Drone Battery Sector: Growth Drivers and Challenges

Growth Drivers

-

High Budgetary Allocation for Drone Technology: Batteries are a cornerstone of modern economics and are essential across consumer electronics, military equipment, and clean energy products such as power grid storage installations and EVs. China has emerged as a dominating power in this industry over the past decade. It has a presence across all stages of the value chain, from mineral extraction to battery production; China accounts for 70-90% of the global battery market share. South Korea and Japan, once market giants in battery technology, now hold minority shares, whereas the U.S. ranks fourth. The U.S. primarily relies on APAC imports for the batteries used today.

Next-generation batteries are likely to far surpass present-day batteries' performance metric limitations, such as energy density by weight and volume, power density, durability, and charging speed. Next-generation batteries have the ability to unlock cutting-edge capabilities for new generations of wearable devices and drones. The U.S. government efforts to strengthen the domestic supply chain of drone batteries have materialized over the last decade. FY 2024 budget submission allocated USD 111.2 million for R&D of drone technology innovation and safety maintenance, including USD 6.1 million to investigate and integrate commercial space operations with national airspace, and USD 21.1 million for UAS safety research. It covers other safety-related research areas, comprising advanced materials for drone batteries, continued airworthiness, icing, aircraft fire safety, such as fire detection and protection against fires involving fuel cells, lithium batteries, and hazardous materials.

Globally, the exponential growth of military or air defense drones is spurred by ingenious refurbishing of commercial UAS. Besides the U.S., China, Israel, Türkiye, and Iran are booming as niche contenders in the military drone space, as per the September 2023 report by the Centre for Joint Warfare Studies (CENJOWS). As endemically developed tactical combat drones are reaching fruition, the existing inventory is being weaponized, strike, drone-based ISR, loiter, swarm, and counter-drones are being enhanced under-sea, at the surface, and aerial domains.

MQ-1C Gray Eagle: The MQ-1C Gray Eagle U.S. Army Unmanned Aircraft System offers real-time full motion video and beyond-line-of-sight and line-of-sight ground control stations with communications equipment. The FY 2025 aims at supporting Heavy Fuel Engines procurement for the Gray Eagle air vehicle. The novel engine propulsion system renders a viable solution to allow functional readiness for MQ-1C Gray Eagle fleet and other weapons systems. The investment will aid the development of Assured Position Navigation & Timing (A-PNT) systems for vision-based navigation.

MQ-1C Gray Eagle Budget

|

||||||||||||||||||||||||||||||

Source: U.S. DoD

MQ-25 Stingray/Unmanned Carrier Aviation: The U.S. Navy and the Unmanned Carrier Aviation (UCA) Mission Control System (UMCS) programs are collaboratively developing UAS to embark upon surveillance, intelligence, and reconnaissance missions as part of the Carrier Air Wing (CVW). The MQ25 is expected to extend the CVW mission and mitigate the Carrier Strike Group organic ISR shortfall.

The Navy will tentatively deploy the fleet for MQ-25 with an Initial Operational Capability (IOC) by FY 2026.

