Distributed Control System Market Outlook:

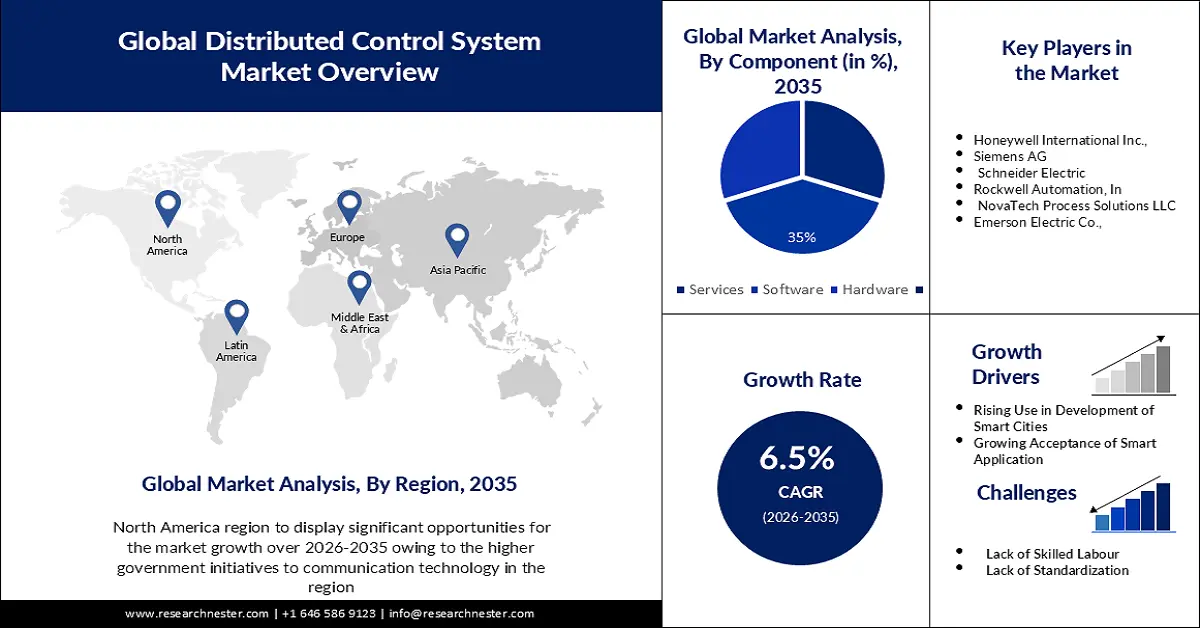

Distributed Control System Market size was over USD 21.04 billion in 2025 and is anticipated to cross USD 39.49 billion by 2035, witnessing more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of distributed control system is assessed at USD 22.27 billion.

The market growth is mainly owing to the growing acceptance of loT technologies with the integration of distributed control system. The number of connected loT devices worldwide is projected to reach nearly 76 billion by 2025.

Factors such as rising demand for electricity grid management and escalating need for loT in water distribution and generation are further projected to expand the globally distributed control system market size over the predicted time period.

Key Distributed Control System Market Insights Summary:

Regional Highlights:

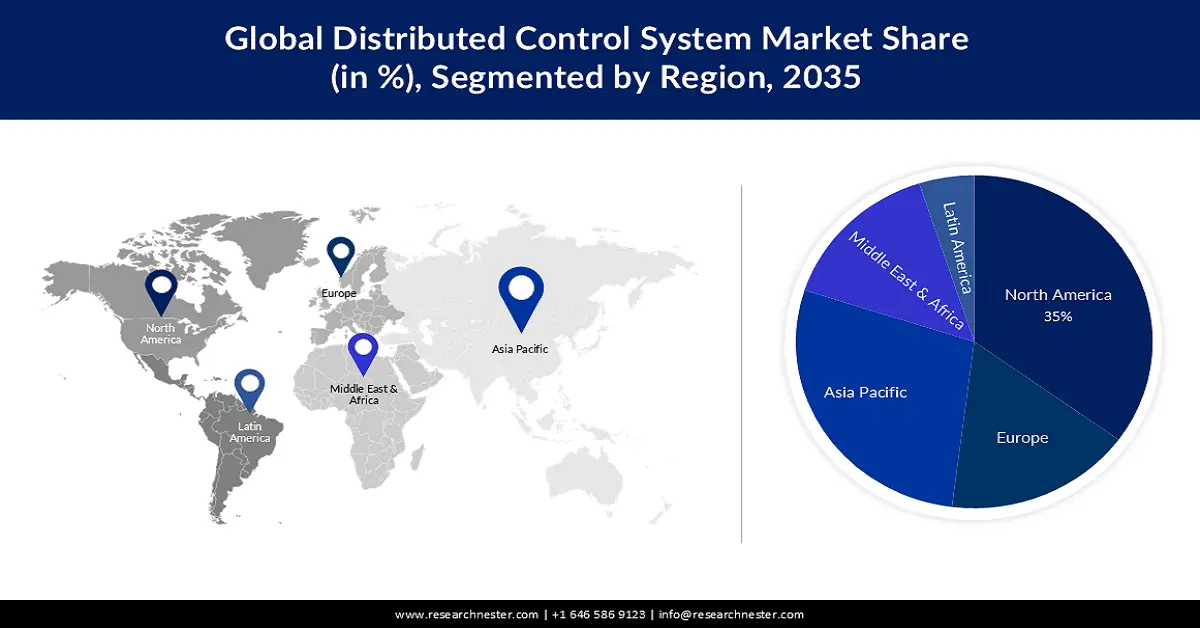

- North America distributed control system market will dominate more than 35% share by 2035, driven by increasing government initiatives to improve communication technology, heavy R&D investments in new optical satellite communication technologies, and strong presence of market players.

