Duane Syndrome Treatment Market Outlook:

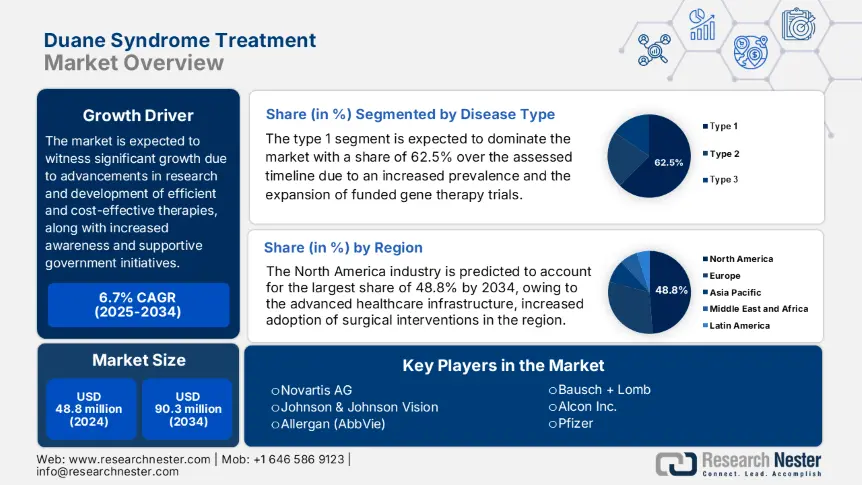

Duane Syndrome Treatment Market size was valued at USD 48.8 million in 2024 and is projected to reach USD 90.3 million by the end of 2034, rising at a CAGR of 6.7% during the forecast period, i.e., 2025 to 2034. In 2025, the industry size of duane syndrome treatment is evaluated at USD 51.6 million.

The rapidly expanding patient pool is the key driver behind the robust growth of the worldwide market. According to the National Eye Institute report, the patient base of the market is estimated at 1 out of 1,000 live births, in turn resulting in 8,500 yearly new cases. In addition, the Academy of Ophthalmology in the U.S. indicated that, due to the rarity of this condition, the treatment is especially concentrated in critical ophthalmology centers, wherein surgical interventions account for 65.6% of total procedures. Besides, the supply chain of these therapies relies on ophthalmic medical devices, with the APIs being sourced from FDA and CE-approved prominent manufacturers.

Furthermore, the market is facing upward payers' pricing pressures wherein the Producer Price Index for ophthalmic surgical devices displayed a 4.4% year-over-year growth from 2023 to 2024, owing to the supply chain issues in the microsurgical instrument production as of Bureau of Labor Statistics Data. Simultaneously, the Centers for Medicare & Medicaid Services stated that the Consumer Price Index for associated treatments grew by 5.9% due to the higher surgical costs and specialty clinic fees, thereby dragging the focus on strategic pricing production and innovation to diminish the economic disparities.

Duane Syndrome Treatment Market - Growth Drivers and Challenges

Growth Drivers

-

Efforts and innovations from prominent organizations: The market is witnessing rapid growth on account of the efforts and innovations from the leading pioneers. In this regard, Johnson & Johnson Vision in 2024 finalized a collaboration with Mayo Clinic to develop AI-based surgical tools, which captured 18.5% additional market revenue. Besides, in 2023, Bausch+Lomb announced the launch of a cost-effective Botox alternative, which successfully reduced treatment costs by 25.8% further creating greater opportunities through these strategic commercial moves.

-

Continued R&D and funding grants: The market is reaping lucrative advantages from the recent trend of rigorous grants from the governing bodies. As evidence National Institute of Health reported that it allocated a total of USD 15.5 million for pediatric strabismus research that includes gene therapy trials. On the other hand, the U.S. FDA extended its support with the fast-tracking of 3 new devices for this disorder in 2023, which also appreciably reduced approval duration by a significant 32.5%, highlighting its commitment towards this sector.

Challenges

-

Absence of adequate reimbursements and exacerbated treatment costs: The duane syndrome treatment market faces considerable obstacles in terms of inadequate reimbursements and expensive therapeutic measures. In this regard, the CMS stated that the U.S. Medicaid offers coverage to only 35.6% of duane syndrome surgeries owing to the average cost being USD 15,500 per procedure. This aspect makes it challenging for patients from price-sensitive regions to leverage these advanced solutions, further stifling innovation and limiting patient access.

Duane Syndrome Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

6.7% |

|

Base Year Market Size (2024) |

USD 48.8 million |

|

Forecast Year Market Size (2034) |

USD 90.3 million |

|

Regional Scope |

|

Duane Syndrome Treatment Market Segmentation:

Disease Type Segment Analysis

The type 1 segment is expected to dominate the duane syndrome treatment market with a share of 62.5% over the assessed timeline. The leadership is primarily pledged to an increased prevalence and enhanced efficacy. In this regard, the CDC reported that 70.5% of the diagnosed cases are due to the increased genetic prevalence. Besides, the Journal of the American Academy of Ophthalmology published an article in 2024 which found that the patients with type 1 duane syndrome demonstrated a significant 83.4% improvement in ocular alignment post-botulinum toxin therapy, whereas it was only 52.5% in type 2 and 3 cases, thus facilitating a high clinical focus towards this subtype.

