Diagnostic Cartridge Field Diagnostic System Market Outlook:

Diagnostic Cartridge Field Diagnostic System Market size was over USD 8.32 billion in 2025 and is anticipated to cross USD 13.42 billion by 2035, growing at more than 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of diagnostic cartridge field diagnostic system is estimated at USD 8.69 billion.

The uptrend of point-of-care diagnostics or near-patient testing to avail accurate, precise, and timely results will thrust the market growth.

Diagnostic field system refers to the detection of the amount of or an analyte in body fluids or tissue that affects the pathogenesis of any disease. It helps as a biological marker shown to indicate a predisposition to any disease. The field is gaining importance with the increasingly deteriorating lifestyle of the global population, diminishing immunity globally.

Key Diagnostic Cartridge Field Diagnostic System Market Insights Summary:

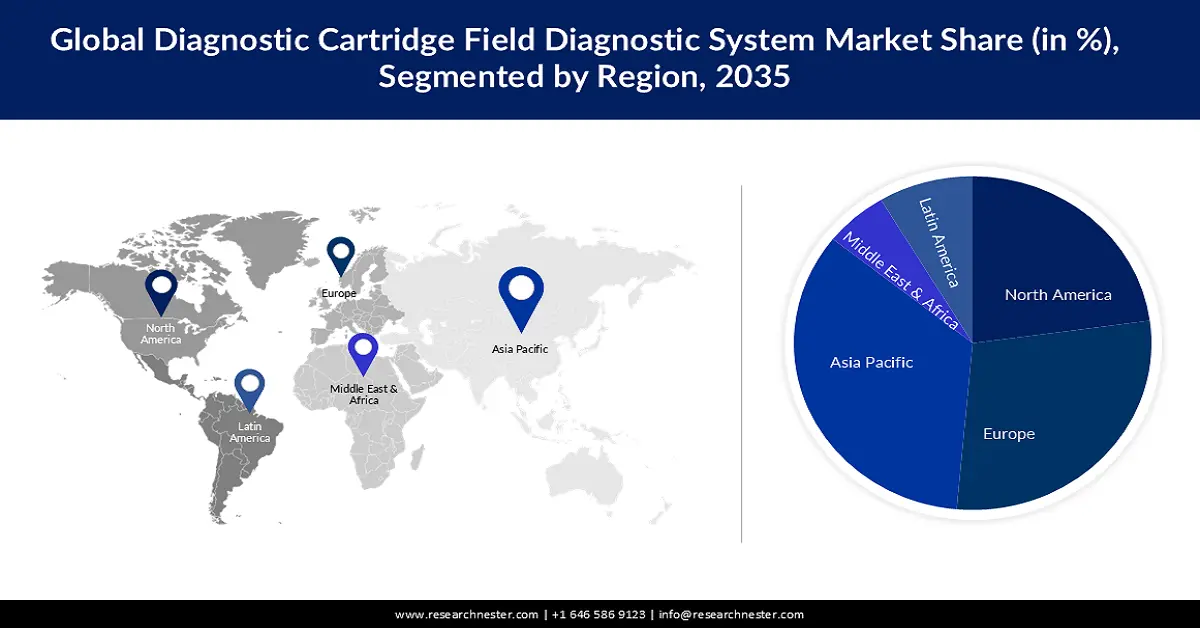

Regional Insights:

- Asia Pacific is anticipated to secure a 35% share by 2035 in the diagnostic cartridge field diagnostic system market, supported by increasing disease prevalence that is fostering collaborations and investment inflows across the diagnostic landscape.

- North America is projected to command around a 25% share by 2035, bolstered by the swift uptake of advanced medical technologies and rising healthcare expenditure.

Segment Insights:

- The cardiac markers testing segment is expected to capture a 40% share of the diagnostic cartridge field diagnostic system market by 2035, propelled by the growing incidence of myocardial infarction requiring early biomarker-based detection.

- The hospital segment is poised to attain nearly a 40% share by 2035, spurred by advancements in diagnostic operations and the expanding use of portable and handheld diagnostic devices.

