DevSecOps Market Outlook:

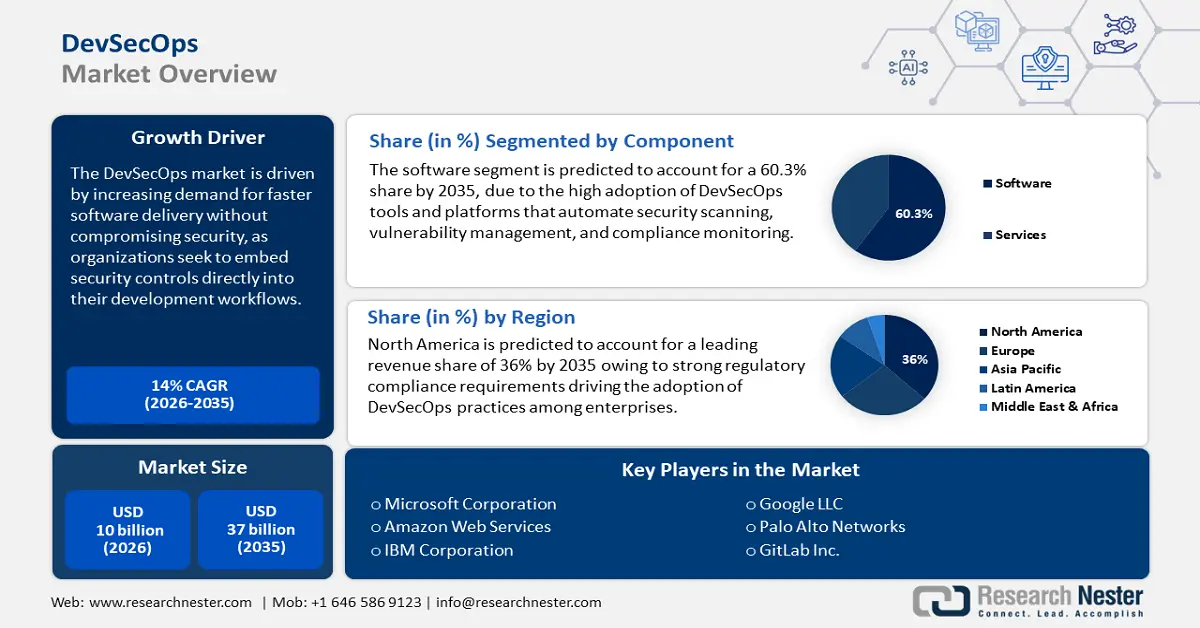

DevSecOps Market size was valued at USD 10 billion in 2025 and is projected to reach USD 37 billion in 2035, expanding at a CAGR of 14% during the anticipated timeline from 2026 to 2035. In 2026, the industry size of DevSecOps is estimated to reach USD 11.4 billion.

The market is experiencing stable growth as organizations prioritize integrating security into every phase of the software development lifecycle. This shift is driven by the urgent need to deliver secure applications at the speed of modern business. The market is characterized by a strong emphasis on automation, collaboration, and the adoption of "shift-left" security practices. This rapid remediation capability is a key factor driving the adoption of DevSecOps platforms and tools across industries. In the first half of 2024, the Office of the Director of National Intelligence highlighted that there were more than 2300 reported ransomware attacks worldwide, reflecting a slight increase from the same period in 2023. The market is also benefiting from the growing awareness that embedding security from the start is more cost-effective than addressing vulnerabilities in production.

Government programs and cybersecurity strategies at a national level are driving the DevSecOps market further. The governments, in improving digital security, are increasingly requiring software providers and critical infrastructure to meet higher security thresholds. Regulations are, in turn, providing strong motivations to organizations to deploy DevSecOps practices to meet compliance and limit exposure to risks. In March 2023, the White House in the U.S. issued the National Cybersecurity Strategy, which centers around shifting software and infrastructure providers' responsibility for security. The approach, in combination with equivalent moves in other nations, is establishing a more supportive regulatory climate, facilitating market expansion.

