Dyspepsia Drugs Market Outlook:

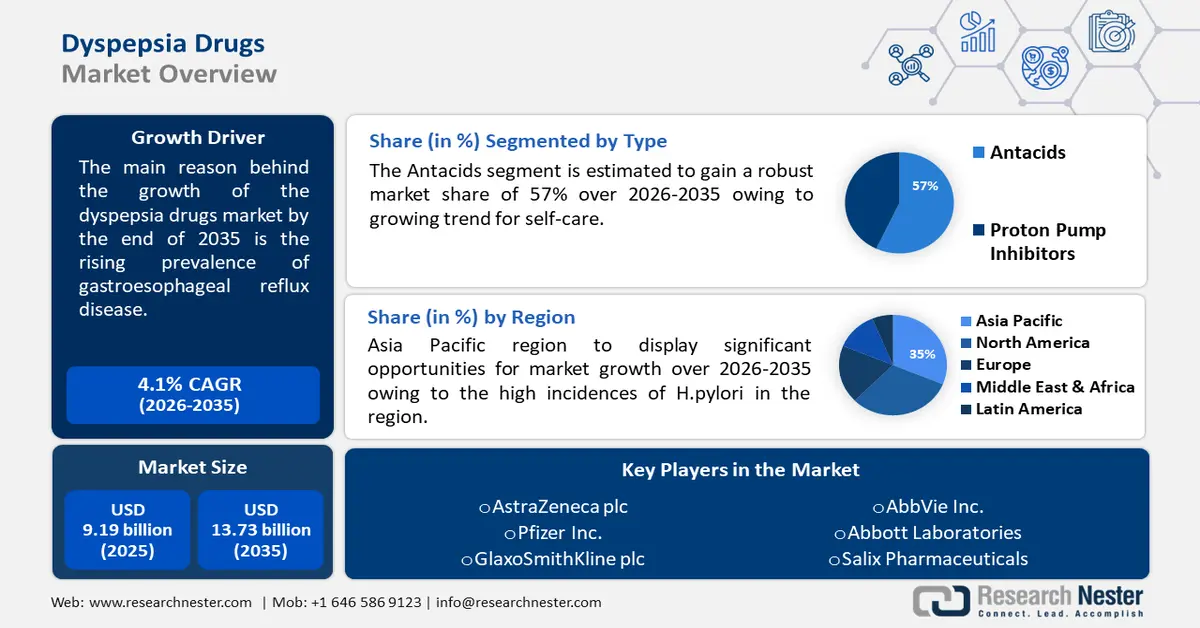

Dyspepsia Drugs Market size was valued at USD 9.19 billion in 2025 and is expected to reach USD 13.73 billion by 2035, expanding at around 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dyspepsia drugs is evaluated at USD 9.53 billion.

The market is expanding due to the rising prevalence of gastroesophageal reflux disease. Around the world, gastroesophageal reflux sickness has become increasingly more generally known as ongoing indigestion prompting expanded interest for compelling dyspepsia therapy.

According to the report, GERD symptoms occur in about 33% of all people worldwide. The prevalence of GERD also varies between men and women, with men more likely to have complications and extraesophageal symptoms.

In addition to this, a factor that is believed to fuel the growth of the dyspepsia drugs market is the growing need for sophisticated pharmaceutical therapies. Pharmaceutical companies can anticipate a substantial increase in demand for dyspepsia drugs as the incidence of GERD continues to grow, which confirms the market's growth.

Key Dyspepsia Drugs Market Insights Summary:

Regional Highlights:

