DeNOx Catalyst Market Outlook:

DeNOx Catalyst Market size was valued at USD 3.32 billion in 2025 and is likely to cross USD 5.21 billion by 2035, expanding at more than 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of DeNOx catalyst is assessed at USD 3.46 billion.

Rising air pollution, stringent environmental regulations, industrial emission control needs, and the push for cleaner technologies drive demand for DeNOx catalysts. Furthermore, DeNOx catalyst plays a vital role in controlling nitrogen oxide (NOx) emissions from key industrial sectors such as automotive, power generation, and chemical manufacturing. These catalysts facilitate the conversion of harmful NOx gases into benign substances like nitrogen and water vapor, supporting global efforts toward cleaner industrial operations. Tightening environmental regulations, including initiatives like the U.S. Clean Air Act and the European Union’s Industrial Emissions Directive, have accelerated the adoption of DeNOx technologies. Material innovations continue to enhance catalyst efficiency, with metals such as platinum, palladium, and rhodium being commonly used for their durability and high catalytic activity.

Moreover, trends towards recyclable and sustainable catalyst solutions are gaining traction, particularly as industries seek to optimize costs and environmental impact. A notable instance is Haldor Topose has been a prominent player in the DeNOx catalyst market, providing advanced solutions for reducing nitrogen oxide emissions in various industrial applications. The company continues to innovate by enhancing its production capabilities and introducing new catalyst technologies that improve emission control efficiency. Haldor Topsoe’s strategic focus on sustainability and technological advancements drives its growth and strengthens its position in the global DeNOx catalyst market.

In the automotive sector, the focus on hybrid and electric vehicles has further fueled the need for advanced catalyst systems. Additionally, the integration of DeNOx technologies in emerging sectors like green hydrogen production presents new growth avenues. Overall, DeNOx catalysts are instrumental in helping industries meet stringent air quality standards while supporting global sustainability initiatives.

Key DeNOx Catalyst Market Insights Summary:

Regional Highlights:

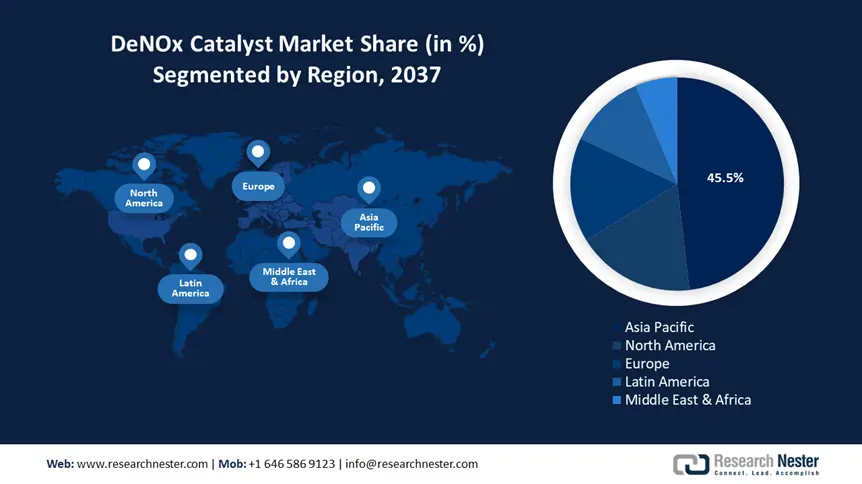

- Asia Pacific commands a 45.5% share of the DeNOx Catalyst Market, driven by stringent government policies in China and India to reduce industrial emissions, positioning it as a key market leader through 2026–2035.

Segment Insights:

- The Honeycomb segment is expected to capture a 55.7% share by 2035, propelled by its high surface area, structural stability, and efficient flow dynamics.

- The Power Plant segment of the DeNOx Catalyst Market is anticipated to hold a substantial share from 2026 to 2035, driven by the critical need for advanced NOx reduction technologies in thermal power generation.

Key Growth Trends:

- Advancement in catalyst technologies improving efficiency and lifecycle

- Expansion of the automotive and power generation sectors

Major Challenges:

- High cost of raw materials

- Temperature sensitivity

- Key Players: Tianhe Environmental Engineering, Shangdong Gemsky Environmental Technology, Jiangsu Fengye Tech & Environmental Group, BASF SE, Cormetech, IBIDEN Porzellanfabrick Frauenthal GmbH, Johnson Matthey Plc, Haldor Topsoe, Hitachi Zosen Corp, Seshin Electronics Co Ltd, JGC C&C, CRI Catalyst Company.

Global DeNOx Catalyst Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.32 billion

- 2026 Market Size: USD 3.46 billion

- Projected Market Size: USD 5.21 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

DeNOx Catalyst Market Growth Drivers and Challenges:

Growth Drivers

-

Advancement in catalyst technologies improving efficiency and lifecycle: The need to comply with strict emission standards, reduce operational costs, minimize downtime, and extend catalyst service life drives the demand for advancements in catalyst technologies. Moreover, challenges like high temperature exposure, catalyst poisoning, and performance degradation over time have pushed industries to develop more efficient, durable, and regenerative catalyst solutions for long-term environmental compliance. Advances in catalyst technologies have significantly enhanced the efficiency and lifecycle of DeNOx systems, enabling industries to meet stringent emission regulations while optimizing operational performance.

