Diethyl Acetoacetamide Market Outlook:

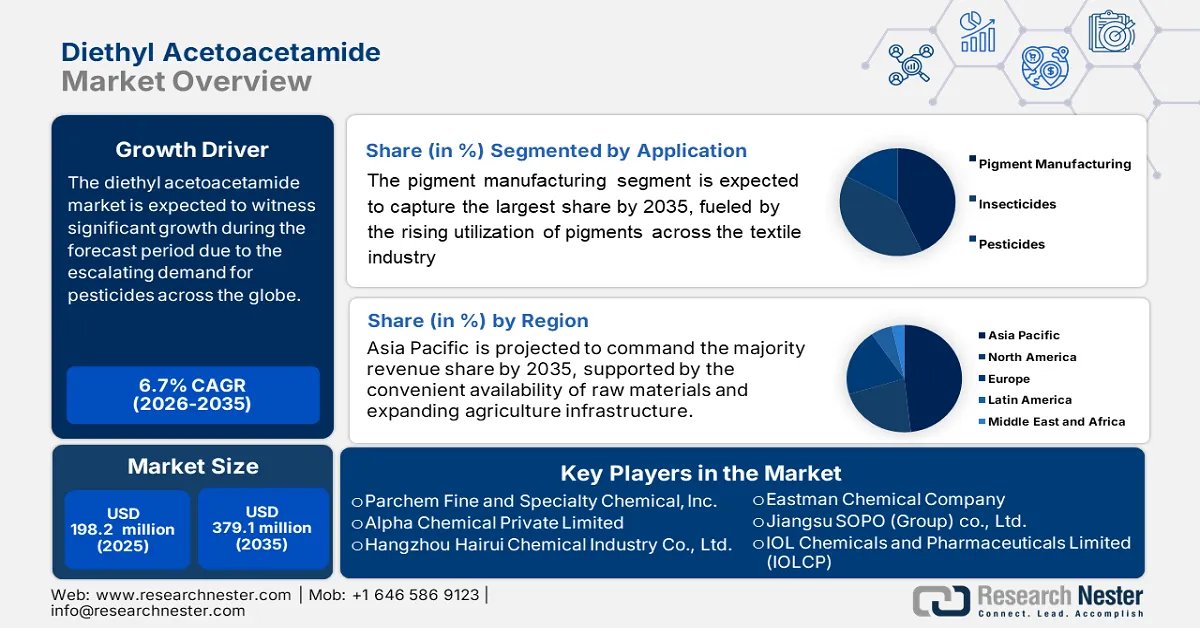

Diethyl Acetoacetamide Market size was over USD 198.23 million in 2025 and is poised to exceed USD 379.15 million by 2035, growing at over 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of diethyl acetoacetamide is evaluated at USD 210.18 million.

The growth of the market can be attributed to the increasing agricultural land as well as the rising use of insecticides across the world. In the U.S. more than 50% of the land base is used for agricultural production as of 2021. Also, the increasing use of chemical pigments for coloring is anticipated to drive market growth in the coming years. The increasing population around the world is rising the demand for food crops productivity and manufacturing of various disease control pesticides which in turn are estimated to drive the market growth.

The escalating chemical sector growth with increasing manufacturing of different chemicals is estimated to increase the market growth. The increasing application of the paper industry is also estimated to drive market growth. The increasing number of institutions, the financial and law sectors is propelling the use of paper across the world. The global value of the educational services sector in the year 2023 was worth more than USD 2 trillion as per the estimations. The diethylacetoacetamide is the intermediate in the manufacturing of various pigments which are used in paints, coatings, and other sectors that need color and are estimated to drive market growth as per the market analysis.

Key Diethyl Acetoacetamide Market Insights Summary:

Regional Highlights:

