Dermatoscope Market Outlook:

Dermatoscope Market size was valued at USD 1.14 billion in 2025 and is projected to reach USD 3.54 billion by the end of 2035, rising at a CAGR of 12.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of dermatoscopes is estimated at USD 1.28 billion.

The advancements in imaging technology, the rising prevalence of skin diseases, and artificial intelligence, increasing awareness about early skin cancer detection, are the key factors facilitating growth in the market. As per a WHO article published in March 2023, skin conditions affect around 1.8 billion people across all nations, and the Neglected tropical diseases (NTDs) of the skin account for approximately 10% of all skin disorders in many communities, hence positively influencing market growth.

Furthermore, the expanding applications beyond dermatology into fields such as cosmetology and telemedicine are broadening market opportunities, making dermatoscopes an essential tool in modern skin health management. Also, this has resulted in consumption of significant capital, wherein the American Academy of Dermatology Application reported that skin disease costs in the U.S. led to USD 75 billion in medical, preventative, and prescription and non-prescription drug costs.

Key Dermatoscope Market Insights Summary:

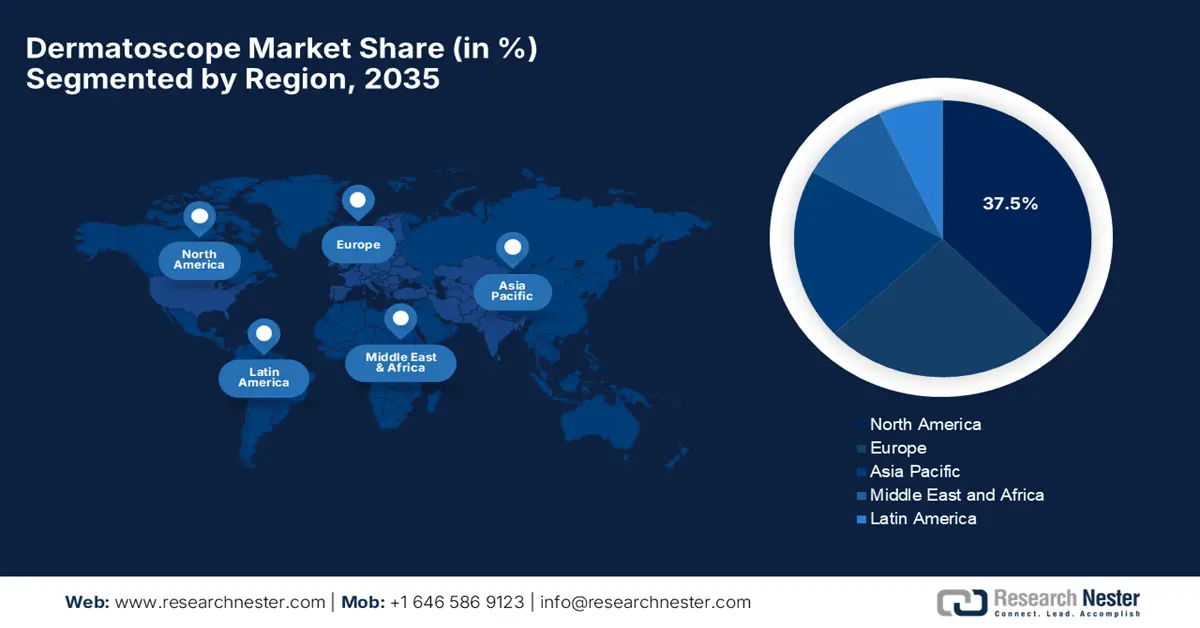

Regional Highlights:

- North America is projected to hold a 37.5% share of the dermatoscope market by 2035, owing to increasing funding grants and ongoing technological discoveries.

- Europe is anticipated to maintain its position as the second-largest marketplace by 2035, impelled by the high prevalence of skin disorders and the adoption of innovative diagnostic technologies.

Segment Insights:

- The handheld dermatoscope segment is predicted to account for 45.7% of the dermatoscope market share by 2035, propelled by its portability, ease of use, and cost-effectiveness compared to integrated systems.

- The dermatology clinics segment is expected to capture a 42.9% share by 2035, driven by the rising volume of dermatological procedures and the increasing preference for outpatient care.

