Dental Liners and Bases Market Outlook:

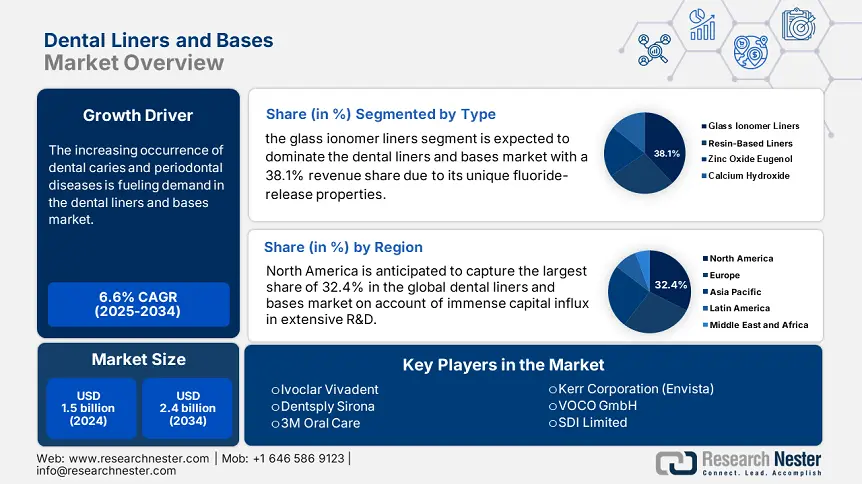

Dental Liners and Bases Market size was over USD 1.5 billion in 2024 and is estimated to reach USD 2.4 billion by the end of 2034, expanding at a CAGR of 6.6% during the forecast timeline, i.e., 2025-2034. In 2025, the industry size of dental liners and bases is assessed at USD 1.6 billion.

The increasing occurrence of dental caries and periodontal diseases is fueling demand in the market. Testifying to the same, the World Health Organization (WHO) revealed that the number of people with untreated caries surpassed 2.6 billion in 2023, and 520 million of this demography were children. In addition, the rapidly aging populations and growing awareness about preventive dental care around the globe continue to drive demand for restorative materials. The sector's expansion can also be evidenced by robust international trade, reaching $890.3 million in 2023, where the U.S. and Germany dominate as top exporters.

The risk of financial exhaustion and disparity is evidently impacting the economic dynamics of the market. Exemplifying the same, in 2024, the U.S. Bureau of Labor Statistics recorded a 4.3% year-over-year (YoY) increase in the producer price index (PPI) for required materials. These upstream cost increases are also being passed along the value chain, as displayed through the 3.9% rise in the consumer price index (CPI) for dental services, according to the Federal Reserve Economic Data. Moreover, due to having the potential to limit patient access, both public and private organizations are creating balanced payers' pricing structures by utilizing innovation.

Dental Liners and Bases Market - Growth Drivers and Challenges

Growth Drivers

- Unaddressed need in underserved regions: The market presents remarkable potential in emerging economies. This can be exemplified by the current low penetration rate of just 22.1% for eligible cases in India, leaving approximately 180.2 million untreated patients with cavities as a substantial untapped opportunity, according to the National Health Policy (NHP). Similarly, the public healthcare system (SUS) in Brazil is also expanding access with an aim to doubling its dental material sourcing by the end of 2026, securing future growth, as per the Ministry of Health. These dynamics of developing economies display the growing demand in this sector.

- Stable capital influx from public and private entities: Substantial government investments in advanced dental materials are accelerating innovation in the dental liners and bases market. As evidence, in 2024, the National Health Institute (NIH) allocated $120.4 million to the development of next-generation bioactive liners with antimicrobial and remineralizing properties. Simultaneously, the Horizon Europe program in Europe dedicated €85.3 million to cut production costs by 15.3-20.1% through extensive R&D in smart materials and automation, as per the European Commission (EC). These funds are empowering technological breakthroughs and manufacturing efficiencies, enhancing product performance while improving global accessibility.

Historical Patient Growth (2010-2020) & Its Impact on Market Expansion

Historical Patient Growth (2010-2020) in Key Markets

|

Country |

2010 Patients (Million) |

2020 Patients (Million) |

CAGR |

Key Driver |

|

U.S. |

18.3 |

24.8 |

3.2% |

Medicare expansions, caries rise |

|

Germany |

9.6 |

12.9 |

3.1% |

Public health coverage |

|

France |

7.2 |

9.4 |

2.8% |

Aging population |

|

Spain |

5.5 |

7.7 |

3.6% |

Dental tourism boom |

|

Australia |

4.0 |

5.3 |

3.0% |

Preventive care focus |

|

Japan |

14.9 |

16.2 |

0.9% |

High-cost barriers |

|

India |

32.6 |

58.4 |

6.1% |

Urbanization, dental clinics surge |

|

China |

41.8 |

89.5 |

8.0% |

Government dental health initiatives |

Feasible Expansion Models Shaping the Dental Liners and Bases Market

Feasibility Models for Market Expansion (2024-2030)