Modern catalysts now feature improved thermal stability, greater resistance to poisoning from contaminants, and enhanced activity across broader temperature ranges. These innovations reduce the frequency of catalyst replacement, lower maintenance costs, and ensure consistent NOx reduction over extended periods. Additionally, the integration of nano-structured materials and regenerative designs has further improved the durability and effectiveness of these systems in challenging industrial environments.

A notable instance is YARA Environmental Technologies GmbH, part of Yara International, which specializes in providing DeNOx solutions for industrial applications. In collaboration with Primetals Technologies, YARA supplied SCR DeNOx elements for flue gas treatment systems at a power plant in Taranto, Italy, aiming to significantly reduce NOx, SOx, and dust emissions. This commitment to innovation underscores the industry’s broader shift towards sustainable, high-efficiency technologies that align with evolving environmental standards and long-term economic goals. - Expansion of the automotive and power generation sectors: Growing energy, strict emission regulations, transportation demand, technological advancements, and increasing environmental awareness drive the expansion of the automotive and power sectors, boosting demand for DeNOx catalyst solutions. As global energy consumption and vehicle production rise, so do nitrogen oxide (NOx) emissions, harmful pollutants linked to smog formation and respiratory issues. Governments worldwide are enforcing stricter emission standards to address environmental and public health concerns, compelling industries to adopt advanced NOx reduction systems.

In the automotive sector, both diesel and gasoline engines must comply with evolving regulations such as Euro 6 and EPA Tier 3 standards. This has driven the integration of selective catalytic reduction systems and lean NOx traps using high-efficiency catalysts. Similarly, in power generation, especially coal, natural gas, and biomass-fired plants, DeNOx catalysts are crucial for reducing emissions from flue gas before release into the atmosphere.

A notable instance is BASF’s Four-Way conversion (FWC) catalyst. This innovative technology combines the functionalities of a traditional three-way catalyst with a particulate filter in a single component. It effectively removes nitrogen oxides (NOx), carbon monoxide (CO), hydrocarbons (HC), and particulate matter (PM) from gasoline engine exhaust, aiding automakers in meeting stringent emission standards such as Euro 6 and the U.S. Tier 3. This FWC catalyst is designed to maintain engine performance without requiring additional space, making it a compact solution for emission control. Its advanced coating techniques allow for high catalyst activity while reducing the need for precious metals, contributing to both environmental compliance and cost efficiency.

Challenges

-

High cost of raw materials: Precious metals like platinum and palladium used in catalysts are very expensive and subject to price volatility. These metals are essential for the catalytic reactions that convert nitrogen oxides into harmless nitrogen and water. However, their prices are subject to significant volatility due to limited global supply, geopolitical factors, and increasing industrial demand. This cost pressure directly impacts manufacturing expenses and product pricing, making it difficult for companies to maintain competitive margins. As a result, there is growing interest in alternative formulations and recycling strategies to reduce dependence on these expensive materials.

- Temperature sensitivity: DeNOx catalysts require specific temperature ranges to function optimally; low temperatures in some engines reduce efficiency. Temperature sensitivity poses a significant challenge in the performance of DeNOx catalysts, particularly in applications where consistent exhaust temperatures are difficult to maintain. These catalysts, especially those used in Selective Catalytic Reduction (SCR) systems, require a specific temperature window typically between 250◦C and 450◦C for optimal NOx conversion efficiency. In low temperature operating conditions, such as during cold starts or in low load engine operations, catalyst activity is substantially reduced, leading to lower NOx removal rates. This limitation complicates emission compliance and demands additional design considerations such as preheating systems or advanced catalyst formulations capable of functioning effectively across broader temperature ranges.

DeNOx Catalyst Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 3.32 billion |

|

Forecast Year Market Size (2035) |

USD 5.21 billion |

|

Regional Scope |

|

DeNOx Catalyst Market Segmentation:

Type (Honeycomb and Flat)

The Honeycomb segment is predicted to gain the largest DeNOx catalyst market share of 55.7% during the projected period. This dominance is driven by its high surface area, structural stability, and efficient flow dynamics, which enable superior NOx conversion rates. The honeycomb configuration provides an extensive surface area relative to its volume, facilitating efficient interaction between the exhaust gases and the catalyst, which enhances the reduction of NOx. This structural efficiency, durability under high temperature, and low pressure drop make honeycomb catalysts particularly suited for applications in power plants, waste incineration, and heavy-duty vehicles, where stringent emission standards necessitate robust performance.

A prominent company advancing this technology is Hitachi Zosen Corporation, which manufactures honeycomb DeNOx catalysts for industrial use. Their products are known for high NOx removal efficiency, thermal stability, and resistance to chemical deactivation. These characteristics make Hitachi Zosen a key player in supporting Japan’s and global industries' transition toward environmentally responsible operations. As industries increasingly prioritize sustainability, honeycomb-type catalysts are expected to remain integral to emission control strategies, reinforced by continuous innovation and evolving regulatory compliance requirements.

Application (Power Plant, Cement Plant, Refinery Plant, Steel Plant, and Transportation Vehicle)

The power plant segment is expected to lead the DeNOx catalyst market by holding a substantial share during the forecast period. This dominance underscores the critical need for advanced NOx reduction technologies in thermal power generation, where nitrogen oxide emissions are a significant environmental concern. Power plants, particularly those burning coal and natural gas, face increasingly stringent emission standards, necessitating the adoption of efficient Selective Catalytic Reduction (SCR) systems. DeNOx catalysts play a crucial role in converting harmful nitrogen oxides (NOx) into harmless nitrogen and water, thereby ensuring compliance with environmental regulations and advancing sustainability goals.

A notable instance is Toshiba Energy Systems & Solutions Corporation, which provides high-efficiency SCR systems equipped with DeNOx catalysts for thermal power plants in Japan and abroad. Toshiba’s solutions are engineered to ensure long-term reliability, reduce ammonia slip, and achieve superior NOx conversion efficiency. Their continuous innovation supports the power plant’s transition towards cleaner, more environmentally responsible energy production while meeting operational and regulatory challenges.

Our in-depth analysis of the global DeNOx catalyst market includes the following segments:

|

Type |

|

|

Application |

|

|

Material

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

DeNOx Catalyst Market Regional Analysis:

Asia Pacific Market Statistics

The Asia Pacific DeNOx catalyst market is poised to hold a 45.5% share by the end of 2037. This dominance is driven by China and India’s commitment to reducing industrial emissions while sustaining economic growth. In China, stringent government policies such as the Blue Sky Protection campaign have accelerated the implementation of DeNOx technologies across power generation, cement, and chemical industries. The extensive coal-fired power plants and industrial centers in the country require the implementation of selective catalytic reduction (SCR) systems for the control of nitrogen oxides (NOx).

India, on the other hand, is rapidly expanding its power infrastructure and industrial base, resulting in growing environmental concerns. The Ministry of Environment, Forest and Climate Change (MoEFCC) has established more stringent NOx emission regulations for thermal power plants, leading to an increased demand for DeNOx catalysts. The country’s increasing investment in cleaner technologies and retrofitting of older plants has positioned it as a vital growth DeNOx catalyst market.

North America Market Analysis

The North America region is expected to hold a substantial share in the global DeNOx catalyst market during the forecast period. The U.S. and Canada are increasingly contributing to the rapid expansion of the DeNOx catalyst market is highly driven by their strong environmental governance and commitment to reducing NOx emissions. The U.S. Environmental Protection Agency (EPA) enforces rigorous emission standards, compelling industries to adopt DeNOx catalysts to reduce nitrogen oxide (NOx) emissions.

Similarly, Canada has reinforced its regulatory frameworks through initiatives such as the Multiple Sector Air Pollutants Regulations (MSAPR), targeting NOx reductions from industrial boilers and turbines. This has created a robust demand for high-performance DeNOx catalysts, especially in Alberta’s oil sands and Ontario’s manufacturing sectors. A significant instance is CanCat Tech focuses on industrial combustion and thermal processing equipment, encompassing catalyst activator systems. Their expertise encompasses the design, engineering, and supply of high-temperature processing solutions tailored for industries such as petrochemical, oil and gas, mining, cement, and biogas. Their commitment to innovation and efficiency positions them as a key player in supporting Canada’s efforts to reduce NOx emissions through advanced catalyst technologies.

Key DeNOx Catalyst Market Players:

- Envirotherm GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tianhe Environmental Engineering

- Shangdong Gemsky Environmental Technology

- Jiangsu Fengye Tech & Environmental Group

- BASF SE

- Cormetech

- IBIDEN Porzellanfabrick Frauenthal GmbH

- Johnson Matthey Plc

- Haldor Topsoe

- Hitachi Zosen Corp

- Seshin Electronics Co, Ltd

- JGC C&C

- CRI Catalyst Company

Key players leverage advanced technologies like Selective Catalytic Reduction (SCR), honeycomb catalyst structures, and proprietary metal-oxide formulations. These innovations enhance NOx conversion efficiency, extend catalyst lifespan, and ensure compliance with stringent global emission regulations across diverse industries.

Recent Developments

- In October 2023, Cormetech unveiled an innovative zeolite-based DeNOx catalyst designed for power plants, featuring enhanced ammonia conversion efficiency.

- In November 2024, BASF SE increased its production capacity for DeNOx catalysts to meet the rising demand.This strategic move aims to strengthen BASF’s position in the emission control catalyst market and meet the growing needs of industries seeking to reduce NOx emissions

- Report ID: 7607

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

DeNOx Catalyst Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.