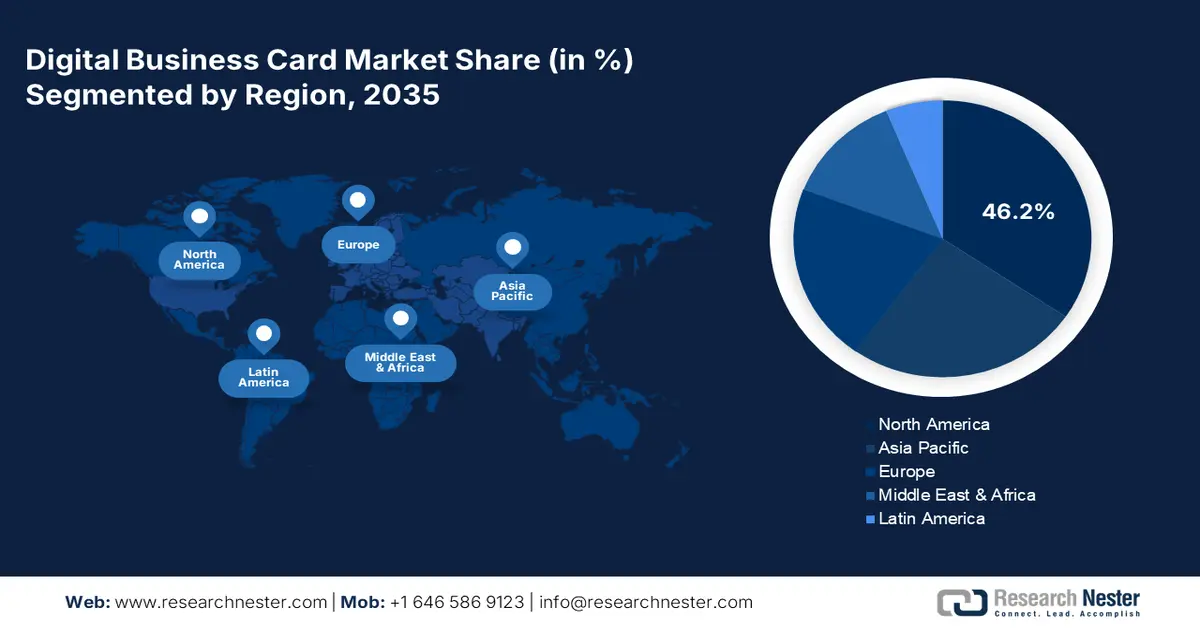

Digital Business Card Market Regional Analysis:

North America Market Forecast

North America digital business card market is expected to account for revenue share of more than 46.2% by the end of 2035. The strong presence of tech-savvy consumers, the swift digitalization of companies, and the existence of industry giants are contributing to the increasing sales of digital business cards. The strict environmental regulations and increasing adoption of sustainable practices are fueling the adoption of digital business cards.

In the U.S., businesses and professionals have started adopting contactless solutions including digital business cards as a result of post COVID-19 pandemic. Digital business cards eliminate the need for physical interaction and are a more secure and efficient way to exchange contact information. The advanced networking culture in the U.S. is also augmenting the demand for digital business cards for both individual and enterprise use.

In Canada, government initiatives such as the Digital Ambition to promote sustainable and tech-driven business practices are driving the use of digital business cards. As many companies both corporate and manufacturing prioritize sustainable practices the use of digital business cards is anticipated to accelerate.

Asia Pacific Market Statistics

The Asia Pacific digital business card market is estimated to offer lucrative opportunities for digital business card producers in the coming years due to the rising digital shift across various industries. The digital transformation positively influences the adoption of digital business cards in the region. The key market players' expansion in the region is also projected to drive innovations leading to the production of modern contact solutions.

The digital business card market is foreseen to increase at a healthy CAGR in Australia during the projected period. The increasing emergence of new companies in the market is highlighting the popularity of digital business cards. For instance, founded in 2018, Blinq Technologies is offering efficient and advanced digital business cards in the country. In May 2022, Blinq Technologies received an investment of around USD 3 million (AUS 5 million dollars) from Blackbird and Square Peg Capital to develop simple and effective contact-sharing solutions. The company integrated advanced technologies such as QR codes, NFC chips, and email signatures to enhance its digital business card solutions.

In India, the digital transformation trend coupled with supportive government initiatives is generating high-earning opportunities for digital business card producers. The government is investing heavily in infrastructure development initiatives such as the Smart Cities Mission and Housing for All, and the Digital India aim is estimated to drive the demand for digital business cards in the coming years.