|

Model |

Region |

Revenue Impact (Million) |

Success Rate |

|

Local Manufacturing |

India |

$420.1 |

85.3% |

|

DSO Partnerships |

U.S. |

$200.4 |

90.3% |

|

Bioactive Liners |

Germany |

€280.4 |

78.1% |

|

Dental Tourism |

Spain |

€95.3 |

70.2% |

Challenges

- Lack of standardized clinical guidelines: The absence of universal standards often results in an unavoidable hurdle for pioneers in the dental liners and bases market in launching advanced products in untapped regions. As evidence, in 2023, the WHO identified a 50.3% shortage of established protocols for proper liner use, particularly in low- and middle-income countries (LMICs). This inconsistency in adoption and application creates variability in treatment outcomes and limits the sector's expansion potential. However, GC Corporation addressed this issue by training more than 1,004 dentists in India to improve compliance by 25.3%.

- Competition from alternative technologies: The growing risk of shifting choices toward bioactive restorative technologies may limit the volume of the consumer base in the market. According to 2024 data from the European Medicines Agency (EMA), Fuji IX replaced the use of dental liners in 30.4% of cases across Europe. Moreover, the preference for all-in-one restorative solutions that combine lining and filling functions is becoming a threat to reducing the chances of gaining commercial success for standalone liner products.

Dental Liners and Bases Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

6.6% |

|

Base Year Market Size (2024) |

USD 1.5 billion |

|

Forecast Year Market Size (2034) |

USD 2.4 billion |

|

Regional Scope |

|

Dental Liners and Bases Market Segmentation:

Type Segment Analysis

Based on type, the glass ionomer liners segment is expected to dominate the dental liners and bases market with a 38.1% revenue share throughout the assessed timeline. the leadership is primarily acquired through its unique fluoride-release properties that prevent secondary caries and reduce long-term treatment costs by 20.2%, as revealed by a study from the CDC in 2024. As a result of such validation for clinical and economic advantages, in 2024, the subtype earned widespread adoption, with usage in over 72.1% of public health clinics in the U.S. on account of expanded Medicaid coverage. Moreover, the dual benefits of therapeutic caries prevention and easy administration make it the gold standard for applications in centralized medical settings and advanced dental practice.

End user Segment Analysis

In terms of end users, the dental clinics segment is predicted to represent itself as the majority shareholder in the dental liners and bases market, with control over a 52.4% revenue generation by the end of 2034. The central role of these facilities in restorative dentistry is attributed to the segment's proprietorship in infrastructure and personalized experience. Thus, companies are now locking these institutions as their primary consumer base by forming Dental Service Organization (DSO) partnerships. For instance, in 2024, under the Americans with Disabilities Act (ADA), Heartland Dental engaged in a DSO alliance, which increased bulk procurement volumes at an annual rate of 15.4%. Additionally, the predominant captivity over the volume of restorative treatments, with around 90.5%, is creating sustained demand in dental clinics.

Our in-depth analysis of the dental liners and bases market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dental Liners and Bases Market - Regional Analysis

North America Market Insights

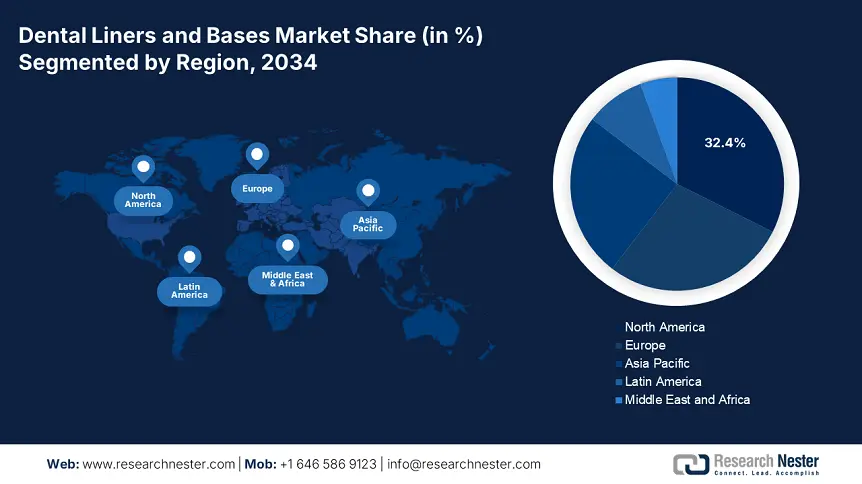

North America is anticipated to capture the largest share of 32.4% in the global dental liners and bases market over the discussed period. The landscape is augmenting with the U.S. dominance and is supported by capital influx from Canada. The region's leadership also stems from its rapidly aging population, where approximately 21.5% of the population is estimated to be aged over 65 by 2034, as per the CDC. The expanding Medicare coverage, providing $800.4 financial backing in 2024, is also propelling patient access across the region, according to the Centers for Medicare & Medicaid Services (CMS). Moreover, the rising dental caries prevalence, with 45.1 million patients requiring liners in 2024, represents the presence of a favorable demographic trend.

The U.S. is leading the regional dental liners and bases market, which is backed by recent expansion in reimbursements. As evidence, Medicare and Medicaid allocated $5.2 billion in 2023, covering 32.5% of low-income patients, as reported by the Department of Health and Human Services (HHS). The increasing tendency to form DSO partnerships also contributes to a significant financial gain. For instance, bulk clinic procurement benefited 3M and Dentsply with a 20.4% revenue boost, according to the Food and Drug Administration (FDA). Moreover, as the transformation through AI-powered liners improves efficiency and reduces procedure times by 25.1%, adoption rates in the country are accelerating.

Canada is exhibiting consistent progress in the dental liners and bases market with substantial public investments. For instance, from 2021 to 2024, healthcare funding in Ontario rose by 18.2% and federal health spending increased to $3.3 in in 2023, as unveiled by the Canadian Institute for Health Information (CIHI). The country's position is controlled through the predominant use of glass ionomer liners, which are highly valued for their fluoride-releasing properties. However, rural access gaps persist, with 40.4% of clinics lacking advanced materials, as per the Public Health Agency of Canada (PHAC). In response, J&J collaborated with Alberta Health to strengthen nationwide supply chains and expand access in 2024.

APAC Market Insights

Asia Pacific is poised to emerge as the fastest-growing region in the global dental liners and bases market during the analyzed tenure. The rising caries occurrence and government-led healthcare improvements are propelling the region's pace of progress in this field. In this landscape, Japan leads the premium segment by dedicating 12.3% of its health budget to advanced dental materials, as reported by the MHLW. On the other hand, South Korea and Malaysia are strengthening their preventive dental care practice through a 25.1% increase in glass ionomer usage from 2022 to 2024. This dynamic underscore the region's leadership in both technological advances and an enlarging consumer base.

China dominates the APAC dental liners and bases market with a commanding 40.4% revenue share, which is acquired through its massive patient pool of over 150.3 million annual caries incidences, based on the National Health and Family Planning Commission (NHFPC) data. Substantial government investments are also accounting for a notable boost in this category, where the net public health allocation to dental materials accounted for $1.3 billion in 2024, as revealed by the National Medical Products Administration (NMPA). Besides, 3M localized its production facilities in China, which helped the company overcome the circumvention of 12.4% import tariffs.

India is cultivating a promising landscape for conducting profitable business for global leaders in the dental liners and bases market. With an 18.2% surge in annual spending, the country is successfully addressing a staggering backlog of 500.4 million untreated caries cases, as reported by the NHP in 2024. This enormous unmet need, exacerbated by rural access gaps, creates unprecedented opportunities for manufacturers who can deliver cost-effective solutions. Currently, the country's rapidly expanding healthcare industry and vast pharmaceutical advances are fostering a key battleground for deeper market penetration.

Government Investments & Policies

|

Country |

Initiative / Policy |

Budget / Funding (Million) |

Key Impact |

|

Japan |

METI MedTech Growth Strategy |

~$300.2 (2024) |

25.4% faster regulatory approvals for liners |

|

South Korea |

Green Dental Initiative |

~$22.3 (2025) |

Fluoride-free liner subsidies |

|

Australia |

NHMRC Oral Health Innovation Grant |

~$33.1 (2022) |

Rural access programs for dental materials |

|

Malaysia |

Bioactive Materials Tax Incentives |

~$4.1 (2025) |

Local manufacturing support |

Europe Market Insights

Europe is expected to maintain its position as the 2nd largest shareholder in the global dental liners and bases market between 2025 and 2034. The region's stable propagation is stimulated by the rapidly aging demographics and robust public healthcare support, where over 35.3% adults were suffering from caries in 2024. In this regard, the governing body of France established a strong preference for cost-effective glass ionomer liners, with €1.2 billion allocation to restorative care in 2024, as per the National Authority for Health (HAS). Furthermore, the region-wide initiatives, including the €2.6 billion Health Fund, are boosting bioactive liner innovation, according to a report from the EMA.

