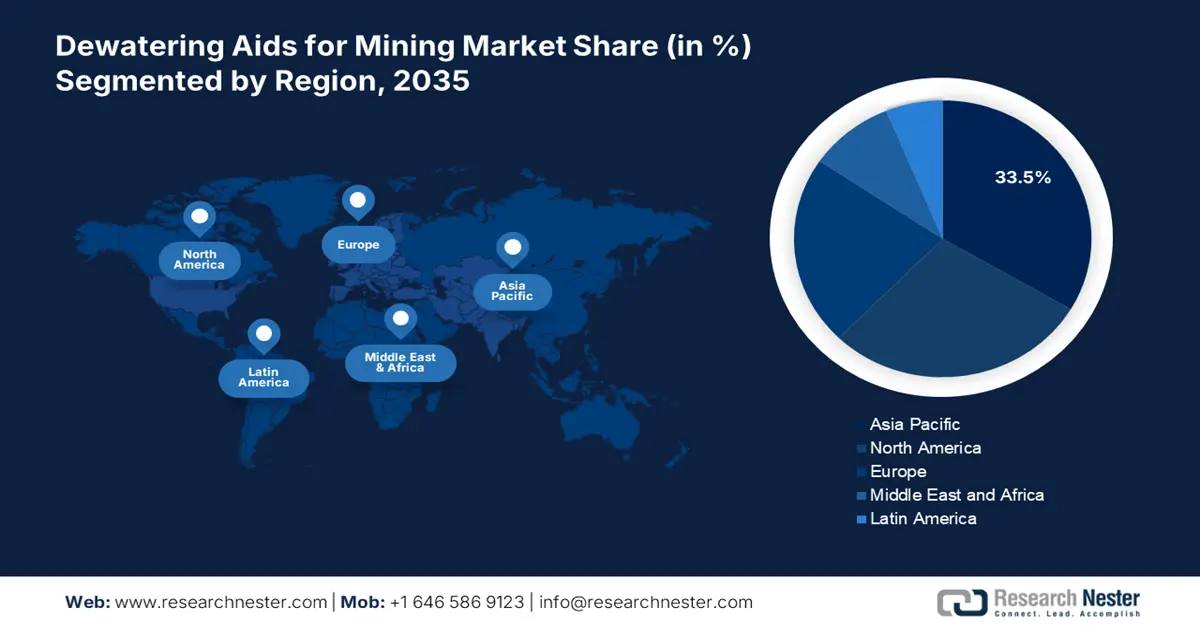

Dewatering Aids for Mining Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific market is expected to hold 33.5% of the dewatering aids for mining market share due to extensive mineral exploration and mineral processing, along with mineral processing activities in China, India, and Southeast Asia. Although China's management policies are becoming stricter, ultimately, the rapid increase in coal mining in India will strengthen demand. The forecast value of the market will show substantial growth on account of ore recovery efficiency improvements and in processing plants where demand for water scarcity mitigation is being addressed. Investments being made in gold and nickel extraction technologies in Australia and Indonesia will collectively enhance market growth. Advances in technology that improve solid-liquid separation will still be in strong demand and directly correlate to the positive growth of dewatering aids for the mining market.

China will provide a sustained growth of dewatering aids for mining market in the region from 2026 to 2035, as its environmental policies related to zero-discharge tailings facilities and dewatering improvement policies will create value. The market will be sustained based on the continued high level of mineral extraction, including coal, iron ore, and rare earth elements. Additionally, the rapid uptake of advanced chemical reagents that promote filtration improvements and reductions in slurry moisture content will drive growth in the category of conformance, where the customer buys dewatering aids. The adoption of green mining under the five-year plans will warrant higher consumption of dewatering aids. Furthermore, the expansion of mineral processing capacity to meet domestic and export demand will continue to expand development in China, a core area for growth. This is evidenced by the scale of its mining sector; according to the U.S. Geological Survey, China accounted for 60% of global rare earth mine production in 2023, extracting 240,000 metric tons.

India is anticipated to emerge as the fastest-growing dewatering aids for mining market in the Asia-Pacific until 2035, propelled by the expansion of its mining sector and a governmental objective of achieving 1.5 billion tonnes of coal production by 2030. The National Mineral Policy of 2019 emphasizes sustainable mining practices, scientific mineral processing, and the integration of advanced technologies, thereby underscoring the necessity for effective dewatering solutions. These regulations advocate for water recycling and stringent tailings management, which in turn boosts the demand for high-performance flocculants and dewatering aids within mineral processing operations.

North America Market Insights

The North American market is expected to hold 28.8% of the dewatering aids for mining market share due to the increased metal and mineral mining activity in the region. The rising demand for effective tailings and sludge treatment and disposal options (along with stringent environmental disposal requirements) is driving adoption in North America. Large producers in North Mountain are investing heavily in bio-based dewatering aids to meet EPA and mining regulatory agency sustainability standards.

Canada is expected to demonstrate the most significant growth rate in the dewatering aids for mining market across North America, propelled by its Critical Minerals Strategy, which focuses on enhancing the production of essential resources such as nickel, cobalt, and lithium. The stringent environmental regulations enforced by Environment and Climate Change Canada (ECCC), along with the necessity to process intricate ores in remote mines located in cold climates, are driving the demand for sophisticated, tailored dewatering solutions. Additionally, Natural Resources Canada is promoting innovations such as in-line dewatering to minimize the volumes of oil sands tailings ponds.

In the U.S., the dewatering aids for mining market is anticipated to grow at a 5.6% CAGR by 2035. This growth trend is driven by an increase in underground mining operations, the development of tailings filtration units, and the increased focus of the US mining industry on water recycling and compliance with Clean Water Act discharge limits. Major producers are looking to invest in new polymer blends to increase separation efficiency for coal, gold, and rare earth mineral processing applications in both the Western and Appalachian mining belts of the U.S.

Europe Market Insights

The European dewatering aids for mining market is significantly shaped by strict environmental regulations, particularly the EU Water Framework Directive, which requires improved wastewater treatment and resource recovery initiatives. Major factors driving this market include increasing urbanization and the growth of industrial activities that heighten the demand for sophisticated dewatering technologies. Germany and the UK play pivotal roles in this market due to their well-established industrial sectors and dedication to sustainable water management practices, bolstered by robust regulatory frameworks.

Germany is anticipated to command the largest portion of Europe’s dewatering aids for mining market by 2035, driven by its strong industrial foundation and stringent environmental policies that align with EU directives. The country’s 2025 Annual Economic Report underscores the importance of infrastructure development, especially in water and wastewater systems, as vital to its economic growth and environmental sustainability objectives. In a similar vein, the UK is expected to emerge as a prominent market player by 2035, fueled by its advanced water treatment infrastructure and rigorous government regulations. The UK government’s spending review highlights ongoing investments in enhancements to wastewater treatment, including dewatering technologies, to comply with changing environmental standards.