Autonomous Delivery Robots Market Outlook:

Autonomous Delivery Robots Market size was valued at USD 738.3 million in 2025 and is projected to reach approximately USD 7,579.4 million by the end of 2035, rising at a CAGR of 27.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of autonomous delivery robots is estimated at USD 939.4 million.

The growth of the market can be attributed to the rising expansion of the e-commerce sector and the surge in demand for last-mile delivery. Besides, the evolution of urbanization is intensifying the demand for faster, contactless, and cost-efficient delivery across sectors such as food & beverage, retail, healthcare, and logistics. Testifying to this, World in Data in September 2025 revealed that more than half of the world’s population, which is over 4 billion people, are currently residing in urban areas, marking a major shift in human settlement patterns.

Additionally, the advancement in artificial intelligence and machine learning is also fostering a profitable business environment for the autonomous delivery robots market. In this regard, the Journal of Urban Mobility in June 2025 surveyed around 1,344 e-commerce customers across the U.S., Europe, and Asia to understand the acceptance of autonomous delivery robots among the audience. The research found that ease of use is extremely driving acceptance across all regions, whereas in the U.S. and Europe, customers were more concerned about costs and perceived risks, while in Europe and Asia, social influence played a major role in shaping these attitudes.

Key Autonomous Delivery Robots Market Insights Summary:

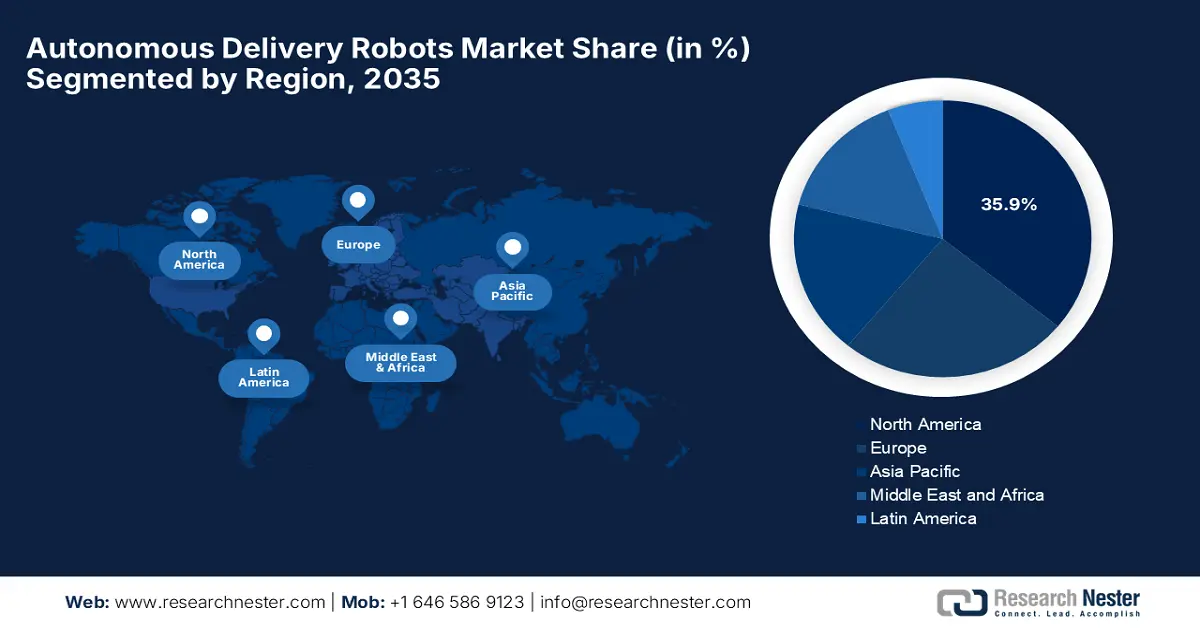

Regional Highlights:

- North America is projected to hold a 35.9% revenue share by 2035 owing to state-of-the-art ICT infrastructure and expanding e-commerce platforms.

