Dithiocarbamate Market Outlook:

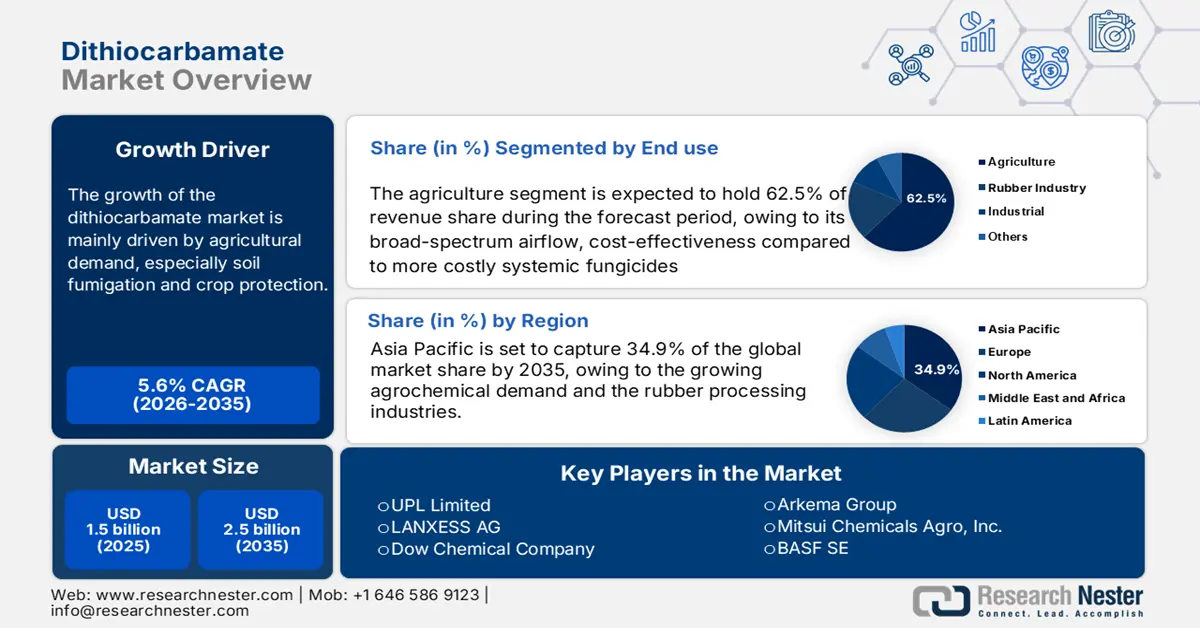

Dithiocarbamate Market size was estimated at USD 1.5 billion in 2025 and is expected to surpass USD 2.5 billion by the end of 2035, rising at a CAGR of 5.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of dithiocarbamate is estimated at USD 1.6 billion.

The growth of the dithiocarbamate market is mainly driven by agricultural demand, especially soil fumigation and crop protection. The U.S. EPA has identified the dithiocarbamate salts metam/sodium and metam/potassium, which break down into methyl isothiocyanate (MITC), as important pre-plant fumigants used across high-acreage crops, ornamentals, and turf. Additionally, the EPA, along with its pesticide registration efforts, has highlighted that maneb, mancozeb, and metiram collectively represent a significant market share within the EBDC group, further emphasizing their strong agricultural use.

Dithiocarbamate salts are produced through the use of raw materials such as carbon disulfide (CS₂) along with various primary or secondary amines, with the selection of the specific amine being determined by the desired properties of the salt. The accessibility of these materials facilitates scalable production, especially in areas where a robust chemical infrastructure is present. Major production facilities located in North America and Europe are equipped to support large-scale synthesis. For instance, LANXESS, a prominent global specialty chemicals firm headquartered in Germany, produces dithiocarbamate-based products intended for both agricultural and industrial uses. These facilities are engineered to safely manage the hazardous characteristics of CS₂ while ensuring a steady output to satisfy global demand across various sectors.

Key Dithiocarbamate Market Insights Summary:

Regional Highlights:

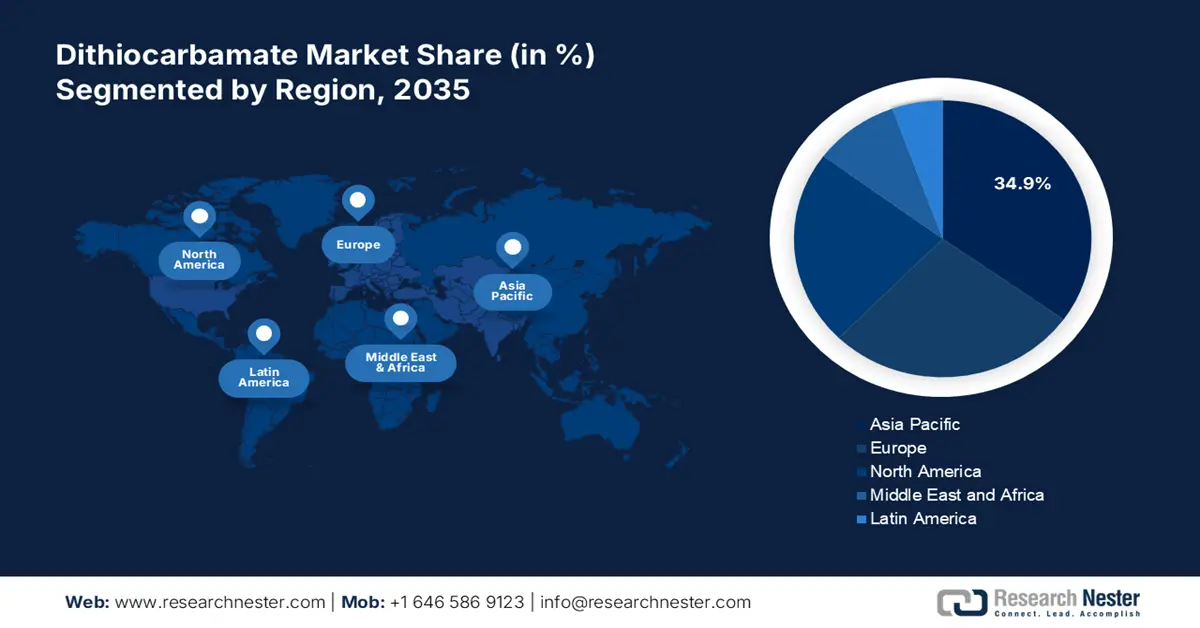

- Asia Pacific is projected to hold 34.9% of the dithiocarbamate market by 2035, driven by rising agrochemical demand, expanding rubber processing industries, and government-backed agricultural subsidies.

- Europe is anticipated to secure 27.4% of the market share by 2035, supported by favorable regulatory approvals, sustained fungicide demand, and ongoing research investments in sustainable chemical formulations.

Segment Insights:

- The agriculture sector is projected to dominate the dithiocarbamate market with a 62.5% share by 2035, propelled by broad-spectrum crop protection efficiency, cost-effectiveness, and rising disease management needs driven by climate fluctuations.

- The fungicide segment is expected to lead the market with a 51.3% share by 2035, supported by high usage of dithiocarbamates such as thiram, ziram, and mancozeb for preventing fungal diseases and ensuring food security.

Key Growth Trends:

- Expansion in fruit and vegetable cultivation

- Increasing demand for fungicidal applications in agriculture

Major Challenges:

- Volatility in raw material prices

- Health hazards and occupational safety concerns

Key Players: Taminco (Eastman Chemical Company), LANXESS AG, Dow Chemical Company, Nippon Soda Co. Ltd., Arkema Group, Mitsui Chemicals Agro Inc., BASF SE, Indofil Industries Limited, Ever Grow Group, Nufarm Limited, LG Chem Ltd., Chemtura Corporation (LANXESS subsidiary), Ishihara Sangyo Kaisha Ltd. (ISK), Kumiai Chemical Industry Co. Ltd.

Global Dithiocarbamate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.5 billion

- 2026 Market Size: USD 1.6 billion

- Projected Market Size: USD 2.5 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Germany, France

- Emerging Countries: Indonesia, Malaysia, Brazil, Mexico, Vietnam

Last updated on : 6 October, 2025

Dithiocarbamate Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in fruit and vegetable cultivation: The increasing consumption of fruits and vegetables is accelerating the usage of dithiocarbamates. FAO data for 2023 indicates that total world vegetable production was nearly 1.2 billion tons, and fruit production was 891 million tons. Asia accounted for 864 million tons or approximately 79% of total fruit and vegetable production. Dithiocarbamates are used for the treatment of fungal rots of fruits and vegetables, and they are essential in controlling foliar diseases. In the OECD-FAO Agricultural Outlook 2024-2033, it is projected that the production of fruits and vegetables will continue to grow as well, increasing at a rate of 1.6% per year, which will increase the need for fungicides to maintain quality standards for exports of fruit crops and to reduce post-harvest losses.

