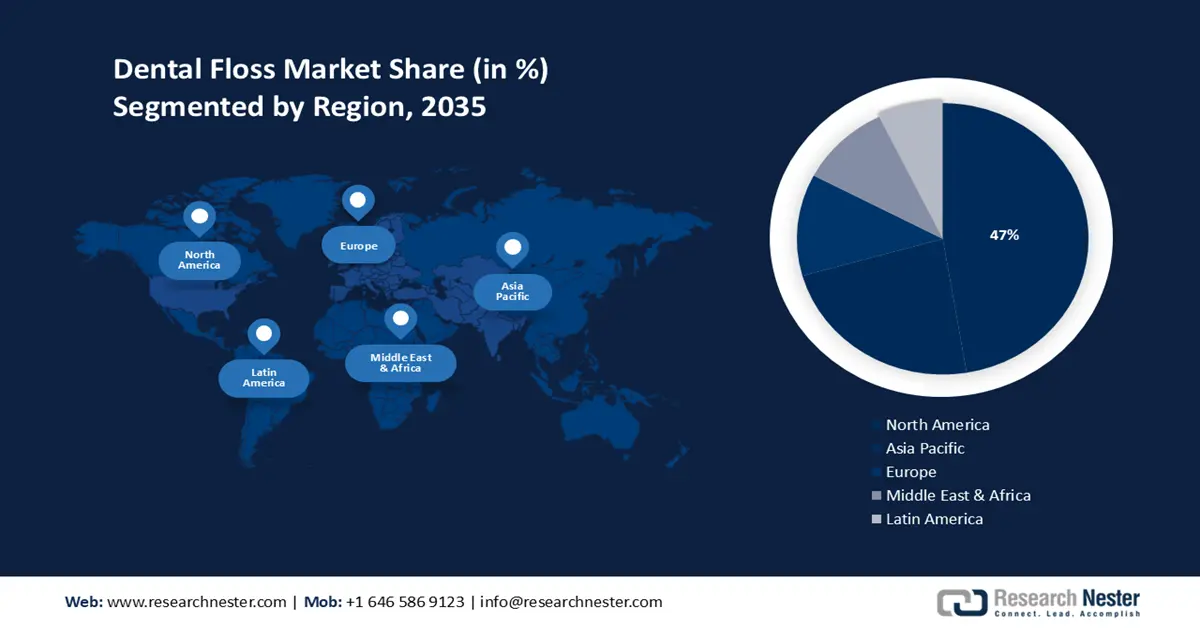

Dental Floss Market Regional Analysis:

North America Market Insights

North America industry is likely to hold largest revenue share of 47% by 2035. The growing awareness about oral hygiene and the importance of preventive care is boosting the demand for dental floss. The Journal of the American Dental Association 2022 stated that the percentage of Americans, especially young children annual visits for oral healthcare witnessed a lucrative gain from 74% to 86% between 2000 and 2018.

The dental facilities in the U.S. are at a surge. For instance, the Centers for Disease Control and Prevention published a report in June 2023, stating that the percentage of adult dental visits in 2020 was estimated to be 62.7%. In addition, the U.S. also showed increasing spending on healthcare by the public and private sectors. For instance, the Centers for Medicare & Medicaid Services in July 2024 slated that U.S. healthcare spending increased by 4.1%, while health spending accounted for about 17.3% of the country’s GDP.

Dental floss in Canada is in high demand owing to the prevalence of major key players such as AVACO, Simply Natural, and Simply Floss. Led by this a variety of media, including the internet, television, and dental experts promote dental floss in this country. According to the National Institutes of Health 2022, dental caries is the most prevalent chronic illness affecting children in Canada. The presence of such key players will augment the interdental brush share in the forecast period.

APAC Market Insights

Asia Pacific will also encounter huge growth in the dental floss market share during the forecast period with a notable market size. The rising dental caries and related diseases is expected to drive the market. According to the World Health Organization 2022, Asia Pacific had more than 900 million untreated cases of dental caries, severe periodontal diseases, and edentulism in 2019.

Economic growth and rising disposable incomes in China and India are leading to higher spending on health and wellness products. According to the State of China in July 2024, the national per capita disposable income increased by 5.9% as compared to 2023 and crossed USD 2400.

Japan has shown a lucrative increase in people having dental disorders such as periodontal pockets, caries, and dental calculus. According to a report by the National Institutes of Health in 2022 estimated that about 6.1% of people between 15-19 years old and 25.7% 20-24 years old had periodontal pockets of 4mm and deeper.