- Asia Pacific is anticipated to emerge as the fastest-growing region during the forecast period owing to rapid urban e-commerce expansion and integration of last-mile delivery robots.

Segment Insights:

- The four-wheel robots segment is expected to account for 60.6% market share by 2035 owing to superior stability, payload capacity, and adaptability across varied terrains.

- The sidewalk robots segment is projected to capture 55.6% market share by the end of 2035 owing to their efficiency in dense urban environments and lower operational costs.

Key Growth Trends:

- Labor shortages

- E‑Commerce growth and high population density

Major Challenges:

- Strict data protection regulations

- Lack of global standardization

Key Players: Nuro, Amazon.com, Inc., Kiwibot, Robby Technologies, Eliport, TeleRetail, Marble, Dispatch (Acquired by Amazon), Savioke, FedEx Corporation, JD.com, Inc., Panasonic Corporation, Sony Corporation, ZMP Inc., Toyota Motor Corporation, Robomart, Cartken, Postmates (Acquired by Uber), Boston Dynamics.

Global Autonomous Delivery Robots Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 738.3 million

- 2026 Market Size: USD 939.4 million

- Projected Market Size: USD 7,579.4 million by 2035

- Growth Forecasts: 27.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 10 October, 2025

Autonomous Delivery Robots Market - Growth Drivers and Challenges

Growth Drivers

- Labor shortages: This, along with rising delivery costs, is encouraging the utilization of autonomous delivery robots since human labors demand expensive charges. Testifying this METI in February 2025 reported that autonomous delivery robots are being promoted in Japan to address logistics challenges such as labor shortages and limited shopping access, with legal reforms enabling their public road use since April 2023. It also stated that higher-capacity robots; Japan’s METI and NEDO formed a working group in 2024 to explore use cases such as home delivery, mobile vending, and B2B transport, thereby denoting a positive market outlook.

- E‑Commerce growth and high population density: There has been a heightened demand for fast, frequent deliveries for food, groceries, and others, presenting an encouraging opportunity for firms involved in the market. As evidence, the International Trade Administration revealed that the rapid growth of global B2B eCommerce, projected to rise at a 14.5% CAGR, is one of the major drivers for autonomous delivery robots. Besides, the strong demand for faster, contactless, and cost-efficient logistics solutions is pushing businesses, especially in the Asia Pacific, to adopt automation.

- Supportive government policies: This is yet another factor positively influencing growth in the autonomous delivery robots market since the governing bodies in most of the nations are forming working groups, policy roadmaps, and regulatory frameworks to encourage ADR deployment. Johns Hopkins University in October 2023 reported that a USD 201,307 research project in Austin is deploying short to medium range autonomous delivery systems to reduce GHG emissions and improve urban delivery efficiency, thus elevating the market’s potential across all nations.

Global Urban and Rural Population Distribution (2024)

|

Category |

Value |

|

Urban Population |

4.7 billion |

|

Rural Population |

3.4 billion |

Source: Our World in Data

Recent Developments in Autonomous and Smart Parcel Delivery Initiatives 2024

|

Organization |

Partnership/Initiative |

Objective |

Key Highlights |

|

Oman Post + OTaxi |

Strategic collaboration for parcel delivery |

Enhance last-mile delivery across Oman |

24-hour delivery in Muscat; 48–72 hrs in other regions; supports SMEs; aligns with Oman Vision 2040 |

|

Cartken |

USD 22.5 million total funding round (latest USD 10 million led by 468 Capital) |

Advance AI-based autonomous delivery robots. |

Supports indoor-outdoor robot navigation; enterprise automation; backed by Shell Ventures, Magna, etc. |

Source: Company Official Press Releases

Challenges

- Strict data protection regulations: Autonomous delivery robots depend on real-time data collection, such as details of customers and locations, which raises privacy concerns, as unauthorized access or misuse of such data could jeopardize user trust. To protect this market, players are also required to comply with the General Data Protection Regulation (European Union), California Consumer Privacy Act (U.S.), and Digital Personal Data Protection Act (India), which can ultimately slow down deployment and increase costs.

- Lack of global standardization: This is yet another factor that is posing a major challenge for manufacturers, logistics providers, and regulators involved in this field. Without global uniform standards, last-mile delivery robots face challenges in deployment and interoperability. Different regions have a variety of rules on road access, speed limits, and liability. Therefore, this patchwork of regulations complicates the robot design and programming as companies must customize their systems to comply with local laws rather than deploying a universally compatible solution.

Autonomous Delivery Robots Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

27.7% |

|

Base Year Market Size (2025) |

USD 738.3 million |

|

Forecast Year Market Size (2035) |

USD 7,579.4 million |

|

Regional Scope |

|

Autonomous Delivery Robots Market Segmentation:

Platform Segment Analysis

The four-wheel robots segment is expected to capture the largest revenue share of 60.6% in the autonomous delivery robots market during the forecast duration. The better stability and payload capacity offered by this subtype make it favored for commercial delivery. Also, the advancements in four-wheel autonomous platforms for robust navigation in various sorts of terrain and weather conditions position the subtype at the forefront of revenue generation in this field.

Type Segment Analysis

Sidewalk robots segment in the autonomous delivery robots market is predicted to garner a share of 55.6% by the end of 2035. The growth in the segment is highly subject to dense urban environments, enabling last-mile delivery with lower operational costs and easier regulatory acceptance. In October 2024, Uber Technologies, with Avride, reported that they entered a multi-year strategic partnership to integrate Avride's delivery robots and, subsequently, autonomous vehicles into the Uber and Uber Eats platforms. It also stated that the initiative will launch initially with sidewalk robots for Uber Eats deliveries in Austin, with plans to expand to Dallas and Jersey City, hence denoting a wider segment scope.

Application Segment Analysis

Food & beverage delivery segment is likely to attain a share of 40.7% in the market during the analyzed timeframe. The heightened demand for quick, contactless, and cost-effective delivery services is the key factor behind the leadership. For instance, in August 2022, Ottonomy Inc. reported that it launched Ottobot 2.0, a fully autonomous delivery robot that is designed for enhanced maneuverability, modularity, and accessibility in last-mile delivery scenarios. Besides, it follows the close of a USD 3.3 million seed funding round, the Santa Monica-based startup aims to scale deployments across various applications.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Platform |

|

|

Type |

|

|

Application |

|

|

End user |

|

|

Component |

|

|

Load Carrying Capacity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Autonomous Delivery Robots Market - Regional Analysis

North America Market Insights

North America market is projected to register the largest revenue share, i.e., 35.9% revenue share, between 2026-2035. The market growth can be ascribed to the presence of state-of-the-art ICT infrastructure and expanding e-commerce platforms. Testifying, the International Trade Administration stated that gross merchandise value for B2B eCommerce in North America for 2025, accounting for approximately 15.0% of the worldwide B2B eCommerce market, underscoring the region's critical role in the digital transformation of business-to-business trade.

U.S. market is productively influenced by the rising adoption of digitalization in logistics and favorable regulatory policies. The country has also benefited from the presence of rising investment in start-up initiatives and high consumer tech adoption. In August 2022, the NCSES working paper highlights how digitalization and cloud computing are reshaping innovation in U.S. businesses, especially by lowering the cost of experimentation, hence paving the way for broader autonomous robotic vehicle adoption.

Canada is gaining momentum in the market, efficiently backed by last-mile delivery and middle-mile logistics, driven by both private firms and retailers. The businesses in the country are increasingly preferring reduced delivery costs and increasing efficiency. In October 2022, Gatik and Loblaw announced that they had launched the country's ever fully driverless commercial delivery operation, wherein it uses autonomous, multi-temperature box trucks to move online grocery orders for Loblaw’s PC Express service in the Greater Toronto Area, hence suitable for standard market growth.