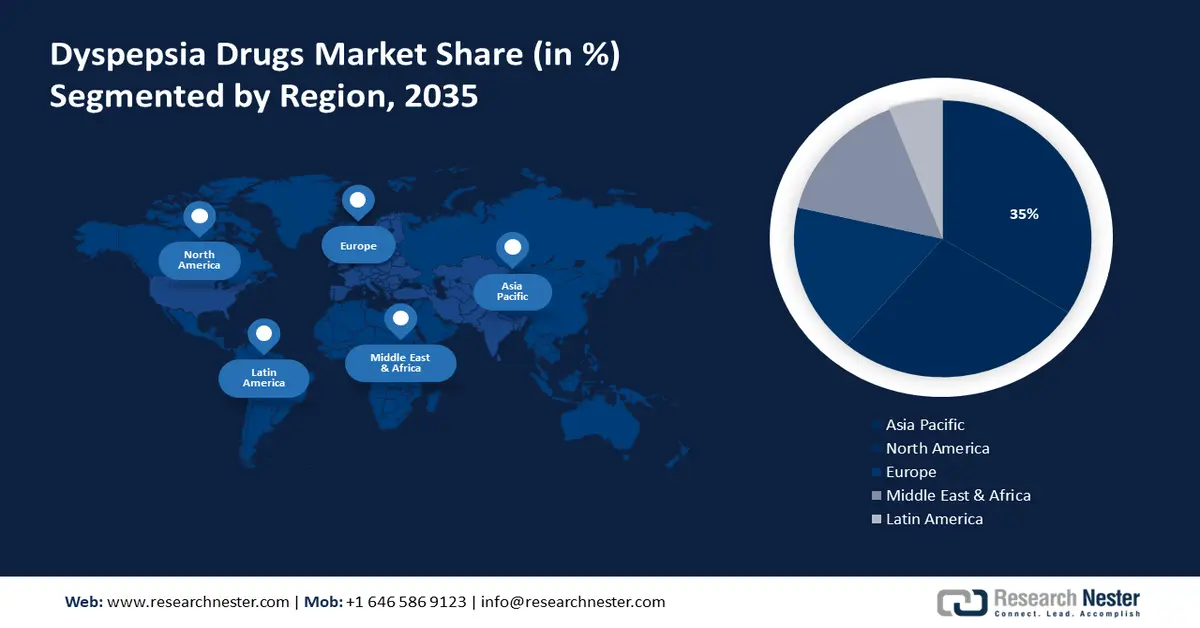

- Asia Pacific dyspepsia drugs market will dominate more than 35% share, driven by high prevalence of H. pylori and increasing need for pharmacological therapy, forecast period 2026–2035.

- North America market will register huge growth, fueled by rising prevalence of GERD and demand for treatments like PPIs and H2 blockers, forecast period 2026–2035.

Segment Insights:

- Antacids segment in the dyspepsia drugs market is projected to achieve 57% growth by the forecast year 2035, fueled by the growing trend towards self-care and over-the-counter availability.

- The hospitals segment in the dyspepsia drugs market is projected to hold a 48% share by 2035, attributed to the rising incidence of severe dyspeptic disorders requiring specialized care.

Key Growth Trends:

- Increasing aging population

- Growing shift towards unhealthy lifestyle choices

Major Challenges:

- Generic competition

- Lack of awareness among people may hinder the market expansion

Key Players: AstraZeneca plc, Pfizer Inc., GlaxoSmithKline plc, Johnson & Johnson Controls, AbbVie Inc., Abbott Laboratories, Salix Pharmaceuticals, Bayer AG, Allergan plc, Sanofi.

Global Dyspepsia Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.19 billion

- 2026 Market Size: USD 9.53 billion

- Projected Market Size: USD 13.73 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 16 September, 2025

Dyspepsia Drugs Market Growth Drivers and Challenges:

Growth Drivers

- Increasing aging population - The aging population is a major growth factor in the dyspepsia drugs market. The prevalence of gastrointestinal problems, especially dyspepsia, naturally increases with age. The aged are more likely to develop disorders including gastritis and peptic ulcers, necessitating the usage of dyspepsia drugs.

For instance, worldwide, there are about 6.3 cases of eosinophilic gastritis for every 100,000 people. This demographic trend toward an older population creates a long-term demand for pharmaceutical interventions to treat age-related digestive disorders. - Growing awareness and diagnosis rates - Increased knowledge of dyspepsia and its associated consequences leads to a greater diagnostic rate. As awareness campaigns and healthcare programs educate the public on the need to treat stomach discomfort, more people are likely to seek medical attention.

This rising knowledge not only benefits early diagnosis but also increases the demand for dyspepsia drugs as part of a management and therapy approach. For instance, "Be Clear on Cancer" campaign was launched in January 2015, which encourages people to see a doctor if they have had heartburn every day for three weeks or more. The campaign's launch coincides with the results of a recent poll done on behalf of Public Health England, which found that only half of respondents (55%) would consult a doctor if they had heartburn every day for three weeks or more. - Growing shift towards unhealthy lifestyle choices - In recent years, the adoption of unhealthy lifestyles has increased, contributing to an increase in dyspepsia prevalence. Dyspepsia can be exacerbated by unhealthy lifestyle choices such as a high-processed food diet, a lack of exercise, and excessive drinking. Consequently, the demand for dyspepsia medicinal products has increased due to people seeking relief from their symptoms.

Several medicines, such as proton pump inhibitors, H2 receptor antagonists, and antacids, have responded to this demand on the dyspepsia drugs. Therefore, this factor is contributing to the growth of dyspepsia drugs market.

Challenges

- Generic competition - Many dyspepsia drugs, particularly antacids, and some proton pump inhibitors, face generic competition. The availability of generic alternatives can lead to price erosion and reduced profit margins for branded medications. Pharmaceutical companies need to navigate the competitive landscape and develop strategies to differentiate their products or explore new formulations to maintain market share. Some dyspepsia drugs, especially those in the proton pump inhibitor (PPI) class, have been associated with long-term use concerns, including an increased risk of fractures, kidney disease, and Clostridium difficile infections.

