Dyspnea Treatment Market Outlook:

Dyspnea Treatment Market size was over USD 7.07 billion in 2025 and is poised to exceed USD 13.78 billion by 2035, witnessing over 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dyspnea treatment is estimated at USD 7.51 billion.

The growth of the dyspnea treatment market can be characterized by contemporary lifestyle and environmental changes. There is a fast-rising prevalence of respiratory disorders such as COPD, asthma, and certain cardiovascular disorders that have been linked with dyspnea as a primary symptom. For instance, in April 2024, a Pulmonology study revealed that there is a strong relationship between dyspnea and airflow obstruction (OR 3.76). The global mean prevalence of dyspnea stands at 13.7% with notable variations among regions. In Mysore, India, the prevalence is as low as 0%, while the Philippines reports a much higher 28.8%. This underscores the heightened requirement for dyspnea diagnosis in the global landscape for early detection.

In addition, excessive addiction to tobacco and nature degradation led to a surge in breathing concerns, thereby contributing to the need for accessible management strategies. Due to the huge demand, companies undertook acquisitions and collaborations to enhance their respective portfolios. For instance, in November 2020, AptarGroup, Inc. acquired Cohero Health, Inc., including the whole of its operational assets and the proprietary portfolio to enhance the management procedures of asthma and COPD with its innovative tools and technologies. These factors contribute to betterment in respiratory hygiene and the health status of the affected population.

Key Dyspnea Treatment Market Insights Summary:

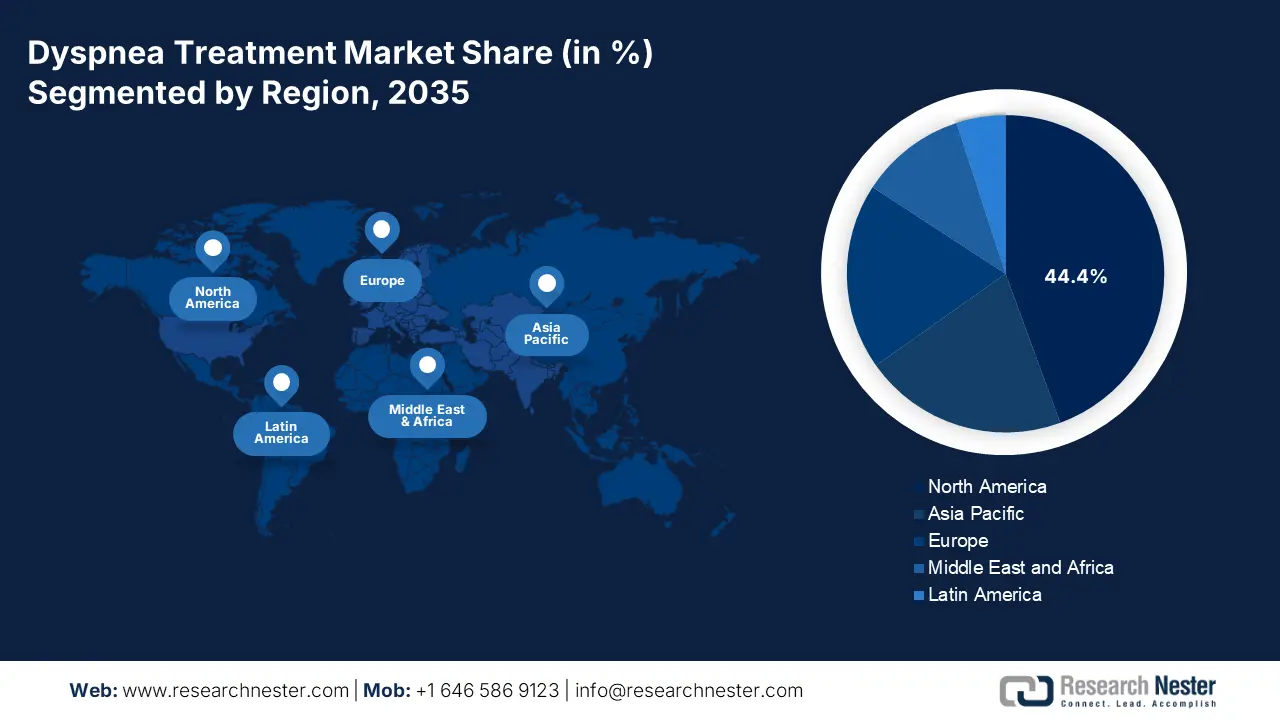

Regional Highlights:

- North America dominates the Dyspnea Treatment Market with a 44.00% share, propelled by the geriatric population, environmental pollution, surge in smoking rates, and supportive regulatory frameworks, fostering growth by 2035.

- Asia Pacific's Dyspnea Treatment Market is poised for lucrative growth from 2026–2035, propelled by an aging population, governmental developmental initiatives, and favorable reimbursement policies.

Segment Insights:

- The Inhalation segment is projected to achieve 62.4% market share by 2035, driven by its rapid action, reduced side effects, and effective delivery to affected airways.

- The Hospitals segment is projected to grow at a considerable rate from 2026 to 2035, supported by robust hospital infrastructure addressing dyspnea and related conditions.

Key Growth Trends:

- Cutting-edge technological breakthroughs

- Increasing occurrence of ventilatory disorders

Major Challenges:

- Lack of standardized treatment protocols

- High cost of targeted therapies

- Key Players: Novartis AG, Boehringer Ingelheim International GmbH, Nephron Pharmaceuticals Corporation, Cadila Healthcare Limited, Mayne Pharma Group Limited, and more.

Global Dyspnea Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.07 billion

- 2026 Market Size: USD 7.51 billion

- Projected Market Size: USD 13.78 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Dyspnea Treatment Market Growth Drivers and Challenges:

Growth Drivers

-

Cutting-edge technological breakthroughs: The major driver of the dyspnea treatment market is the launch of new diagnostics and advanced therapeutics that aid in dyspnea treatment. For instance, in September 2024, Sanofi SA received the U.S. FDA clearance for Dupixent (dupilumab), the first ever biologic to be indicated for patients with COPD and an eosinophilic phenotype in adults in the U.S. This heightened awareness of respiratory health encourages global leaders to develop more of such accurate drugs, which leads to a rising demand for better management strategies for dyspnea treatment.

-

Increasing occurrence of ventilatory disorders: The principal driver for the dyspnea treatment market is the rising burden of respiratory disorders. This would allow treatments aside from the standard procedures, bringing targeted therapies to patients, treating the source of the disorder, and lessening side effects. As per a June 2020 National Institute of Health report, 544·9 million people were diagnosed with respiratory disorders in a year, with an increase of 39·8% over a few decades. Mortality reached 3,914,196 cases with a rise of 18%, thus this underscores the expeditious requirement of early diagnostic interventions, fueling the market growth.

Challenges

-

Lack of standardized treatment protocols: The main bottleneck in the dyspnea treatment market is the lack of standardized and globally approved treatment protocols. Dyspnea itself is a major symptom for various diseases, such as chronic obstructive pulmonary disease, heart failure, and asthma require different management approaches relying on the root cause. This factor makes it difficult for healthcare providers to adopt a one-size-fits-all strategy, resulting in subjective clinical judgment. This lack of evidence-based guidelines leads to poor patient outcomes, hampering the market growth and awareness worldwide.

- High cost of targeted therapies: Another major limiting factor in the dyspnea treatment market is the rising costs of targeted treatments, insurance coverage, mainly due to poor reimbursement of diagnostic tests and treatments that go with respiratory disorders. These costs are further exacerbated by biologics, gene therapies, and targeted medications that are often expensive, making it hard for a particular group of patients to afford them. Thus, some people who require immediate attention do not access these due to such an economic deterrent, thus not only locking people out from full and effective care but further widening disparities in health in communities.

Dyspnea Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 7.07 billion |

|

Forecast Year Market Size (2035) |

USD 13.78 billion |

|

Regional Scope |

|

Dyspnea Treatment Market Segmentation:

Route of Administration (Inhalation, Oral)

Based on route of administration, the inhalation segment is expected to garner the highest share of 62.4% in the dyspnea treatment market by the end of 2035. The dominance of the segment is attributable to its capability of rapid action by reducing side effects and delivering the medication to the affected airways. For instance, in June 2024, Boehringer Ingelheim launched a program to cap the cost of its COPD and asthma inhalers at USD 35 per month for eligible patients in the U.S., aiming to make inhalers more affordable. The growing recognition of inhalation as a major contributor to dyspnea has spurred increased demand for dyspnea tools and treatment options worldwide.

End Users (Hospitals, Home Care, Specialty Centres)

Based on end users, the hospitals segment is projected to grow at a considerable rate in the dyspnea treatment market during the forecast period. This is an immense area of growth since these settings play a crucial role in addressing the dyspnea and associated conditions with their robust infrastructure. According to a May 2020 AAFP Organization study, dyspnea accounts for up to 2.5% of all physician consultations and up to 8.4% of emergency consultations with symptoms, particularly in patients older than 65. Thus, research into new management formulations proves to be helpful, hence, entrenching the hospital visits in managing dyspnea.

Our in-depth analysis of the global market includes the following segments:

|

Route of Administration |

|

|

Distribution Channel |

|

|

End Users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dyspnea Treatment Market Regional Analysis:

North America Market Statistics

The North America dyspnea treatment market is poised to capture the largest share of 44.4% during the forecast period. The dominance of the region is attributable to several key factors, including the geriatric population, environmental pollution, and a surge in smoking rates. Moreover, the region’s supportive regulatory frameworks promote awareness of a healthy life. In August 2024, Johnson & Johnson declared that its RYBREVANT (amivantamab-vmjw) with LAZCLUZE (lazertinib) received U.S FDA clearance. To treat metastatic non-small cell lung cancer with epidermal growth factor receptor exon 19 deletions or exon 21 L858R substitution mutations in adults. Thus, this denotes a positive outlook for market expansion.