Key Growth Trends:

- Rising Prevalence of Chronic and Acute Diseases

- Increasing Importance of the Diagnostic Industry

Major Challenges:

- Challenge of Quality Control and Result Reporting

- Lack of Accuracy due to Test Error

Key Players: Siemens Healthineers AG, Abbott Laboratories, F. Hoffmann-La Roche AG, Danaher Corporation, Bio-Rad Laboratories, Inc., Sysmex Corporation, Arkray Inc., Becton, Dickinson, and Company, Binx Health Limited, Nova Biomedical Corporation.

Global Diagnostic Cartridge Field Diagnostic System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.32 billion

- 2026 Market Size: USD 8.69 billion

- Projected Market Size: USD 13.42 billion by 2035

- Growth Forecasts: 4.9%

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 20 November, 2025

Diagnostic Cartridge Field Diagnostic System Market - Growth Drivers and Challenges

Growth Drivers

-

Rising Prevalence of Chronic and Acute Diseases – Diseases such as diabetes, cardiac disorders, and cancer are now prevailing amongst people worldwide at a higher rate. This has emerged in the importance of a cartridge-based diagnostic market. According to the data from the World Health Organization (WHO), nearly 1.6 million deaths are caused by diabetes, and nearly 17.9 million deaths are caused by cardiovascular diseases worldwide every year.

-

Increasing Importance of the Diagnostic Industry - The increasing demand for testing, quick results, and accurate diagnosis is leading to the adoption of technology and has further brightened the future of the smart diagnostic and monitoring medical device market. Moreover, augmenting awareness about preventive healthcare is poised to fuel market growth.

Challenges

-

Challenge of Quality Control and Result Reporting - the improper quality check protocols and incomplete reporting of results hamper the growth of the market.

- Lack of Accuracy due to Test Error

- Slower Penetration

Diagnostic Cartridge Field Diagnostic System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 8.32 billion |

|

Forecast Year Market Size (2035) |

USD 13.42 billion |

|

Regional Scope |

|

Diagnostic Cartridge Field Diagnostic System Market Segmentation:

Type Segment Analysis

The cardiac markers testing segment is slated to hold 40% share of the global diagnostic cartridge field diagnostic system market by 2035. The increasing cases of myocardial infarction (MI), commonly known as a heart attack can be predicted earlier with cardiac marker tests that identify blood chemicals associated with myocardial infarction. As per findings, in the United States, nearly at every 40 seconds someone suffers from a heart attack.

End-User Segment Analysis

The hospital segment is anticipated to account for around 40% revenue share by 2035, owing to the rising advancements in diagnostic activities in the hospital setting. Increasing the use of handheld/ portable diagnostics devices is also propelling the market growth.

Further, healthcare practitioners also collect a blood sample from the patient and send this sample to a satellite lab for quick results due to the increasing volume of diagnoses that need to be performed in hospitals.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Diagnostic Cartridge Field Diagnostic System Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is anticipated to hold largest revenue share of 35% by 2035. The increasing spread of disease in the region is resulting in several collaborations between corporates and multinational companies to uplift the overall diagnostic market. This is expected to pool investment in the diagnostic cartridge field diagnostic system market.

The cost-effective, hassle-free, and quality treatment options with superior diagnostic services available at low prices in countries such as India which is fast emerging as a medical tourism hub are also garnering more growth. India recorded a footfall of around 6.19 million foreign tourists in 2022, which was 4 times more compared with 1.52 million in 2021.

North American Market Insights

North America diagnostic cartridge field diagnostic system market is estimated to register a share of about 25% till 2035. The rapid adoption of advanced medical technology in the region especially with the rising total spending in the healthcare sector is estimated to back the market expansion.

World Bank revealed that 16% of the total GDP of the North American region was spent on healthcare. Adding to it, the immense research by giant players to develop accurate testing tools is also estimated to boost market growth.

Diagnostic Cartridge Field Diagnostic System Market Players:

- Siemens Healthineers AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- F. Hoffmann-La Roche AG

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- Sysmex Corporation

- Arkray Inc.

- Becton, Dickinson, and Company

- Binx Health Limited

- Nova Biomedical Corporation

Recent Developments

- ViiV Healthcare, collectively owned by GlaxoSmithKline plc, Pfizer Inc., and Shionogi announced the approval of the U.S. Food and Drug Administration (FDA) for Cabotegravir, an antiviral drug.

- Danaher Corporation announced the acquisition of Aldevron, to expand Danaher's life sciences segment.

- Report ID: 3936

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Diagnostic Cartridge Field Diagnostic System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.