Dexrazoxane Market Outlook:

Dexrazoxane Market size was valued at USD 887.7 million in 2025 and is projected to reach USD 1502 million by the end of 2035, rising at a CAGR of 5.4% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of dexrazoxane is estimated at USD 935.6 million.

The global dexrazoxane market is unfolding appreciable growth opportunities fueled by the growing demand for chemotherapy-based cardioprotection, coupled with anthracycline extravasation management. Besides, the NLM study in March 2022 reports that nearly 650,000 patients in the U.S. received anthracycline-based treatment measures, reflecting the demand for dexrazoxane. Additionally, the market expansion is significantly influenced by the synthesis of ingredients, that is, the supply chain is dominated by China and India, with high production. Similarly, formulations in GMP-certified facilities in the U.S., EU, and Japan are distributed through varied pharmaceutical networks, denoting a positive outlook for market upliftment.

At a trade and economic level, the producer price index for chemoprotectant agents has been fairly stable, reflecting established manufacturing, although vulnerable to variations in bulk API prices from overseas suppliers. Consumer prices, influenced to a large extent by reimbursement policy as opposed to direct purchase, are protected from immediate market volatility. The OEC report in 2023 depicts that the global export of pharmaceutical products has increased by 0.85% from 2022-2023. Further, the import-export dynamics are characterized by the export of bulk APIs from India and China to formulation and packaging plants in Western markets. The final drug product is then dispensed by specialty pharmaceutical wholesalers to hospital systems.

Key Dexrazoxane Market Insights Summary:

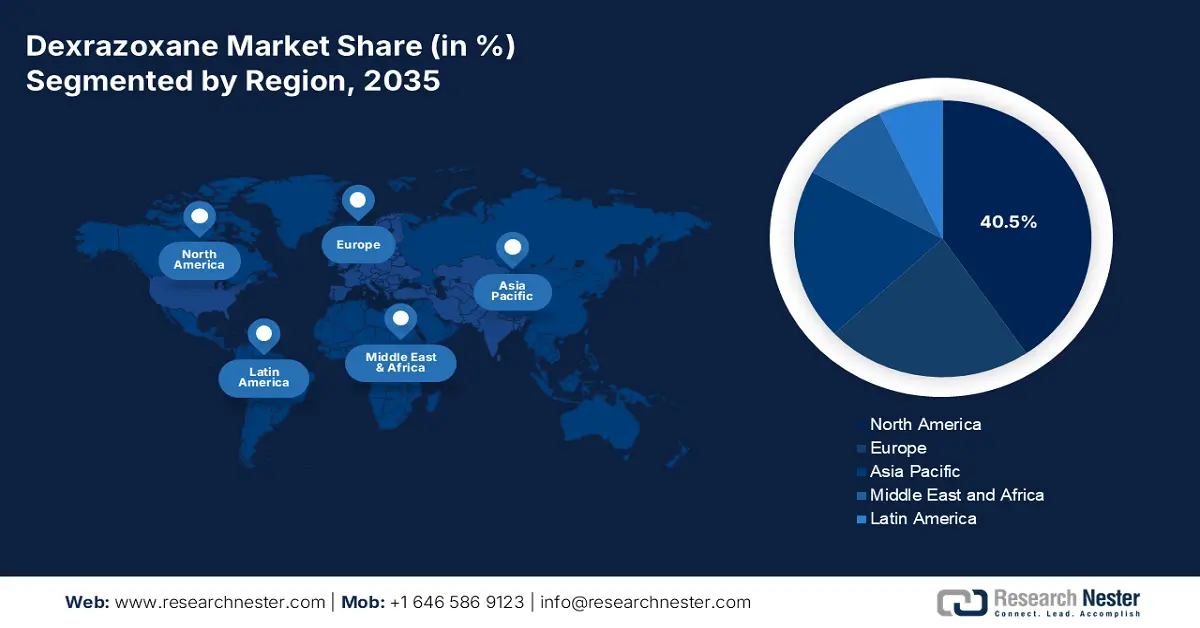

Regional Insights:

- North America is anticipated to hold a 40.5% share during the forecast period 2026–2035, driven by extensive chemotherapy utilization and supportive insurance reimbursement policies.

- Asia Pacific is projected to register the fastest growth by 2035, owing to rising cancer incidence, expanded medical access, and government initiatives promoting cardioprotective therapies.

Segment Insights:

- The hospital sub-segment is projected to account for 70% share by 2035, owing to the controlled clinical environment required for safe intravenous administration during chemotherapy.

- The lyophilized powder form is expected to hold the leading share by 2035, propelled by its stability, long shelf-life, and ease of reconstitution in hospital settings.

Key Growth Trends:

- Increased incidence of anthracycline-exposed cancers

- Growing demand for cardioprotection

Major Challenges:

- Stringent regulatory approvals

- Budget restrictions in public health systems

Key Players:Pfizer Inc.,Teva Pharmaceutical Industries Ltd.,Mylan N.V. (now part of Viatris),Hikma Pharmaceuticals PLC,Fresenius Kabi AG,Sun Pharmaceutical Industries Ltd.,Cipla Ltd.,Dr. Reddy's Laboratories Ltd.,Sandoz International GmbH (Novartis division),Accord Healthcare Inc.,Gland Pharma Ltd.,Jiangsu Aosaikang Pharm Co., Ltd.,Intas Pharmaceuticals Ltd.,Apotex Inc.,Baxter International Inc.,Nippon Kayaku Co., Ltd.,Sawai Pharmaceutical Co., Ltd.,Kyowa Kirin Co., Ltd.,Nichi-Iko Pharmaceutical Co., Ltd.,Takeda Pharmaceutical Company Limited

Global Dexrazoxane Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 887.7 million

- 2026 Market Size:USD 935.6 million

- Projected Market Size: USD 1502 million by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, France, Canada

- Emerging Countries:China, India, Brazil, South Korea, Australia

Last updated on : 3 October, 2025

Dexrazoxane Market - Growth Drivers and Challenges

Growth Drivers

- Increased incidence of anthracycline-exposed cancers: The growing pool of patients is a basic driver of growth. Anthracyclines are still a cornerstone therapy for prevalent cancers such as breast cancer and lymphoma. In Germany, the incidence of breast cancer was more than 70,000 new cases, according to the NLM study in August 2024. This increased incidence has a direct relation on a higher population in need of cardioprotection. The manufacturers can use epidemiological information obtained from sources such as the CDC (CDC.gov) for purposes of identifying high-growth geographies and orientation of market entry based on the highest unmet need and volume of patients.

- Growing demand for cardioprotection: There is a surge in chemotherapy-induced cardiotoxicity and the need for cardioprotection that is driving growth in the dexrazoxane market. In this context, NIH states that dexrazoxane formulations are highly effective in the form of a cardioprotective agent, in cancer patients using anthracycline-based chemotherapy. Besides, in 2022 AHRQ study declared that this element lowered the cardiac hospitalization rates, conserving in the U.S. healthcare expenditure. Furthermore, in Europe, ESMO is recommending dexrazoxane for high-risk patients, thereby accelerating market growth.

- Focus on healthcare quality and cost-effectiveness: Payer focus on value-based care is a critical driver. NLM's March 2025 study points out that dexrazoxane significantly decreases the incidence of heart failure, particularly in sarcoma patients receiving high cumulative doses of doxorubicin. Heart failure incidence is as low as 1.1% in clinical trials with dexrazoxane compared with 5.4% without dexrazoxane. This information enables hospital systems to rationalize the drug's initial cost, fueling uptake as a best practice in quality oncology care and providing a compelling narrative for manufacturers during negotiations with payers.

Heart Failure and Cardiac Dysfunction Incidence in Contemporary Trials

|

Population |

Dexrazoxane Use (% use) |

Cumulative Doxorubicin Dose (mg/m²) |

Number of Patients |

Age Range (years) |

Heart Failure Incidence |

LVEF Decline (%) |

|

Leiomyosarcoma |

No |

360-450‡ |

149 |

30-86 |

5.4 |

NA |

|

Soft-Tissue Sarcoma |

Yes (38.6%) |

< 450 |

153 |

NA* |

2 |

16.2 (with dexrazoxane) 5.9 (without dexrazoxane) |

|

Soft-Tissue Sarcoma |

Yes (88.5%) |

450-599 |

159 |

NA |

3 |

9.9 (with dexrazoxane) 23.5 (without dexrazoxane) |

|

Soft-Tissue Sarcoma |

Yes (90%) |

≥ 600 |

89 |

NA |

1.1 |

12.5 (with dexrazoxane) 44.4 ( without dexrazoxane) |

|

Pediatric Osteosarcoma |

Yes (100%) |

450-600 |

242 |

3-30 |

0 |

2.1† |

Source: NLM March 2025

Challenges

- Stringent regulatory approvals: One of the major bottlenecks of dexrazoxane market is the strict regulations imposed by the governing bodies that delay the product’s market entry. Despite possessing higher efficacy, the product needs to undergo rigorous clinical trials for the exploration of its potential. Besides when compared to the U.S. Japan’s PMDA necessitates more than 6 months for approvals associated with oncology therapeutics. This adds higher expenses for the manufacturer, delaying product exposure across the healthcare industry.

- Budget restrictions in public health systems: Public health systems, particularly in developing countries, have limited oncology drug budgets. According to the WHO, cancer drug spending can take up a significant percentage of the national health budget (WHO.int). A supplier of dexrazoxane will be competing against the main chemotherapies themselves and therefore will be a lesser priority. This compels manufacturers to create tiered pricing models or get onto international aid programs in order to gain access in such markets.