MQ-25 Stingray/Unmanned Carrier Aviation Budget

| FY 2023 | FY 2024 FY 2025 | |||||

| RDT&E Procurement - MQ-25 Procurement - UMCS |

Qty | $M | Qty | $M | Qty | $M |

| - 1 - |

250.9 748.2 134.7 |

- 3 - |

220.4 596.3 152.7 |

- - - |

220.4 596.3 152.7 |

|

| Total | 1 | 1,133.80 | 3 | 969.4 | - | 898 |

Source: U.S. DoD

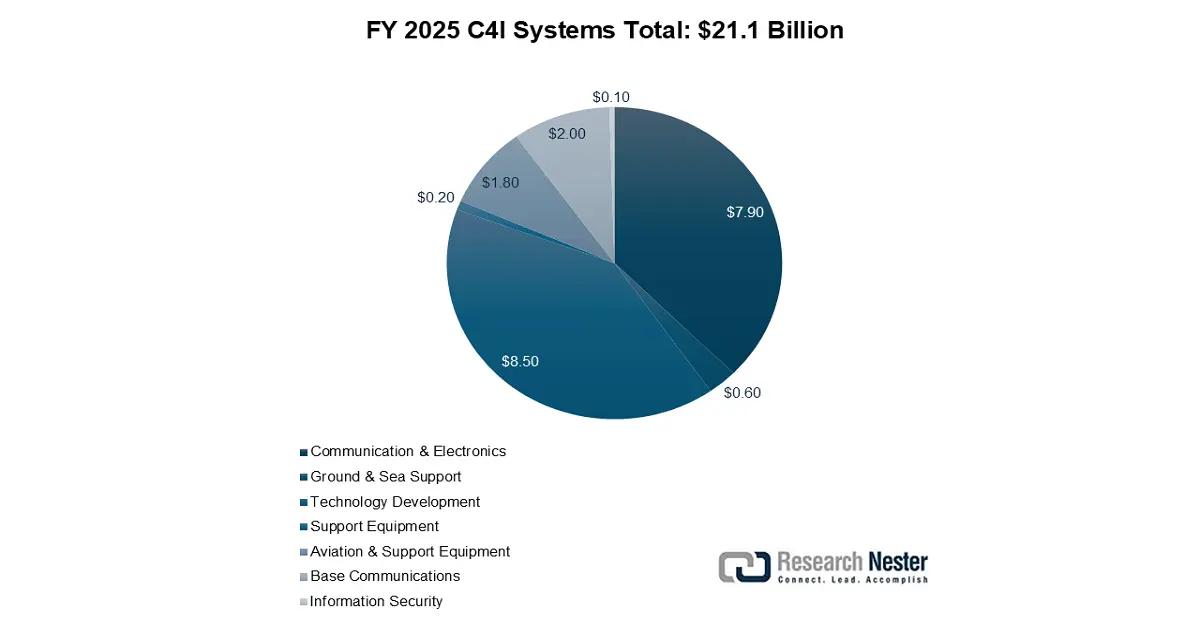

The FY 2025 budget request displayed in the DoD portfolio is USD 6.6 billion more than the FY 2024 President’s Budget request. The 45% surge is ascribed to 5G communications, the recategorization of programs in C4I from the Mission Support category and funding alterations for Combined Joint All-Domain Command (CJADC2), Agile Software development, Artificial Intelligence (AI), and net-centricity service-based architecture.

FY 2025 C4I Systems, in USD Billion

Source: U.S. DoD

The FY 2025 PB program reflects the U.S. DoD’s strategy to layer capability to address various threats; a modernized 4th-gen F-15EX, 5th generation F-35 jet fighters to address advanced technology aircraft operated or deployed by China and Russia. The category also includes funding for utility and attack helicopters, UAS, VC-25B Presidential Aircraft Recapitalization (PAR), manned reconnaissance systems, the KC-46A Pegasus tanker, the Next Generation (6th generation fighter) Air Dominance, and B-21 Long Range Strike Bomber. The category includes the following subgroups:

• Combat Aircraft (USD25.4 billion)

• Cargo Aircraft (USD 4.5 billion)

• Support Aircraft (USD 4.9 billion)

• Unmanned Aircraft Systems (USD 2.4 billion)

• Aircraft Support (USD 8.6 billion)

• Technology Development (USD 5.4 billion)

• Aircraft Modifications (USD 9.9 billion)

• System Development (USD 0.1 billion)