- Lack of awareness among people may hinder the market expansion

- Lack of skilled professionals may impede the dyspepsia drugs market growth

Dyspepsia Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 9.19 billion |

|

Forecast Year Market Size (2035) |

USD 13.73 billion |

|

Regional Scope |

|

Dyspepsia Drugs Market Segmentation:

Type Segment Analysis

In dyspepsia drugs market, antacids segment is poised to hold more than 57% share by 2035. The segment’s growth is driven by growing trend towards self-care. Heartburn and dyspepsia are prominent symptoms of periodic dyspepsia, which is a widespread condition worldwide. People who want to get relief from these symptoms quickly are driving the demand for antacids.

Due to their accessibility and over-the-counter availability, antacids are a common choice for individuals experiencing mild to moderate dyspeptic discomfort. Nearly 40% of people globally, according to a poll, occasionally experience dyspeptic symptoms. Many persons who experience occasional dyspeptic symptoms prefer to treat their symptoms on their own and use non-prescription options.

Because antacids are widely acquired without a prescription over-the-counter, they meet customers' needs for quick, convenient relief. Antacids' rapid onset of action is a significant advantage. For those seeking quick symptom alleviation from disorders associated with acid reflux, antacids offer a convenient solution.

End User Segment Analysis

In dyspepsia drugs market, hospitals segment is estimated to hold more than 48% revenue share by 2035. Hospital-based therapies are required due to the increasing incidence of severe dyspeptic disorders, which include consequences such as gastrointestinal bleeding, perforated ulcers, and refractory dyspepsia.

Since these situations necessitate specialist medical treatment, the demand for sophisticated therapeutic approaches and extensive inpatient care is driving the rise of the hospital’s category. Serious consequences from complicated gastrointestinal diseases may need emergency medical intervention.

To manage these cases, which require pharmacological therapies, endoscopic procedures, and diagnostic tests, hospitalization becomes necessary. As medical personnel handle the complexity of severe dyspeptic illnesses in an inpatient setting, the hospital segment is growing.

Hospitals are the central locations for extensive diagnostic tests, such as gastroscopy, which are used to determine the underlying reasons for dyspepsia. Patients are drawn to hospital settings by the requirement for precise diagnosis and specialist interventions like therapeutic endoscopy and tissue biopsies. The dyspepsia drugs market is estimated to grow significantly in the segment due to the above-mentioned elements.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End-users |

|

|

Age Group |

|

|

Treatment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dyspepsia Drugs Market Regional Analysis:

APAC Market Insights

Dyspepsia Drugs Market in the Asia Pacific industry is predicted to hold largest revenue share of 35% by 2035. The market growth in the region is also expected on account of the high prevalence of H.pylori. Therefore, the increasing need for pharmacological therapy to treat H. pylori-associated dyspepsia, is influencing the market growth in the region.

Urbanization and changing eating patterns are two factors that are causing dyspepsia to become more common in the Asia-Pacific area. More spicy and high-fat food consumption is associated with gastrointestinal distress, necessitating the use of drugs called dyspepsia. The correlation between food choices and dyspepsia in the area is what drives the necessity for medications to alleviate the condition's symptoms. In this context, the Asia Pacific dyspepsia drugs market is expanding.

North America Market Insights

The North America region will also encounter huge growth for the dyspepsia drugs market during the forecast period and will hold the second position owing to the increasing prevalence of GERD. For instance, every day, approximately 10-20% of Americans suffer GERD symptoms. Proton pump inhibitors (PPIs) and H2 blockers are two dyspepsia treatments that are required for the vast population with GERD, which is driving the market's rise.

The rising rate of dyspepsia in North America is attributed to lifestyle-related variables, such as obesity. The need for dyspepsia medications is fueled by obesity's association with increased incidence of GERD and other gastrointestinal problems. Lifestyle modifications might not be enough on their own, which would push people to look for pharmaceutical remedies and expand the dyspepsia drugs market.

Dyspepsia Drugs Market Players:

- AstraZeneca plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc.

- GlaxoSmithKline plc

- Johnson & Johnson Services, Inc.

- AbbVie Inc.

- Abbott Laboratories

- Salix Pharmaceuticals

- Bayer AG

- Allergan plc

- Sanofi

Recent Developments

- AstraZeneca plc’s LYNPARZA® (olaparib) and IMFINZI® (durvalumab) significantly improved clinical outcomes and more than quadrupled the median duration of response in patients with advanced or recurrent endometrial cancer that was mismatched for repair.

- Bayer announced that The Lancet Respiratory Medicine has published the results of the phase IV REPLACE (Riociguat replaces PDE-5i therapy eVeLuated Against PDE-5i Therapy) trial in adults with intermediate-risk pulmonary arterial hypertension (PAH) (WHO group 1). ) ) switched to Adempas® (riociguat) after inadequate response to phosphodiesterase-5 inhibitor (PDE5i) therapy.

- Report ID: 5649

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dyspepsia Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.