Key DevSecOps Market Insights Summary:

Regional Highlights:

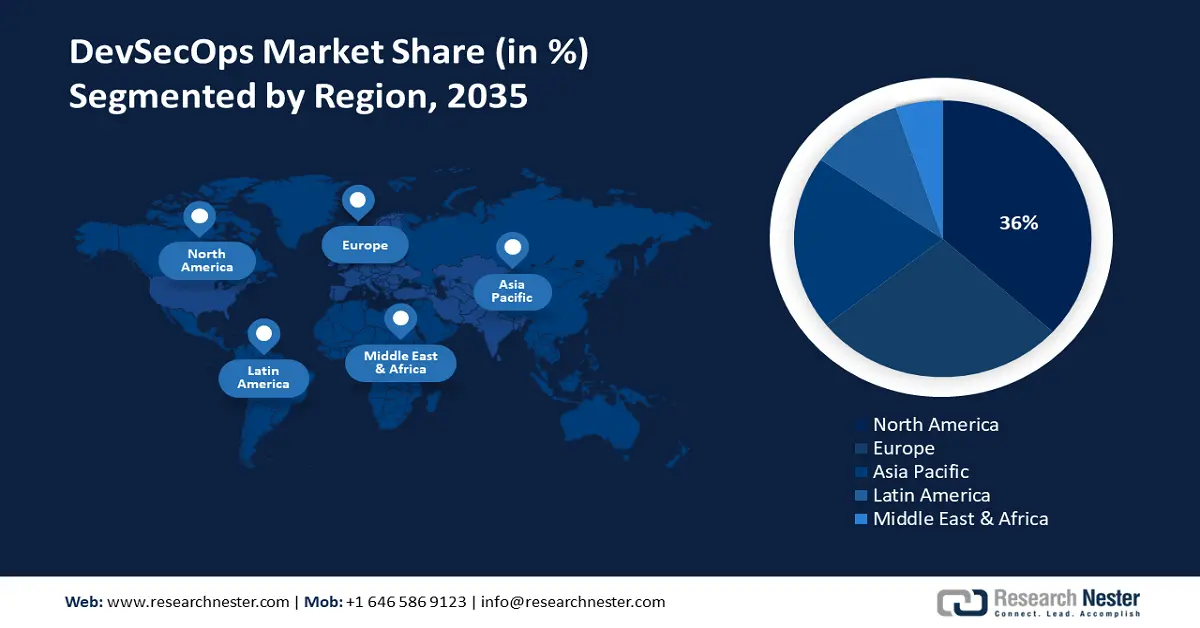

- North America is expected to secure a 36% share by 2035 in the devsecops market, supported by its strong base of technology companies, mature cloud landscape, and early adoption of agile and devops practices.

- Europe is projected to grow steadily through 2035, reinforced by stringent data protection norms and the region’s emphasis on building a secure digital single market.

Segment Insights:

- The software segment is anticipated to capture a 60.3% share by 2035 in the devsecops market, driven by the rising demand for automated and integrated security tools that embed protection throughout the ci/cd pipeline.

- The BFSI sector is projected to hold a 30.3% revenue share through 2035, supported by its heightened need for secure software development and strict compliance requirements.

Key Growth Trends:

- Growing use of cloud-native technologies

- Growing rate and sophistication of cyber attacks

Major Challenges:

- Cultural resistance and availability of skilled workforce

- Complexity of the latest toolchains and environments

Key Players: Amazon Web Services, Inc., IBM Corporation, Google LLC, Palo Alto Networks, Inc., GitLab Inc., Synopsys, Inc., Fortinet, Inc., Aqua Security Software Ltd., Trend Micro Incorporated, Atlassian Corporation Plc, Checkmarx Ltd., DeepSource, XebiaLabs, Entersoft Security.

Global DevSecOps Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 26 September, 2025

DevSecOps Market - Growth Drivers and Challenges

Growth Drivers

- Growing use of cloud-native technologies: Mass deployment of cloud-native technologies, like microservices and containers, is a key driver behind the DevSecOps market. The new, modern architectures create new security and complexity issues that are beyond what traditional security solutions can address. DevSecOps gives organizations a much-needed model to secure dynamic, distributed environments by putting security in the CI/CD pipeline. In November of 2023, CloudBees made its new cloud-native DevSecOps platform on AWS that will orchestrate a variety of CI/CD solutions across enterprises. The launch reflects what is happening in the industry to support delivering single, unified platforms that can handle the nuances of cloud-native development. In turn, it is facilitating organizations to develop and deploy secure applications in the cloud more confidently.

- Growing rate and sophistication of cyber attacks: Expanding threat landscapes, defined by more frequent and complex cyberattacks, are driving organizations to take a more anticipatory approach to security. DevSecOps meets this challenge by distributing security controls and testing across the software development lifecycle so that vulnerability detection and remediation take place earlier. The "shift-left" approach decreases the attack surface and lowers security breach risk. In September 2023, Checkmarx Ltd. purchased Dustico, a software supply chain security firm, in a move to beef up its application security platform by adding more advanced features to detect malicious code in open-source packages. The acquisition is a reflection of the increasing organizational need to take a holistic approach to securing the software supply chain in a DevSecOps model.

- Growing need for security automation using AI: Integrating AI is transforming DevSecOps by adding more automated and intelligent security processes. AI-based tools allow vulnerability scanning, threat detection, and incident response to be automated, freeing up security teams to work on more strategic projects. The technology also improves the security test results' validity, as well as reducing instances of false positives. Atlassian Corporation Plc, in April 2023, launched Atlassian Intelligence, an AI-based feature interconnected across its cloud platform. The rollout of this service helps DevSecOps teams automate, summarize security results, as well as develop test cases against security flaws. The use of AI is also improving DevSecOps efficiency and effectiveness, prompting further adoption industrywide.

Cybersecurity Initiatives in the Market

A key growth driver of the global DevSecOps market is the heightened cybersecurity threats worldwide. This creates greater opportunities for providers of DevSecOps platforms as security has become essential for every phase of the software development pipeline. The table below highlights significant cyberattacks and mitigation strategies, and DevSecOps platforms are expected to assist in the resolution strategies:

|

Company |

Attack Type |

Impact |

Mitigation Strategy |

|

Coinbase |

Insider Theft / Bribery |

Customer data (PII, partial bank details) was leaked, affecting around 70,000 users via a third-party contractor. Criminals used this data for phishing scams. The total cost of the breach is estimated to be within the range of $180 million to $400 million, covering remediation, legal fees, and reimbursement to affected customers |

Stricter access controls and enhanced monitoring for third-party vendors. Coinbase also terminated the compromised agents and reimbursed affected customers |

|

Marks & Spencer |

Ransomware / Social Engineering |

Service disruption, including the suspension of online orders and click-and-collect, with some customer data stolen. Attackers gained access via a third-party IT provider using social engineering. The financial impact is estimated at a £300 million profit loss, partially covered by insurance |

Enhanced third-party risk management and stricter MFA enforcement for vendor access. M&S also forced password resets for online accounts |

|

Snowflake |

Credential Theft |

Data breaches at over 160 customers, not just AT&T and Santander. The stolen credentials, which often lacked MFA, led to the exposure of data from companies including Ticketmaster, AT&T, and Santander. The breach also prompted a Department of Justice indictment |

Mandatory MFA enforcement for all user accounts, robust anomaly detection, and resetting credentials. Snowflake and its partner Mandiant also advised customers to implement network allow lists |

Source: Coinbase, Marks & Spencer, Snowflake

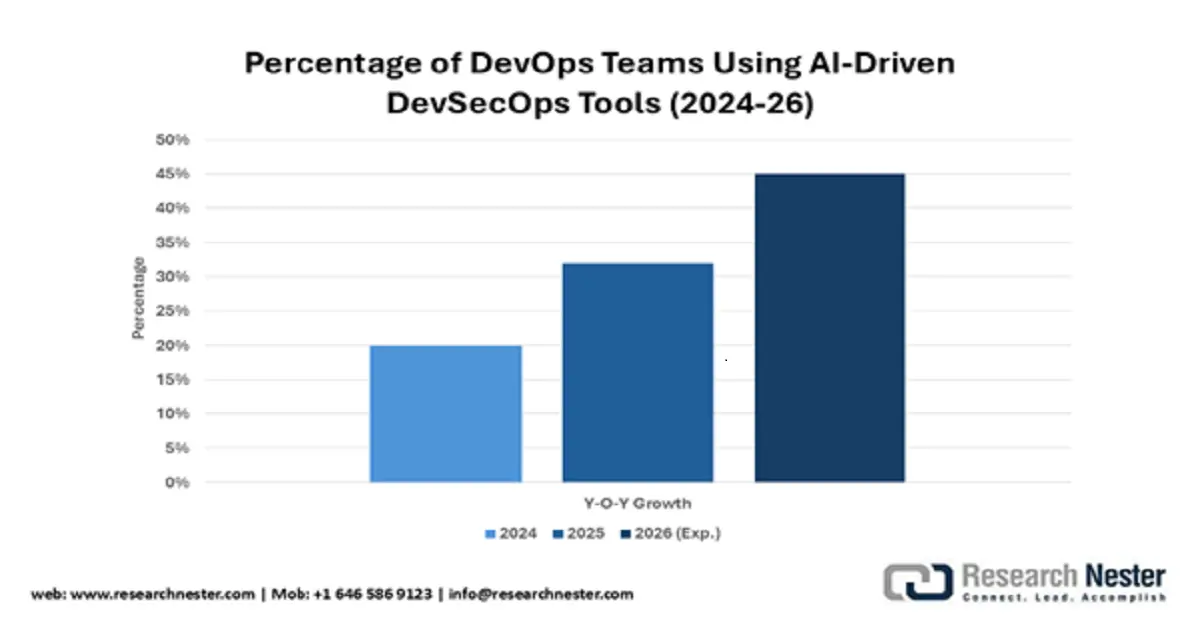

Projected Adoption of AI-Driven DevSecOps Tools (2024-2026)

The projected surge in AI-driven DevSecOps tool adoption, from 20% to 45% by 2026, reflects growing reliance on automation to address escalating security threats and regulatory pressures like GDPR/CCPA. This trend underscores a strategic shift toward embedding intelligent security into DevOps pipelines, enabling faster vulnerability detection, supply chain resilience, and compliance adherence.

Source: EEC

Challenges

- Cultural resistance and availability of skilled workforce: One of DevSecOps adoption's greatest hurdles is organizational cultural resistance. The old silos among security, development, and operations teams often lead to friction and inhibit cross-functional work. Security might be seen by a lot of developers as a slowdown of development; hence, there will be resistance to new security practices. That perception gap is evidence of how much there is a struggle in trying to create a culture of security and shared responsibility. The non-availability of individuals who possess the proper mix of security, development, and operations expertise further makes it challenging to scale and deploy DevSecOps initiatives in organizations.

- Complexity of the latest toolchains and environments: Continuously more complex software development environments and the burgeoning number of tools pose another significant challenge. Organizations can make use of numerous tools at varying periods of time in a development lifecycle, resulting in a disjointed and hard-to-manage toolchain. Merging security tools in such complex environments can be a challenging proposition that involves considerable expertise as well as resources. The aforementioned complexity gives rise to security holes as well as provides a siloed view of an application's security posture, therefore defying the objectives that a DevSecOps approach aims to address.

DevSecOps Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14% |

|

Base Year Market Size (2025) |

USD 10 billion |

|

Forecast Year Market Size (2035) |

USD 37 billion |

|

Regional Scope |

|

DevSecOps Market Segmentation:

Component Segment Analysis

The software segment is predicted to account for a 60.3% share by 2035, due to rising demand for automated and integrated security tools. Organizations adopting DevSecOps are investing in a whole gamut of software solutions, ranging from static and dynamic analysis tools to software composition analysis and container security solutions. The tools are critical in baking security into the CI/CD pipeline and in facilitating constant security testing. In June 2023, Fortinet, Inc. introduced FortiDevSec, a new solution that offers developers SAST, SCA, and container security tools in a single platform. The launch is in line with the industry approach of adopting versatile platforms that make it easy to integrate security with the development workflow.

Industry Segment Analysis

The BFSI sector is predicted to dominate with a 30.3% revenue share through 2035 due to the high value of data and strong regulatory needs. Cyberattacks primarily happen to financial institutions, so security is of utmost importance. DevSecOps helps such organizations develop more secure software and meet regulatory compliance, like PCI DSS and SOX. The need to develop new digital services in a short time while having a robust security stance is also driving DevSecOps in the BFSI sector. In May 2023, IBM Corporation bought out Polar Security, a Data Security Posture Management (DSPM) firm, in order to grow its Guardium portfolio and support DevSecOps teams in automating data security across multicloud environments.

Organization Size Segment Analysis

Large Organization segment is likely to garner around 65% revenue share during the forecast period, as such organizations possess both the means and the mandate to commit to complete security solutions. Large organizations possess complicated IT infrastructure and a vast app portfolio, and hence, are a chief target of cyberattacks. The imperative to handle risk at scale and meet a vast litany of compliance obligations is fueling DevSecOps adoption in this segment. In May 2023, Microsoft Corporation made a series of new identity and compliance features in its security portfolio available, aimed at being more deeply integrated in DevSecOps workflows and securing large organizations' digital assets.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Deployment |

|

|

Organization Size |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

DevSecOps Market - Regional Analysis

North America Market Insights

North America is expected to hold a revenue share of 36% in the DevSecOps market due to the presence of a high number of technology companies and early adoption of the latest IT trends. The presence of a mature cloud market and extensive utilization of agile and DevOps practices in the region make it an ideal breeding ground for DevSecOps adoption. Strong regulations and higher occurrences of high-profile cyberattacks are also pushing organizations to ensure security in software development processes.

The U.S. leads the market, with a thriving DevSecOps vendor ecosystem and huge enterprises adopting digital transformation. The U.S. federal government is also a key market driver, with programs such as the National Cybersecurity Strategy to bolster digital security across the country. The U.S. federal government also issued in 2023 the Federal Cybersecurity Research and Development Strategic Plan, offering refreshed guidance to federal agencies regarding research priorities in cybersecurity, further driving the market.

Canada also experiences strong DevSecOps market growth, driven by government initiatives in favor of cybersecurity and digital innovation. The Government of Canada's focus on securing a strong and resilient digital future is driving public and private sector organizations to invest in DevSecOps. In 2025, the Standards Council of Canada (SCC) promoted the Canadian Program for Cyber Security Certification (CPCSC), which helps businesses demonstrate compliance with procurement requirements and enhance cyber resilience by providing trusted, third-party cybersecurity assessments. This program incentivizes the adoption of secure development practices, further fueling the market.

Europe Market Insights

Europe DevSecOps market is expected to expand at a steady pace owing to strong data protection norms and focus on digital sovereignty. The EU's efforts at building a secure digital single market are also enabling market expansion conditions. The focus on security because of norms like the GDPR has been driving organizations toward seeking DevSecOps as a path to getting in compliance.

Germany is a leading market in Europe, with a strong industrial base and a high adoption of advanced technologies. The German government's focus on Industry 4.0 and the need to secure industrial control systems are driving the demand for DevSecOps in the manufacturing sector. In 2024, the German Government continued implementing its cybersecurity strategy, designating the Federal Office for Information Security (BSI) as the central agency for a "Coordinated Vulnerability Disclosure" process to reduce the attack surface for public and private sector systems.

The UK is also a key market, with a dynamic tech sector and a strong emphasis on security. The UK Government is encouraging safe development practices and has initiated a number of measures to bolster cyber defences in the country. In April 2023, the UK Government introduced GovAssure, a new cyber assurance program aimed at carrying out annual, third-party evaluations of the cybersecurity of every central Government department, raising the resilience of key IT infrastructure.