Dexrazoxane Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 887.7 million |

|

Forecast Year Market Size (2035) |

USD 1502 million |

|

Regional Scope |

|

Dexrazoxane Market Segmentation:

End user Segment Analysis

The hospital sub-segment is the largest end-user in the dexrazoxane market, which is expected to have the largest revenue share of 70% by 2035. This is mainly because of the drug's administration mode; as an intravenous infusion employed for the prevention of anthracycline-induced cardiotoxicity, it has to be administered in a controlled clinical environment under direct medical control during chemotherapy procedures. Hospitals and their related oncology departments have the required infrastructure, skilled staff, and equipment for safe administration and monitoring of patients.

Product Formulation Segment Analysis

The lyophilized powder form leads because of its better stability, long shelf-life, and simple reconstitution in hospital facilities, which is essential for an intravenous drug used in combination with chemotherapy. The June 2025 NLM report illustrates that the Essential Medicines lists supplies more than 70% of antibiotics as lyophilized sterile powders for injection. FDA regulatory guidelines prioritize the injectable formulation's stability, which has led to lyophilized powder being the preferred choice among manufacturers and clinicians alike, providing an assured consistency of efficacy and safety profiles (FDA.gov). Its logistical benefits are the rationale behind its market-leading revenue share.

Distribution Channel Segment Analysis

In the distribution channel segment, hospital pharmacies lead the segment as the dexrazoxane is usually used as intravenous drug administered in clinical setting under strict medical supervision during the sessions of chemotherapy. The NLM study in April 2022 depicts that overall pharmaceutical expenditure in hospital pharmacies increased by 7.7% in 2021 and totaled USD 576.9 billion. Moreover, it is not a retail pharmacy product. The Centers for Medicare & Medicaid Services policies that reimburse these drugs under hospital outpatient system, reinforce this channel. The requirement for controlled administration and monitoring ensures that distribution is centralized within hospital pharmacy networks.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

End user |

|

|

Product Formulation |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dexrazoxane Market - Regional Analysis

North America Market Insights

The North America dexrazoxane market is poised to capture the largest share of 40.5% during the forecast period, 2026-2035. The region benefits from the presence of emerging nations such as the U.S. and Canada, which contribute to the maximum revenue share in the region. U.S. dominates the North America market owing to the extensive utilization of chemotherapy treatments and insurance reimbursement policies. Besides, the CMS states that Medicare expenditure for this element in 2024, fueled by the coverage for pediatric oncology. The U.S. FDA’s 2023 label expansion for adults having a higher risk further increased the adoption of dexrazoxane, contributing to market progression in the region.

The U.S. dexrazoxane market is dominated by huge government expenditure and favorable reimbursement policy. The major trend is the increasing coverage of Medicare for cardioprotective agents due to population aging and long-term cancer care needs. As reported by the AACR Cancer Progress Report in 2025, the NIH’s National Cancer Institute (NCI) supports extensive research to focus on managing adverse effects of cancer treatments, with extramural grants contributing to overall NIH cancer research funding that surpassed USD 37.81 billion in FY 2023. There is also federal funding reflected, with the NIH having given priority to research on preventing chemotherapy side effects, solidifying demand. These together create a stable growth in the market, aiming to enhance patient outcomes in oncology care.

There is a huge opportunity for the market in Canada, driven by the increasing provincial healthcare investments. The market is anticipated to grow with government-backed funding and increasing instances of cancer cases. Besides, Ontario report in July 2023 states that Ontario for the Ministry of Health, provides 75% of the total funding for intravenous cancer drugs. This budget supports in adoption, accessibility, and clinical use as part of the broader oncology drug budget. Moreover, Health Canada mandated this element for pediatric anthracycline use, reflecting the higher efficacy.

Cancer Statistics in U.S. and Canada

|

Category |

U.S. (2025) |

Canada (2024) |

|

New Cancer Cases |

2,041,910 estimated new cases |

247,100 new cases |

|

Cancer Deaths |

618,120 estimated deaths |

88,100 deaths |

|

Men (Top 3 Cancers) |

Prostate, Lung, Colorectal 48% of diagnoses |

127,100 new cases (all cancers combined) |

|

Women (Top 3 Cancers) |

Breast, Lung, Colorectal → 51% of diagnoses |

120,000 new cases (all cancers combined) |

Source: National Cancer Institute May 2025, Canadian Cancer Society 2025

APAC Market Insights

Asia Pacific is expected to demonstrate the fastest growth in the market with its strong capacity in pharmaceuticals, including cancer therapeutics. The region is augmenting such growth due to the increasing burden of cancer, expanded medical access, and proactive government initiatives aiming to enhance management strategies. Besides, countries in the region are appreciably integrating cardioprotective therapies in cancer treatments, denoting an increased adoption. Hence, these factors will readily bolster the market positioning of Asia Pacific as a key leader in the market.

