Diabetes Devices Market Outlook:

Diabetes Devices Market size was valued at USD 34.18 billion in 2025 and is set to exceed USD 77.28 billion by 2035, registering over 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of diabetes devices is estimated at USD 36.79 billion.

The growing prevalence of diabetes across the world’s population and growing awareness about diabetes disease are estimated to drive the market’s growth during the forecast period. As per the American Diabetes Association estimations, in 2019, the total American population with diabetes was nearly 11.3 % of people i.e., about 37.3 million individuals.

In addition, one of the factors boosting the market's expansion is the rise in diabetes cases brought on by age, obesity, and bad lifestyle choices. According to the data reported, nearly 38 percent of adults across the globe are overweight as of 2019. Diabetes incidence is rising as a result of risk factors such as obesity and overweight. Therefore, it is anticipated that risk factors including smoking, being overweight or obese, and having high cholesterol levels will increase the prevalence of diabetes and increase the demand for diabetic devices. Numerous incentives, including a sizable ageing population, economical healthcare options, cost-effective labor, and relatively lax regulatory standards, are driving diabetic device manufacturers to grow their operations. To capture the largest possible proportion of the market, firms are now concentrating on harnessing opportunities existing in developing economies. Hence, these factors are highly expected to influence the global diabetes devices market’s growth positively over the projected period.

Key Diabetes Devices Market Insights Summary:

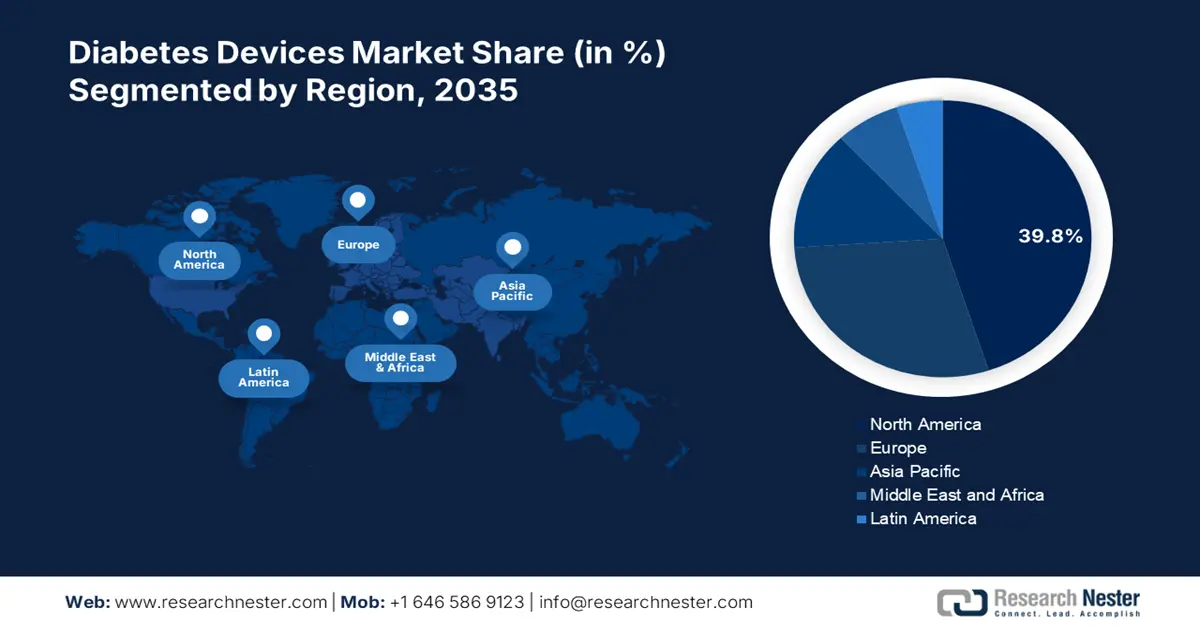

Regional Highlights:

- North America diabetes devices market is predicted to capture 39.8% share by 2035, driven by increased prevalence of diabetes, rising healthcare expenditure, and strong healthcare network.

Segment Insights:

- The online pharmacy segment in the diabetes devices market anticipates a massive CAGR through 2026-2035, propelled by increasing awareness and convenience of online platforms.

- The insulin delivery devices segment in the diabetes devices market is forecasted to secure the largest share by 2035, driven by rising diabetic complications requiring advanced solutions.

Key Growth Trends:

- Technological Advancements in Diabetes Monitoring Devices

- Rising Gestational Diabetes Cases

Major Challenges:

- Lack of Exact Blood Glucose Measurement

- The Presence of Adverse Effects

Key Players: Medtronic plc, Abbott Laboratories, ARKRAY, Inc., Bayer AG, Lifescan, Inc., B. Braun Melsungen AG, Dexcom, Inc., Insulet Corporation, Ypsomed AG, Sanofi.

Global Diabetes Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 34.18 billion

- 2026 Market Size: USD 36.79 billion

- Projected Market Size: USD 77.28 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 10 September, 2025

Diabetes Devices Market Growth Drivers and Challenges:

Growth Drivers

-

Technological Advancements in Diabetes Monitoring Devices – The advancements in science, technology, and manufacturing will help to manage the treatment of type 1 diabetes. People suffering from diabetes do not produce enough insulin or cannot use the insulin produced in the required way. The unavailability of insulin increases sugar levels in the blood. So, it is necessary to regulate the blood glucose levels in these people through regular monitoring. Many advancements have been made to make this process user-friendly, which is estimated to drive the diabetes devices market growth in the coming years. In 2020, the U.S Food and Drug Administration (FDA) approved a hybrid closed-loop management device named ‘Minimed770G’. This will keep an eye on the sugar levels and helps caregivers of users to estimate the appropriate insulin doses.

- Rising Gestational Diabetes Cases – As per the Centers for Disease Control and Prevention (CDC), gestational diabetes increased by 29% from 2016 to 2020 in the United States.

- Sedentary Lifestyle and Lack of Physical Activity – As per the CDC, over 60% of adults in the U.S do not participate in the recommended physical activity, and 25% of them are completely inactive.

- Increasing Geriatric Population Across the Globe – The older population aged 65 and above across the U.S. was 54.1 million in 2019, as per the Administration for Community Living.

- Rising Personal Disposable Income – The disposable personal income of the U.S population as per the Bureau of Economic Analysis 2022, increased to USD 67.6 billion and the personal consumption expenditure rose to USD 67.5 billion.

Challenges

- Lack of Exact Blood Glucose Measurement – Although monitoring glucose has become a crucial element of treating diabetes, its precision has certain drawbacks. For the variations in strip production, strip storage, and strip ageing, accuracy may be restricted. They might also be the result of patient issues such as inaccurate coding, insufficient hand washing, a changed hematocrit, or naturally existing interfering chemicals, or environmental restrictions such as temperature or altitude.

- The Presence of Adverse Effects

- Lack of Knowledge to Operate Devices

Diabetes Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 34.18 billion |

|

Forecast Year Market Size (2035) |

USD 77.28 billion |

|

Regional Scope |

|

Diabetes Devices Market Segmentation:

Type

The global diabetes devices market is segmented and analyzed for demand and supply by type into blood glucose monitoring, and insulin delivery devices. Out of these, the insulin delivery devices segment is anticipated to hold the largest market size by the end of 2035 owing to rising diabetic cases with complications that can’t be treated with medications alone, high adoption and easy availability of self-monitoring devices, and increasing demand for homecare products and therapies during COVID-19. The number of blood glucose monitors sold in 2019 alone by private labels was 14 million units. Syringes, pens, jet injectors, oral insulin, pumps, and other forms of insulin delivery methods are among the numerous ones available. Inhalable insulin and other innovative methods of treating diabetes are also in various stages of development and availability around the globe.

Distribution Channel

The global diabetes devices market is also segmented and analyzed for demand and supply by distribution channel into retail pharmacy, hospital pharmacy, clinics, online pharmacy, and others. Amongst these five segments, the hospital pharmacy segment is expected to garner a significant share. Patients suffering from diabetes often visit hospitals for treatment and glucose monitoring, and it is easier and more convenient for them to purchase the prescribed drugs or needful devices directly from the same hospital premises. On the other hand, the online pharmacy segment is projected to witness a massive CAGR during the forecast period, owing to the rising awareness of these online platforms amongst users across the world. Purchasing diabetes devices online help the user to receive the prescribed drugs directly at their homes, without the need to visit offline stores. Besides this, several online pharmaceutical businesses are also offering wide discounts to lure their customers as part of their customer retention process. This, as a result, is estimated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Distribution Channel |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Diabetes Devices Market Regional Analysis:

North American Market Insights

North America region is set to dominate around 39.8% market share by 2035, driven by increased prevalence of diabetes, rising healthcare expenditure, and strong healthcare network. The healthcare expenditure of the U.S in 2020 rose to 9.7% and is estimated to reach USD 4.1 trillion. Further, the presence of a strong healthcare network in the region, along with the availability of supportive policies by the regulatory bodies that promote the market players to opt for easy testing of newly launched devices over a large target population so as to develop efficient treatment options and glucose monitoring options, are also expected to contribute to the market growths in the region. In addition, the region's expanding healthcare industry and rising commercialization of diabetes device products are also predicted to fuel the market growth notably over the projected period.

Diabetes Devices Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- ARKRAY, Inc.

- Bayer AG

- Lifescan, Inc.

- B. Braun Melsungen AG

- Dexcom, Inc.

- Insulet Corporation

- Ypsomed AG

- Sanofi

Recent Developments

-

LifeScan IP Holdings, LLC declared the launch of U.S OneTouch Verio Reflect, the first product with a Blood Sugar Mentor. This feature allows people with diabetes a personalized real-time guide.

-

Insulet Corporation declared that it’s Omnipod 5 Automated Insulin Delivery System received clearance from the U.S Food and Drug Administration. This was used for 6 years and older people suffering from type 1 diabetes.

- Report ID: 4642

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Diabetes Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.