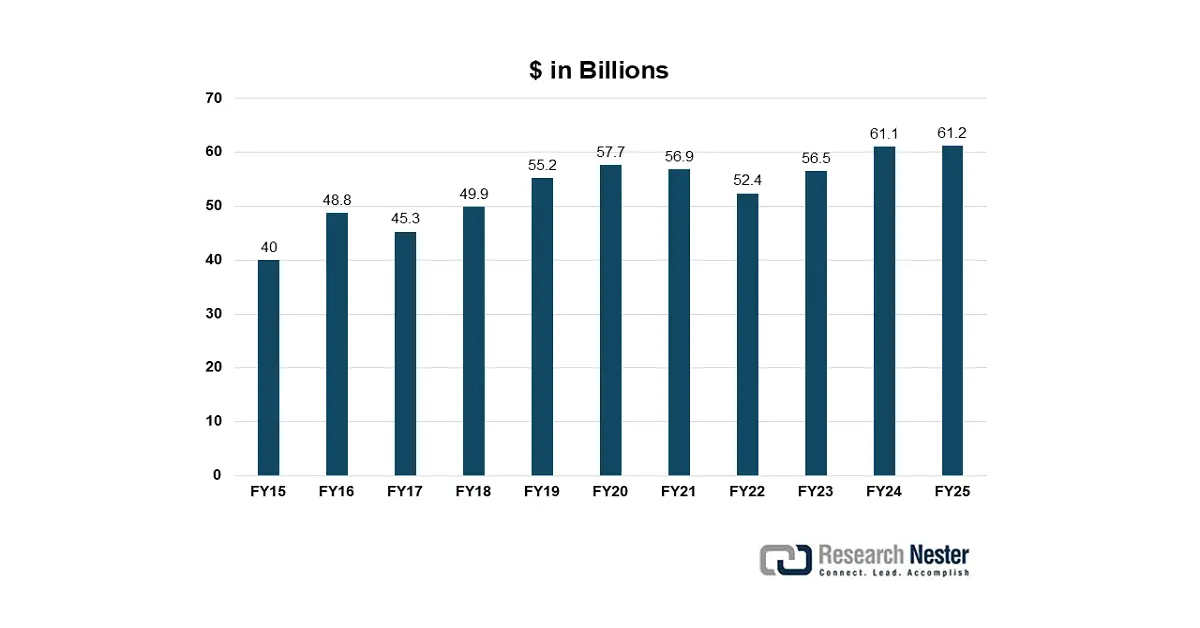

Aircraft & Related Systems Annual Budget Request

Source: U.S. DoD

- Demand for longer flight time and higher energy density: Users increasingly want batteries that have higher energy density, so that we can increase the duration of flight, provide more payload capacity, and operate further distances, even remotely. Battery technology focusing on lithium-silicon, solid-state chemistry, and battery cooling systems is paramount, along with advancements in modularity, reliability, portability, and safety.

- Technological advancements in battery systems and management: Developments in smart battery-management systems (BMS), machine and operator learning, is growing and creating demand in the market as well as AI/IoT real time health monitoring, predictive diagnostics and hybrid battery designs (e.g., Lithium ion + fuel cells), are improving efficiency, safety, operational up-time, particularly in defense and industrial drone use.

Challenges

-

Raw material price volatility: Drone batteries have a significant impact on several critical-to-modern-life materials, lithium, cobalt, or nickel. The price of these critical materials is affected by supply chain bottlenecks for mining, geopolitical tensions, and demand-supply mismatches for the materials at the production limit. But these unpredictable price-spiking events increase the price of manufacturing batteries and put downward pressure on margins and profits, especially for smaller and mid-size drone manufacturers. Further complicating the matter, China accounted for significant lithium processing and thus introduced a new level of geopolitical supply risk.

-

Environmental and recycling concerns: Li-ion batteries, which are the primary battery of choice for drones, can pose environmental risks if not disposed of properly. For instance, the U.S. Environmental Protection Agency a small portion of lithium-ion batteries get recycled. Without recycling, there are environmental risks from toxins leaking into the ecosystem and fire hazards from disassembly. If no ecosystem exists for recycling these batteries, not only is the opportunity for circular economic use missed, but regulatory bodies are increasing scrutiny for improper disposal of lithium-ion batteries. These environmental concerns will mount as adoption of drones increases, and polluting, unsustainable outcomes push governments and OEMs to invest in circular economies, closed-loop battery systems, and new, environmentally friendly battery choices.

Drone Battery Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14% |

|

Base Year Market Size (2025) |

USD 10 billion |

|

Forecast Year Market Size (2035) |

USD 37.04 billion |

|

Regional Scope |

|