The market of dexrazoxane in India is growing at a very fast rate because of the high dedication of public and private healthcare centers to provide phenomenal cancer care. In this respect, the PRS Legislative Research report in 2025 has stated that during 2025-26, Rs 99,859 crore has been invested by the Ministry, which is an 11% rise compared to 2024-25 in the healthcare sector. This increased investment reflects more access to advanced oncology drugs such as dexrazoxane, bolstering cancer care infrastructure in India.

The China dexrazoxane market is experiencing stable growth, driven by the rising cancer burden and growing application of anthracycline-based chemotherapies that require cardioprotective measures. According to the NLM report in February 2022, the number of cancer cases in China in 2022 was 4,820,000. This persistent disease incidence underscores the need for supportive therapies such as dexrazoxane to avert chemotherapy-related adverse effects. Increased hospital infrastructure expansion, along with increased investment in oncology research, positions China as a leading emerging market for dexrazoxane in the Asian region.

Europe Market Insights

The market in Europe is influenced by high rates of cancer prevalence and treatment, strong healthcare infrastructure, and strict regulatory systems that provide drug safety and efficacy. Key growth drivers include the increasing adoption of anthracycline-based chemotherapy and a growing emphasis on cardioprotection to mitigate associated cardiac toxicity. Trends indicate a transition towards treatments, which include cardioprotective agents such as dexrazoxane that are driven by positive reimbursement policies and government programs.

The UK is set to have the largest revenue share in Europe by 2035, led by a strong healthcare policy environment and accelerated uptake of clinical guidelines. The National Institute for Health and Care Excellence (NICE) guideline recommends dexrazoxane for certain patient populations, providing uniform application in the NHS. Based on nhs.uk statistics, the Cancer Drugs Fund spending in 2023/2024 was about £247 million, covering early access to novel cancer drugs. Strong clinical research facilities in the UK, financed by Cancer Research UK, also enhance market penetration.

Germany is also leading the dexrazoxane market in Europe and is fueled by its rising population and comprehensive statutory health insurance system. The Federal Ministry of Health states that a continuus reimbursement expansion codes for support in oncological care. Further the high decentralized healthcare system in Germany allows a swift adoption in university hospitals and regional cancer centers. The major trend is rising the focus on outcomes on long term patient in reducing the chemotherapy related comorbidities which is prioritized by the German Cancer Research Center.

Cancer Drugs Fund Expenditure 2023-2024

|

Total CDF budget 2023/24 |

£340 million |

|

n/a |

Cumulative YTD Totals |

|

n/a |

Quarters 1 to 2 |

|

n/a |

Actual (£) |

|

Interim funding agreements |

£20.56 million |

|

Managed access agreements |

£226.51 million |

|

Total drug cost |

£247.07 million |

Source: NHS December 2024

Kry Dexrazoxane Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V. (now part of Viatris)

- Hikma Pharmaceuticals PLC

- Fresenius Kabi AG

- Sun Pharmaceutical Industries Ltd.

- Cipla Ltd.

- Dr. Reddy's Laboratories Ltd.

- Sandoz International GmbH (Novartis division)

- Accord Healthcare Inc.

- Gland Pharma Ltd.

- Jiangsu Aosaikang Pharm Co., Ltd.

- Intas Pharmaceuticals Ltd.

- Apotex Inc.

- Baxter International Inc.

- Nippon Kayaku Co., Ltd.

- Sawai Pharmaceutical Co., Ltd.

- Kyowa Kirin Co., Ltd.

- Nichi-Iko Pharmaceutical Co., Ltd.

- Takeda Pharmaceutical Company Limited

Companies involved in the market are witnessing intensifying competition between the global players in various regions. Leading firms such as Pfizer Inc. and Hikma Pharmaceuticals are gaining exceptional recognition with products such as Zinecard and Totect. Besides, companies in developing countries are enhancing manufacturing capabilities to meet the rising demand. Furthermore, firms are leveraging collaborations, regulatory support, and research investments to enhance their product portfolio. Hence, with these constant efforts from the players across all nations, the market will grow at the fastest rate.

Below is the list of some prominent players in the industry:

Recent Developments

- In May 2025, Reach Pharmaceuticals announced the TGA approval of DEXRAZOXANE-REACH for injection, which is used to reduce the incidence and severity of cardiomyopathy related to doxorubicin administration among women with breast cancer.

- In August 2023, CNX Therapeutics acquired nearly 4 medicines, such as Cardioxane (dexrazoxane), Totect (dexrazoxane), Savene (dexrazoxane), and Ethyol (amifostine), all of which help alleviate the side effects patients may experience when treated with any other cancer therapies.

- Report ID: 2614

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dexrazoxane Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.