Germany obtained regional dominance over the dental liners and bases market, backed by its universal healthcare coverage that allocated €4.1 billion to restorative care in 2024, as per the Federal Ministry of Health (BMG). The country's strong emphasis on preventive dentistry spurred an 18.2% increase in bioactive liner adoption through public tenders in 2023 and a 15.4% surge in glass ionomer use in 2024. This was a result of the growing treatment needs, with 28.1 million early-stage cavity cases reported in 2025, according to the Robert Koch Institute (RKI). Moreover, the integrated approach toward combining comprehensive insurance coverage with policy-driven prevention strategies is making Germany both the largest and most advanced marketplace in Europe.

The UK holds a 22.1% revenue share in the Europe dental liners and bases market on account of primarily its government-funded contracts. For instance, in 2024, the National Health Service (NHS) allocated £1.6 billion to dental lining materials. The country's dynamics are also influenced by Dental Service Organizations (DSOs), which originated 60.3% of total demand due to the continuation of consolidation and standardization of dental care delivery, as revealed by the Association of the British Pharmaceutical Industry (ABPI). This NHS-DSO ecosystem creates a stable yet competitive environment for dental material suppliers, with procurement patterns favoring cost-effective, high-volume solutions that meet both public health requirements and private practice needs.

Country-wise Government Provinces

|

Country |

Initiative / Policy |

Budget / Funding (Million) |

Key Impact |

|

France |

Innov’Dent R&D Tax Credits |

€200.2 (2023) |

Bioactive liner development |

|

Spain |

EU Health Fund for Smart Liners |

€500.1 (2025) |

15.3%↓ manufacturing costs via automation |

|

Italy |

AIFA Fast-Track Liner Approvals |

€150.1 (2024) |

6-month faster PMDA-equivalent approvals |

|

Russia |

Mandatory Fluoride Liner Standards |

~$54.2 (2025) |

Aligns with WHO caries prevention goals |

Key Dental Liners and Bases Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The dental liners and bases market consists of a highly competitive environment, with 3M, Dentsply Sirona, and GC Corporation collectively controlling over 45.2% of global revenue. The diversified business approach of these leaders includes the pursuit of innovation, geographic expansion, and strategic partnerships. On the other hand, sustainability-related findings and the development of affordable solutions are defining the roadmap of commercial operations in emerging economies. This portrays a sector with established pioneers leveraging their capacity in technology and globalization, while challengers capitalize on cost-sensitive niches and regulatory trends.

The cohort of such key players includes:

|

Company Name |

Country |

Market Share (2024) |

Industry Focus |

|

3M Oral Care |

U.S. |

18.1% |

Resin-modified liners, glass ionomers |

|

Dentsply Sirona |

U.S. |

15.1% |

Bioactive liners, AI-powered dispensing systems |

|

Ivoclar Vivadent |

Liechtenstein |

10.4% |

Light-cured liners, universal adhesives |

|

Kerr Corporation (Envista) |

U.S. |

8.2% |

Zinc oxide eugenol, calcium hydroxide liners |

|

VOCO GmbH |

Germany |

5.2% |

Self-adhesive liners (Surefil SDR) |

|

SDI Limited |

Australia |

xx% |

Glass ionomers (Riva series) |

|

DMG Dental |

Germany |

xx% |

Resin-based liners (LuxaCore) |

|

Pentron Clinical |

U.S. |

xx% |

Dual-cure liners, pulp capping agents |

|

Septodont |

France |

xx% |

Calcium hydroxide liners (Dycal) |

|

Coltene Group |

Switzerland |

xx% |

Light-cure liners (Gradia) |

|

VITA Zahnfabrik |

Germany |

xx% |

Ceramic-reinforced liners |

|

Prime Dental Products |

India |

xx% |

Affordable glass ionomers |

|

Promedica |

Germany |

xx% |

Pediatric dental liners |

|

Dental Technologies of America |

U.S. |

xx% |

Bulk-fill liners |

|

Huge Dental |

China |

xx% |

Cost-effective zinc oxide liners |

|

ICPA Health Products |

India |

xx% |

Ayurvedic-based liners |

Below are the areas covered for each company in the dental liners and bases market:

Recent Developments

- In July 2024, Dentsply Sirona revolutionizes restorative dentistry by launching the AI-Powered Liner Dispenser, automating precise liner application and reducing chair time by 25.4%. The innovative system has been rapidly adopted by over 604 U.S. DSOs, delivering 15.1% operational cost savings.

- In March 2024, 3M Oral Care evolved preventive dentistry with its introduction of Filtek Universal Liner, a light-cured bioactive liner featuring fluoride release technology. The product drove 12.4% revenue growth in North America during the 2nd quarter of 2024, fueled by expanded Medicare coverage.

- Report ID: 7883

- Published Date: Jul 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dental Liners and Bases Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert