DevSecOps Market - Growth Drivers and Challenges

Growth Drivers

- Growing use of cloud-native technologies: Mass deployment of cloud-native technologies, like microservices and containers, is a key driver behind the DevSecOps market. The new, modern architectures create new security and complexity issues that are beyond what traditional security solutions can address. DevSecOps gives organizations a much-needed model to secure dynamic, distributed environments by putting security in the CI/CD pipeline. In November of 2023, CloudBees made its new cloud-native DevSecOps platform on AWS that will orchestrate a variety of CI/CD solutions across enterprises. The launch reflects what is happening in the industry to support delivering single, unified platforms that can handle the nuances of cloud-native development. In turn, it is facilitating organizations to develop and deploy secure applications in the cloud more confidently.

- Growing rate and sophistication of cyber attacks: Expanding threat landscapes, defined by more frequent and complex cyberattacks, are driving organizations to take a more anticipatory approach to security. DevSecOps meets this challenge by distributing security controls and testing across the software development lifecycle so that vulnerability detection and remediation take place earlier. The "shift-left" approach decreases the attack surface and lowers security breach risk. In September 2023, Checkmarx Ltd. purchased Dustico, a software supply chain security firm, in a move to beef up its application security platform by adding more advanced features to detect malicious code in open-source packages. The acquisition is a reflection of the increasing organizational need to take a holistic approach to securing the software supply chain in a DevSecOps model.

- Growing need for security automation using AI: Integrating AI is transforming DevSecOps by adding more automated and intelligent security processes. AI-based tools allow vulnerability scanning, threat detection, and incident response to be automated, freeing up security teams to work on more strategic projects. The technology also improves the security test results' validity, as well as reducing instances of false positives. Atlassian Corporation Plc, in April 2023, launched Atlassian Intelligence, an AI-based feature interconnected across its cloud platform. The rollout of this service helps DevSecOps teams automate, summarize security results, as well as develop test cases against security flaws. The use of AI is also improving DevSecOps efficiency and effectiveness, prompting further adoption industrywide.

Cybersecurity Initiatives in the Market

A key growth driver of the global DevSecOps market is the heightened cybersecurity threats worldwide. This creates greater opportunities for providers of DevSecOps platforms as security has become essential for every phase of the software development pipeline. The table below highlights significant cyberattacks and mitigation strategies, and DevSecOps platforms are expected to assist in the resolution strategies:

|

Company |

Attack Type |

Impact |

Mitigation Strategy |

|

Coinbase |

Insider Theft / Bribery |

Customer data (PII, partial bank details) was leaked, affecting around 70,000 users via a third-party contractor. Criminals used this data for phishing scams. The total cost of the breach is estimated to be within the range of $180 million to $400 million, covering remediation, legal fees, and reimbursement to affected customers |

Stricter access controls and enhanced monitoring for third-party vendors. Coinbase also terminated the compromised agents and reimbursed affected customers |

|

Marks & Spencer |

Ransomware / Social Engineering |

Service disruption, including the suspension of online orders and click-and-collect, with some customer data stolen. Attackers gained access via a third-party IT provider using social engineering. The financial impact is estimated at a £300 million profit loss, partially covered by insurance |

Enhanced third-party risk management and stricter MFA enforcement for vendor access. M&S also forced password resets for online accounts |

|

Snowflake |

Credential Theft |

Data breaches at over 160 customers, not just AT&T and Santander. The stolen credentials, which often lacked MFA, led to the exposure of data from companies including Ticketmaster, AT&T, and Santander. The breach also prompted a Department of Justice indictment |

Mandatory MFA enforcement for all user accounts, robust anomaly detection, and resetting credentials. Snowflake and its partner Mandiant also advised customers to implement network allow lists |