- The Asia Pacific region is projected to witness significant expansion through 2026-2035, fueled by the surge in digital satellite broadcasting and internet services across emerging economies.

Segment Insights:

- The software segment in the distributed control system market is projected to account for a 35% revenue share by 2035, propelled by the rising complexity of software applications and the growing adoption of modular software development.

- The healthcare segment is expected to dominate the market share by 2035, supported by the expanding patient base and the rapid increase in the number of hospitals worldwide.

Key Growth Trends:

- Increasing Demand from the Power Generation Industry

- Increasing Research Spending

Major Challenges:

- High Requirement for Associated Least-Cost Technology and Investment

- Lack of Awareness

Key Players: ABB Ltd., Honeywell International Inc., Siemens AG, Schneider Electric, Rockwell Automation, Inc, NovaTech Process Solutions LLC, Emerson Electric Co., Automation Technologies Ltd., Concept Systems Inc.

Global Distributed Control System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.04 billion

- 2026 Market Size: USD 22.27 billion

- Projected Market Size: USD 39.49 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 10 September, 2025

Distributed Control System Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Demand from the Power Generation Industry - The electricity generation industry is expected to represent the largest share of the DCS market. The demand for electricity has significantly increased worldwide. Based on the International Energy Agency (IEA), global electricity demand is expected to grow by 4% in 2021 and add 3.5% in year 2022.

-

Increasing Research Spending - Global market growth during the studied period can also be attributed to increased investment in research and development to continuously find more viable solutions for distributed control systems. Research reports show global R&D real spending has more than tripled since 2000, increasing from about USD 680 billion to more than USD 2.5 trillion in 2019.

-

Increased Use in Development Smart Cities- The increasing development of smart cities across the globe is leading to more automation and use of advanced technologies which further is boosting the expansion of distributed control systems.

Challenges

-

High Requirement for Associated Least-Cost Technology and Investment – Least-cost technology means the technology, or mix of technologies that would be chosen in the end as the most economically efficient choice. This is one of the major factors predicted to slow down the market growth.

-

Lack of Awareness

-

Scarcity of Requisite Technically Skilled Labor

Distributed Control System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 21.04 billion |

|

Forecast Year Market Size (2035) |

USD 39.49 billion |

|

Regional Scope |

|

Distributed Control System Market Segmentation:

Component Segment Analysis

The software segment in the distributed control system market is anticipated to hold a revenue share of 35% by 2035. The growth of the software component segment can be attributed to several factors, including the increasing complexity of software applications, the need for faster time-to-market, and the growing trend toward modular software development. By leveraging pre-built software components, developers can significantly reduce the time and resources required to build new software applications, while also improving overall quality and performance.

End User Segment Analysis

In terms of end users, the healthcare segment is set to hold the largest share of the global distributed control system market during the forecast timeframe. The growth of the segment can be accredited to the presence of a large number of patients in the healthcare industry, which is expanding notably. The hospitals are also growing rapidly in number. For instance, by the year 2022, it was noted that there were approximately 6,100 hospitals in the United States. Hospitals provide a wide range of medical care. Physicians, called hospital doctors, typically specialize in internal medicine, pediatrics, or general practice. They have the knowledge to solve common problems and the resources to solve more complex medical problems. Hospitals may also offer specialized care, such as neurology, obstetrics and gynecology, and oncology.

Our in-depth analysis of the global distributed control system market includes the following segments:

|

Component |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Distributed Control System Market Regional Analysis:

North America Market Insights

The distributed control system market in the North America is estimated to hold 35% share during the projected timeframe. The regional growth can be attributed to the increasing government initiatives to improve communication technology, which is expected to fuel the growth of the market in the region in the coming years. Moreover, the North American market is expected to account for the largest share during the forecast period owing to heavy R&D investments in new optical satellite communication technologies and the strong presence of market players in the region. According to data released by the Census Bureau as part of the 2018 Annual Survey of Manufacturing, more than 30% of workers in the North American region require technical assistance for a variety of purposes, including transportation equipment, primary metals, plastics, rubber products, and used robots.

APAC Market Insights

The distributed control system market in the Asia Pacific is set to grow substantially during the projected period. The growth of the market in this region can primarily be attributed to the increasing number of digital satellite broadcasting and internet services in the region. The market is expected to grow in China due to increasing support for clean energy projects and a high focus on reducing carbon emissions that will boost the renewable energy sector. This will give rise to power demand that will further expand the funds for power plant infrastructure in the region.

Distributed Control System Market Players:

- ABB Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.

- Siemens AG

- Schneider Electric

- Rockwell Automation, Inc

- NovaTech Process Solutions LLC

- Emerson Electric Co.

- Automation Technologies Ltd.

- Concept Systems Inc.

Recent Developments

- ABB has announced that it has received a new order from DS Smith to realize its vision of highly automated, connected, and safe operations at its plant in Kemsley, UK. The Kent mill is the second largest waste paper mill in Europe, with an annual production capacity exceeding 849,000 tons. ABB supports the development of the company with the ABB Ability System 800xA control system (DCS). Also, paper machine drives are upgraded via PM3, PM4, and PM6.

- Emerson has announced the validation of the Dragos platform within the DeltaVTM control system, “DCS,” which provides organizations with significantly enhanced ICS/OT cybersecurity.

- Report ID: 4802

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Distributed Control System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.