- Increasing demand for fungicidal applications in agriculture: Dithiocarbamates are extensively utilized as fungicides to safeguard crops such as grapes, potatoes, and tomatoes from fungal diseases. As global food demand escalates and concerns regarding crop yield losses intensify, the necessity for efficient fungicides continues to grow. Companies such as UPL Limited, a prominent agrochemical manufacturer, produce dithiocarbamate-based products like Mancozeb, which are widely embraced in both developed and emerging agricultural markets.

- Growth of the rubber and industrial chemicals sector: Dithiocarbamates play a crucial role as accelerators in the vulcanization of rubber, facilitating the production of tires, belts, and various industrial components. The expansion of the automotive and construction sectors drives the demand for rubber additives. For instance, Eastman Chemical Company provides specialty chemicals, including dithiocarbamate derivatives, utilized in rubber processing, which aligns with the increasing investments in infrastructure and the rise in vehicle manufacturing throughout the Asia-Pacific and North America.

1. Emerging Trade Dynamics & Future Market Prospects

Trade Value of Dithiocarbamate in 2023

|

Leading Exporters |

Exports |

Share |

ECI |

|

China |

157M |

42.9% |

1.16 |

|

India |

40.7 M |

11.1% |

0.65 |

|

Germany |

35M |

9.59% |

1.79 |

|

Japan |

20.5M |

5.6% |

2.09 |

|

Belgium |

18.1M |

4.95% |

1.23 |

2. Leading Producer of Fungicides (2023)

Production of Fungicides in 2023

|

Leading Exporters |

Trade Value 1000USD |

Quantity (kg) |

|

European Union |

61,980.35 |

3,049,910 |

|

Germany |

39,307.45 |

1,867,490 |

|

U. S |

19,973.62 |

977,164 |

|

Spain |

16,885.99 |

521,509 |

|

Thailand |

10,288.98 |

1,440,600 |

|

Chian |

3,804.55 |

253,751 |

|

Japan |

3,767.47 |

114,961 |

|

France |

3,094.15 |

337,101 |

|

UK |

2,863.61 |

274,002 |

Challenges

- Volatility in raw material prices: Carbon disulfide (CS₂), an essential raw material for the production of dithiocarbamates, undergoes considerable price variations due to supply limitations and geopolitical influences. This volatility affects the manufacturing expenses and profit margins for producers, resulting in price instability within the dithiocarbamate market. Companies are required to manage supply chain risks effectively to ensure consistent production and maintain competitive pricing.

- Health hazards and occupational safety concerns: Manufacturers of dithiocarbamates encounter substantial health risks during the production process, particularly from exposure to hazardous intermediates such as carbon disulfide (CS₂). Extended exposure can lead to neurotoxic effects in workers, which raises significant concerns regarding occupational safety. It is imperative to implement stringent safety protocols and protective measures to mitigate these risks and protect employee health within manufacturing environments.

Dithiocarbamate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 2.5 billion |

|

Regional Scope |

|

Dithiocarbamate Market Segmentation:

End use Segment Analysis

The agriculture sector is anticipated to secure the largest market share of 62.5% by the year 2035, propelled by the broad-spectrum effectiveness of dithiocarbamates, their cost-efficiency, and their capability to combat increasing crop disease challenges amid climate fluctuations, as reported by the USDA Economic Research Service. The UN FAO emphasizes its preference for integrated pest management in cereals and vegetables within advanced developing nations. This significant dependence fosters market expansion. For instance, UPL Limited manufactures widely utilized dithiocarbamate fungicides such as Mancozeb, which caters to the growing demand for effective crop protection in the global agricultural landscape.

Application Segment Analysis

The fungicide sector is projected to spearhead growth by 2035, capturing a market share of 51.3%, driven by the extensive application of dithiocarbamates, including thiram, ziram, and mancozeb. These fungicides serve to shield crops from fungal diseases such as rust, smut, and blight. The U.S. EPA highlights thiram’s function in inhibiting spore germination, thereby improving yield and shelf life. According to the FAO, the increasing demand for disease-free produce and food security is propelling the global use of fungicides. BASF stands out as a significant contributor, producing dithiocarbamate fungicides that address this escalating agricultural requirement.

Type Segment Analysis

The thiram segment is projected to account for a 28.7% revenue share in the global dithiocarbamate market, driven by its efficacy as a broad-spectrum fungicide and seed treatment agent. Thiram’s capacity to safeguard crops from fungal diseases and pests while promoting seed germination renders it highly esteemed in the agricultural sector. Companies such as UPL Limited produce thiram-based products, leveraging its extensive application in the protection of fruits, vegetables, and cereals, particularly in areas with elevated disease pressure.