Source: Coinbase, Marks & Spencer, Snowflake

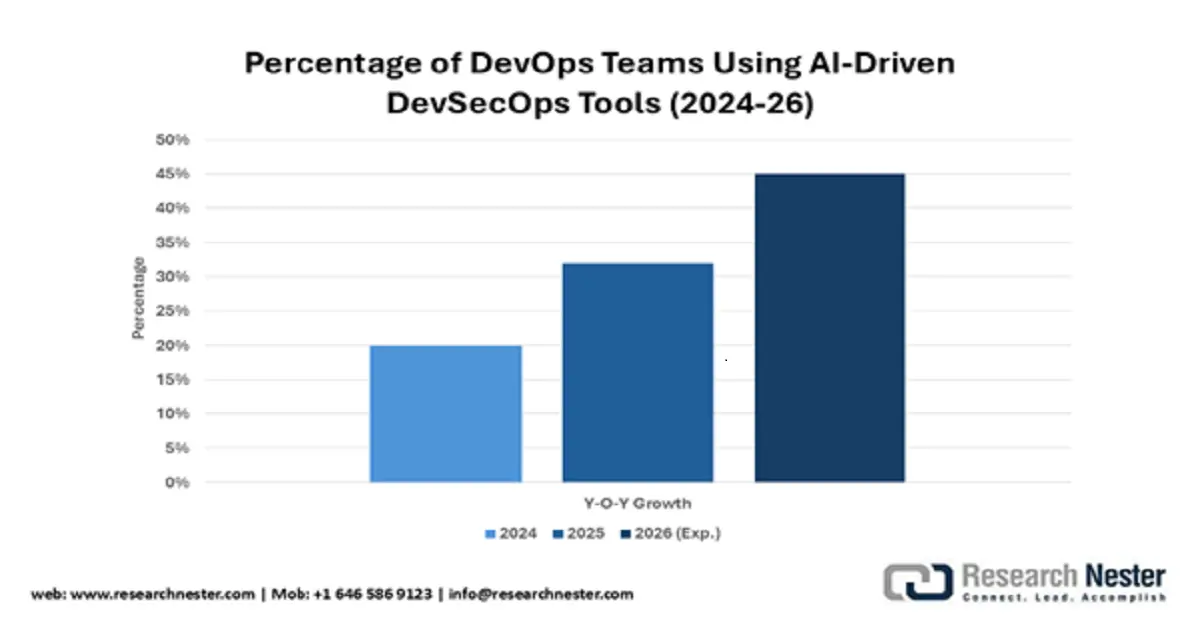

Projected Adoption of AI-Driven DevSecOps Tools (2024-2026)

The projected surge in AI-driven DevSecOps tool adoption, from 20% to 45% by 2026, reflects growing reliance on automation to address escalating security threats and regulatory pressures like GDPR/CCPA. This trend underscores a strategic shift toward embedding intelligent security into DevOps pipelines, enabling faster vulnerability detection, supply chain resilience, and compliance adherence.

Source: EEC

Challenges

- Cultural resistance and availability of skilled workforce: One of DevSecOps adoption's greatest hurdles is organizational cultural resistance. The old silos among security, development, and operations teams often lead to friction and inhibit cross-functional work. Security might be seen by a lot of developers as a slowdown of development; hence, there will be resistance to new security practices. That perception gap is evidence of how much there is a struggle in trying to create a culture of security and shared responsibility. The non-availability of individuals who possess the proper mix of security, development, and operations expertise further makes it challenging to scale and deploy DevSecOps initiatives in organizations.

- Complexity of the latest toolchains and environments: Continuously more complex software development environments and the burgeoning number of tools pose another significant challenge. Organizations can make use of numerous tools at varying periods of time in a development lifecycle, resulting in a disjointed and hard-to-manage toolchain. Merging security tools in such complex environments can be a challenging proposition that involves considerable expertise as well as resources. The aforementioned complexity gives rise to security holes as well as provides a siloed view of an application's security posture, therefore defying the objectives that a DevSecOps approach aims to address.

DevSecOps Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14% |

|

Base Year Market Size (2025) |

USD 10 billion |

|

Forecast Year Market Size (2035) |

USD 37 billion |

|

Regional Scope |

|