APAC Market Insights

Asia Pacific is likely to showcase the fastest growth rate in the autonomous delivery robots market during the analyzed timeframe. The region’s progress in this field is effectively catered to rapid e-commerce expansion, especially in urban centers, which has been a major driver for ADR adoption. Moreover, major pioneers in this region are increasingly integrating both outdoor delivery vehicles and indoor robots to streamline last-mile logistics, particularly in dense cities where labor is costly and congestion is severe.

China is augmenting its leadership in the regional market owing to the growing use of autonomous delivery vehicles by express delivery services to handle large parcel volumes and cover repetitive routes. China Post in November 2022 reported that it had launched its integrated indoor and outdoor Robot Plus AI delivery solution in June 2023, which is a combination of unmanned vehicles for outdoor delivery and robots for indoor navigation. The company also stated that the system enhances last-mile delivery efficiency by over 50% when compared to traditional methods, utilizing advanced sensors and AI for autonomous operation.

India represents one of the most influential landscapes for the autonomous delivery robots market, wherein aerial drones are seen as the fastest-growing segment. As per an article published by IBEF in May 2025, the country is witnessing booming e-commerce and hyperlocal delivery sectors, which are expected to lay a fertile ground for the adoption of autonomous delivery robots. As quick commerce, same-day, and ultra-fast models proliferate in metro and Tier‑II/III cities, demands for efficient, scalable last-mile solutions intensify.

Europe Market Insights

The market in Europe is anticipated to garner a considerable share, with prominent contributions from the U.K., Germany, Italy, and Nordic countries. For instance, in August 2025, Just Eat Takeaway.com declared that it us partnering with RIVR in Zurich to use innovative robots powered by Physical AI. The company further stated that these robots combine wheels for speed and legs for navigating stairs and curbs, operating safely around obstacles and pedestrians at about 15 km/h in various weather conditions, hence positively influencing market upliftment.

Germany is investing heavily in making last-mile automation feasible in its country, showcasing tremendous efforts made by the government. The market is also flourishing in the country, fueled by a significant surge in policies in logistics digitalization. In May 2025, Amazon unveiled seven new robots at its Last Mile Innovation Center in Dortmund, the country, which includes Tipper, which automates package unloading from carts to conveyor belts, reducing manual labor and physical strain.

The U.K. in the autonomous delivery robots market is rapidly advancing, driven by increasing demand for contactless and efficient last-mile delivery solutions. Besides, key players, including technology startups and established logistics firms, are proactively piloting and deploying robots in urban environments to enhance delivery speed and reduce costs. This is also supported by technological improvements in terms of AI, navigation, and safety features, thereby enabling robots to operate reliably in complex city landscapes.

Key Autonomous Delivery Robots Market Players:

- Starship Technologies

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nuro

- Amazon.com, Inc.

- Kiwibot

- Robby Technologies

- Eliport

- TeleRetail

- Marble

- Dispatch (Acquired by Amazon)

- Savioke

- FedEx Corporation

- JD.com, Inc.

- Panasonic Corporation

- Sony Corporation

- ZMP Inc.

- Toyota Motor Corporation

- Robomart

- Cartken

- Postmates (Acquired by Uber)

- Boston Dynamics

The competitive landscape of the market is rapidly evolving as established key players, IT giants, and new entrants are investing in electrification and hydrogen technologies. Key players in the market are focused on developing new technologies and products that cater to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to enhance their product base and strengthen their market position.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In October 2025, Serve Robotics announced the deployment of its 1,000th third-generation autonomous sidewalk delivery robot, with over 380 units deployed in September alone. The company remains on track to achieve its goal of 2,000 deployed robots by the end of 2025, reflecting the rapid scaling of its AI-powered fleet.

- In September 2025, DoorDash introduced Dot, which is its first commercial autonomous delivery robot, designed to navigate bike lanes, sidewalks, roads, and driveways for efficient, local last-mile delivery.

- Report ID: 3857

- Published Date: Oct 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Autonomous Delivery Robots Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.