Our in-depth analysis of the dithiocarbamate market includes the following segments:

| Segment | Subsegment |

|

End use |

|

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dithiocarbamate Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific market is expected to hold 34.9% of the market share due to growing agrochemical demand and the rubber processing industries. By 2035, the region is expected to reach USD 651 million, growing at a 4.9% CAGR from 2026 to 2035. The Asia Pacific can expect continued growth from rapid industrialization of Southeast Asian industries, government subsidies for agriculture, and increased R&D spending on sustainable fungicide formulations. The usage and awareness of crop protection chemicals, as well as the construction of rubber processing plants in Malaysia and Indonesia, will govern regional output.

While the China Dithiocarbamate market is expected to continue to be the dominant market in Asia Pacific, continued class progress of agricultural modernizations, including the growth of domestic production and scaling up, is anticipated. The market is projected to grow to USD 311 million by 2035, with a CAGR of 5.3% from 2025. The market will benefit from continued government incentives to develop pesticide efficiency, investments in local production plants, and the combination of efforts between manufacturers of chemicals and research facilities. The market will be informed by strong agricultural modernization plans (improving crop yields), the expansion of domestic supply chains, and an increase in exports to less-regulated business jurisdictions, all of which will be implemented during the construction phase, along with strict quality control standards. For instance, Syngenta stands as a prominent player in the dithiocarbamate market in China, utilizing government incentives and partnerships with research institutions to enhance local production, boost pesticide effectiveness, and aid in agricultural modernization efforts.

India accounts for approximately one-third of the worldwide dithiocarbamate fungicide market, propelled by significant demand in agriculture, rubber, and pharmaceuticals. The growth of the country reflects the APAC CAGR, bolstered by government incentives and a strong CRDMO ecosystem that enhances domestic supply chains. This inward orientation strengthens export-focused chemical and agrochemical firms. For instance, PI Industries is a major player capitalizing on these trends, broadening its production and export capabilities within the dithiocarbamate sector.

Europe Market Insights

The European market is expected to hold 27.4% of the market share, and it is expected to be worth USD 411 million by 2035, due to expanding fungicide demand in agriculture and the rubber industries. Positive regulatory approval trends for dithiocarbamate-based materials and a growing sum of research investments by chemical companies in Europe will also facilitate market expansion. Top European economies with established dithiocarbamate markets, such as Germany, France, and the UK, are increasing their focus on sustainable crop protection chemicals and exposure chemicals across all markets. Further, consistent demand for rubber additive formulations and end-use in the tire-making process, where dithiocarbamates are consistent additive materials, will ensure product consumption trends across the dithiocarbamate value chain as the European market grows at a slow CAGR of 3.8% from 2026 to 2035.

Germany is expected to grow at a CAGR of 3.5% from 2026 to 2035. Germany is related to the promotion of pesticides and fungicides for, for example, cereals instead of chemicals for pest management, increasing area for vineyards, and expansion in horticulture with regulatory compliance initiatives that increase demand for an effective crop protection product. Relative to these issues, the German dithiocarbamate chemical manufacturers in this market invest heavily in research and development to produce eco-friendly dithiocarbamate derivatives and end formulations for compliance and enable market growth expansion in the agriculture and rubber vulcanization markets over the forecast period. For instance, Syngenta UK is committed to investing in research and development to create safer, low-residue dithiocarbamate fungicides. This initiative ensures adherence to post-Brexit regulations while also broadening export possibilities to the EU and Commonwealth markets.

The UK dithiocarbamate market is expected to grow at a CAGR of 3.5% over the forecast period 2026-2035. Growth is supported by regular use of fungicides on oilseed rape and vegetable crops, and their use in manufacturing rubber and latex products. Investments are made to evaluate the technology of residue reduction and engage in research and development efforts to seek alternatives that are less toxic while ensuring compliance with post-Brexit regulations covering chemicals (e.g., pesticides and fungicides for agriculture) and enhancing export opportunities to the EU and Commonwealth markets over the decade ahead. For instance, Evonik Industries, a leading German specialty chemicals firm, is dedicated to enhancing eco-friendly dithiocarbamate formulations through comprehensive research and development efforts. This focus not only promotes regulatory compliance but also fosters growth in the agriculture and rubber vulcanization industries.