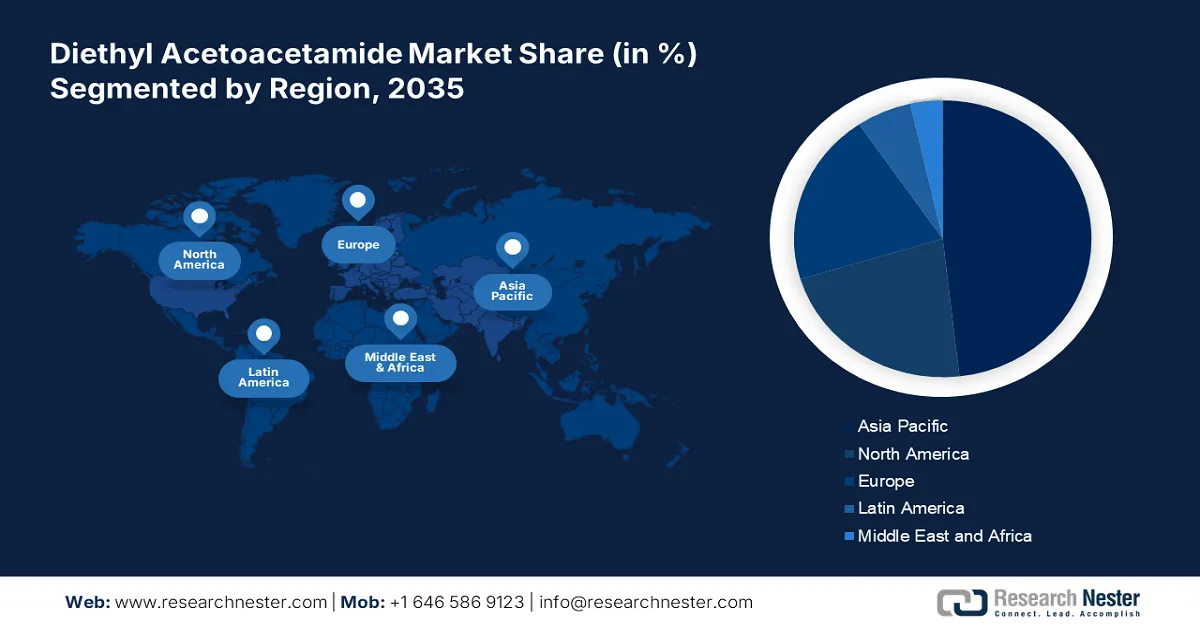

- The Asia Pacific region is projected to command the majority revenue share by 2035 in the Diethyl Acetoacetamide Market, attributed to the convenient availability of raw materials.

- North America is anticipated to secure a notable share by 2035, supported by the rising demand for weed removal chemicals and insecticides.

Segment Insights:

- The pigment manufacturing segment is projected to account for the largest share by 2035 in the Diethyl Acetoacetamide Market, influenced by the increasing utilization of pigments in the textile industry.

- The paper & pulp segment is expected to capture a significant share by 2035, underpinned by the increasing use of paper in the packaging industry.

Key Growth Trends:

- Escalating Demand for Pesticides Across the Globe

- Increasing Requirements for Weed Removal Substances

Major Challenges:

- Availability of Alternative Chemicals in the Market

- Rising Harmful Effects on the Environment and Mankind

Key Players: Alkyl Amines Chemical Limited, Parchem Fine and Specialty Chemical, Inc., TCI Chemical (India) Pvt. Ltd., Alpha Chemical Private Limited, Hangzhou Hairui Chemical Industry Co., Ltd., Eastman Chemical Company, Jiangsu SOPO (Group) co., Ltd., IOL Chemicalsand Pharmaceuticals Limited (IOLCP), Jiangsu Baichuan High-tech New Materials Co., Ltd., Godavari Biorefineries Limited.

Global Diethyl Acetoacetamide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 198.23 million

- 2026 Market Size: USD 210.18 million

- Projected Market Size: USD 379.15 million by 2035

- Growth Forecasts: 6.7%

Key Regional Dynamics:

- Largest Region: Asia Pacific (Majority Revenue Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: South Korea, Brazil, Indonesia, Vietnam, Mexico

Last updated on : 21 November, 2025

Diethyl Acetoacetamide Market - Growth Drivers and Challenges

Growth Drivers

- Escalating Demand for Pesticides Across the Globe – The rising number of diseases for agricultural plants is estimated to drive market growth across the world. The increasing demand for food crops with a rising population worldwide is driving market growth across the world. The demand for pesticides and insecticides to improve crop productivity was also anticipated to increase the market growth. The worldwide use of pesticides was estimated to raise to reach more than 3.5 million tonnes by 2020.

- Increasing Requirements for Weed Removal Substances – The increasing consumption of herbicides for agriculture worldwide in the year 2020 was estimated to be more than 1300 thousand metric tons.

- High Utilization in Pigment Production with Rising Construction Sector – The value of pigments and dyes in the year 2022 across the world was worth more than USD 35 billion across the world.

- Significant Need in Multiple Industries, Such as Paint & Coating, Plastic & Textile, Paper & Pulp – In the year 1975, the number of textile fibers produced was over 23 million metric tons and was increased to more than 110 million metric tons in the year 2021.

