Disposable Camera Market Outlook:

Disposable Camera Market size was valued at approximately USD 1.02 billion in 2025 and is projected to reach around USD 1.88 billion by the end of 2035, rising at a CAGR of approximately 6.33% during the forecast period 2026-2035. In 2026, the industry size of disposable camera is estimated at USD 1.08 billion.

The supply chain for the market is susceptible to vulnerability in procuring raw materials, regional trade barriers, and constantly changing regulations. A significant portion of procurement is sourced from East Asia, including acetate backing and silver halide chemicals. Recent policy transitions, such as import tariffs imposed by the U.S. in 2025 on Chinese goods, have increased production costs. A significant development is the arrival of the recyclable disposable cameras. Prominent companies such as Fujifilm are making models with film cartridges that are reprocessable.

The disposable camera market is going through a significant pathway of innovations, fueled by increased efforts for sustainability. Companies are investing heavily in research and development to launch innovative models, incorporating biodegradable casings. The incorporation of technological advancements includes higher-speed emulsions. These efforts of the market players demonstrate the inclination for the trial-based sustainable design. Also, these efforts position the market as a rising niche fostered by social media trends. Companies are focusing on integrating circular economy practices and reviving the analog appeal.

Key Disposable Camera Market Insights Summary:

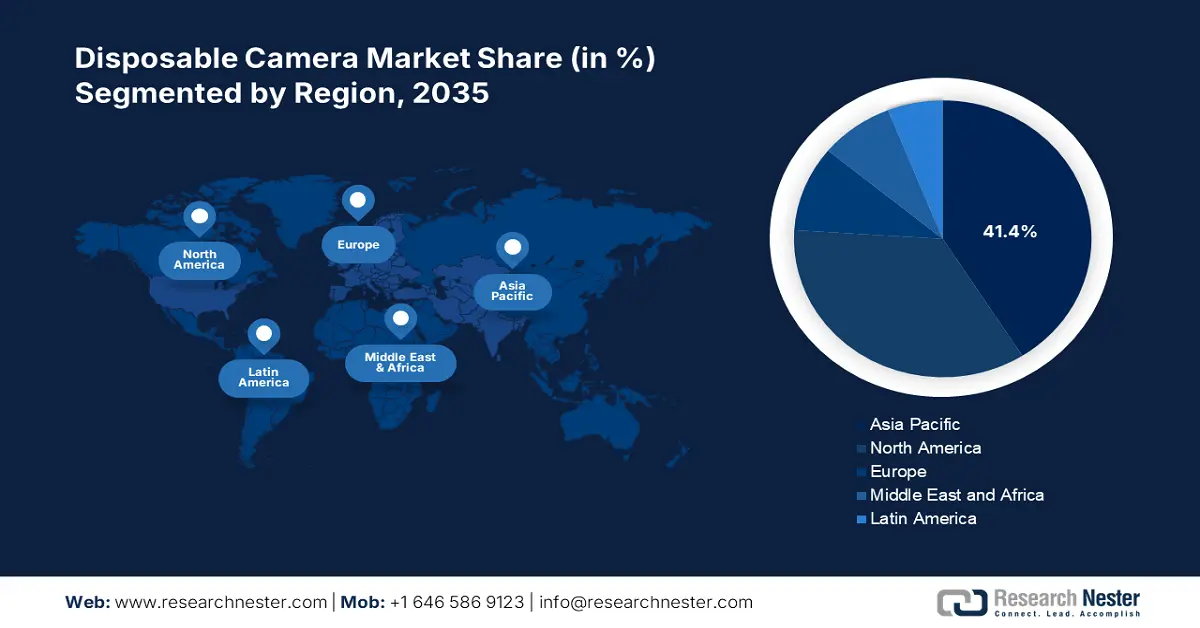

Regional Highlights:

- The Asia Pacific Disposable Camera Market is projected to command 41.4% share by 2035, owing to tourism revival and increasing retail density.

- North America is expected to account for 34.6% share by 2035, impelled by Gen Z influence and the rising demand for DIY wedding photography.

Segment Insights:

- The color disposable cameras segment is projected to capture 51.3% share of the Disposable Camera Market by 2035, owing to wider usage in casual photography.

- The individual use segment is anticipated to hold 54.3% share by 2035, propelled by the appeal of analog photography.

Key Growth Trends:

- Nostalgia-driven shift for the tangible photography

- Rising event-based usage in weddings and celebrations

Major Challenges:

- Environmental and sustainability concerns

- Limited production and supply chain restraints

Key Players: Kodak, AgfaPhoto, Ilford Imaging, Lomography, Harman Technology, Dubblefilm, Rollei, CineStill, RETO Project, Ilford Photo, Escura, KODAK Professional, PhotoKlassik, Plastic Photo Co., Paper Shoot.

Global Disposable Camera Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.02 billion

- 2026 Market Size: USD 1.08 billion

- Projected Market Size: USD 1.88 billion by 2035

- Growth Forecasts: 6.33% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.4% Share by 2035)

- Fastest Growing Region: China

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 11 September, 2025

Disposable Camera Market - Drivers and Challenges

Growth Drivers

- Nostalgia-driven shift for the tangible photography: People are gravitating towards conventional analog photography. The advent of disposable cameras renders unforeseeable tones of colors and a remarkable grainy surface. Also, disposable cameras are affordable, need no specific expertise, and are very easy to use. Such simplicity enhances the user base who are looking for an easy and cost-efficient way to capture their precious moments. Additionally, the retro aesthetic effects rendered by the disposable cameras have garnered significant popularity among the younger generation. These trends are projected to reinforce the emotional appeal and demand for such cameras in the coming period.

- Rising event-based usage in weddings and celebrations: Disposable cameras have gained traction in events and festivals. Event planners are placing such cameras on tables so that guests can capture candid pictures, which later become permanent memories. The inclination towards tangible prints produced by these cameras is usually curated into the albums to strengthen their emotional value. Couples are incorporating disposable cameras in their gatherings to foster informal bonding. Event organizers also highlight that disposable cameras promote guest interaction, as participants exchange cameras and capture each other’s perspectives.

- Emergence of eco-friendly innovations and government-backed sustainability programs: The exponentially increasing awareness is stimulating manufacturers to introduce environmentally friendly disposable cameras fabricated from reusable and biodegradable materials. As the number of local photo shops is declining significantly, people are buying disposable cameras that are convenient to use. The growth of the market is driven by a surge in remote service models aligning with widespread trends and expectations of consumer choices. Social media platforms have also amplified the sale of such types of cameras due to rising trending hashtags.

Challenges

- Environmental and sustainability concerns: The concern for environmental impact is one prominent hurdle. The disposable cameras that are made up of a plastic casing are extremely difficult to recycle. However, various companies are offering recycling programs, but efficiency remains a constraint. Also, the regulatory pressure and exorbitant cost of the eco-friendly alternatives pose a major challenge for the manufacturers.

- Limited production and supply chain restraints: The production of the disposable cameras is restrained owing to the very limited availability of the primary components. The manufacturing industry has significantly shrunk, with few companies producing photographic films. The scarcity results in price fluctuations and production delays, further hampering the smooth flow of the supply chain.

Disposable Camera Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.33% |

|

Base Year Market Size (2025) |

USD 1.02 billion |

|

Forecast Year Market Size (2035) |

USD 1.88 billion |

|

Regional Scope |

|

Disposable Camera Market Segmentation:

Type Segment Analysis

The color disposable cameras are projected to garner 51.3% of the share by 2035, owing to wider usage in casual photography. Prominent brands such as AgfaPhoto are producing high-resolution models for numerous lighting conditions. The affordability across the world contributes to the segment growth. These cameras are also popular in music festivals and weddings as they offer spontaneous experiences of photography. Prominent brands are capitalizing on launching cameras with enhanced color saturation options, which are appealing to consumers for vintage aesthetics. These are also getting popular due to low cost and favorable margins.

Application Segment Analysis

The individual use segment is projected to hold 54.3% of the disposable camera market share by 2035, fueled by the appeal of analog photography. Gen Z and millennial consumers are unearthing the charisma of film cameras for getting authentic and raw images. Many people also consider disposable cameras as a tool to reignite vintage appeal and nostalgia. Also, a growing trend to use low-cost and no-charge setups is preferred over camera phones. Various event organizers usually place devices in places to capture the candid moments of the guests. Additionally, social media influencers and vloggers are producing aesthetic content with the help of disposable cameras.

Distribution Channel Segment Analysis

The offline segment is projected to garner 59.7% of the disposable camera market share by the end of 2035, fueled by burgeoning incidences of impulse purchases and the creation of brick-and-mortar stores at airports and shopping malls. Disposable cameras are frequently purchased, particularly at locations where the cameras are required instantly. In the U.S., Best Buy is stocking such cameras and serving both tourists and hobbyists. The availability at low prices and easy accessibility is encouraging people to buy more disposable cameras more often than not. Offline sales are also fulfilling the instant needs, and their retro design also propels the segment growth.

