Dioctyl Phthalate Market Outlook:

Dioctyl Phthalate Market size was over USD 2.13 billion in 2025 and is anticipated to cross USD 3.34 billion by 2035, witnessing more than 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dioctyl phthalate is assessed at USD 2.22 billion.

The primary growth driver of the dioctyl phthalate (DOP) market is the escalating demand for flexible polyvinyl chloride (PVC) products across key industries such as construction, automotive, and healthcare. DOP serves as a crucial plasticizer, enhancing the flexibility, durability, and processability of PVC materials, which are extensively utilized in these sectors.

DOP is integral in producing flexible PVC used in flooring cables, roofing membranes, and wall coverings. The surge in global infrastructure development, particularly in emerging economies like India and China, is propelling the demand for DOP in construction applications.

Key Dioctyl Phthalate Market Insights Summary:

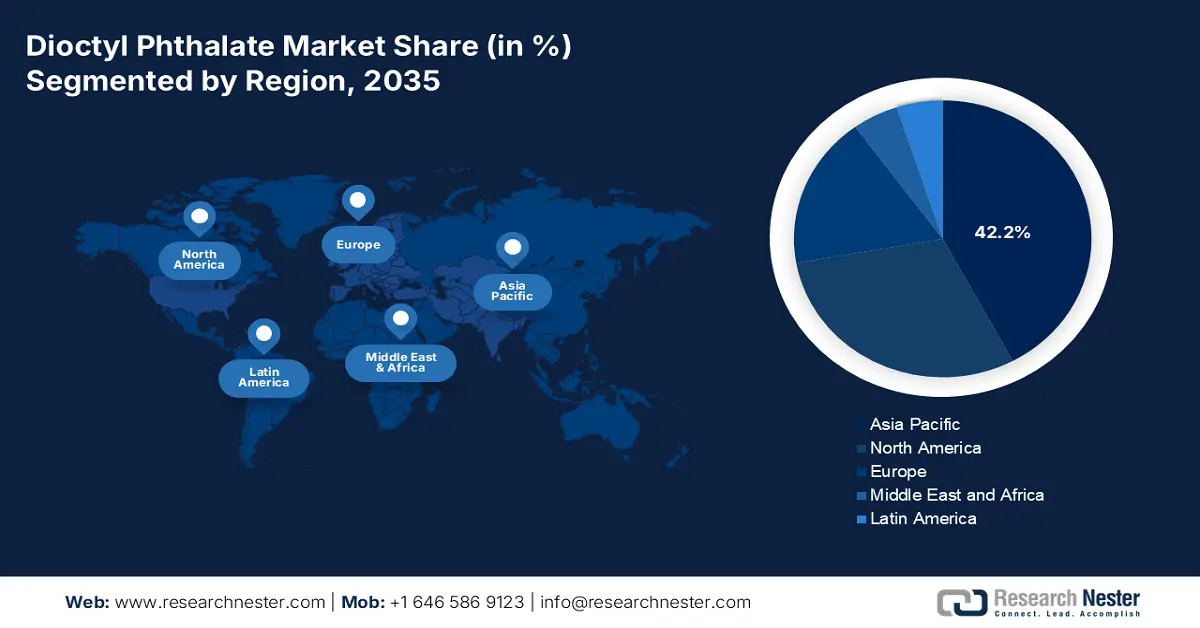

Regional Highlights:

- Asia Pacific commands a 42.2% share in the dioctyl phthalate market, driven by rapid industrial development and high DOP demand in flexible PVC applications, ensuring robust growth through 2035.

- North America’s dioctyl phthalate market is projected to grow rapidly by 2035, driven by infrastructure demand and the use of DOP in construction and consumer products.

Segment Insights:

- The Upto 99% Purity segment is anticipated to secure a significant share by 2035, fueled by its balanced performance and affordability in various industrial applications.

- The Industrial Grade Segment is anticipated to hold a 67.5% share by 2035, fueled by its extensive use as a plasticizer in construction and packaging.

Key Growth Trends:

- Automotive industry expansion

- Healthcare and medical applications

Major Challenges:

- Availability of safer alternatives

- Public perception and market pressure

Key Players: Eastman Chemical Company, Saudi Basic Industries Corporation, VINA Plasticizers Chemical Company Limited, KLJ Plasticizers Ltd., UPC Technology Corp..

Global Dioctyl Phthalate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.13 billion

- 2026 Market Size: USD 2.22 billion

- Projected Market Size: USD 3.34 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Dioctyl Phthalate Market Growth Drivers and Challenges:

Growth Drivers

-

Automotive industry expansion: DOP is integral in producing flexible PVC components that are essential in vehicles, including wiring insulation, interior trims and dashboards, underbody coatings, and sealants and gaskets. The automotive industry’s growth leads to increased production of vehicles, thereby escalating the demand for flexible PVC components. As DOP is a primary plasticizer in flexible PVVC, its demand rises. For instance, the global automotive production has been on an upward trajectory, with emerging economies like India and China contributing significantly to this growth. This surge in vehicle manufacturing necessitates more PVC components, thus driving the DOP market.

Additionally, the shift towards electric vehicles has amplified the need for advanced wiring systems and lightweight materials. DOP-plasticized PVC meets these requirements, further bolstering its demand in the evolving automotive landscape. - Healthcare and medical applications: DOP is extensively utilized as a plasticizer in the production of flexible PVS, which is a critical material in numerous medical devices due to its flexibility, durability, and clarity. Flexible PVC tubing, plasticized with DOP, is commonly used for IV administration sets, providing the necessary flexibility and strength. Also, DOP-plasticized PVC is used in blood storage bags, ensuring the bags are flexible and durable for safe blood storage and transfusion.

Globally, healthcare spending is on the rise, leading to greater demand for medical devices and, consequently, the materials used in their production, such as DOP-plasticized PVC. Moreover, an aging global population necessitates more medical interventions, increasing the need for medical devices that utilize DOP.

Challenges

- Availability of safer alternatives: The development of bio-based and non-phthalate plasticizers is increasingly attracting industries that are looking for more sustainable and health-compliant options. Many companies are transitioning to these alternatives to align with environmental, social, and governance goals.

- Public perception and market pressure: Consumer awareness around product safety and sustainability is increasing, especially in markets like North America and Europe. Companies face pressure to label products as phthalate-free, particularly in toys, cosmetics, and medical devices. This pushes demand away from DOP, especially in sensitive product categories.

Dioctyl Phthalate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 2.13 billion |

|

Forecast Year Market Size (2035) |

USD 3.34 billion |

|

Regional Scope |

|

Dioctyl Phthalate Market Segmentation:

Grade (Laboratory Grade, Industrial Grade)

The industrial grade segment is anticipated to hold a share of 67.5% in the global dioctyl phthalate market by 2035, primarily due to its extensive use as a plasticizer in various industrial applications. Industrial grade DOP is a high-performance plasticizer primarily used to improve the flexibility, durability, and longevity of PVC and other plastics. It differs from other grades mainly in purity and intended application scope.

In the construction industry, industrial grade DOP is used in PVC flooring, roofing membranes, pipes, and insulation. Moreover, they are used in synthetic leather, toys, footwear, adhesives, and packaging. Their demand is high in developing countries with expanding manufacturing sectors.

Purity (Upto 99% and Above 99%)

The upto 99% purity segment is expected to capture a significant portion of the global dioctyl phthalate market. DOP with upto 99% purity is the most commonly used grade in industries such as construction, packaging, and consumer goods. It offers a good balance between performance and affordability, making it ideal for bulk manufacturing. This purity level is sufficient for most applications using PVC and other polymers, proving excellent plasticizing efficiency.

Our in-depth analysis of the global dioctyl phthalate market includes the following segments:

|

Grade |

|

|

Purity |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dioctyl Phthalate Market Regional Analysis:

APAC Market Statistics

Asia Pacific dioctyl phthalate market is projected to gain the largest share of 42.2% by 2035, driven by the region’s robust industrial base and the extensive use of DOP as a plasticizer in various applications. Rapid development in countries like China and India increases the demand for flexible PVC products, thereby boosting DOP consumption. China is a pivotal player in the global dioctyl phthalate market, both as a leading producer and consumer. The country’s expansive industrial base, particularly in PVC production, underpins its significant role in the DOP landscape.

India’s ongoing infrastructure projects and urban housing initiatives are increasing the demand for PVC products, thereby increasing DOP usage. Further, the expanding automotive sector requires flexible PVC components, leading to higher DOP usage. DOP’s affordability compared to alternative plasticizers makes it a preferred choice for manufacturers in the country.

North America Market Analysis

North America has rapidly emerged as the fastest-growing dioctyl phthalate market. The market is poised for substantial growth, underpinned by industrial demand and supportive infrastructure developments. The U.S. construction sector’s demand for flexible PVC products, such as cables, flooring, and wall covering, propels DOP consumption. Moreover, rising demand for products like synthetic leather and footwear, which utilize DOP-plasticized PVC, contributes to market expansion. Similarly, the demand for flexible PVC products is propelling DOP consumption in Canada’s construction sector.

Key Dioctyl Phthalate Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eastman Chemical Company

- Saudi Basic Industries Corporation

- VINA Plasticizers Chemical Company Limited

- KLJ Plasticizers Ltd.

- UPC Technology Corp.

- Aekyung Petrochemical Co., Ltd.

- Hanwha Chemical Co, Ltd.

Key players in the dioctyl phthalate market are actively driving the growth through strategic initiatives focused on innovation, sustainability, and global expansion. These companies are adapting to evolving regulatory landscapes and consumer preferences by enhancing product offerings and operational efficiencies.

Here are some of the key players in dioctyl phthalate market:

Recent Developments

- In February 2025, BASF stated that it now offers clients biomass-balanced (BMB) and Ccycled grades of its plasticizer range from production sites in Pasadena, Texas, and Cornwall, Ontario. The sites and mass-balanced items have been certified by the International Sustainability and Carbon Certification (ISCC) PLUS program.

- In March 2022, KLJ Group commissioned a new integrated manufacturing plant in Bharuch, Gujarat, with an installed capacity of 300,000 tons per annum of plasticizers and 100,000 tons per annum of phthalic anhydride.

- Report ID: 7639

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dioctyl Phthalate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.