Challenges

- Availability of Alternative Chemicals in the Market

- Rising Harmful Effects on the Environment and Mankind - The harmful effects of diethyl acetoacetamide cause skin, and eye irritation, may affect the respiratory tract when exposed too long, and may also cause central nervous system disorders and hepatotoxicity affecting the liver. These side effects are estimated to hamper the market growth in the coming years.

- Requirement of Skilled Personnel to Handle

Diethyl Acetoacetamide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 198.23 million |

|

Forecast Year Market Size (2035) |

USD 379.15 million |

|

Regional Scope |

|

Diethyl Acetoacetamide Market Segmentation:

Application (Insecticides, Pesticides, Pigment Manufacturing)

The global diethyl acetoacetamide market is segmented and analyzed for demand and supply by application into insecticides, pesticides, and pigment manufacturing. Out of the three segments, the pigment manufacturing segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the increasing utilization of pigments in the textile industry in the coming years. The textile sector worldwide was worth over USD 550 billion in the year 2022 and reached more than USD 600 billion in 2023 as per the reports. The growing application of pigments in the paint and coating industry is rising with the increasing construction sector and renovations across the world. Also, the increasing number of paper industries owing to the adoption of paper packaging is rising the application of pigments in the coming years. All these factors are estimated to have a positive impact on the growth of the market during the forecast period.

End-user (Paint & Coating, Plastic & Textile, Paper & Pulp, Agriculture)

The global diethyl acetoacetamide market is also segmented and analyzed for demand and supply by end-user into paint & coating, plastic & textile, paper & pulp, agriculture, and others. Amongst these segments, the paper & pulp segment is expected to garner a significant share. The increasing number of educational institutions and rising number of hospitals are estimated to drive the market of the paper industry. The growth of the pulp and paper industry across the world is attributed to the increasing use of tissue paper, toilet paper, paper rolls, printing, and writing paper.The rising utilization of paper in the packaging industry is also driving market growth in the coming years. The rising preference for sustainable products and goods is also anticipated to boost market growth during the forecast period. The United States is the first-largest producer and second-largest consumer of paper with the use of more than 60 million metric tons in 2020.

Our in-depth analysis of the global market includes the following segments:

|

By Purity |

|

|

By Application |

|

|

By End User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Diethyl Acetoacetamide Market - Regional Analysis

APAC Market Statistics

Asia Pacific industry is predicted to dominate majority revenue share by 2035. The growth of the market can be attributed majorly to the convenient availability of raw materials, the growing agriculture sector, and the increasing investment of major companies. Based on data presented by the World Bank in 2018, 2,705,488 sq. km of agricultural land was found available alone in South Asia, meanwhile, 47.4% of land in East Asia and the Pacific was being utilized for agricultural activities. The increasing utilization of chemicals for the manufacturing of paints, coatings, paper, and pulp industry is estimated to drive market growth in the coming years in this region. The growing number of textile industries is also anticipated to propel the growth of the market in the future.

North American Market Forecast

Furthermore, the global diethyl acetoacetamide market is also projected to hold a remarkable share in North America region on the back of rising demand for weed removal chemicals and insecticides over the forecast period. Additionally, growing investment in other industries, such as paint & coating, paper & pulp, and plastic & textile is also anticipated to influence the growth of the market positively during the forecast period. As per a report published by the United States Geological Survey (USGS) about 1 billion pounds of pesticides are utilized in the USA annually to put a stop to weeds, pests, and insects. Such factors are forecasted to boost the growth of the market throughout the forecast period in this region.

Diethyl Acetoacetamide Market Players:

- Alkyl Amines Chemical Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Parchem Fine and Specialty Chemical, Inc.

- TCI Chemical (India) Pvt. Ltd.

- Alpha Chemical Private Limited

- Hangzhou Hairui Chemical Industry Co., Ltd.

- Eastman Chemical Company

- Jiangsu SOPO (Group) co., Ltd.

- IOL Chemicals and Pharmaceuticals Limited (IOLCP)

- Jiangsu Baichuan High-tech New Materials Co., Ltd.

- Godavari Biorefineries Limited

Recent Developments

-

Sun Chemical Group Cooperatief U.A. introduced new effect pigments that highlight the natural colorants and ingredients to make them sustainable solutions for the beauty sector.

- Report ID: 4086

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Diethyl Acetoacetamide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.