Key Growth Trends:

- Increasing awareness

- Boom in the cosmetic dermatology sector

Major Challenges:

- Exacerbated device expenses

- Lack of skilled personnel

Key Players: DermoScan GmbH, Canfield Scientific Inc., Firefly Global, Heine Optotechnik GmbH & Co. KG, DermLite (3Gen Inc.), AMD Global, FotoFinder Systems GmbH, MoleMax Systems, MetaOptima Technology Inc., Caliber I.D., Welch Allyn (Hillrom), Rudolf Riester GmbH, Kawe GmbH & Co. KG, Sharn Inc., Boris Surgical, NIDEK Co. Ltd., Canon Inc., Mizuno Corporation, Hayashi Denki Co. Ltd., IMMEDIATE Co. Ltd.

Global Dermatoscope Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.14 billion

- 2026 Market Size: USD 1.28 billion

- Projected Market Size: USD 3.54 billion by 2035

- Growth Forecasts: 12.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, South Korea, Australia, Brazil

Last updated on : 1 October, 2025

Dermatoscope Market - Growth Drivers and Challenges

Growth Drivers

- Increasing awareness: There has been an increased awareness regarding skin conditions and early diagnosis, which has constantly driven business in the market over the past few years. The article published by the CDC in February 2025 underscored the importance of increasing skin cancer awareness, reporting that many people underestimate the risks caused by UV exposure. It also stated that public health campaigns are urging individuals to protect their skin daily, which helps reduce melanoma, which is the deadliest form of skin cancer.

- Boom in the cosmetic dermatology sector: The market has heavily benefited from the global focus on aesthetic appearance and the emergence of cosmetic dermatology, which contributes to the heightened demand. To meet this, HEINE Optotechnik in November 2022 stated that it expanded its in-house production with new automation for disposable medical components, including laryngoscope blades and otoscope tips made from recycled plastics, denoting a wider scope for the dermatoscope industry.

- Emergence of tele dermatology: The aspect of remote consultations and tele dermatology has been a principal driver for the dermatoscope industry, which enables the expanded usage of these devices. In this regard, in September 2022, Barco’s Demetra skin imaging business and Gnosco’s Dermicus teledermatology platform merged to form Dermicus, which is a new digital health company focused on teledermatology, telewoundcare, and digital dermoscopy solutions, aiming to provide an integrated end-to-end skin diagnostics and treatment platform for clinicians worldwide.

Global Burden of Skin and Subcutaneous Diseases (2019)

|

Metric |

Value |

|

New skin and subcutaneous disease cases |

~4.86 billion (95% UI: 4.68 billion - 5.06 billion) |

|

Most common disease types |

Fungal (34%), Bacterial (23%) |

|

Deaths due to skin diseases |

~98,522 (95% UI: 75,116 - 123,949) |

|

DALYs (Disability-Adjusted Life Years) |

~42.88 million (95% UI: 28.63 million- 63.44 million) |

Source: Frontiers

Emerging Revenue Opportunities in the Market

|

Year |

Event/Approval |

Company |

Market Impact |

|

2025 |

Expected FDA Clearance |

DeepX Health LLC |

First FDA-cleared automated skin cancer detection tool using ESS |

|

2022 |

Funding Round |

DermaSensor ($10M Raised) |

Prepares for U.S. launch, pivotal studies successful |

Sources: U.S. FDA, DermaSensor

Challenges

- Exacerbated device expenses: One of the considerable hurdles in the market limiting adoption among small-scale manufacturers is the high cost associated with these advanced devices. Besides the innovations such as AI-powered analysis, high-resolution imaging, and wireless connectivity, which add to the production expenses, these devices are also making them less affordable for smaller clinics and rural healthcare centers.

- Lack of skilled personnel: This is yet another factor negatively influencing growth in the market since most of the developing nations are facing a scarcity of skilled workforce. A proper diagnosis and interpretation of dermatoscopic images requires specialized expertise; therefore, the aspect of skill disparities hampers the complete potential of dermatoscopes, restricting their utilization in most healthcare settings.

Dermatoscope Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.4% |

|

Base Year Market Size (2025) |

USD 1.14 billion |

|

Forecast Year Market Size (2035) |

USD 3.54 billion |

|

Regional Scope |

|

Dermatoscope Market Segmentation:

Application Segment Analysis

Based on the application, the skin cancer diagnostics segment is projected to garner the largest revenue share of 65.6% in the dermatoscope market during the forecast timeline. The dominance of the segment is attributable to the rising occurrence of skin cancers, particularly melanoma, and increased preference for dermatoscopy due to improvements in survival rates. Besides, the public health initiatives are continuously emphasizing the importance of skin checks, thus denoting a wider scope.