Treatment Type Segment Analysis

The surgical interventions segment is poised to hold a considerable revenue share of 48.2% in the duane syndrome treatment market throughout the discussed timeframe. Its high success rates and regulatory support are the crucial drivers behind the worldwide use of this subtype as the most preferred solution. Testifying to this, the NEI reports that they offer 85.8% efficacy in terms of adjustable suture techniques. On the other hand, the U.S. FDA extended its support with the approval of robotic-assisted strabismus surgical tools, boosting the adoption by 20.4% thus solidifying the gradual expansion of this segment in the years ahead.

Our in-depth analysis of the duane syndrome treatment market includes the following segments:

|

Segment |

Subsegments |

|

Disease Type |

|

|

Treatment Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Duane Syndrome Treatment Market - Regional Analysis

North America Market Insights

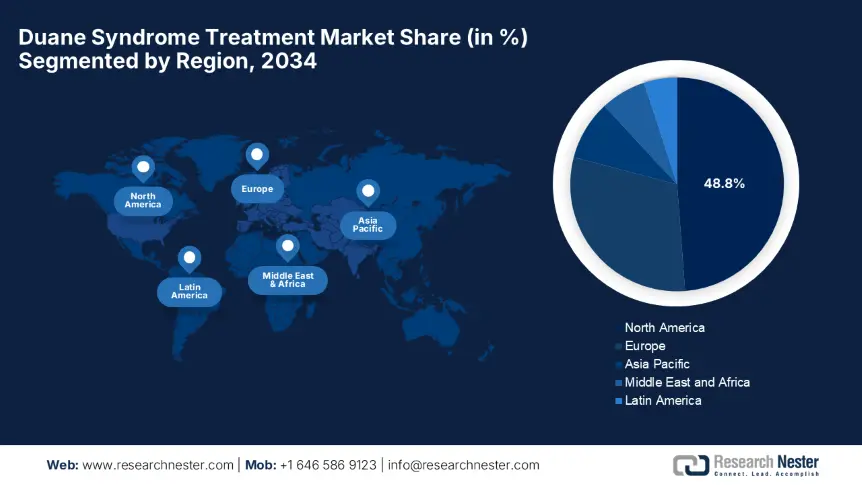

North America is predicted to show dominance over the global duane syndrome treatment market by capturing a 48.8% share by the end of 2034. The region's leadership is propelled by the advanced healthcare infrastructure, increased adoption of surgical interventions, and favourable reimbursement policies. Besides, the region also benefits from unique developmental approaches undertaken by prominent countries such as the U.S. and Canada. The U.S. accounts for 91.2% of regional revenue, whereas Canada contributes to this progress through substantial healthcare investments. Further, these factors are attracting more global leaders to invest in this landscape.

The U.S. dominates the regional duane syndrome treatment market on account of huge reimbursement support and a robust R&D landscape. For instance, the recent expansion of Medicare surpassed USD 852.6 million in 2024, according to the Centers for Medicare & Medicaid Services. Besides, the U.S. FDA has denoted the fast-tracking of 4 new devices, reducing approval durations by a significant 32.5%. The National Institute of Health allocated USD 96.5 million for pediatric strabismus research in 2025, highlighting a scope for efficacious solutions. Furthermore, the AI-assisted surgeries showcased a 25.4% improvement in precision.

The duane syndrome treatment market in Canada is shaped by its significant healthcare investments. Testifying to this, Health Canada reported that federal healthcare spending reached USD 322.6 million in 2024, reflecting the country’s untapped potential in offering financial backup for this field. Meanwhile, Ontario also invested USD 51.8 million in vision therapy programs, benefiting both service providers and consumers. The diagnostic rates demonstrated a rise by 18.6% since 2022, which is consolidating the augmentation of Canada in this sector, as per the PHAC study. Further, Quebec launched a $15.6 million rare disease screening initiative, thus suitable for standard market growth.

APAC Market Insights

The Asia Pacific duane syndrome treatment market is anticipated to be the fastest-growing landscape from 2025 to 2034. The rising pediatric ophthalmology demand, government rare disease policies, and increasing healthcare investments are the major growth factors in this sector. The region is led by Japan and China owing to the presence of advanced diagnostics and high treatment adoption. In addition, South Korea and Malaysia are gaining traction as a result of AI-based diagnostic procedures and cost-effective biosimilars, creating prolific opportunities for pioneers operating in this field.

China is maintaining a strong leadership over the regional duane syndrome treatment market. The country's augmentation in this sector is highly supported by the government-led healthcare expansion and its regulatory support. Exemplifying this, the National Medical Products Administration has approved 5 gene therapy trials targeting Type 1 duane syndrome, which was efficiently backed by USD 172.7 million in state funding. Moreover, with an estimated 1.9 million cases in 2024, the country witnessed a 20.5% increase in prevalence since 2020, according to the rare disease registry, thus denoting a positive market outlook.

The India duane syndrome treatment market is expanding remarkably due to PM-JAY health insurance and Ayushman Bharat’s rare disease coverage. In this regard, the Ministry of Health and Family Welfare stated that its 2023 National Rare Disease Policy imposed mandatory 50.5% cost coverage for below-poverty-line (BPL) families, benefiting more than 500,000 patients. Besides, the ICMR granted funds for 15 AI-based screening clinics from 2024 to 2026 with a prime focus on early detection, thus positioning India as the predominant leader of progression in the Asia Pacific region.

Country-wise Government Provinces

|

Country |

Policy/Initiative |

Budget/Funding |

Launch Year |

|

Japan |

PMDA Sakigake Fast-Track for Pediatric Devices |

USD 23.7 Million |

2022 |

|

Australia |

Medicare Benefits Schedule (MBS) Expansion |

USD 56.6 Million |

2023 |

|

South Korea |

KFDA Orphan Drug Designation Program |

USD 92.6 Million |

2024 |

|

Malaysia |

MySihat Rare Disease Fund |

USD 32.8 Million |

2023 |

Europe Market Insights

The duane syndrome treatment market in Europe is propagating at a notable pace, with the potential to maintain its position as the 2nd largest stakeholder. This is supported by the presence of universal healthcare coverage, high diagnosis rates, and strong government R&D funding. The region’s market is led by Germany, followed by France and the U.K., which are putting constant efforts to strengthen the region’s prominence on the global landscape. Besides, the EU Health Policy in 2025 allocated €2.6 billion for rare disease treatments, including duane syndrome, hence fostering a profitable business environment.

Germany dominates the Europe duane syndrome treatment market, fueled by technological advancements and pharmaceutical sector expansion. In this regard, the country received €510.8 million in federal investment for AI-driven diagnostics that spurred early detection. This has further led to the reduction of diagnostic delays from 18 months to 3 months in terms of pediatric cases. In addition, there has been a 15.6% yearly demand growth for botulinum toxin, which highlights the heightened demand for non-surgical procedures, thus reflecting the country’s position as the leader in this field.

France in the duane syndrome treatment market is set for an expedited growth, highly facilitated by proactive screening initiatives, therapeutic innovations, and cost containment policies. As evidence, the compulsory school screening program implemented by HAS has successfully identified 2,200 previously underdiagnosed cases, with a significant detection rate ranging from 59% to 94 in children aged between 6 to 12. Besides the fund of €306.7 million for gene therapy, it enables its support to 8 active clinical trials, thus positioning the country as an innovative hub for advanced therapeutics.

Government Investments, Policies & Funding

|

Country |

Policy/Initiative |

Budget/Funding |

Launch Year |

|

UK |

NHS England Precision Medicine Initiative |

£123.7 Million |

2023 |

|

Italy |

AIFA Orphan Drug Fund |

€322.6 Million |

2021 |

|

Spain |

Rare Disease CSUR Network |

€212.6 Million |

2022 |

Key Duane Syndrome Treatment Market Players:

- Novartis AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson Vision

- Allergan (AbbVie)

- Bausch + Lomb

- Alcon Inc.

- Pfizer

- Roche

- Sun Pharmaceutical

- Hanmi Pharmaceutical

- CSL Limited

- Lupin Limited

- Pharmaniaga

- Samsung Bioepis

- Cipla

- Endo International

The current dynamics of the duane syndrome treatment market are highly controlled by Novartis, J&J, and Santen, who are collectively dominating with maximum revenue shares. Leading players such as Roche and Daiichi Sankyo are concentrating their focus on advancing gene therapies, with over 6 trials in the pipeline. Besides, the pioneers based in India, such as Sun Pharma and Lupin, are leveraging biosimilars to capture the interest of price-sensitive economies. Furthermore, Alcon and Bausch + Lomb lead in terms of robotic-assisted devices, reducing recovery time by a remarkable 40.7% thus ultimately creating a favorable commercial environment for this sector.

The cohort of key players in the market includes:

Recent Developments

- In May 2024, Santen Pharmaceutical announced the launch of StrabisSight AI Surgical Planner, which is a pre-operative AI tool for strabismus surgery, reducing procedure time by 25.9% and improving alignment accuracy to 92.6%.

- In March 2024, Novartis introduced its U.S. FDA-approved pediatric formulation of Xeomin (incobotulinumtoxinA) specifically for Type 1 Duane Syndrome, reducing dosing errors by 40%.

- Report ID: 7902

- Published Date: Jul 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Duane Syndrome Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert