federation of Pharmaceutical Industries and Associations in 2022, USD 54.7 billion was spent on research and development in the pharmaceutical industry. These factors are also propelling the market growth with the emergence of novel delivery systems, such as minimally invasive injection strategies are enhancing the patient outcomes. These advancements are upgrading therapeutic performance and rendering numerous opportunities for manufacturers, driving the revenue growth.

- Integration of digital health and telemedicine: The widespread utilization of telemedicine is enhancing patient access even in underserved or remote areas. The implementation of virtual consultations allows the neurologists to assess the symptoms and suggest the required pharmacological treatments. The enhanced accessibility to medical services leads to swift diagnosis, bolstering the demand for dystonia drugs as soon as the treatment starts. Additionally, early detection with AI tools analyzes patient-submitted recordings that identify involuntary movement traits of the dystonia. These factors are propelling the market growth during the forecasted period.

Challenges

- Government-imposed price caps: Many governments provide a robust pricing strategy for dystonia drugs such as botulinum toxin and anticholinergics to control public healthcare spending and hence limit the manufacturer's profits. Various market players are transforming their pricing strategies by having a strategic partnership with national health agencies. With the help of these partnerships, companies are negotiating the broader reimbursement terms that increase the market access and reimbursement coverage.

Dystonia Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 0.94 billion |

|

Forecast Year Market Size (2035) |

USD 1.53 billion |

|

Regional Scope |

|

Dystonia Drugs Market Segmentation:

Route of Administration Segment Analysis

Under the route of administration, the injectable segment is dominating the dystonia drugs market and is expected to hold the maximum share of 41.8% by 2035. The injectable segments hold the higher revenue share due to the clinical preference for administering botulinum toxin. This toxin is formally used every 13 to 17 weeks and provides precise, region-specific relief from symptoms. In individuals with dystonia, intramuscular injections are linked to better motor control and a higher quality of life, according to the U.S. National Library of Medicine.

Drug Class Segment Analysis

In the drug class segment, the botulinum toxin segment registers the largest share and is expected to have 39.9% of revenue share in 2035. The botulinum toxin segment is witnessing the largest growth in the market due to the targeted and localized muscle relaxation effect, particularly in focal, laryngeal, and cervical dystonia. Long-term effectiveness evidence supports it as the sole FDA-approved treatment for cervical dystonia. According to NIH, botulinum toxin injections are to be the first-line treatment for focal dystonia with a long-lasting formulation in clinical trials.

Distribution Channel Segment Analysis

The hospital segment is anticipated to register the maximum share of 52% for the dystonia drugs during the forecasted period. The main treatment includes injections of the botulinum toxin, which requires specialist supervision. Most of the time, this supervision is mainly administered in hospitals and creates a robust dependency on the hospital for the procurement of the drugs. Also, a plethora of drugs for dystonia needs cold storage and temperature-controlled conditions, making hospitals perfect for adequate management from a distribution point of view.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Route of Administration |

|

|

Drug Class |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dystonia Drugs Market - Regional Analysis

North America Market Insights

North America is the dominant player in the dystonia drugs industry and is projected to hold a market share of 41.7% with a CAGR of 8.2% by 2035. The market is mainly driven by the high prevalence rates, robust reimbursement frameworks, and substantial healthcare expenditure. The U.S. leads the market share with the widespread access to botulinum toxin therapies like Botox and Dysport, supported by Medicaid and Medicare. Also, the region is witnessing significant growth with the rising telehealth and telepharmacy follow-ups.

The U.S. holds the largest share in the North America market and is driven by Medicare and Medicaid expansion policies, strong federal funding for neurological disorders, and greater diagnostic rates. In the U.S., Botulinum toxin type A is the 1st line treatment for most forms of dystonia. There has been a surge in awareness amongst the patients as well as healthcare professionals regarding the efficacy of injections based on botulinum toxin. Additionally, the market in Canada is growing as Botulinum toxin injections remain the gold standard for handling focal dystonia in the country. Also, the publicly funded healthcare system remarkably supports access to dystonia treatments.