Product Type Segment Analysis

In terms of product type, the handheld dermatoscope segment is predicted to gain a share of 45.7% in the dermatoscope market by the end of 2035. The portability, ease of use, and lower costs when compared to integrated systems are the key factors behind the leadership. The article published by NIH in August 2023 reported that handheld dermatoscopes feature achromatic lenses with 10× to 200× magnification, crossed-polarizers to reduce glare, and eliminate the need for immersion fluids. Also, a few models support smartphone attachment, digital imaging, and lesion tracking through integrated or external photography systems.

End user Segment Analysis

Based on the user dermatology clinics segment, it is expected to capture a share of 42.9% in the dermatoscope industry during the discussed timeframe. The amplifying volume of dermatological procedures performed in these settings positions it at the forefront of revenue generation in this field. Besides, these are the primary points of care for screening, diagnosis, and monitoring of skin lesions. Also, the shift towards outpatient care due to cost-efficiency and convenience further consolidates the segment, hence denoting a positive market outlook.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Product Type |

|

|

End user |

|

|

Technology |

|

|

Modality |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dermatoscope Market - Regional Analysis

North America Market Insights

North America is predicted to be the dominating region in the worldwide dermatoscope market, capturing a share of 37.5% by the end of 2035. This dominance of the region effectively caters to the increasing funding grants and continued technological discoveries. As per an article published by JAAD in September 2023, in a span of four years, the dermatology non-profits received approximately USD 138 million in grants, wherein research received 93.9% of the total funding. Therefore, such instances underscore the pivotal role of these organizations in advancing dermatology.

The U.S. remains the key contributor to progress in the regional market, facilitated by the growing occurrence of skin cancer, strong federal support, and widespread insurance coverage. In January 2024, DermaSensor Inc. reported that it received the U.S. FDA clearance for its AI-powered, non-invasive device designed to detect all three common skin cancers, such as melanoma, basal cell carcinoma, and squamous cell carcinoma, in primary care settings, enabling earlier diagnosis, especially critical in underserved areas.

Canada is also extensively growing in the dermatoscope market owing to the presence of strong governmental healthcare investment and proactive provincial health initiatives. As of the December 2022 report from the Canadian Institute of Health Research, it has allocated a total of USD 400,000 annually for up to five years specifically to support a Skin Health research network, as part of a broader USD 4.2 million funding opportunity intended to support three major health research networks, hence suitable for standard market development.

Key Statistics and Overview of Common Skin Conditions in the U.S.

|

Skin Condition |

Key Facts & Statistics |

|

Acne |

- Affects up to 50 million people in the U.S. annually. |

|

Eczema (Atopic Dermatitis) |

- Affects nearly 1 in 10 people of all ages in the U.S. |

|

Psoriasis |

- Affects nearly 7.5 million people in the U.S. |

|

Rosacea |

- Most common in ages 30-60. |

Source: AAD

APAC Market Insights

Asia Pacific is considered to be the fastest-growing region in the dermatoscope market during the analyzed timeframe. This rapid upliftment is due to the expanding healthcare infrastructure, growing awareness of skin conditions, and increasing patient demand for early diagnosis. Also, teledermatology and digital health platforms are gaining enhanced traction across both urban and rural settings, which is enabling broader access to diagnostic tools. On the other hand, the region also benefits from both national and international manufacturers, which are productively pushing innovation in this field.

China is also witnessing notable expansion in the market owing to the preceding healthcare modernization and heightened public focus on dermatologic wellness. Also, the improvements in hospital capabilities are making precision diagnostic tools more accessible in the country. In August 2024, a study at Xuzhou Medical University analyzed 397 cases of five hypopigmentation disorders using CLSM, dermoscopy, and Wood’s lamp, which revealed distinct imaging features such as pigment loss in vitiligo and scaly patches in pityriasis alba, helping improve differential diagnosis, enabling a wider segment scope.

India is presenting steep growth in the regional dermatoscope market, having teledermatology as the pivotal component, especially in regions lacking specialist access. The country benefits extremely from the existence of public procurement, wherein JIPMER in December 2022 stated that it issued a 2023 tender (GEM/2022/B/2860010) under the Ministry of Health, emphasizing Make in India compliance and strict eligibility norms, which also include a ₹20 lakh (USD 24,000) turnover and prior government supply experience. It also stated that the bid required a 3-year warranty and 5-year CMC, reflecting the focus on long-term service support.