APAC Market Insights

Asia Pacific is experiencing a rapid digital transformation, leading to increased awareness of cyber risks. This trend is expected to drive a CAGR of 15% through 2035. Increasing use of cloud and mobility technologies, as well as a booming e-commerce sector, is creating a massive need for secure and agile software development methodologies. The governments of this region are also investing aggressively in digital infrastructure and promoting cybersecurity initiatives, further propelling the DevSecOps market.

China is among the largest markets in the APAC, driven by its huge digital economy as well as a strong emphasis by its government in terms of technology and cybersecurity. China has in place a whole-of-government approach to legal cyberspace governance, as seen by the development of a secure development practice adoption being promoted. China's "Interim Measures for the Management of Generative AI" came into force in August 2023, introducing a clear AI-related cyber risk governance framework and placing providers under accountability regarding the security of services.

India rapidly expanding market is further strengthened by its flourishing IT sector and the government's push for digital transformation. The "Digital India" program and rising use of digital payment methods are driving a robust need for secure software solutions. In October 2023, the National Security Council Secretariat of India coordinated the 'Bharat NCX 2023', a nationwide cybersecurity exercise to drill government and key sector organizations in modern cyber threats and response techniques. This demonstrates India's proactive approach to bolstering its cybersecurity defenses.

Key DevSecOps Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amazon Web Services, Inc.

- IBM Corporation

- Google LLC

- Palo Alto Networks, Inc.

- GitLab Inc.

- Synopsys, Inc.

- Fortinet, Inc.

- Aqua Security Software Ltd.

- Trend Micro Incorporated

- Atlassian Corporation Plc

- Checkmarx Ltd.

- DeepSource

- XebiaLabs

- Entersoft Security

The DevSecOps market includes a wide variety of established software leaders, purpose-built security vendors, as well as new software innovation leaders. Leaders such as Microsoft Corporation, IBM Corporation, and GitLab Inc. are taking advantage of their long history in the market and wide portfolios of products to provide integrated DevSecOps solutions. The vendors are challenging each other based on the breadth and depth of offerings, ease of integration with current toolchains, as well as the strength of their partner ecosystem. The market is also marked by extreme innovation, as vendors continually develop new features and functions in response to the changing security needs of contemporary software development.

Acquisition is among the key trends in the DevSecOps industry, as companies consider expanding their offerings and achieving differentiation. Small, niche players are being acquired by vendors to augment products in portfolios and reach the market sooner. Consolidation is leading to complete and integrated DevSecOps platforms that offer end-to-end security across the whole software development lifecycle. In November 2023, Palo Alto Networks, Inc. acquired Dig Security, a leader in Data Security Posture Management (DSPM), in order to bolster its Prisma Cloud platform by being able to secure sensitive data across multi-cloud infrastructure. Organizations can embed data security as part of the DevSecOps workflow using this acquisition, so data remains secure from code to cloud.

Recent Developments

- In September 2025, Microsoft Corporation released a service update for Azure DevOps that introduced a new SARIF processing completed service hook event for GitHub Advanced Security. This cloud update allows for better integration and automation of security workflows, enabling teams to receive notifications when a SARIF file has been processed, which is crucial for tracking security scan results within a DevSecOps pipeline.

- In May 2025, GitLab Inc. launched GitLab 18, a major platform update that introduced AI-native capabilities to its DevSecOps platform. This software launch provides Premium and Ultimate customers with AI-powered Code Suggestions and Chat features at no additional cost. These new features are designed to improve developer efficiency by offering real-time code completion, refactoring suggestions, and test generation, all within a secure DevSecOps framework.

- In November 2024, Palo Alto Networks, Inc. enhanced its Prisma Cloud platform to help organizations adopt DevSecOps and shift-left security. This software update embeds security scanning early in the DevOps lifecycle, providing a centralized view of misconfigurations, exposed secrets, and open-source vulnerabilities.

- Report ID: 2926

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

DevSecOps Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.