Our in-depth analysis of the disposable camera market includes the following segments:

|

Segments |

Subsegments |

|

Application |

|

|

Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Disposable Camera Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific disposable camera market is set to garner 41.4% of the share by 2035, owing to tourism revival and increasing retail density. The market in China is the fastest-growing and is undergoing a significant reawakening, mainly driven by the trend for a leading creative lifestyle. The youth in China, mainly in Beijing and Shenzhen, are opting for such cameras as artistic media. Millions of people share on social media various pictures related to the trends. Online shopping portals such as Taobao are offering a vast range of selection of disposable cameras.

The disposable camera market in India is also showing emerging growth trends with the adoption of disposable cameras for educational purposes. The market growth is largely influenced by demand for the unfiltered and vintage-looking photos in the country. Various art-focused educational institutes have started incorporating basic photography in their curriculum. These factors are acting as a catalyst for affordable options in disposable cameras. Also, the Press Information Bureau stated in February 2025 that India has the largest youth population in the world, with 65% of people under 35 years of age, which is a large consumer base.

North America Market Insights

The disposable camera market in North America is anticipated to reach 34.6% market share by 2035. The market growth is driven by Gen Z influence in the region and the rising demand for DIY wedding photography. Prominent players such as Walmart and Target are continuing to offer state-of-the-art disposable cameras. In the U.S., numerous startups are rendering analog photography kits that include not only disposable cameras but also film rolls and vouchers. Also, consumers are seeking tangible prints over digital-only storage, driving photo-printing kiosks and services.

Canada's disposable camera market is thriving due to a surge in domestic tourism to the natural parks. In the scenic landscape, people are apprehensive about the probable risk of high-cost smartphones in a rough environment. Moreover, the independent creators in Vancouver are promoting disposable cameras for film photography. Disposable cameras are not only relics, but they are becoming necessary tools for storytelling. Also, the country’s vast natural landscape, such as the Rocky Mountains, fuels camping culture. Also, the country hosts plenty of multicultural events, such as the Toronto International Film Festival. Organizers and attendees often look for creative, interactive ways to document experiences. Disposable cameras are increasingly included as part of themed kits, enhancing cultural engagement.

Europe Market Insights

The disposable camera market in Europe is set to witness staggering growth in the coming period, owing to an increase in the adoption of recyclable products and battery-free equipment. The circular economy mandates in the EU promote low-waste consumer electronics. In the UK, the market is mainly driven by rising consumer demand for authentic and raw visual experiences. According to the Office for National Statistics, there were 246,897 marriages held in Wales and England. Disposable cameras are increasingly included as part of themed kits, enhancing cultural engagement. Moreover, the rich historical beauty of the city attracts creative photographers and encourages them to use a disposable camera.

The market in Germany represents a steadily growing market due to a strong photography culture and eco-conscious consumers. The growth of the market is also driven by increasing demand for analog photography. The University of the Arts Berlin usually has filmmaking courses, supporting and spurring demand in the creative use. Consumers are becoming significantly aware of the environment and opting for sustainable options. Users are clicking vintage-style wedding pictures for scrapbooks for keepsakes. Prominent cities such as Berlin and Dresden witness spikes during holidays for such cameras.

Key Disposable Camera Market Players:

- Kodak

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AgfaPhoto

- Ilford Imaging

- Lomography

- Harman Technology

- Dubblefilm

- Rollei

- CineStill

- RETO Project

- Ilford Photo

- Escura

- KODAK Professional

- PhotoKlassik

- Plastic Photo Co.

- Paper Shoot

The market is shaped by legacy brands and emerging startups, consistently responding to the altering consumer behavior. These companies are emphasizing minimalism and trying to revive vintage product category. Various strategic programs incorporate AI-enabled flavor development, aggressive expansion, and the advent of eco-friendliness. Various cross-border collaborations and humongous investments are also reinforcing brand positioning. Key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to enhance their product base and strengthen their market position.

Here is a list of key players operating in the global disposable camera market:

Recent Developments

- In April 2025, Lomography released a new color splash reloadable disposable-style camera that includes colored flash filters and psychedelic film. The launch targeted Gen Z creatives on Instagram and TikTok, promoted through influencer unboxing campaigns across Europe and the U.S.

- In June 2024, Kodak launched the FunSaver Ocean Series, a waterproof disposable camera designed for beachgoers and divers. The product is launched making partnership with major travel retailers like REI and Decathlon. Also, the camera features improved waterproofing (up to 50 ft) and eco-friendly packaging.

- Report ID: 7987

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Disposable Camera Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.