Europe Market Insights

Europe is retaining its position as the second-largest marketplace in the dermatoscope sector during the forecast timeline from 2026 to 2035. The region’s progress in this field is propelled by a high prevalence of skin disorders, and strong adoption of innovative diagnostic technologies contributes to market growth. In May 2025, AI Medical Technology received CE mark approval for Dermalyser, which is an AI-powered melanoma detection tool designed for smartphones with dermatoscopes. Besides, clinical trials in Sweden showed that Dermalyser outperformed experienced dermatologists.

The U.K. is solidifying its potential in the regional dermatoscope market, primarily fueled by the advancements in diagnostic technology and government programs and professional societies in the country, which are proactively promoting skin cancer screening. For instance, in July 2025, GHO Capital Partners reported that it had acquired a majority stake in FotoFinder Systems, a pioneer in dermoscopy and AI-powered skin imaging technology, and the acquisition aims to support the company’s expansion into adjacent markets like aesthetics.

Germany also gained enhanced recognition in the market of Europe owing to the strong emphasis on early diagnosis and prevention. The country is a house of diverse manufacturers, which is encouraging high adoption of innovative technologies, including AI-enabled and digital dermatoscopes, which improve diagnostic accuracy and patient outcomes. Besides, the emergence of public awareness campaigns and government initiatives promoting skin health is further driving demand in this field.

Prevalence of the 12 Most Common Skin Conditions in Adults - Europe as of NIH March 2022 Data

|

Skin Condition |

Prevalence (%) |

Estimated Cases (Millions) |

|

Fungal skin infection |

8.9 % |

38.1 |

|

Atopic dermatitis/eczema |

5.5 % |

23.4 |

|

Acne |

5.4 % |

22.9 |

|

Alopecia (hair loss) |

5.1 % |

21.9 |

|

Psoriasis |

3.9 % |

16.8 |

|

Sexually transmitted diseases |

2.8 % |

11.9 |

|

Rosacea |

2.0 % |

8.6 |

|

Chronic urticaria |

1.0 % |

4.2 |

|

Non-melanoma skin cancers |

1.1 % |

4.7 |

|

Vitiligo |

0.8 % |

3.4 |

|

Hidradenitis suppurativa |

0.6 % |

2.7 |

|

Melanoma skin cancers |

0.6 % |

2.6 |

Source: NIH

Key Dermatoscope Market Players:

- DermoScan GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Canfield Scientific, Inc.

- Firefly Global

- Heine Optotechnik GmbH & Co. KG

- DermLite (3Gen, Inc.)

- AMD Global

- FotoFinder Systems GmbH

- MoleMax Systems

- MetaOptima Technology Inc.

- Caliber I.D.

- Welch Allyn (Hillrom)

- Rudolf Riester GmbH

- Kawe GmbH & Co. KG

- Sharn Inc.

- Boris Surgical

- NIDEK Co., Ltd.

- Canon Inc.

- Mizuno Corporation

- Hayashi Denki Co., Ltd.

- IMMEDIATE Co., Ltd.

The global market for dermatoscope is witnessing intensifying competition between the pioneers who are implementing strategic initiatives focused on technological integration and market expansion. The key players, such as DermoScan and FotoFinder, are proactively incorporating AI into their digital systems, which remarkably enhances the diagnostic accuracy. Concurrently, companies such as Firefly Global and MetaOptima are encouraging the trend of connectivity, developing smartphone-compatible devices and software platforms that facilitate teledermatology and remote patient monitoring.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In May 2024, EMZ Partners-backed FotoFinder Systems finalized the acquisition of DermLite, which will unite the leaders in skin imaging and handheld dermatoscopes, thereby creating a dermatological diagnostics platform, combining DermLite’s portable devices with FotoFinder’s AI-powered imaging systems.

- In March 2024, FotoFinder Systems reported that it had launched skeen, which marks the first wireless AI-driven dermatoscope with integrated cloud storage, revolutionizing skin and hair examinations, comprising high-resolution imaging, 20x/40x magnification, and AI lesion scoring.

- In July 2025, GOKO stated that a study published in The Journal of Dermatology utilized its high-magnification whole-body capillaroscope, the Bscan-Z, to examine capillaroscopic findings in a patient from Japan with exogenous ochronosis, enhancing the company’s role in diagnostic imaging for rare skin conditions.

- In February 2025, Casio announced that it is implementing a business succession through a company split, transferring its sales management and business support operations to its subsidiary Casio Human Systems Co., Ltd. to gain investors' interest.

- Report ID: 8161

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dermatoscope Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.