North America’s Pesticides Production in 2023

|

Leading Exporters |

Global Share Value |

Leading Importers |

Global Share Value |

|

U.S. |

83.9% |

Canada |

34.5% |

|

Mexico |

6.92% |

U.S. |

31.3% |

|

Guatemala |

3.56% |

Mexico |

15.3% |

|

Canada |

2.57% |

Guatemala |

3.36% |

North America Market Insights

The North America market is expected to hold 22.9% of the market share due to strong agrochemical demand and an increase in applications of fungicides in the cultivation of cereals, vegetables, and fruits. The market is forecast to reach USD 314 million by 2035 and grow at a CAGR of 4.3% over the period from 2026 to 2035. Market growth is supported by an increase in crop protection chemical consumption and new formulations that have been approved by the EPA, which can improve crop yield sustainability. Continuing improvements in formulation technology and the efficiency of the regional supply chain will provide significant boosts to North America’s global market share in the production and trade of dithiocarbamates.

The U.S. dithiocarbamate market will continue to be the largest in North America, expecting to grow to USD 132.7 million by 2035, at a CAGR of 4.1% from 2026 - 2035. The growth of the market can be attributed to a strong demand for crop protection chemicals, with mancozeb and thiram used for soybeans, corn, and wheat leading the dithiocarbamate family of chemicals. Dithiocarbamate chemicals will benefit in industrial applications based on the continued strong demand in the rubber and chemical sectors. For instance, DuPont is a prominent American corporation that manufactures dithiocarbamate fungicides, including mancozeb and thiram. This company plays a significant role in meeting the robust demand for crop protection and industrial uses, such as rubber production and chemical processing.

The Canadian dithiocarbamate market will reach a CAGR of 5.6% from 2026 - 2035. Market growth is supported by an extensive agriculture sector, especially potatoes, canola, and fruits, where fungicide application is still important in yield improvement. Canada's stringent regulatory framework surrounding pesticides encourages the use of safer formulations, creating steady growth. A focus on sustainable farming programs will likely create additional demand for the market, creating sustained opportunities for locally grown suppliers and international manufacturers. For instance, Nufarm Canada stands out as an important participant in the Canadian dithiocarbamate sector, offering safer formulations of fungicides that adhere to stringent regulations and promote sustainable agricultural practices in crops such as potatoes, canola, and various fruits.

Key Dithiocarbamate Market Players:

- UPL Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Taminco (Eastman Chemical Company)

- LANXESS AG

- Dow Chemical Company

- Nippon Soda Co., Ltd.

- Arkema Group

- Mitsui Chemicals Agro, Inc.

- BASF SE

- Indofil Industries Limited

- Ever Grow Group

- Nufarm Limited

- LG Chem Ltd.

- Chemtura Corporation (LANXESS subsidiary)

- Ishihara Sangyo Kaisha, Ltd. (ISK)

- Kumiai Chemical Industry Co., Ltd.

The global dithiocarbamate market is somewhat concentrated; a few major corporations control the market. Together with some top Japanese corporations, including Nippon Soda and Mitsui Chemicals Agro, UPL, Eastman, LANXESS, and Dow have relatively significant market control. These companies have strategically expanded operations to build a stronger presence in Asia and Europe. They have accomplished this by mergers, acquisitions, and expanding distribution networks. The main focus of leading Japanese manufacturers is R&D for environmentally friendly fungicides and to develop sustainable manufacturing processes and/or technologies that will support compliance with environmental laws. Indian manufacturers focus on low-cost production, while Western manufacturers focus on sustainable sourcing and partnerships. Continuous investment in innovation, supply chain resilience, and local regulations provides an additional competitive advantage.

Some of the key players operating in the market are listed below:

Recent Developments

- In April 2024, UPL Corporation acquired the standalone Mancozeb business from Corteva Agriscience, which includes the Dithane brand, as it sought to enhance its existing global fungicide portfolio. This acquisition enabled UPL to remain a key player in the multisite fungicide market and address rising concerns regarding pathogen resistance. UPL also has a market position in crop protection where mancozeb can be used, along with expanded access to key growing regions. The acquisition supports UPL in its intended strategic growth in the global fungicide market with an enhanced and diversified portfolio.

- In May 2024, FMC Corporation achieved Brazilian registration of its herbicides, Azugro and Ezanya, containing bixlozone, a dithiocarbamate-like active ingredient, which is then approved for use in cotton, tobacco, and wheat crops in Brazil. The approval is consequential since it enables FMC to enter one of the largest agricultural markets across the globe with its products. The decision to grow in a new geographic market suggests strategic thinking on behalf of FMC. Expectations are for sales growth to occur dramatically in 2024 and 2025 in Brazil. The approvals add to the terms of the license and strengthen FMC in terms of being competitive in herbicides within the rapidly expanding crop protection industry in Brazil.

- Report ID: 7934

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dithiocarbamate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.