The U.S. dyspnea treatment market is unfolding remarkable growth opportunities attributable to the advanced healthcare infrastructure and increasing instances of respiratory, cardiovascular disorders, prompting the demand for effective treatment procedures. For instance, in February 2024, Rigel Pharmaceuticals, Inc. acquired Blueprint Medicines Corporation for the U.S. rights of GAVRETO (pralsetinib), which is indicated to treat metastatic RET fusion-positive non-small cell lung cancer. Hence, it underscores the exceptional demand for effective therapies for respiratory disorders, thereby encouraging the international players to establish their footprint in the country.

The dyspnea treatment market in Canada is witnessing significant growth due to the growing instances of respiratory health deterioration, the impact of pollution, smoking, and other factors. In addition to the Government’s support in promoting effective treatment procedures, the domestic players launching appropriate therapeutics are driving market growth in the country. In February 2024, Olympus Canada Inc. notified the expansion of its respiratory portfolio with the availability of the Spiration Valve System to treat severe emphysema, a form of COPD. Thus, with such expansion strategies, the market is anticipated to witness lucrative growth opportunities during the forecast period.

Asia Pacific Market Analysis

The dyspnea treatment market in Asia Pacific is gaining traction and is expected to witness lucrative growth during the forecast period. The market is augmenting such growth, driven by the aging population experiencing dyspnea, which significantly necessitates effective therapeutics. The key players in the region are implementing developmental initiatives to promote access to advanced healthcare, thereby improving the quality of life. Furthermore, the supportive governments in the region offer favorable reimbursement policies, which exceptionally support the population to receive quality medical care.

The dyspnea treatment market in India is expecting substantial growth owing to the rising awareness about the early detection to avoid long-term complications. Additionally, the adoption of home care and the government’s support, with community health employees such as ASHA, plays a crucial role in educating people and delivering exceptional care, particularly in rural areas. In August 2021, according to the Government of India, the Ministry of Health and Family Welfare will set up 640 NCD clinics at the district level and 5,148 NCD clinics at the community health centre level to treat COPD and asthma. Hence, with such favorable government initiatives, the market will grow at a rapid pace during the forecast period.

The dyspnea treatment market in China is gaining traction due to growing collaborations between pharmaceutical firms, increasing urbanization, and regulatory support, with a collective goal of improving breathing quality through their inventions. For instance, in February 2025, GSK Plc notified that the China NMPA has accepted for review its application for Nucala (mepolizumab), a monoclonal antibody targeting interleukin-5 for patients with COPD experiencing frequent exacerbations. This is the evidence for a wider scope to readily blister the dyspnea treatment market internationally.

Key Dyspnea Treatment Market Players:

- Novartis AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teva Pharmaceutical Industries Ltd.

- Boehringer Ingelheim International GmbH

- Nephron Pharmaceuticals Corporation

- Cadila Healthcare Limited

- Mayne Pharma Group Limited

- Teva Pharmaceutical Industries Ltd.

- Bausch Health Companies Inc.

- Ligand Pharmaceuticals Incorporated

- Lupin Pharmaceuticals Inc.

- GlaxoSmithKline plc.

- Eli Lilly and Company

- Sanofi S.A.

- GSK plc

- AptarGroup, Inc.

- Boehringer Ingelheim

- Johnson & Johnson

- Rigel Pharmaceuticals, Inc.

- Olympus Canada Inc.

The landscape in the dyspnea treatment market is rapidly changing, mainly because of the growing emphasis on enhancing the product portfolio as a critical supporting factor in enhancing accessibility with improved patient outcomes. For instance, in January 2024, GSK plc acquired Aiolos Bio, Inc. by adding AIO-001, a phase II-ready, long-acting antibody targeting the TSLP pathway to its respiratory pipeline for USD 1 billion upfront and up to USD 400 million in milestone payments. This acquisition marks a crucial step in encouraging the global leaders to enhance their developmental tendency, thereby expanding market progression.

Here's the list of some key players:

Recent Developments

- In December 2024, Eli Lilly and Company notified that its Zepbound (tripeptide) received U.S. FDA clearance. This is the first and only prescription medication indicated for adults with obesity and moderate-to-severe obstructive sleep apnea, a sleep-related breathing disorder.

- In March 2023, Sanofi S.A. announced that its Dupixent is the first biologic to demonstrate reduced 30% exacerbations in a Phase 3 trial to treat COPD by notably improving lung function by 160 mL in FEV1 when compared to placebo.

- Report ID: 7628

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dyspnea Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.