Asia Pacific Regional Insights

The APAC region is the fastest-growing sector in the dystonia drugs market and is expected to hold the market share of 20.8% with a CAGR of 8.9% in 2035. The market is driven by the enhancements in the public health infrastructure, government-backed funding for neurological disorders, and rising diagnostic rates. According to data published by the United Nations, in India, the elderly population is projected to reach a staggering 347 million by 2050. The geriatric population is more susceptible to dystonia; thereby, the growing patient pool is creating significant demand for effective treatment of dystonia, positioning the market in leading positions in the coming years.

In Japan, the Ministry of Health, Labour and Welfare in Japan and Japan Agency for Medical Research and Development have a major role in funding for R&D related to neurological treatments and innovations. Their focus is mainly on the enhancements in botulinum toxin-based treatments, impacting the government’s commitment to expanding the innovation in dystonia care among the aging population. The market in Japan is also benefiting from the robust presence of both multinational and domestic pharmaceutical companies. The introduction of advanced therapies bolsters innovations, thereby propelling the overall growth of the market.

Europe Regional Insights

The Europe dystonia drugs market is expanding rapidly and is projected to be the dominant region by 2035 by holding the market share of 27.9% with a CAGR of 7.7%. The market in Europe is driven by the rise in aging population, increasing early diagnosis rates of neurological disorders, and strong government funding. The EU4Health Programme and the European Health Data Space are essential in coordinating member state initiatives to enhance access and innovation for uncommon disorders, such as dystonia. The market in Germany is driven by the extensive healthcare funding, high diagnostic capabilities, and centralized reimbursement policies.

Furthermore, Germany has introduced many neuro care centers under public funding to access the injectable therapies and rehabilitative treatments. Owing to these factors, the market is set to witness unprecedented growth in the country. Also, European pharmaceutical players such as Ipsen, which has its headquarters in France, are developing unique indications and formulations. The expanding applications of the botulinum toxin are fueling the market growth during the forecasted period.

Key Dystonia Drugs Market Players:

- AbbVie Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ipsen Pharma

- Merz Pharmaceuticals GmbH

- Revance Therapeutics, Inc.

- Daewoong Pharmaceutical

- Evolus, Inc.

- Hugel, Inc.

- MediTox Inc.

- Kyowa Kirin Co., Ltd.

- Sun Pharma

- Teijin Pharma Ltd.

- Cipla Ltd.

- Zydus Lifesciences Ltd.

- Oba Pharmaceuticals

- Glenmark Pharmaceuticals

- Sanofi

- Viatris Inc. (formerly Mylan)

- BioCSL (Seqirus)

- Hovid Berhad

- Allergan Aesthetics (AbbVie)

The global market is dominated by key players, including Ipsen, Merz, bVie, and Revance holding significant market share via botulinum toxin brands such as Dysport, Botox, and Xeomin. These companies lead with the approvals of EMA and FDA, innovation in extended-release formulations, and global licensing deals. Some rising manufacturers in Asia lead the market with biosimilars and region-specific alliances. Strategic initiatives include technology transfer partnerships, Medicare-linked reimbursements, and orphan drug designations.

Some of the prominent companies are:

Recent Developments

- In May 2024, Revance Therapeutics expanded the Launch of Daxxify for Cervical Dystonia with FDA approval for cervical dystonia. This launch has led to a rise in the neurological segment revenue. This launch marks a major advance in dystonia therapy. Unlike traditional botulinum toxins, DAXXIFY uses Peptide Exchange Technology.

- In April 2024, FDA approved Ingrezza Sprinkle, a granule formulation of Neurocrine Biosciences’ Ingrezza (valbenazine). This offers a swallowable alternative—ideal for patients with dysphagia or swallowing difficulties—used to treat movement disorders like tardive dyskinesia and chorea.

- Report ID: 3473

- Published Date: Aug 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dystonia Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.